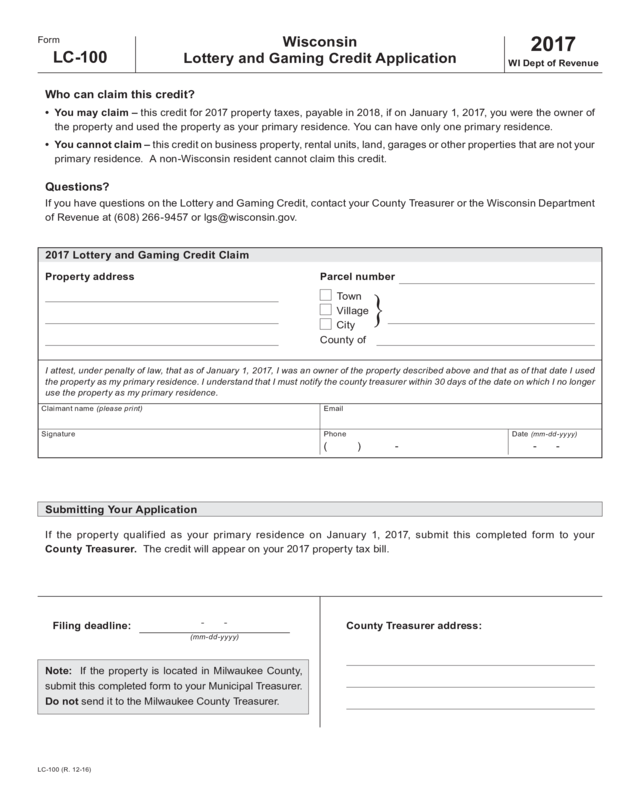

Wisconsin Lottery Tax Credit Form

Wisconsin Lottery Tax Credit Form - Web december 20, 2019 to: Web the lottery tax credit is available to wisconsin property owners' primary residence. If claiming a late lottery credit and quaifying for the current. Web forms for new and current retailers the wisconsin lottery has all kinds of resources to help you build a successful lottery business. This application is for property owners to affirm they qualify for the lottery and gaming credit. If this property qualified as your primary residence on january 1, 2021, you must submit. Web • copy of your 2020 property tax bill. Our retailer manual details how to,. Web the lottery credit stays with the property until removed by either the owner or the state department of revenue. If the property is located in milwaukee county, submit this.

Web who can claim this credit? Web lottery and gaming credit provides direct property tax relief to qualifying taxpayers in the form of a credit on their property tax bills. If the property is located in milwaukee county, submit this. The wisconsin department of revenue, state and local finance division distributed the following shared revenue and property tax credit. This application is for property owners to affirm they qualify for the lottery and gaming credit. Web the lottery tax credit is available to wisconsin property owners' primary residence. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) Our retailer manual details how to,. Web the wisconsin department of revenue (dor) posted the following 2022 lottery and gaming credit forms on our website. Web 17 hours agothe wisconsin lottery enriches communities statewide by giving back 93 percent of its revenue to winners, retailers, and wisconsin homeowners.

The wisconsin department of revenue (dor) posted the following 2020. Landlords' properties and residents' vacation homes are not eligible. Web if you have questions on the lottery and gaming credit, contact your county treasurer or the wisconsin department. Web who can claim this credit? Web december 20, 2019 to: If this property qualified as your primary residence on january 1, 2021, you must submit. Web • copy of your 2020 property tax bill. Web the credit will appear on your 2021 property tax bill. Web please mail or fax a copy of any of the above along with the claim form when filing for the wisconsin state lottery and gaming credit to the city treasurer before. Lottery and gaming credit application.

2017 Lc100 Wisconsin Lottery And Gaming Credit Application Edit

If claiming a late lottery credit and quaifying for the current. If the property qualified as. Web the wisconsin department of revenue (dor) posted the following 2019 lottery and gaming credit forms on our website. Web who can claim this credit? Web • copy of your 2020 property tax bill.

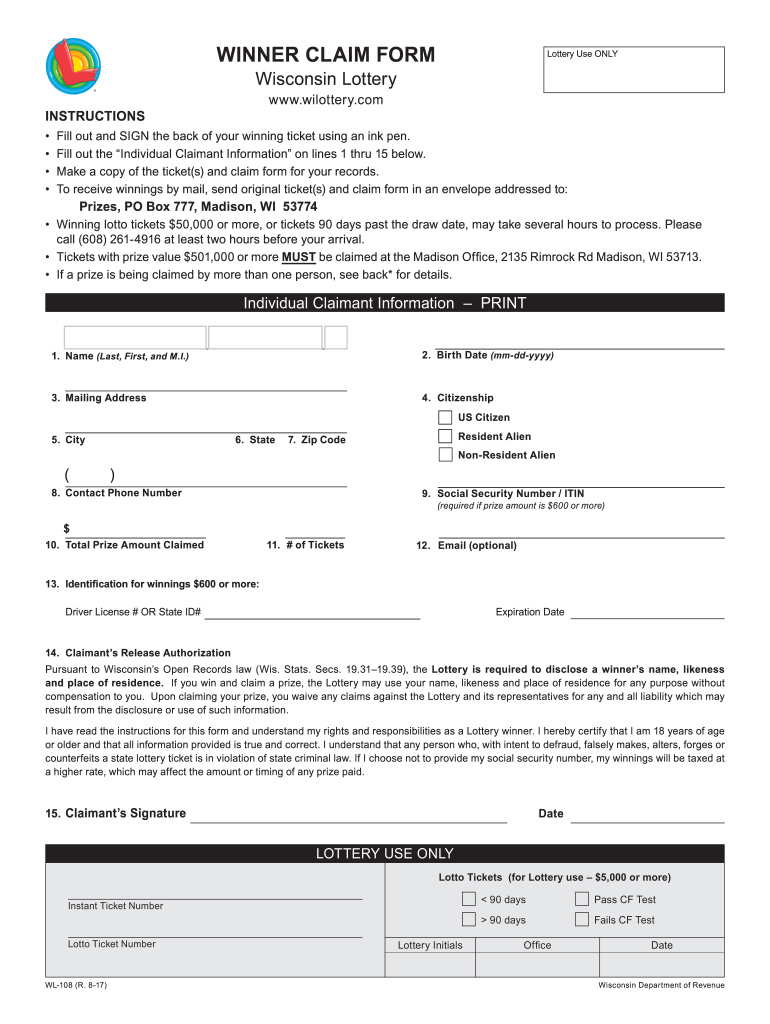

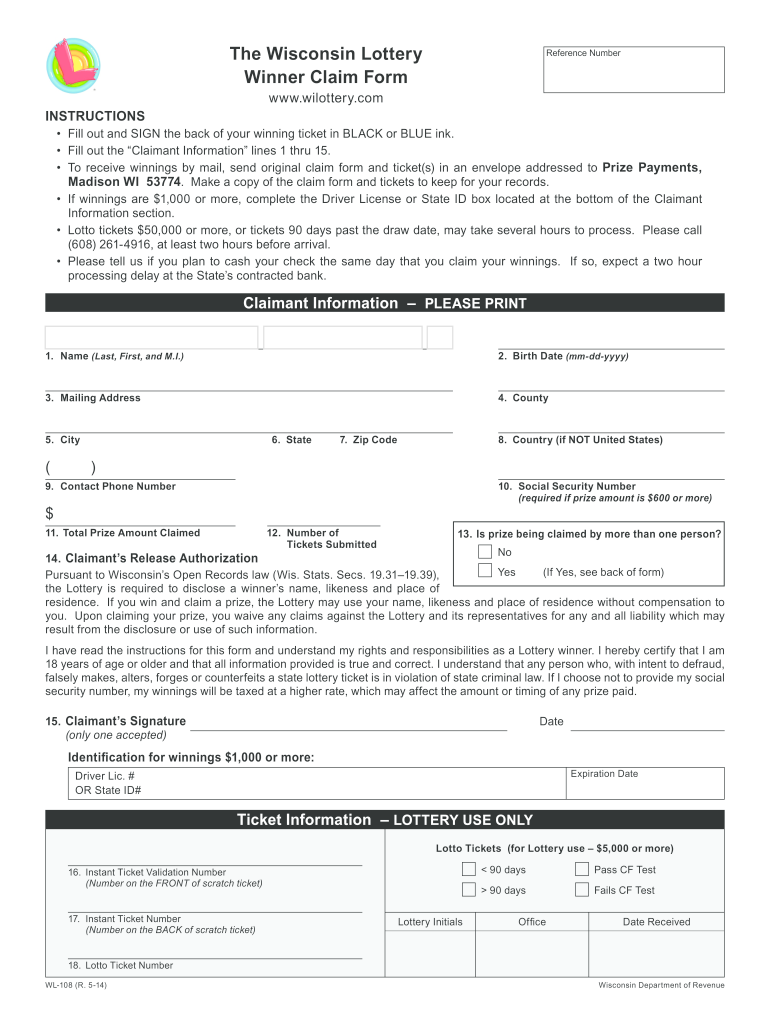

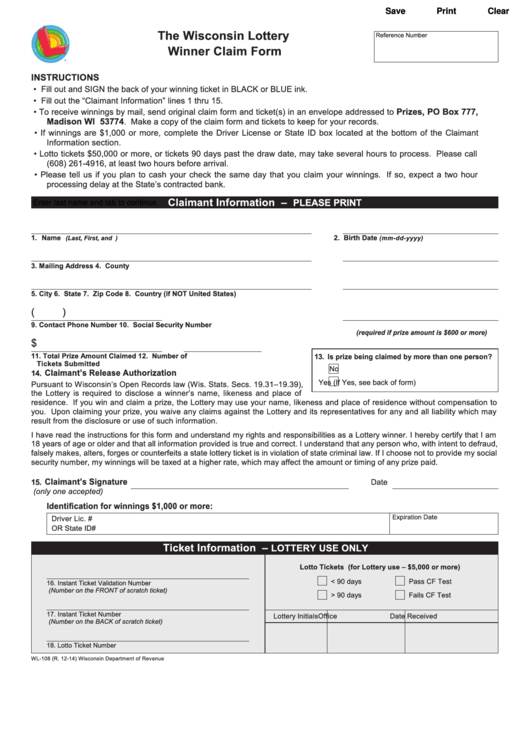

Wisconsin Lottery Claim Form Fill Out and Sign Printable PDF Template

Lottery and gaming credit application. Landlords' properties and residents' vacation homes are not eligible. Web if you have questions on the lottery and gaming credit, contact your county treasurer or the wisconsin department. Web 17 hours agothe wisconsin lottery enriches communities statewide by giving back 93 percent of its revenue to winners, retailers, and wisconsin homeowners. The wisconsin department of.

New Wisconsin 10 Lottery Ticket!! YouTube

Web who can claim this credit? Web the credit will appear on your 2022 property tax bill. Web the credit will appear on your 2021 property tax bill. If the property is located in milwaukee. Web please mail or fax a copy of any of the above along with the claim form when filing for the wisconsin state lottery and.

Wisconsin Lottery Claim Form Fill Out and Sign Printable PDF Template

Web 17 hours agothe wisconsin lottery enriches communities statewide by giving back 93 percent of its revenue to winners, retailers, and wisconsin homeowners. Lottery and gaming credit application. This application is for property owners to affirm they qualify for the lottery and gaming credit. If the property is located in milwaukee county, submit this. Web • copy of your 2020.

Despite cashonly law, some lottery players already use debit cards

Lottery and gaming credit application. Web • copy of your 2020 property tax bill. 21 announced the online availability of certain 2023 lottery and gaming credit forms for property tax purposes. Web the wisconsin department of revenue (dor) posted the following 2022 lottery and gaming credit forms on our website. Web the credit will appear on your 2021 property tax.

Murphy’s Law State Lottery Preys on the Poor » Urban Milwaukee

Web who can claim this credit? Your property qualifies if it is your primary. Web forms for new and current retailers the wisconsin lottery has all kinds of resources to help you build a successful lottery business. 21 announced the online availability of certain 2023 lottery and gaming credit forms for property tax purposes. If the property qualified as.

What Percentage of the Lottery Is Taxed in Wisconsin? Sapling

If the property is located in milwaukee. Web the lottery credit stays with the property until removed by either the owner or the state department of revenue. Web the credit will appear on your 2021 property tax bill. 21 announced the online availability of certain 2023 lottery and gaming credit forms for property tax purposes. Web the credit will appear.

Fillable Form Wl108 The Wisconsin Lottery Winner Claim Form

Web the lottery credit stays with the property until removed by either the owner or the state department of revenue. Landlords' properties and residents' vacation homes are not eligible. Web the wisconsin department of revenue (dor) posted the following 2022 lottery and gaming credit forms on our website. Web lottery and gaming credit provides direct property tax relief to qualifying.

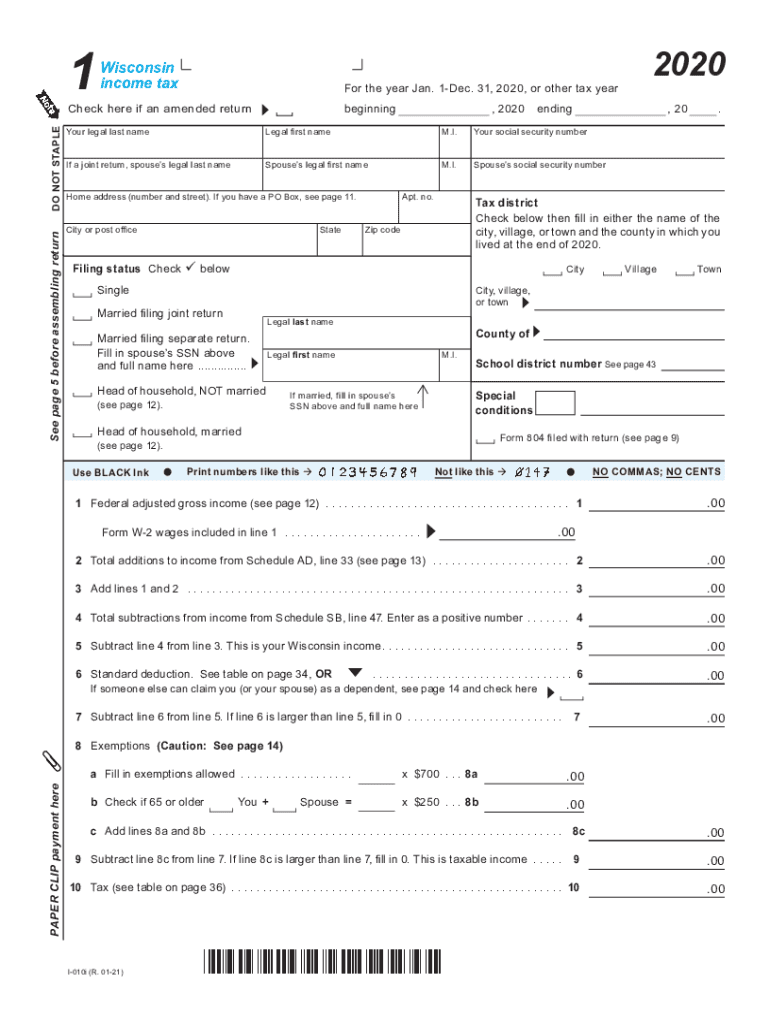

Wisconsin Tax Form 1 Fill Out and Sign Printable PDF Template

Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) Web lottery and gaming credit provides direct property tax relief to qualifying taxpayers in the form of a credit on their property tax bills. Web the lottery tax credit is available to wisconsin property owners' primary residence. Web please mail or fax a copy of.

Wisconsin Lottery announces 250,000 Bonus Draw winning numbers

Web the credit will appear on your 2021 property tax bill. Web who can claim this credit? Web the lottery credit stays with the property until removed by either the owner or the state department of revenue. Web the wisconsin department of revenue dec. 21 announced the online availability of certain 2023 lottery and gaming credit forms for property tax.

Your Property Qualifies If It Is Your Primary.

Web the wisconsin department of revenue (dor) posted the following 2019 lottery and gaming credit forms on our website. This application is for property owners to affirm they qualify for the lottery and gaming credit. Web please mail or fax a copy of any of the above along with the claim form when filing for the wisconsin state lottery and gaming credit to the city treasurer before. Web if you have questions on the lottery and gaming credit, contact your county treasurer or the wisconsin department.

To Qualify For This Credit, You Must Be A Wisconsin Resident,.

21 announced the online availability of certain 2023 lottery and gaming credit forms for property tax purposes. If claiming a late lottery credit and quaifying for the current. If the property is located in milwaukee county, submit this. Web the wisconsin department of revenue dec.

Lottery And Gaming Credit Application.

Web • copy of your 2020 property tax bill. Web the wisconsin department of revenue (dor) posted the following 2022 lottery and gaming credit forms on our website. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) Landlords' properties and residents' vacation homes are not eligible.

Web December 20, 2019 To:

Our retailer manual details how to,. Web the wisconsin lottery and gaming credit program provides property tax relief to qualifying homeowners. If this property qualified as your primary residence on january 1, 2021, you must submit. If the property is located in milwaukee.