1120 Form 2019

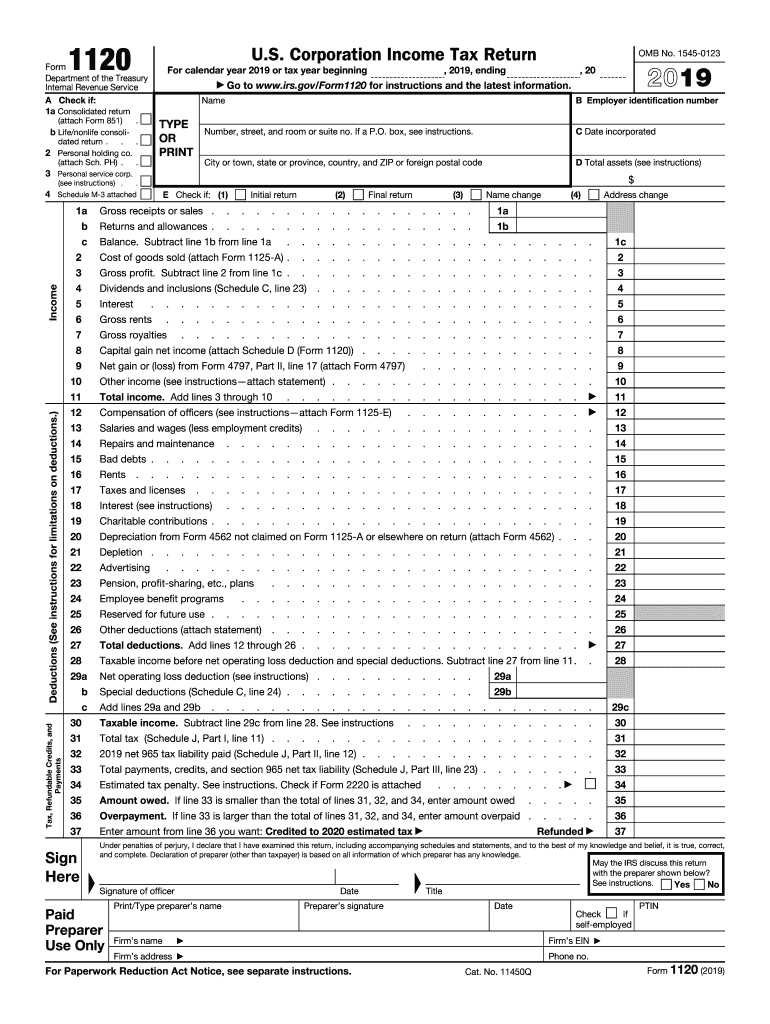

1120 Form 2019 - Corporation income tax payment voucher: Form 7004n, application for automatic extension of time to file nebraska corporation, fiduciary, or partnership return. Department of the treasury internal revenue service. Web corporation, and the instructions for form 2553. Corporation income tax return for calendar year 2019 or tax year beginning, 2019, ending, 20. Use this form to report the income, gains, losses, deductions, credits, and to figure the income tax liability of a corporation. Web a corporation that held a qualified investment in an advanced manufacturing facility that is placed in service after december 31, 2022, can elect to treat the credit for the advanced manufacturing investment as a deemed payment. For instructions and the latest information. Web information about form 1120, u.s. Web form 1120n, 2019 nebraska corporation income tax return, with schedules and instructions.

Web information about form 1120, u.s. For instructions and the latest information. Corporation income tax return for calendar year 2019 or tax year beginning, 2019, ending, 20. Form 7004n, application for automatic extension of time to file nebraska corporation, fiduciary, or partnership return. Web form 1120 department of the treasury internal revenue service u.s. Corporation income tax payment voucher: Corporation income tax payment voucher: Department of the treasury internal revenue service. The changes to the form and schedule aim to improve the quality of the information reported by partnerships both to the irs and the. For instructions and the latest information.

Form 7004n, application for automatic extension of time to file nebraska corporation, fiduciary, or partnership return. Web a corporation that held a qualified investment in an advanced manufacturing facility that is placed in service after december 31, 2022, can elect to treat the credit for the advanced manufacturing investment as a deemed payment. Corporation income tax return department of the treasury internal revenue service section references are to the internal revenue code unless otherwise noted. For instructions and the latest information. The changes to the form and schedule aim to improve the quality of the information reported by partnerships both to the irs and the. Corporation income tax return, including recent updates, related forms and instructions on how to file. Use this form to report the income, gains, losses, deductions, credits, and to figure the income tax liability of a corporation. Corporation income tax return for calendar year 2019 or tax year beginning, 2019, ending, 20. Income tax return for an s corporation. Web form 1120n, 2019 nebraska corporation income tax return, with schedules and instructions.

1120 tax table

Corporation income tax payment voucher: Number, street, and room or suite no. For instructions and the latest information. Department of the treasury internal revenue service. Web information about form 1120, u.s.

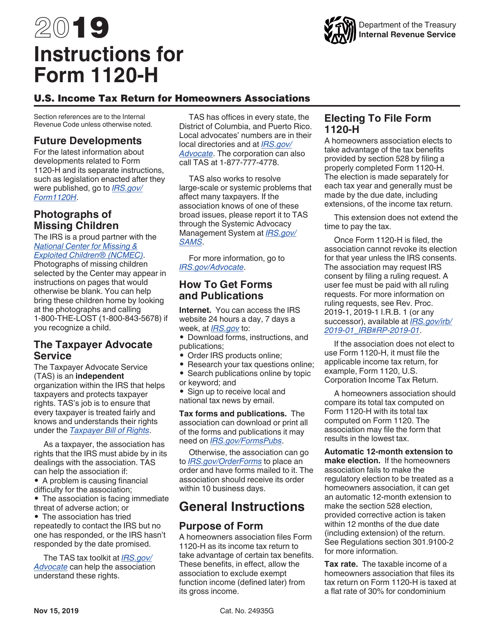

Download Instructions for IRS Form 1120H U.S. Tax Return for

The changes to the form and schedule aim to improve the quality of the information reported by partnerships both to the irs and the. Corporation income tax return, including recent updates, related forms and instructions on how to file. Web instructions for form 1120 u.s. Form 1120xn, amended nebraska corporation income tax return for tax years after 2016 and before.

2019 Form IRS 1120 Fill Online, Printable, Fillable, Blank pdfFiller

For instructions and the latest information. Corporation income tax return, including recent updates, related forms and instructions on how to file. Web form 1120 department of the treasury internal revenue service u.s. Use this form to report the income, gains, losses, deductions, credits, and to figure the income tax liability of a corporation. Web corporation, and the instructions for form.

Corporate tax returns are latest forms to get IRS onceover Don't

The changes to the form and schedule aim to improve the quality of the information reported by partnerships both to the irs and the. Form 7004n, application for automatic extension of time to file nebraska corporation, fiduciary, or partnership return. Corporation income tax return, including recent updates, related forms and instructions on how to file. Corporation income tax return for.

Editable IRS Form 1120S (Schedule K1) 2018 2019 Create A Digital

Corporation income tax return for calendar year 2019 or tax year beginning, 2019, ending, 20. For instructions and the latest information. Use this form to report the income, gains, losses, deductions, credits, and to figure the income tax liability of a corporation. Web form 1120n, 2019 nebraska corporation income tax return, with schedules and instructions. Do not file this form.

Form 1120 Fill Out and Sign Printable PDF Template signNow

Corporation income tax return for calendar year 2019 or tax year beginning, 2019, ending, 20. Department of the treasury internal revenue service. Number, street, and room or suite no. Web corporation, and the instructions for form 2553. Corporation income tax payment voucher:

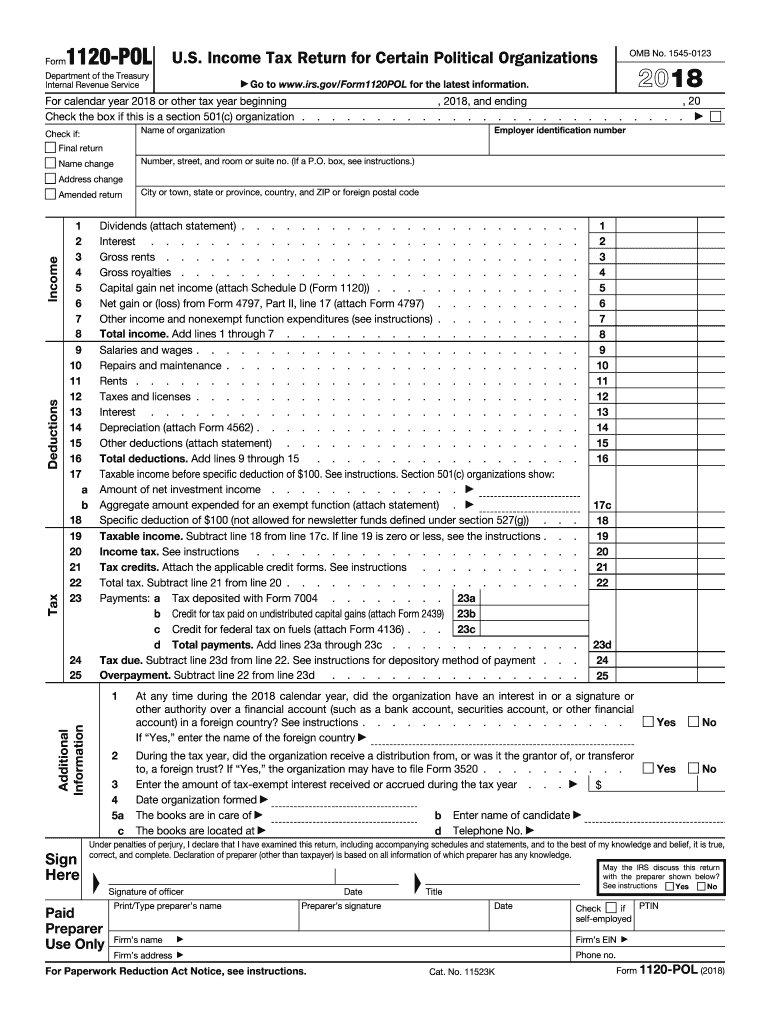

Editable IRS Form 1120PC 2018 2019 Create A Digital Sample in PDF

Corporation income tax payment voucher: Web form 1120n, 2019 nebraska corporation income tax return, with schedules and instructions. Corporation income tax return for calendar year 2019 or tax year beginning, 2019, ending, 20. Income tax return for an s corporation. Form 1120xn, amended nebraska corporation income tax return for tax years after 2016 and before 2020.

Editable IRS Form 1120 (Schedule M3) 2018 2019 Create A Digital

Corporation income tax payment voucher: After filing form 2553, you should have received confirmation that form 2553 was accepted. Form 1120xn, amended nebraska corporation income tax return for tax years after 2016 and before 2020. Web form 1120 department of the treasury internal revenue service u.s. Corporation income tax return department of the treasury internal revenue service section references are.

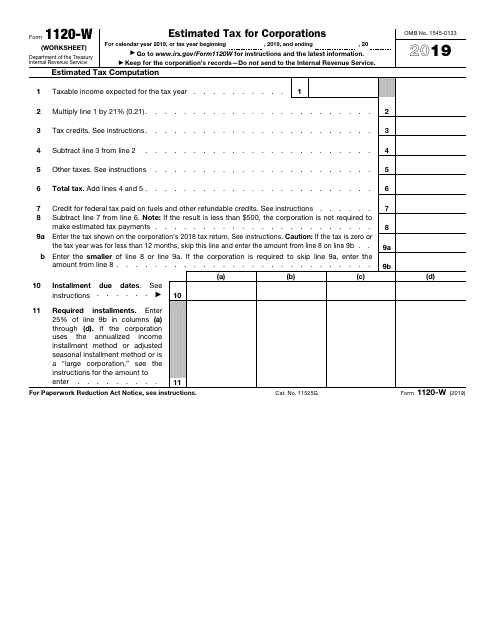

IRS Form 1120W Download Fillable PDF or Fill Online Estimated Tax for

For instructions and the latest information. Web information about form 1120, u.s. Web corporation, and the instructions for form 2553. Corporation income tax return for calendar year 2019 or tax year beginning, 2019, ending, 20. Corporation income tax return, including recent updates, related forms and instructions on how to file.

Draft 2019 Form 1120S Instructions Adds New K1 Statements for §199A

Web form 1120 department of the treasury internal revenue service u.s. Web form 1120n, 2019 nebraska corporation income tax return, with schedules and instructions. Form 7004n, application for automatic extension of time to file nebraska corporation, fiduciary, or partnership return. Web corporation, and the instructions for form 2553. Corporation income tax payment voucher:

Income Tax Return For An S Corporation.

Number, street, and room or suite no. Web a corporation that held a qualified investment in an advanced manufacturing facility that is placed in service after december 31, 2022, can elect to treat the credit for the advanced manufacturing investment as a deemed payment. After filing form 2553, you should have received confirmation that form 2553 was accepted. Web form 1120 department of the treasury internal revenue service u.s.

Web Corporation, And The Instructions For Form 2553.

For instructions and the latest information. Form 7004n, application for automatic extension of time to file nebraska corporation, fiduciary, or partnership return. If the election is made, the corporation is treated as making a payment against tax by the amount of the credit. Corporation income tax return for calendar year 2019 or tax year beginning, 2019, ending, 20.

For Instructions And The Latest Information.

Department of the treasury internal revenue service. Corporation income tax return, including recent updates, related forms and instructions on how to file. Do not file this form unless the corporation has filed or is attaching form 2553 to elect to be an s corporation. Web form 1120n, 2019 nebraska corporation income tax return, with schedules and instructions.

Corporation Income Tax Payment Voucher:

Use this form to report the income, gains, losses, deductions, credits, and to figure the income tax liability of a corporation. Corporation income tax return department of the treasury internal revenue service section references are to the internal revenue code unless otherwise noted. Form 1120xn, amended nebraska corporation income tax return for tax years after 2016 and before 2020. Web instructions for form 1120 u.s.