1099 Form Mn

1099 Form Mn - How to classify a worker [+] worker classification examples [+] employees [+] independent contractors [+] request a determination [+] classifying workers incorrectly [+] information and assistance Find forms and instructions by tax type [+] January 31, 2023 for without tax withheld. You can also look for forms by category below the search box. Web this fact sheet explains how to classify your workers and covers the differences between workers and independent contractors. Use this tool to search for a specific tax form using the tax form number or name. January 31, 2023 for minnesota state taxes withheld. The minnesota department of revenue must send you this information by january 31 of the year after you got the refund. Unemployment benefits are taxable under both federal and minnesota law. Web if you received a frontline worker payment of $487.45 in 2022, minnesota will not send you a federal form 1099 to report the payment because the amount was less than $600.

Web this fact sheet explains how to classify your workers and covers the differences between workers and independent contractors. According to the minnesota department of revenue, minnesota does not tax this payment on your 2022 state income tax return (form m1, individual income tax). Deadline to file minnesota filing taxes: Find forms and instructions by tax type [+] Web taxes and 1099 forms mhcp reimbursement is payment in full prompt payment additional resources legal references please also review the following billing policies for all providers: Web if you received a frontline worker payment of $487.45 in 2022, minnesota will not send you a federal form 1099 to report the payment because the amount was less than $600. Web find a form. January 31, 2023 for minnesota state taxes withheld. The minnesota department of revenue must send you this information by january 31 of the year after you got the refund. January 31, 2023 for without tax withheld.

Web if you received a frontline worker payment of $487.45 in 2022, minnesota will not send you a federal form 1099 to report the payment because the amount was less than $600. Web taxes and 1099 forms mhcp reimbursement is payment in full prompt payment additional resources legal references please also review the following billing policies for all providers: Deadline to file minnesota filing taxes: How to classify a worker [+] worker classification examples [+] employees [+] independent contractors [+] request a determination [+] classifying workers incorrectly [+] information and assistance January 31, 2023 for minnesota state taxes withheld. Web this fact sheet explains how to classify your workers and covers the differences between workers and independent contractors. You can also look for forms by category below the search box. Unemployment benefits are taxable under both federal and minnesota law. According to the minnesota department of revenue, minnesota does not tax this payment on your 2022 state income tax return (form m1, individual income tax). Web find a form.

What is a 1099 & 5498? uDirect IRA Services, LLC

Web find a form. Unemployment benefits are taxable under both federal and minnesota law. The minnesota department of revenue must send you this information by january 31 of the year after you got the refund. How to classify a worker [+] worker classification examples [+] employees [+] independent contractors [+] request a determination [+] classifying workers incorrectly [+] information and.

What is a 1099Misc Form? Financial Strategy Center

Unemployment benefits are taxable under both federal and minnesota law. Web this fact sheet explains how to classify your workers and covers the differences between workers and independent contractors. Web if you received a frontline worker payment of $487.45 in 2022, minnesota will not send you a federal form 1099 to report the payment because the amount was less than.

How Do I Get Form Ssa 1099 For 2020 Darrin Kenney's Templates

January 31, 2023 for without tax withheld. You can also look for forms by category below the search box. Web if you received a frontline worker payment of $487.45 in 2022, minnesota will not send you a federal form 1099 to report the payment because the amount was less than $600. Web this fact sheet explains how to classify your.

What Is A 1099? Explaining All Form 1099 Types CPA Solutions

January 31, 2023 for without tax withheld. According to the minnesota department of revenue, minnesota does not tax this payment on your 2022 state income tax return (form m1, individual income tax). You can also look for forms by category below the search box. Web if you received a frontline worker payment of $487.45 in 2022, minnesota will not send.

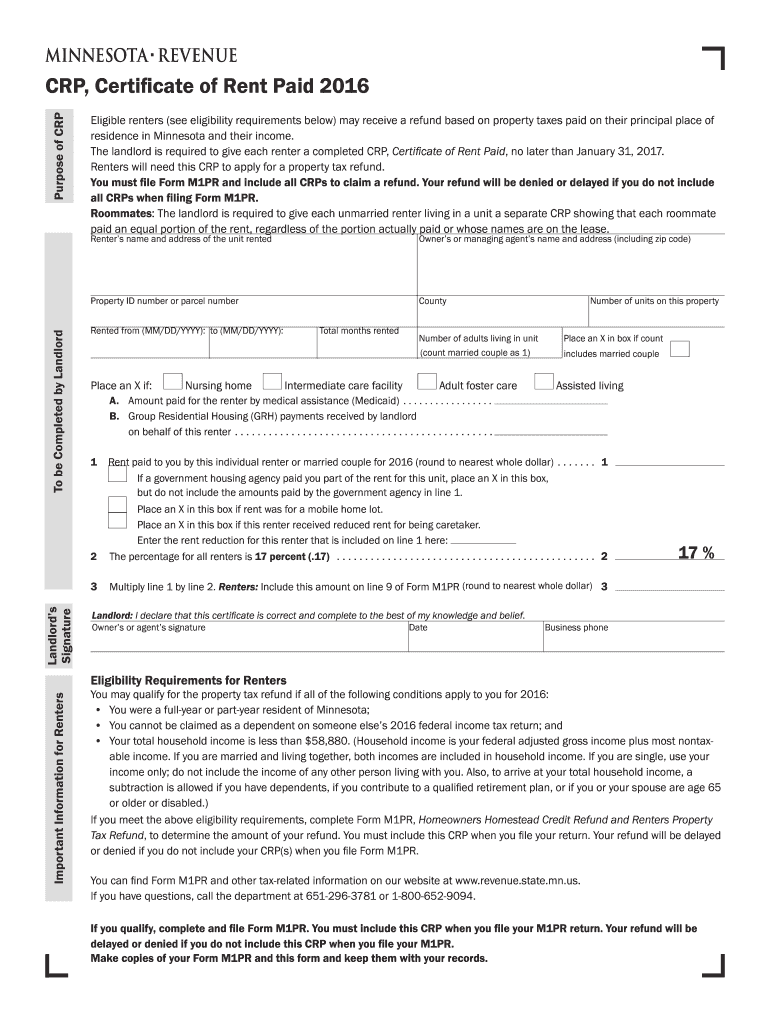

14 Form Mn Ten Great 14 Form Mn Ideas That You Can Share With Your

Deadline to file minnesota filing taxes: The minnesota department of revenue must send you this information by january 31 of the year after you got the refund. January 31, 2023 for minnesota state taxes withheld. Web if you received a frontline worker payment of $487.45 in 2022, minnesota will not send you a federal form 1099 to report the payment.

Does A Foreign Company Get A 1099 Leah Beachum's Template

Use this tool to search for a specific tax form using the tax form number or name. You can also look for forms by category below the search box. Deadline to file minnesota filing taxes: Web find a form. Web this fact sheet explains how to classify your workers and covers the differences between workers and independent contractors.

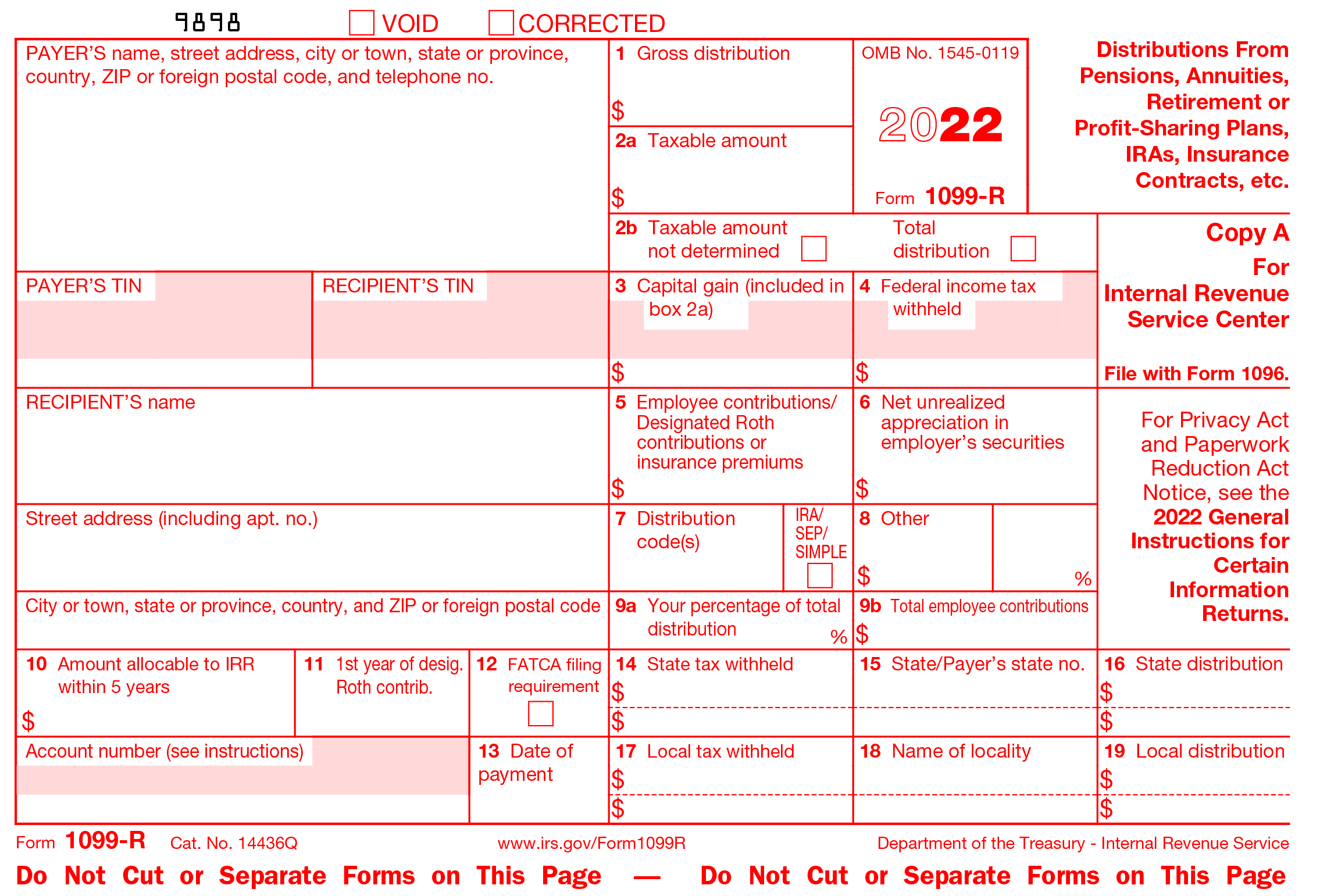

Efile 2022 Form 1099R Report the Distributions from Pensions

Unemployment benefits are taxable under both federal and minnesota law. Find forms and instructions by tax type [+] You can also look for forms by category below the search box. How to classify a worker [+] worker classification examples [+] employees [+] independent contractors [+] request a determination [+] classifying workers incorrectly [+] information and assistance Web if you received.

What Is Form 1099MISC? When Do I Need to File a 1099MISC? Gusto

Web this fact sheet explains how to classify your workers and covers the differences between workers and independent contractors. Unemployment benefits are taxable under both federal and minnesota law. The minnesota department of revenue must send you this information by january 31 of the year after you got the refund. Web find a form. January 31, 2023 for without tax.

Free Printable 1099 Misc Forms Free Printable

Web this fact sheet explains how to classify your workers and covers the differences between workers and independent contractors. You can also look for forms by category below the search box. Use this tool to search for a specific tax form using the tax form number or name. How to classify a worker [+] worker classification examples [+] employees [+].

Form 1099 Misc Fillable Universal Network

According to the minnesota department of revenue, minnesota does not tax this payment on your 2022 state income tax return (form m1, individual income tax). Find forms and instructions by tax type [+] January 31, 2023 for minnesota state taxes withheld. Web if you received a frontline worker payment of $487.45 in 2022, minnesota will not send you a federal.

You Can Also Look For Forms By Category Below The Search Box.

According to the minnesota department of revenue, minnesota does not tax this payment on your 2022 state income tax return (form m1, individual income tax). Web this fact sheet explains how to classify your workers and covers the differences between workers and independent contractors. Deadline to file minnesota filing taxes: Find forms and instructions by tax type [+]

January 31, 2023 For Without Tax Withheld.

Use this tool to search for a specific tax form using the tax form number or name. Web if you received a frontline worker payment of $487.45 in 2022, minnesota will not send you a federal form 1099 to report the payment because the amount was less than $600. Web find a form. January 31, 2023 for minnesota state taxes withheld.

Web Taxes And 1099 Forms Mhcp Reimbursement Is Payment In Full Prompt Payment Additional Resources Legal References Please Also Review The Following Billing Policies For All Providers:

The minnesota department of revenue must send you this information by january 31 of the year after you got the refund. How to classify a worker [+] worker classification examples [+] employees [+] independent contractors [+] request a determination [+] classifying workers incorrectly [+] information and assistance Unemployment benefits are taxable under both federal and minnesota law.

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.57.10AM-8cc0d5ec189e43f7a9c6ff164db34d2c.png)