Wisconsin Form 6 Instructions 2021

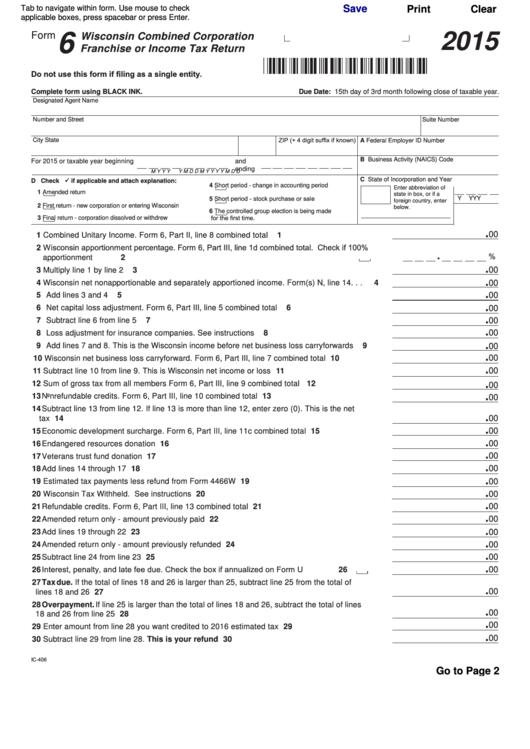

Wisconsin Form 6 Instructions 2021 - Also refer to publication 400, wisconsin’s. Income tax forms tax year 2022 individual fiduciary, estate & trust partnership corporation tax year 2023 individual fiduciary, estate & trust partnership corporation Web for more information on the economic development surcharge, refer to the instructions for form 6, part iii, line 11. Combined groups also use form 6y to report the amount Wisconsin subtraction modification for dividends. If a peo/peg has been approved by employer services assurance corporation (esac), it should use form #2854. Wisconsin combined corporation franchise or income tax return instructions: Combined groups complete form 6y to report the amount of dividends that may be subtracted from federal taxable income under the wisconsin dividends received deduction. You can find this publication on the department of revenue’s web site at: Web instructions for 2021 form 6y:

This is not available for all the forms. Combined groups also use form 6y to report the amount Web 2021 form 6 instructions for combined returns. Combined groups complete form 6y to report the amount of dividends that may be subtracted from federal taxable income under the wisconsin dividends received deduction. Web instructions for 2021 form 6y: If a peo/peg will have a limited presence in wisconsin, it may qualify to use form #2858 instead. This option will not electronically file your form. You can find this publication on the department of revenue’s web site at: Web we last updated the wisconsin combined corporation franchise or income tax return in march 2023, so this is the latest version of form 6, fully updated for tax year 2022. Please read the instructions first before using this option.

Combined groups also use form 6y to report the amount Income tax forms tax year 2022 individual fiduciary, estate & trust partnership corporation tax year 2023 individual fiduciary, estate & trust partnership corporation You can find this publication on the department of revenue’s web site at: This option will not electronically file your form. Wisconsin combined corporation franchise or income tax return instructions: Web we last updated the wisconsin combined corporation franchise or income tax return in march 2023, so this is the latest version of form 6, fully updated for tax year 2022. Web 2021 form 6 instructions for combined returns. This is not available for all the forms. Also refer to publication 400, wisconsin’s. Web for more information on the economic development surcharge, refer to the instructions for form 6, part iii, line 11.

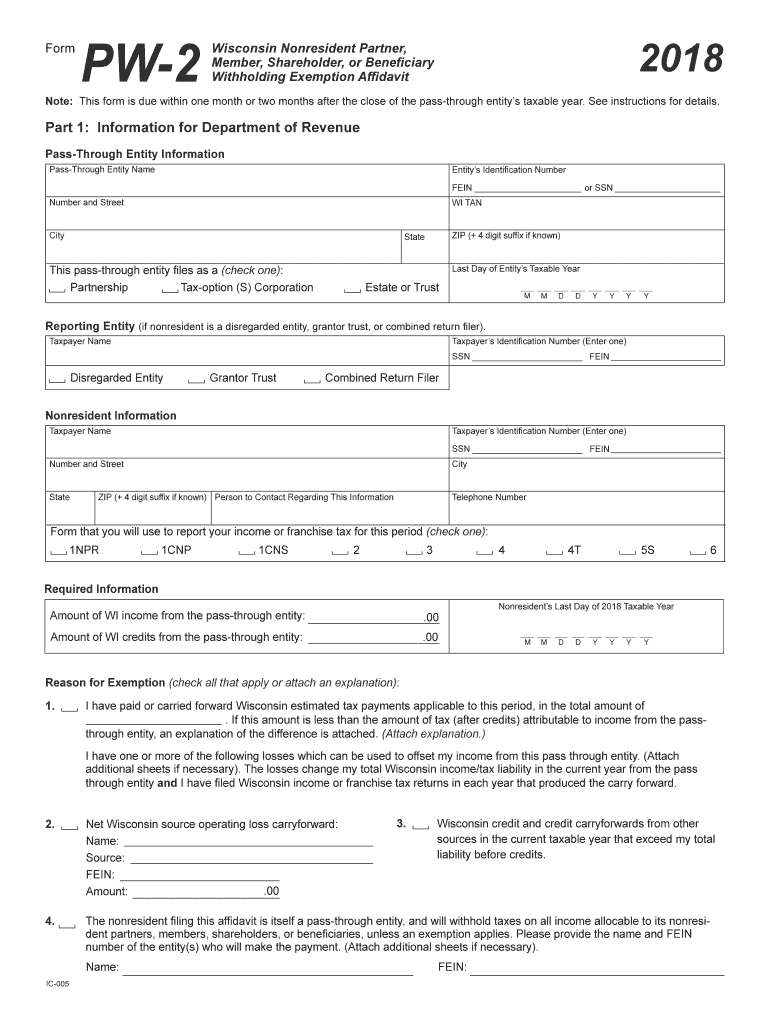

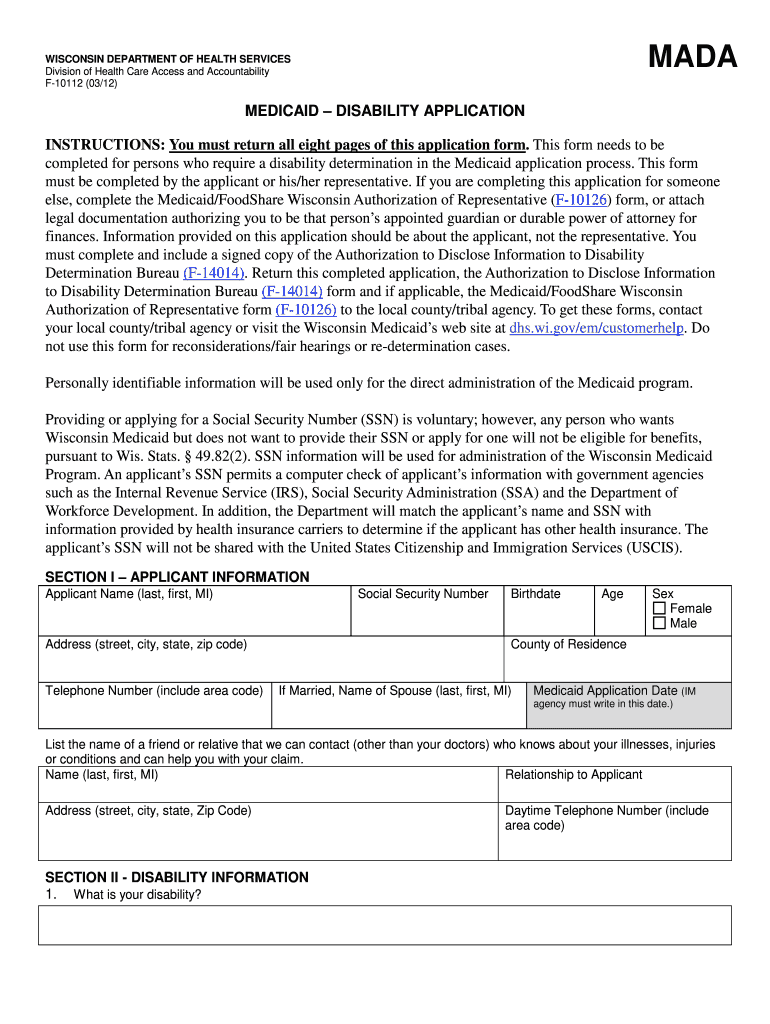

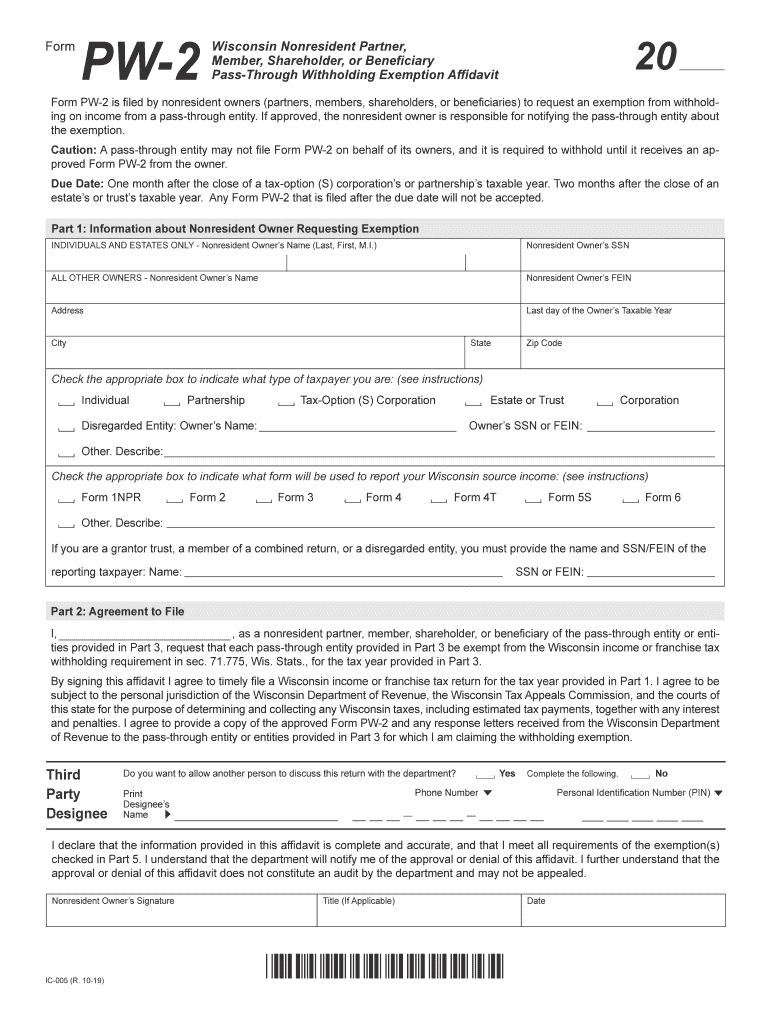

Wisconsin Form Pw 2 Fill Out and Sign Printable PDF Template signNow

Income tax forms tax year 2022 individual fiduciary, estate & trust partnership corporation tax year 2023 individual fiduciary, estate & trust partnership corporation Combined groups also use form 6y to report the amount Also refer to publication 400, wisconsin’s. Web for more information on the economic development surcharge, refer to the instructions for form 6, part iii, line 11. Combined.

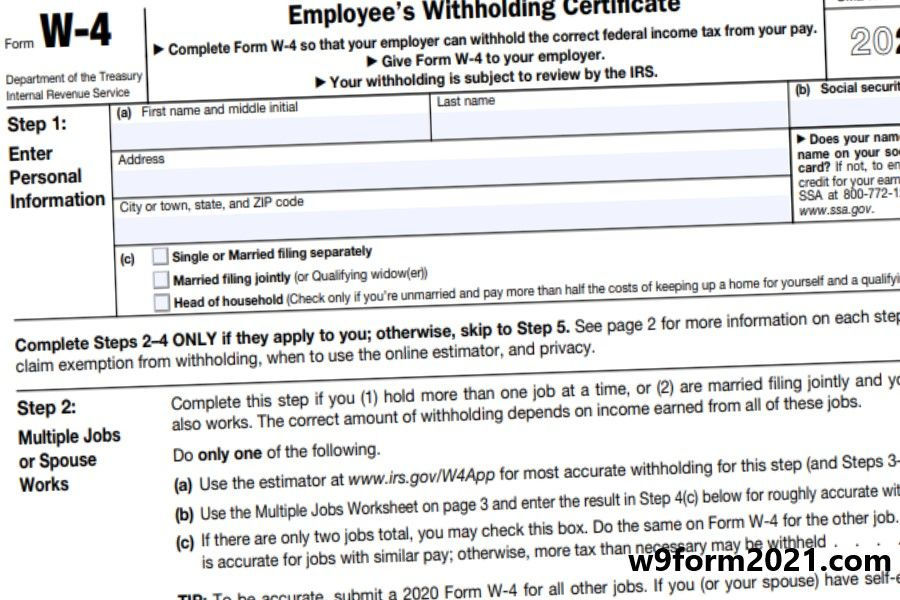

Wisconsin Revenue 2021 W4 Printable 2022 W4 Form

Web 2021 form 6 instructions for combined returns. Please read the instructions first before using this option. This option will not electronically file your form. Income tax forms tax year 2022 individual fiduciary, estate & trust partnership corporation tax year 2023 individual fiduciary, estate & trust partnership corporation Web instructions for 2021 form 6y:

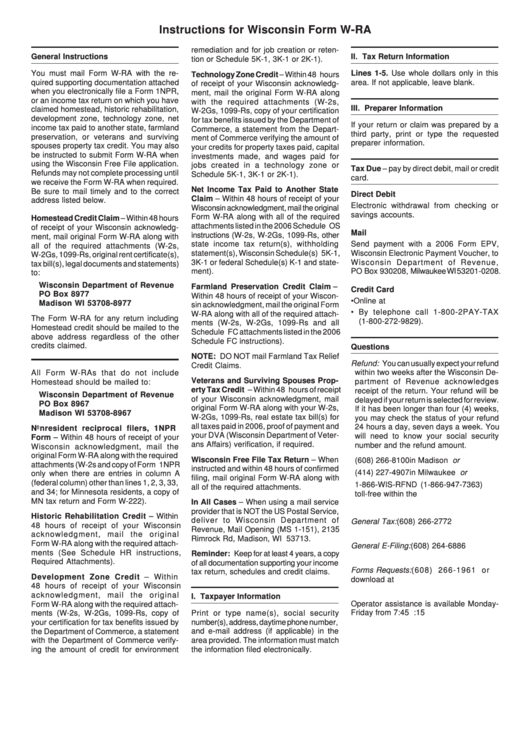

Instructions For Wisconsin Form WRa Required Attachments For

Also refer to publication 400, wisconsin’s. Web we last updated the wisconsin combined corporation franchise or income tax return in march 2023, so this is the latest version of form 6, fully updated for tax year 2022. Web 2021 form 6 instructions for combined returns. This is not available for all the forms. This option will not electronically file your.

Fillable Form 6 Wisconsin Combined Corporation Franchise Or

Income tax forms tax year 2022 individual fiduciary, estate & trust partnership corporation tax year 2023 individual fiduciary, estate & trust partnership corporation If a peo/peg will have a limited presence in wisconsin, it may qualify to use form #2858 instead. Wisconsin combined corporation franchise or income tax return instructions: Web 2021 form 6 instructions for combined returns. Web instructions.

Electronic Signature E Sign Or Esign Fill Out and Sign Printable PDF

Wisconsin combined corporation franchise or income tax return instructions: Web instructions for 2021 form 6y: Also refer to publication 400, wisconsin’s. Web 2021 form 6 instructions for combined returns. Please read the instructions first before using this option.

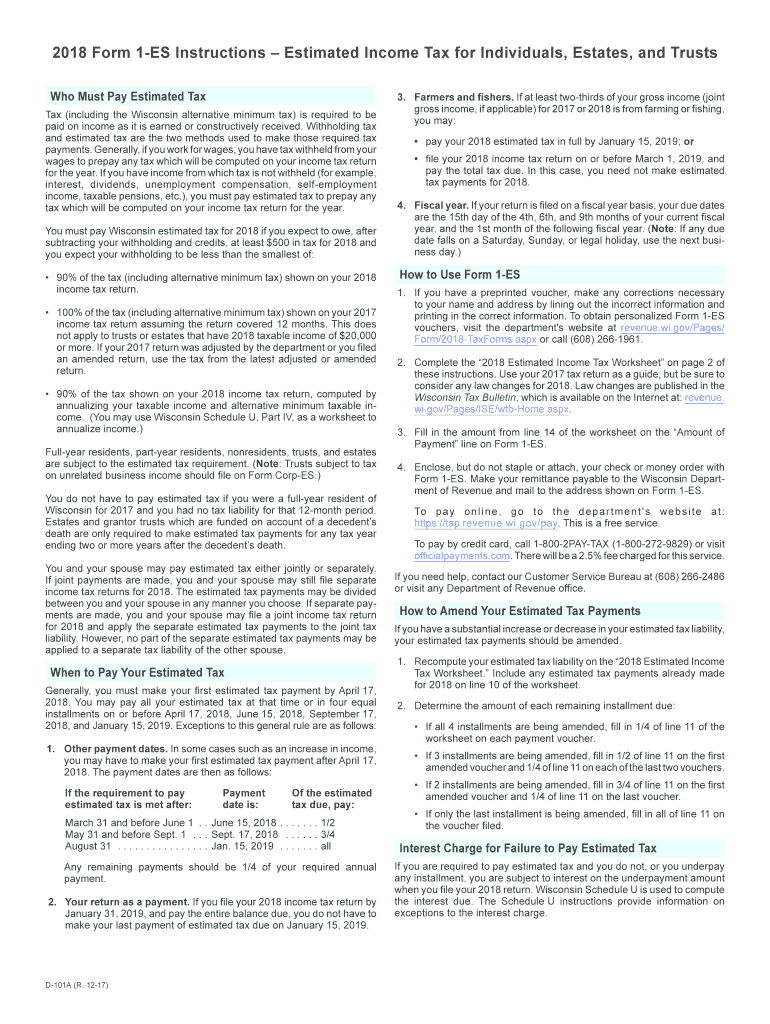

2019 Wisconsin Form 1 Es Printable Fill Out and Sign Printable PDF

This option will not electronically file your form. Please read the instructions first before using this option. Web 2021 form 6 instructions for combined returns. Combined groups complete form 6y to report the amount of dividends that may be subtracted from federal taxable income under the wisconsin dividends received deduction. Wisconsin subtraction modification for dividends.

Wisconsin Form Pw 2 Fill Out and Sign Printable PDF Template signNow

Wisconsin combined corporation franchise or income tax return instructions: Combined groups complete form 6y to report the amount of dividends that may be subtracted from federal taxable income under the wisconsin dividends received deduction. You can find this publication on the department of revenue’s web site at: Web we last updated the wisconsin combined corporation franchise or income tax return.

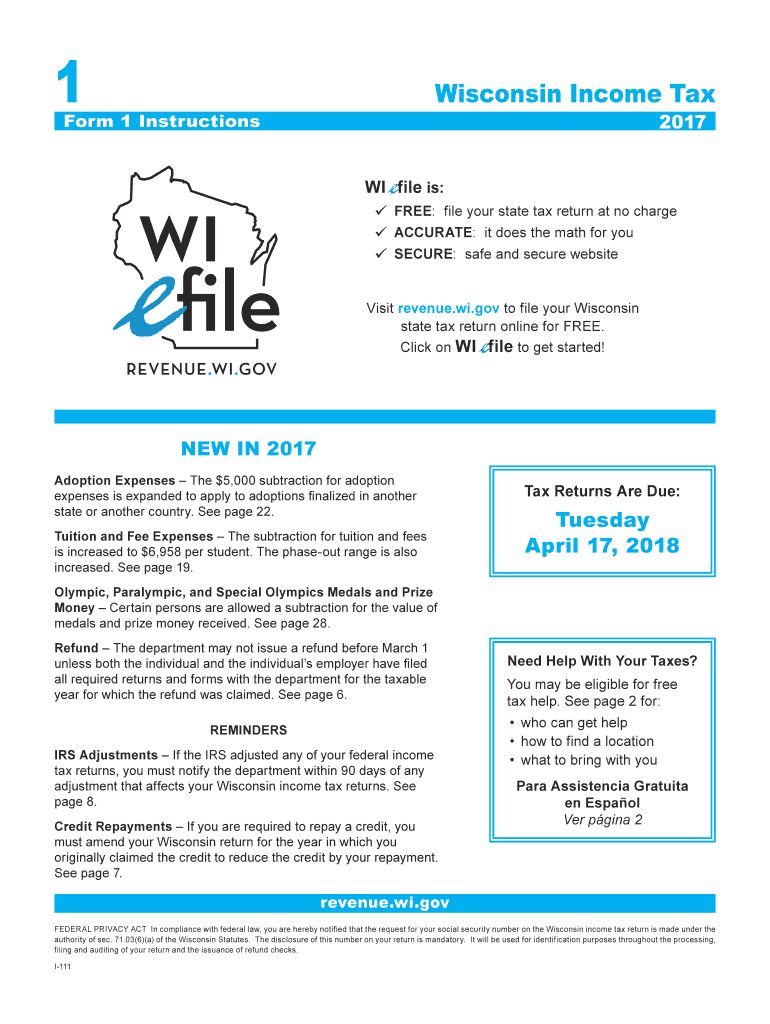

2017 Wisconsin Instructions Fill Out and Sign Printable PDF Template

This is not available for all the forms. Web instructions for 2021 form 6y: Income tax forms tax year 2022 individual fiduciary, estate & trust partnership corporation tax year 2023 individual fiduciary, estate & trust partnership corporation If a peo/peg will have a limited presence in wisconsin, it may qualify to use form #2858 instead. Combined groups also use form.

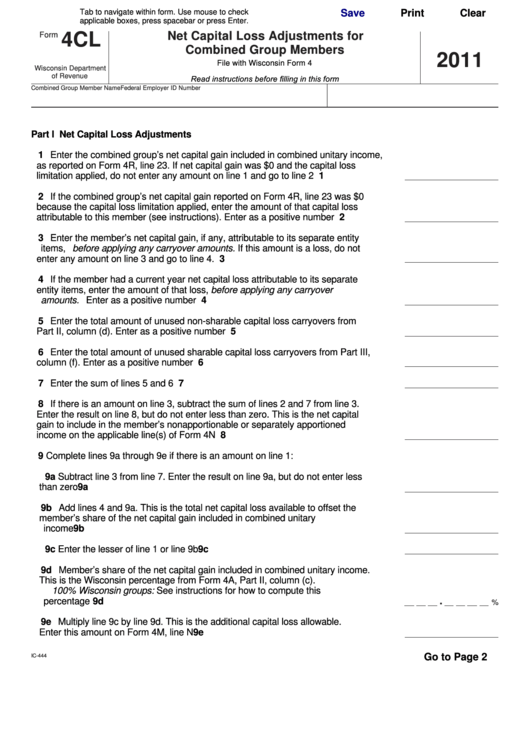

Fillable Form 4cl Wisconsin Net Capital Loss Adjustments For Combined

You can find this publication on the department of revenue’s web site at: Web instructions for 2021 form 6y: Income tax forms tax year 2022 individual fiduciary, estate & trust partnership corporation tax year 2023 individual fiduciary, estate & trust partnership corporation Wisconsin subtraction modification for dividends. Web 2021 form 6 instructions for combined returns.

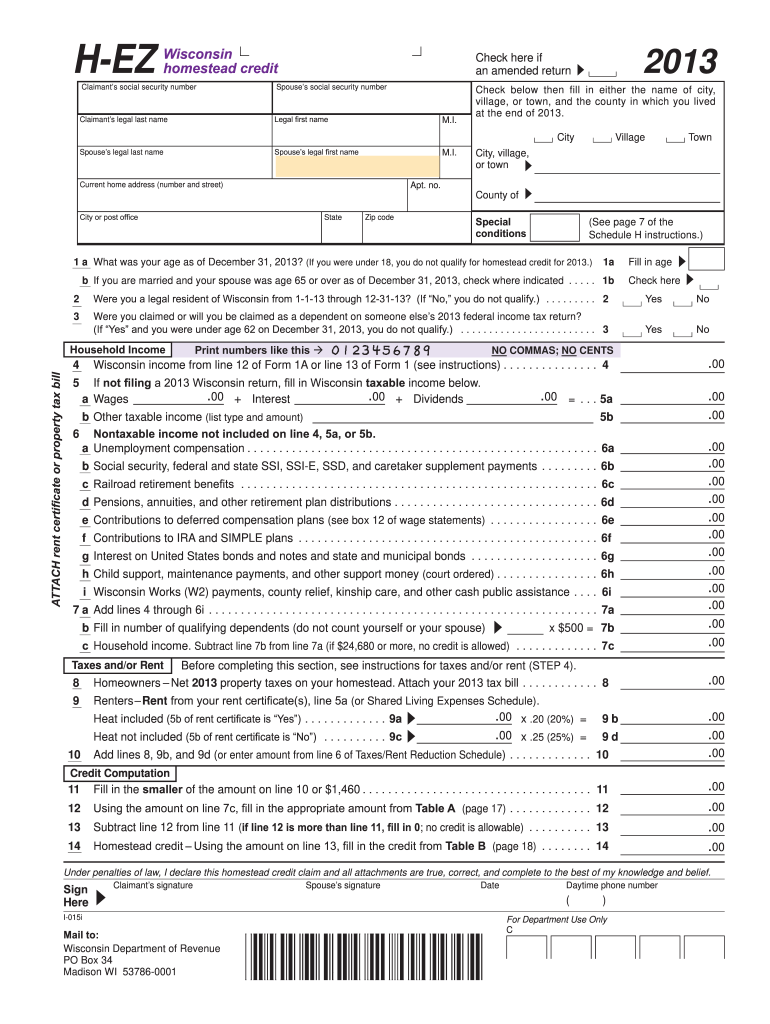

Wisconsin Form Homestead Credit Fill Out and Sign Printable PDF

Wisconsin combined corporation franchise or income tax return instructions: Web for more information on the economic development surcharge, refer to the instructions for form 6, part iii, line 11. If a peo/peg will have a limited presence in wisconsin, it may qualify to use form #2858 instead. Web 2021 form 6 instructions for combined returns. Web we last updated the.

Web Instructions For 2021 Form 6Y:

Please read the instructions first before using this option. You can find this publication on the department of revenue’s web site at: Wisconsin subtraction modification for dividends. If a peo/peg has been approved by employer services assurance corporation (esac), it should use form #2854.

Also Refer To Publication 400, Wisconsin’s.

Combined groups also use form 6y to report the amount Web 2021 form 6 instructions for combined returns. Income tax forms tax year 2022 individual fiduciary, estate & trust partnership corporation tax year 2023 individual fiduciary, estate & trust partnership corporation Combined groups complete form 6y to report the amount of dividends that may be subtracted from federal taxable income under the wisconsin dividends received deduction.

Web For More Information On The Economic Development Surcharge, Refer To The Instructions For Form 6, Part Iii, Line 11.

If a peo/peg will have a limited presence in wisconsin, it may qualify to use form #2858 instead. This option will not electronically file your form. This is not available for all the forms. Web we last updated the wisconsin combined corporation franchise or income tax return in march 2023, so this is the latest version of form 6, fully updated for tax year 2022.