You Expect To Generate 10 Million In The First Year

You Expect To Generate 10 Million In The First Year - A firm has three different investment options, each costing $10 million. Investment b will generate $1.70 million at the. Option a will generate $12 million in revenue at the end of one year. It is a simple tool that tells you how long it will take to recoup your investment. In this case, the movie costs $10 million. Has earnings before interest and taxes (ebit) of $10 million, depreciation expenses of $1 million, capital expenditures of $1.5 million,. Investment a will generate $2.40 million per year (starting at the end of the first year) in perpetuity. You expect it to generate $10 million in the first year, $5 million in the second year, and then $500,000 each year after that (continuing into the indefinite.

In this case, the movie costs $10 million. It is a simple tool that tells you how long it will take to recoup your investment. A firm has three different investment options, each costing $10 million. Option a will generate $12 million in revenue at the end of one year. Investment a will generate $2.40 million per year (starting at the end of the first year) in perpetuity. Has earnings before interest and taxes (ebit) of $10 million, depreciation expenses of $1 million, capital expenditures of $1.5 million,. You expect it to generate $10 million in the first year, $5 million in the second year, and then $500,000 each year after that (continuing into the indefinite. Investment b will generate $1.70 million at the.

Option a will generate $12 million in revenue at the end of one year. A firm has three different investment options, each costing $10 million. Investment a will generate $2.40 million per year (starting at the end of the first year) in perpetuity. It is a simple tool that tells you how long it will take to recoup your investment. You expect it to generate $10 million in the first year, $5 million in the second year, and then $500,000 each year after that (continuing into the indefinite. Has earnings before interest and taxes (ebit) of $10 million, depreciation expenses of $1 million, capital expenditures of $1.5 million,. In this case, the movie costs $10 million. Investment b will generate $1.70 million at the.

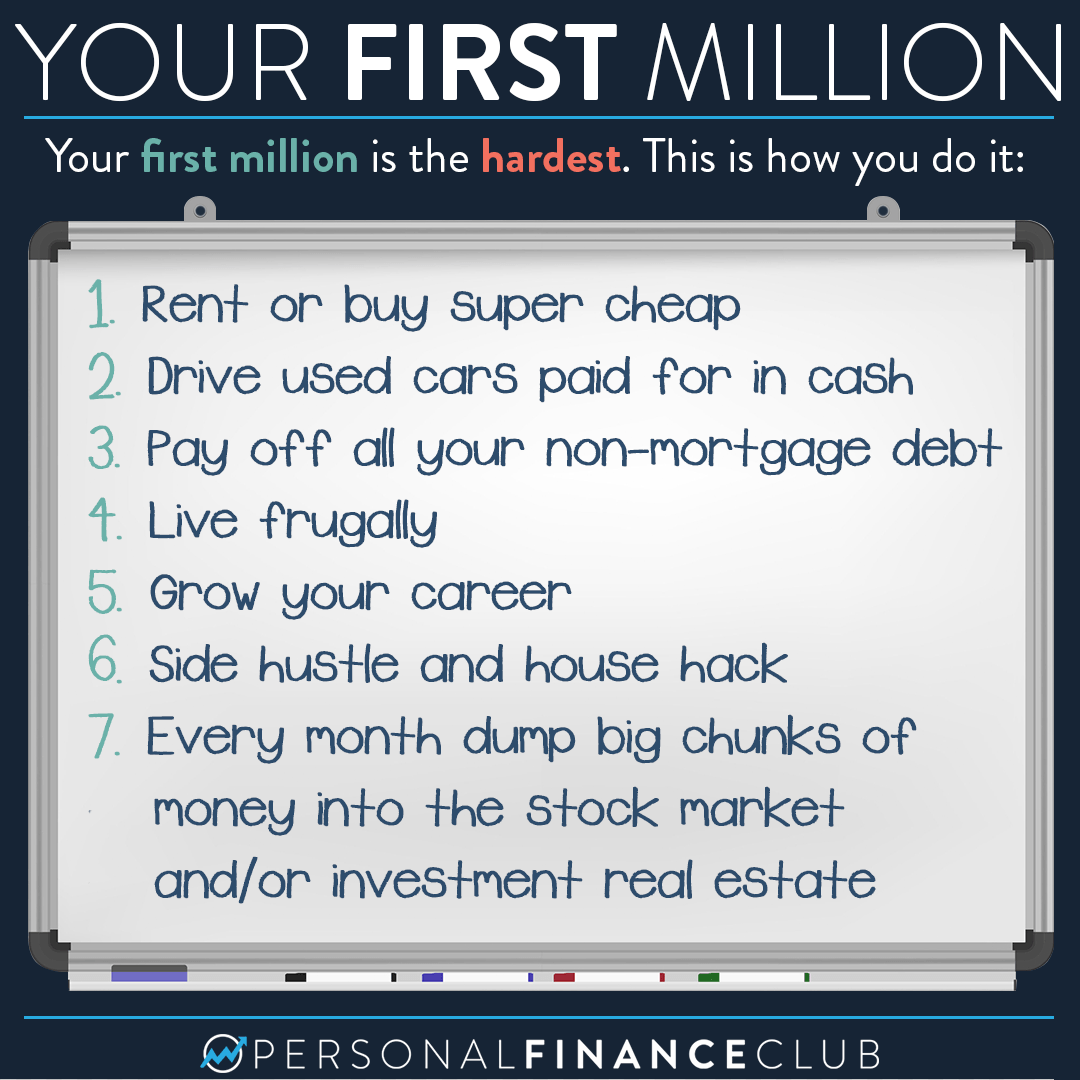

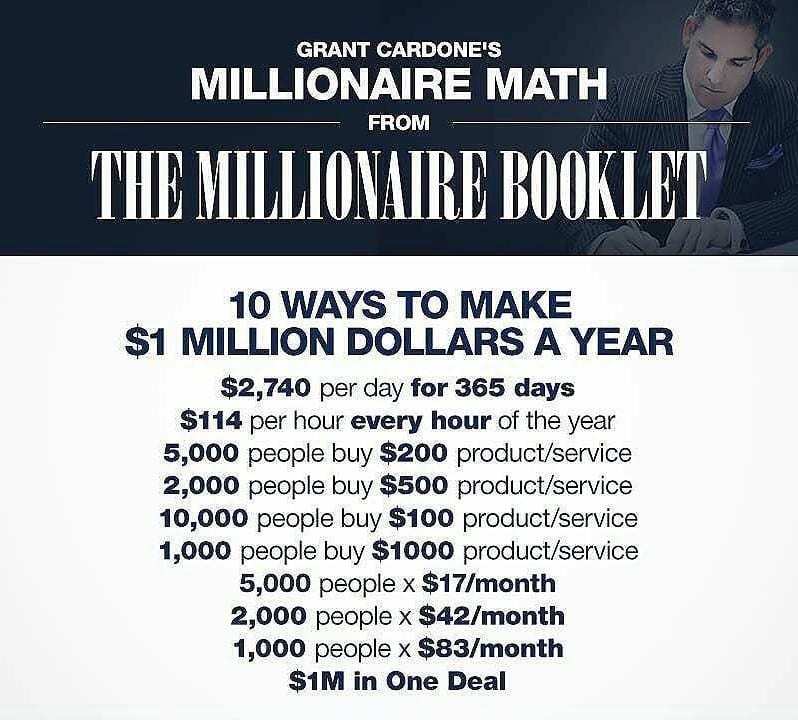

How to make your first million dollars Personal Finance Club

Investment b will generate $1.70 million at the. Option a will generate $12 million in revenue at the end of one year. It is a simple tool that tells you how long it will take to recoup your investment. You expect it to generate $10 million in the first year, $5 million in the second year, and then $500,000 each.

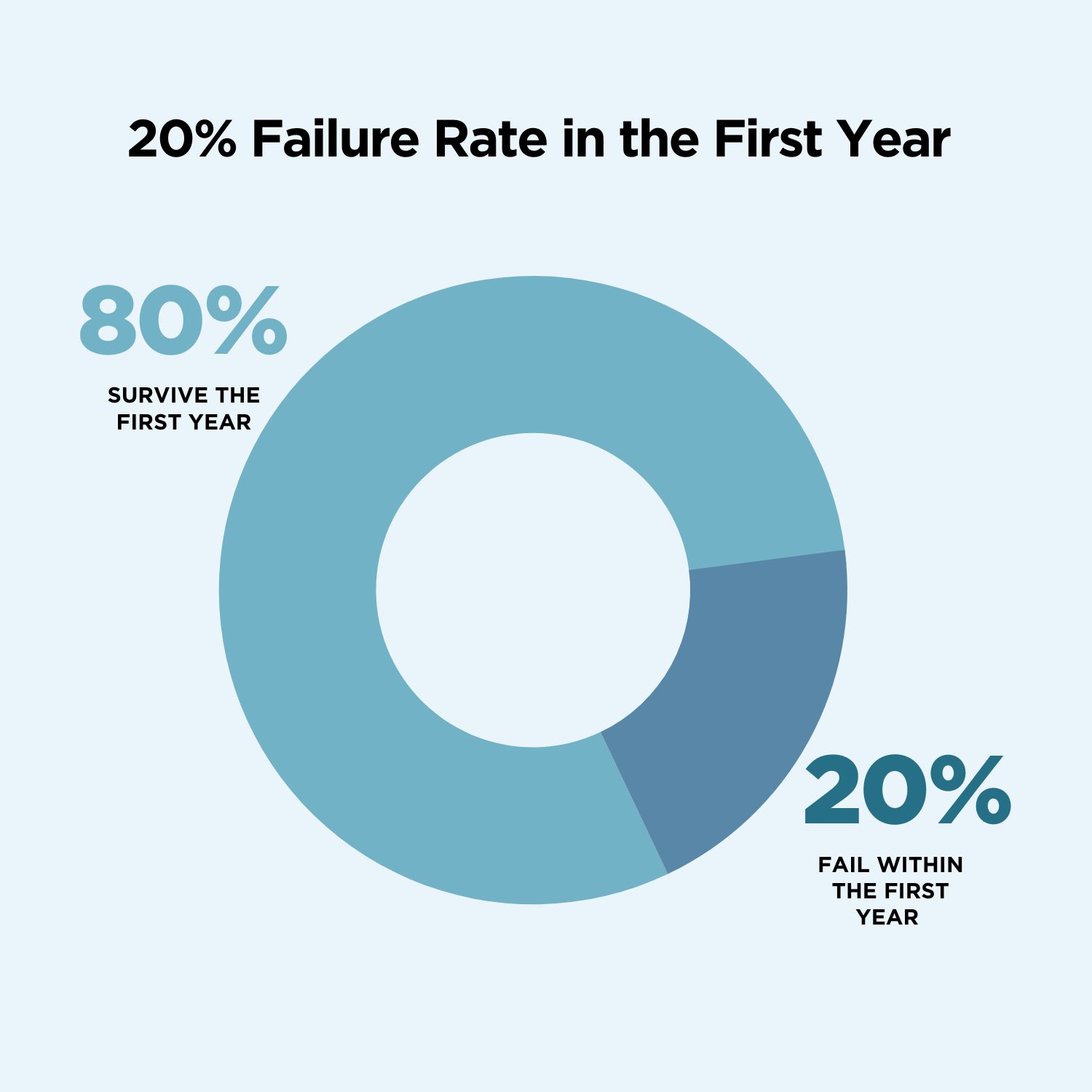

The Percentage of Businesses That Fail (Statistics & Failure Rates)

In this case, the movie costs $10 million. You expect it to generate $10 million in the first year, $5 million in the second year, and then $500,000 each year after that (continuing into the indefinite. Investment b will generate $1.70 million at the. It is a simple tool that tells you how long it will take to recoup your.

How to make 1 million dollars in one year, make your first million

A firm has three different investment options, each costing $10 million. Has earnings before interest and taxes (ebit) of $10 million, depreciation expenses of $1 million, capital expenditures of $1.5 million,. In this case, the movie costs $10 million. Investment b will generate $1.70 million at the. Investment a will generate $2.40 million per year (starting at the end of.

What To Do With 10 Million Dollars in Cash MoneyRyde 2024

In this case, the movie costs $10 million. It is a simple tool that tells you how long it will take to recoup your investment. Investment a will generate $2.40 million per year (starting at the end of the first year) in perpetuity. You expect it to generate $10 million in the first year, $5 million in the second year,.

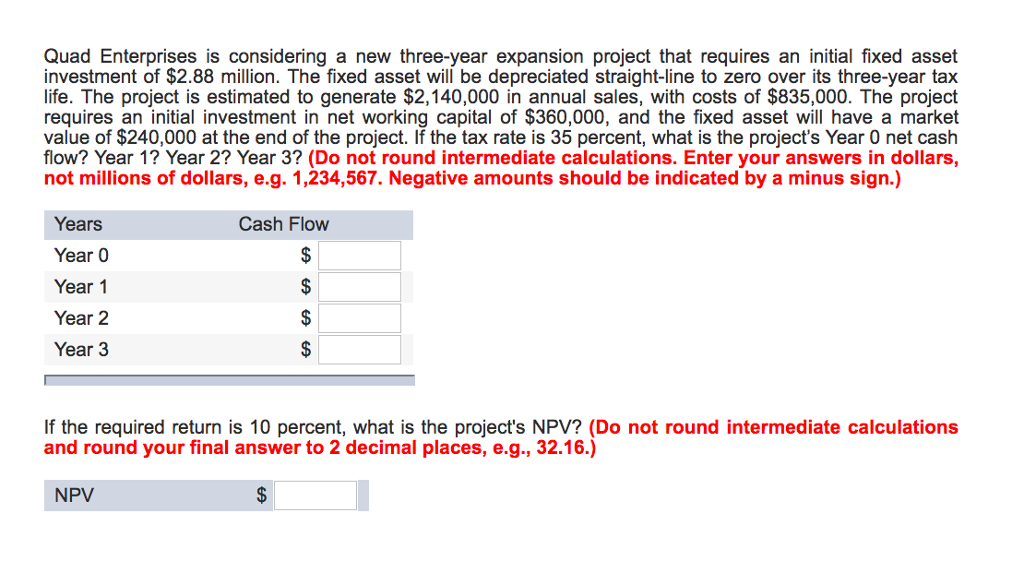

Solved Quad Enterprises is considering a new threeyear

A firm has three different investment options, each costing $10 million. Option a will generate $12 million in revenue at the end of one year. Investment b will generate $1.70 million at the. It is a simple tool that tells you how long it will take to recoup your investment. Investment a will generate $2.40 million per year (starting at.

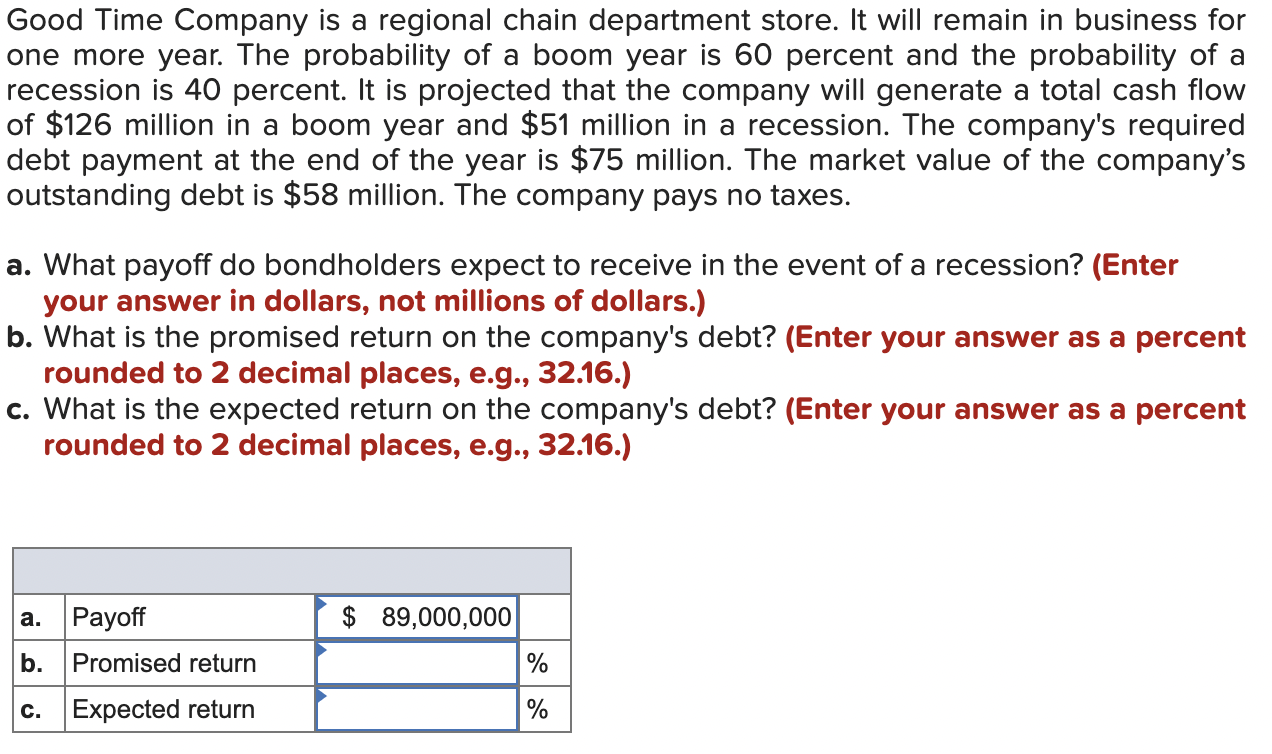

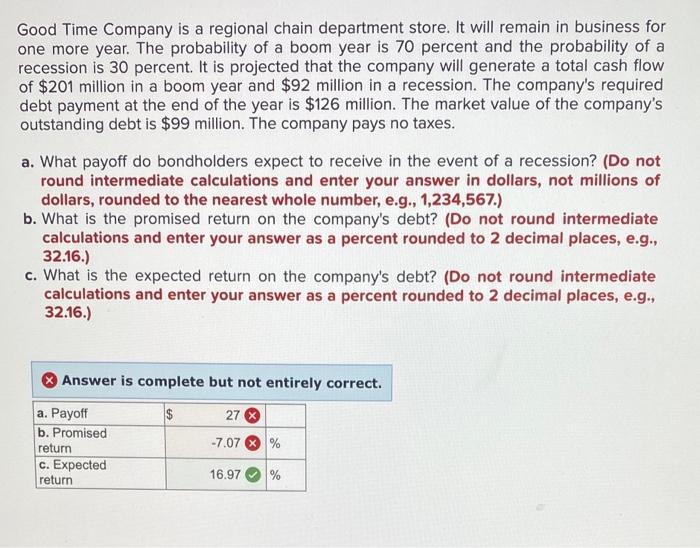

Solved Good Time Company is a regional chain department

Option a will generate $12 million in revenue at the end of one year. In this case, the movie costs $10 million. Investment a will generate $2.40 million per year (starting at the end of the first year) in perpetuity. Investment b will generate $1.70 million at the. A firm has three different investment options, each costing $10 million.

Millionaire Match, How You can Earn Your 1st Million Dollars Online

In this case, the movie costs $10 million. Investment b will generate $1.70 million at the. Option a will generate $12 million in revenue at the end of one year. A firm has three different investment options, each costing $10 million. It is a simple tool that tells you how long it will take to recoup your investment.

The Devil, 10 million, the Detail and how you use it.

In this case, the movie costs $10 million. Investment b will generate $1.70 million at the. Has earnings before interest and taxes (ebit) of $10 million, depreciation expenses of $1 million, capital expenditures of $1.5 million,. It is a simple tool that tells you how long it will take to recoup your investment. Investment a will generate $2.40 million per.

Solved Good Time Company is a regional chain department

Has earnings before interest and taxes (ebit) of $10 million, depreciation expenses of $1 million, capital expenditures of $1.5 million,. In this case, the movie costs $10 million. Option a will generate $12 million in revenue at the end of one year. Investment a will generate $2.40 million per year (starting at the end of the first year) in perpetuity..

The Tools to 10 Million PCA Overdrive

You expect it to generate $10 million in the first year, $5 million in the second year, and then $500,000 each year after that (continuing into the indefinite. Investment a will generate $2.40 million per year (starting at the end of the first year) in perpetuity. Has earnings before interest and taxes (ebit) of $10 million, depreciation expenses of $1.

A Firm Has Three Different Investment Options, Each Costing $10 Million.

Investment b will generate $1.70 million at the. You expect it to generate $10 million in the first year, $5 million in the second year, and then $500,000 each year after that (continuing into the indefinite. In this case, the movie costs $10 million. Investment a will generate $2.40 million per year (starting at the end of the first year) in perpetuity.

Has Earnings Before Interest And Taxes (Ebit) Of $10 Million, Depreciation Expenses Of $1 Million, Capital Expenditures Of $1.5 Million,.

Option a will generate $12 million in revenue at the end of one year. It is a simple tool that tells you how long it will take to recoup your investment.