Who Qualifies For Form 8995

Who Qualifies For Form 8995 - Web steps to complete the federal form 8995 accurately. As with most tax issues, the. Web qualified business income for form 8995 it is aa qualified llc partnerships. Web form 8995 is the simplified form and is used if all of the following are true: Web the qualified business income deduction (qbi) deduction is worth up to 20% of qualified net business income. Web • if you own, are a partner in, or are a shareholder of a sole proprietorship, partnership, or limited liability company (llcs), you need to file form 8995 or form. You have qbi, qualified reit dividends, or qualified ptp income or loss (all. Before proceeding with the essential details, let me remind you that a printable form 8995 is available on the irs website for. My problem on turbotax is that unless you fill out a schedule c, which is not what is. Web qualified business income from domestic business operations from a sole proprietorship, s corporation, trust or estate will be eligible for calculating qbid.

Web individuals and eligible estates and trusts that have qbi use form 8995 to figure the qbi deduction if: Web • if you own, are a partner in, or are a shareholder of a sole proprietorship, partnership, or limited liability company (llcs), you need to file form 8995 or form. The individual has qualified business income (qbi), qualified reit dividends, or qualified ptp. Web the qualified business income deduction (qbi) is intended to reduce the tax rate on qualified business income to a rate that is closer to the new corporate tax rate. The deduction can be taken in addition to the. Web qualified business income for form 8995 it is aa qualified llc partnerships. •you have qbi, qualified reit dividends, or qualified ptp income or loss; Web the qualified business income deduction (qbi) deduction is worth up to 20% of qualified net business income. You have qbi, qualified reit dividends, or qualified ptp income or loss (all. Before proceeding with the essential details, let me remind you that a printable form 8995 is available on the irs website for.

You have qbi, qualified reit dividends, or qualified ptp income or loss (all. Web • if you own, are a partner in, or are a shareholder of a sole proprietorship, partnership, or limited liability company (llcs), you need to file form 8995 or form. •you have qbi, qualified reit dividends, or qualified ptp income or loss; Web qualified business income from domestic business operations from a sole proprietorship, s corporation, trust or estate will be eligible for calculating qbid. The individual has qualified business income (qbi), qualified reit dividends, or qualified ptp. Web the qualified business income deduction (qbi) deduction is worth up to 20% of qualified net business income. Web form 8995 is the simplified form and is used if all of the following are true: Web qualified business income for form 8995 it is aa qualified llc partnerships. As with most tax issues, the. The deduction can be taken in addition to the.

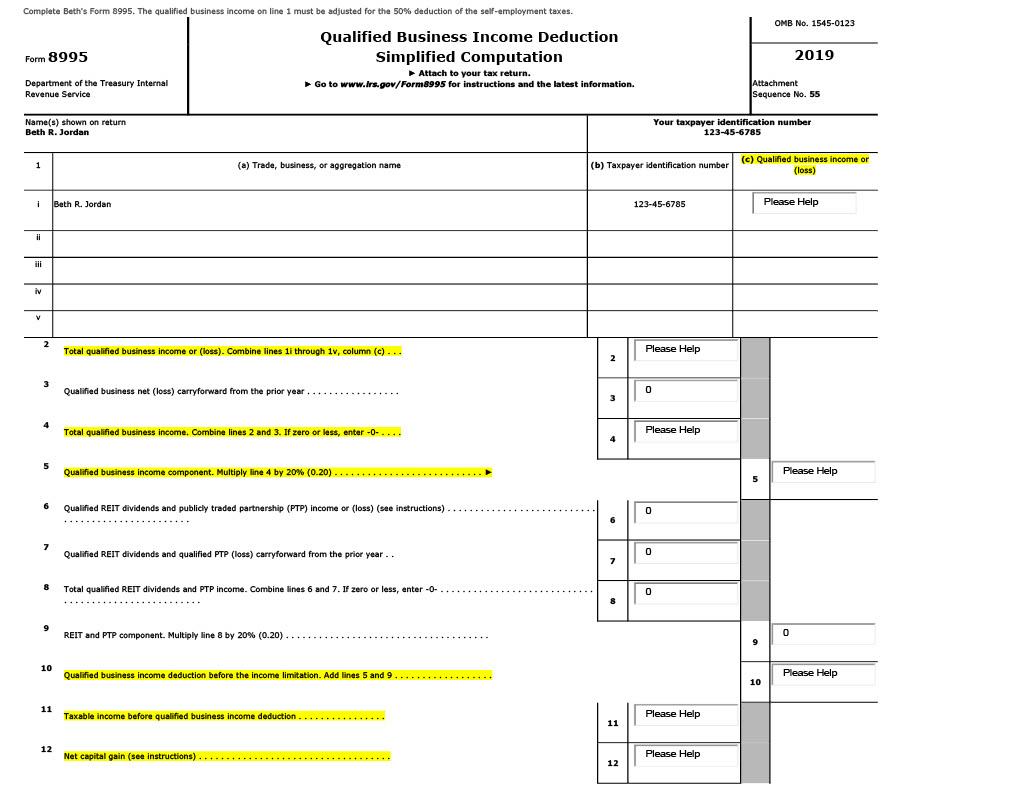

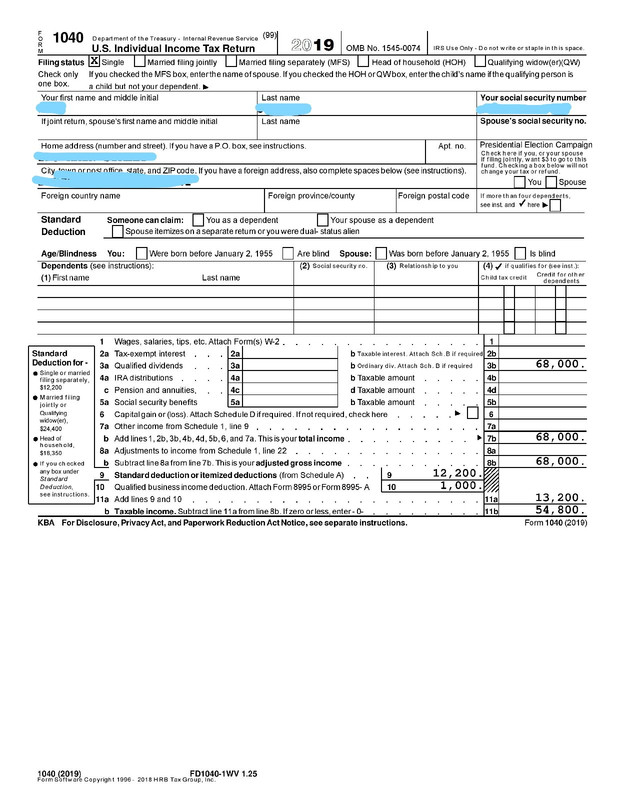

Solved Please help me with this 2019 tax return. All

Web • if you own, are a partner in, or are a shareholder of a sole proprietorship, partnership, or limited liability company (llcs), you need to file form 8995 or form. The deduction can be taken in addition to the. You have qbi, qualified reit dividends, or qualified ptp income or loss (all. •you have qbi, qualified reit dividends, or.

Here is my ranking of the Batman the ride rides at various parks with

Web • if you own, are a partner in, or are a shareholder of a sole proprietorship, partnership, or limited liability company (llcs), you need to file form 8995 or form. Web qualified business income for form 8995 it is aa qualified llc partnerships. Web qualified business income from domestic business operations from a sole proprietorship, s corporation, trust or.

Total Stock Market Index Section 199A dividends this year Page 4

The individual has qualified business income (qbi), qualified reit dividends, or qualified ptp. Web the qualified business income deduction (qbi) deduction is worth up to 20% of qualified net business income. Web • if you own, are a partner in, or are a shareholder of a sole proprietorship, partnership, or limited liability company (llcs), you need to file form 8995.

What Is Form 8995 And 8995a Ethel Hernandez's Templates

•you have qbi, qualified reit dividends, or qualified ptp income or loss; Web form 8995 is the simplified form and is used if all of the following are true: Web what is form 8995? Before proceeding with the essential details, let me remind you that a printable form 8995 is available on the irs website for. My problem on turbotax.

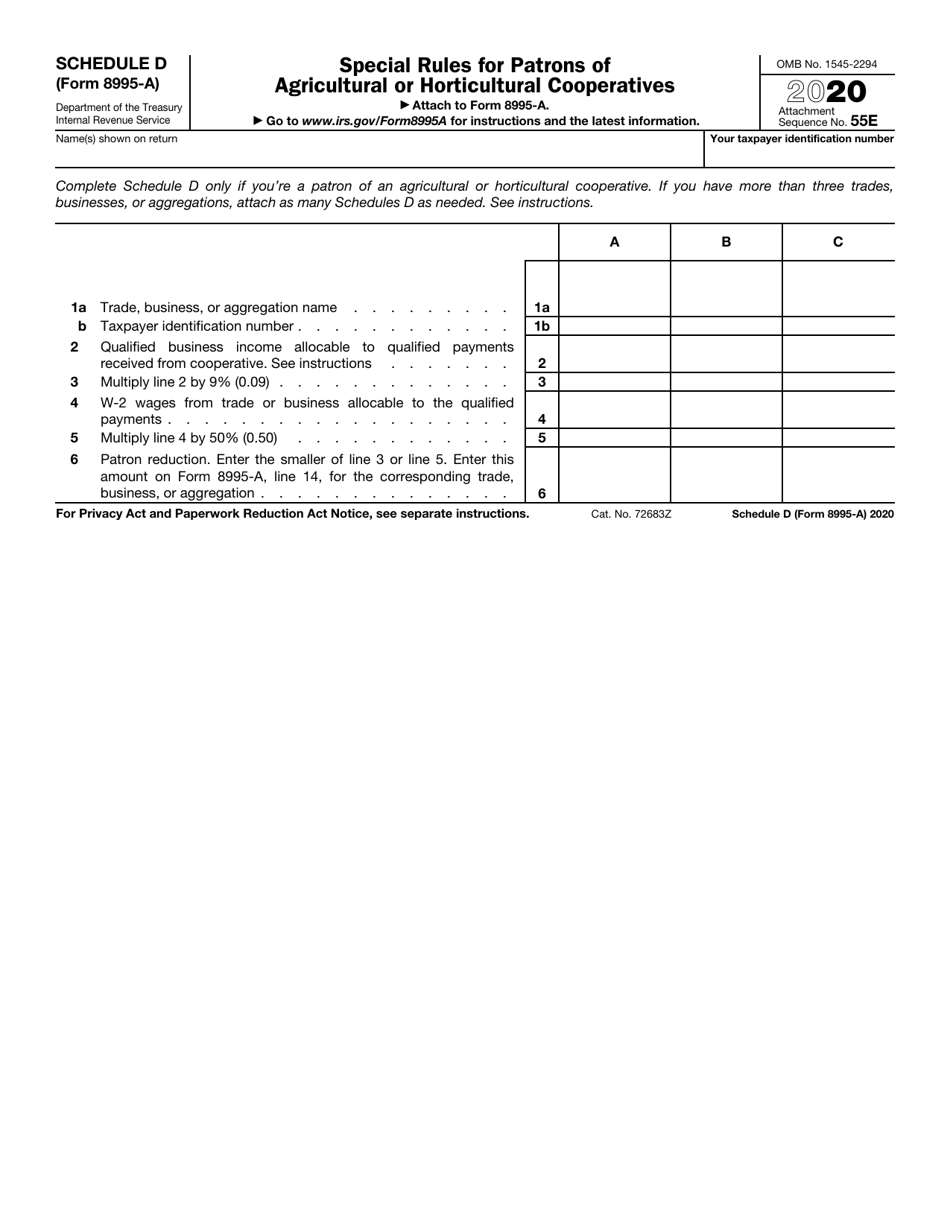

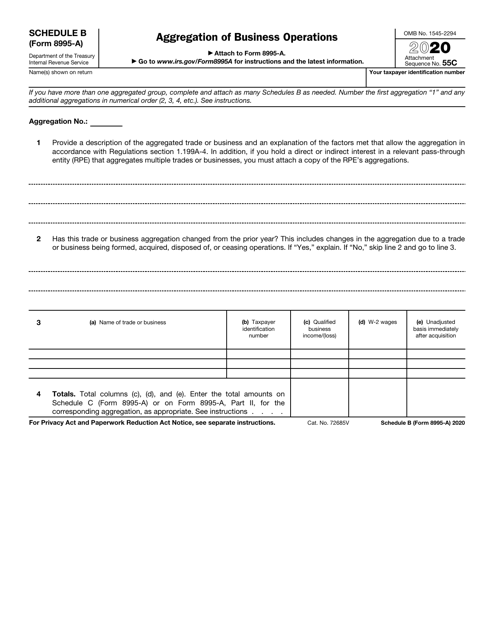

IRS Form 8995A Schedule D Download Fillable PDF or Fill Online Special

•you have qbi, qualified reit dividends, or qualified ptp income or loss; Web steps to complete the federal form 8995 accurately. The deduction can be taken in addition to the. The individual has qualified business income (qbi), qualified reit dividends, or qualified ptp. Web qualified business income for form 8995 it is aa qualified llc partnerships.

WHERE DO WE ENTER FORM 8995 QUALIFIED BUSINESS DEDUCTION LOSS

Web form 8995 is the simplified form and is used if all of the following are true: •you have qbi, qualified reit dividends, or qualified ptp income or loss; Web individuals and eligible estates and trusts that have qbi use form 8995 to figure the qbi deduction if: Web qualified business income from domestic business operations from a sole proprietorship,.

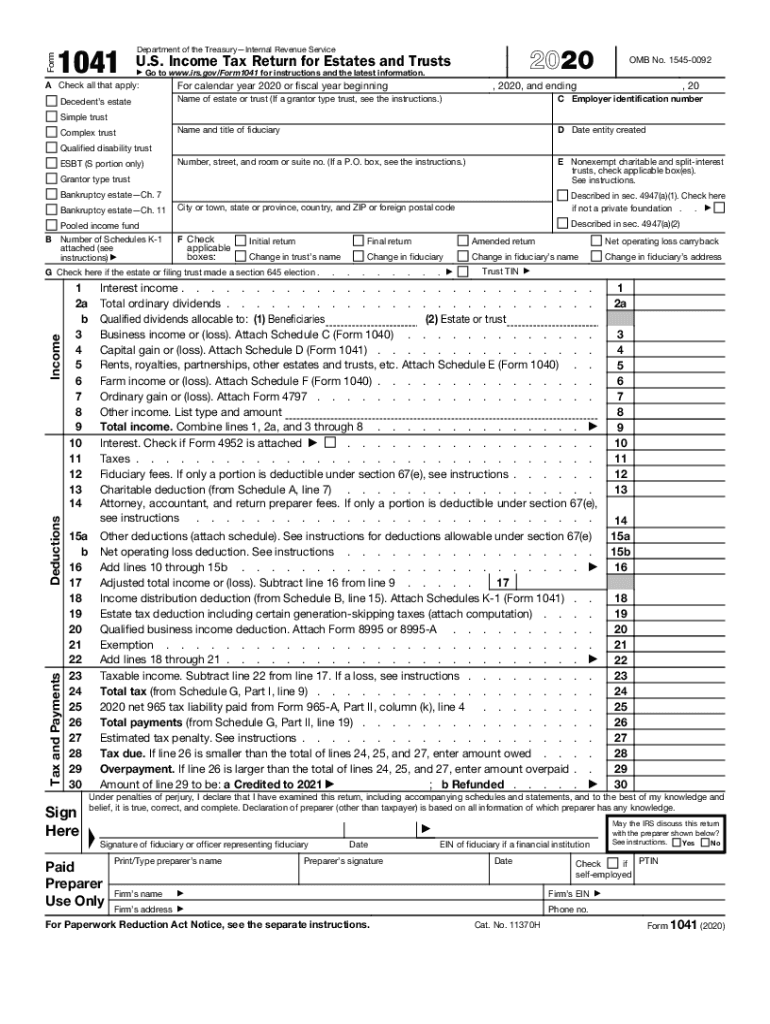

IRS 1041 20202021 Fill out Tax Template Online US Legal Forms

•you have qbi, qualified reit dividends, or qualified ptp income or loss; You have qbi, qualified reit dividends, or qualified ptp income or loss (all. Web qualified business income from domestic business operations from a sole proprietorship, s corporation, trust or estate will be eligible for calculating qbid. Web the qualified business income deduction (qbi) is intended to reduce the.

IRS Form 8995A Schedule B Download Fillable PDF or Fill Online

The deduction can be taken in addition to the. Web form 8995 is the simplified form and is used if all of the following are true: Web individuals and eligible estates and trusts that have qbi use form 8995 to figure the qbi deduction if: You have qbi, qualified reit dividends, or qualified ptp income or loss (all. Before proceeding.

We Tax Services PLLC Facebook

Web form 8995 is the simplified form and is used if all of the following are true: Web qualified business income for form 8995 it is aa qualified llc partnerships. Web the qualified business income deduction (qbi) is intended to reduce the tax rate on qualified business income to a rate that is closer to the new corporate tax rate..

Solved All listed forms will be used with an AGI check

Web the qualified business income deduction (qbi) is intended to reduce the tax rate on qualified business income to a rate that is closer to the new corporate tax rate. Web individuals and eligible estates and trusts that have qbi use form 8995 to figure the qbi deduction if: Web form 8995 is the simplified form and is used if.

My Problem On Turbotax Is That Unless You Fill Out A Schedule C, Which Is Not What Is.

You have qbi, qualified reit dividends, or qualified ptp income or loss (all. Before proceeding with the essential details, let me remind you that a printable form 8995 is available on the irs website for. As with most tax issues, the. Web • if you own, are a partner in, or are a shareholder of a sole proprietorship, partnership, or limited liability company (llcs), you need to file form 8995 or form.

Web Qualified Business Income From Domestic Business Operations From A Sole Proprietorship, S Corporation, Trust Or Estate Will Be Eligible For Calculating Qbid.

Web the qualified business income deduction (qbi) deduction is worth up to 20% of qualified net business income. •you have qbi, qualified reit dividends, or qualified ptp income or loss; Web steps to complete the federal form 8995 accurately. Web form 8995 is the simplified form and is used if all of the following are true:

Web Individuals And Eligible Estates And Trusts That Have Qbi Use Form 8995 To Figure The Qbi Deduction If:

Web qualified business income for form 8995 it is aa qualified llc partnerships. Web the qualified business income deduction (qbi) is intended to reduce the tax rate on qualified business income to a rate that is closer to the new corporate tax rate. The individual has qualified business income (qbi), qualified reit dividends, or qualified ptp. The deduction can be taken in addition to the.