2016 Form 940

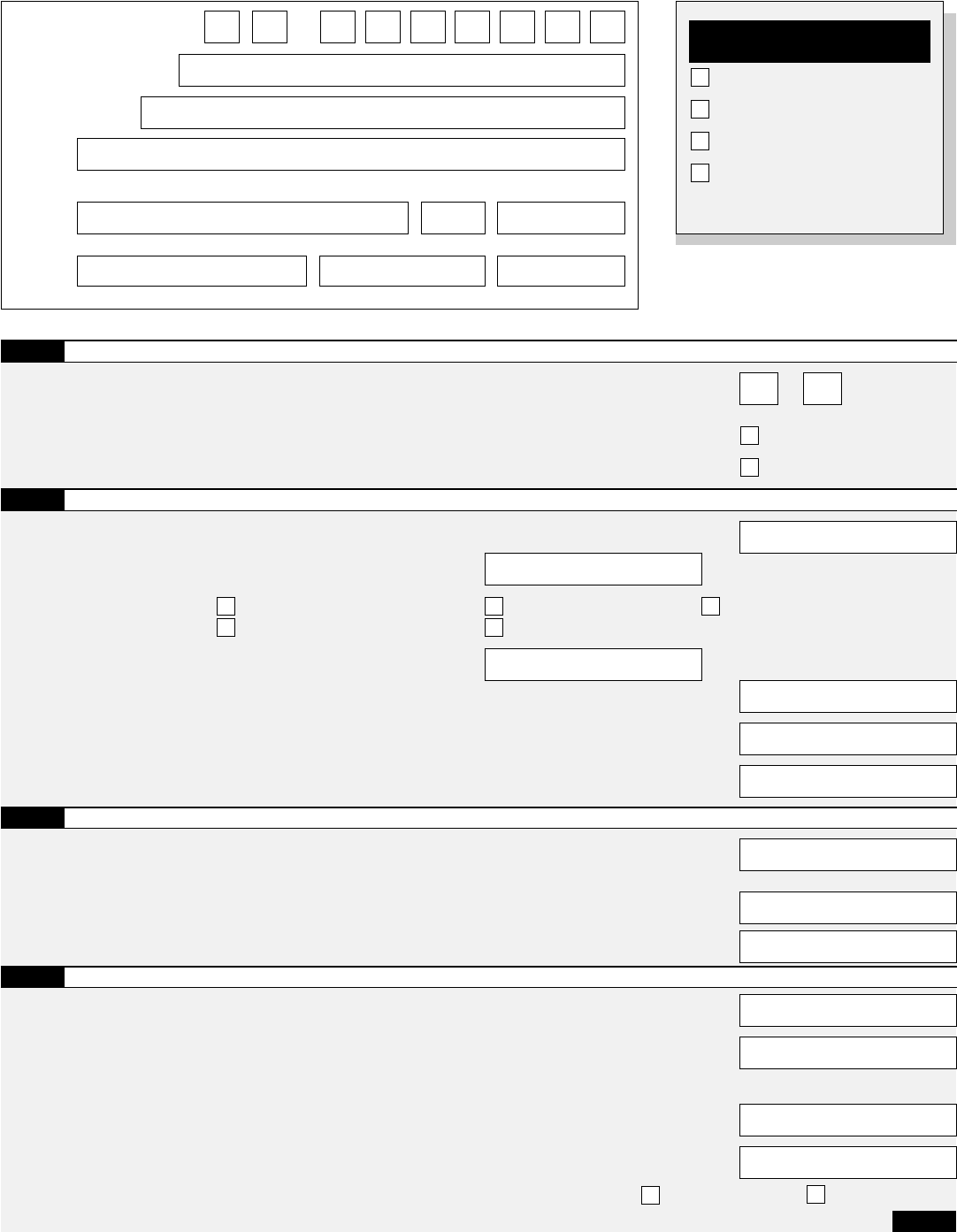

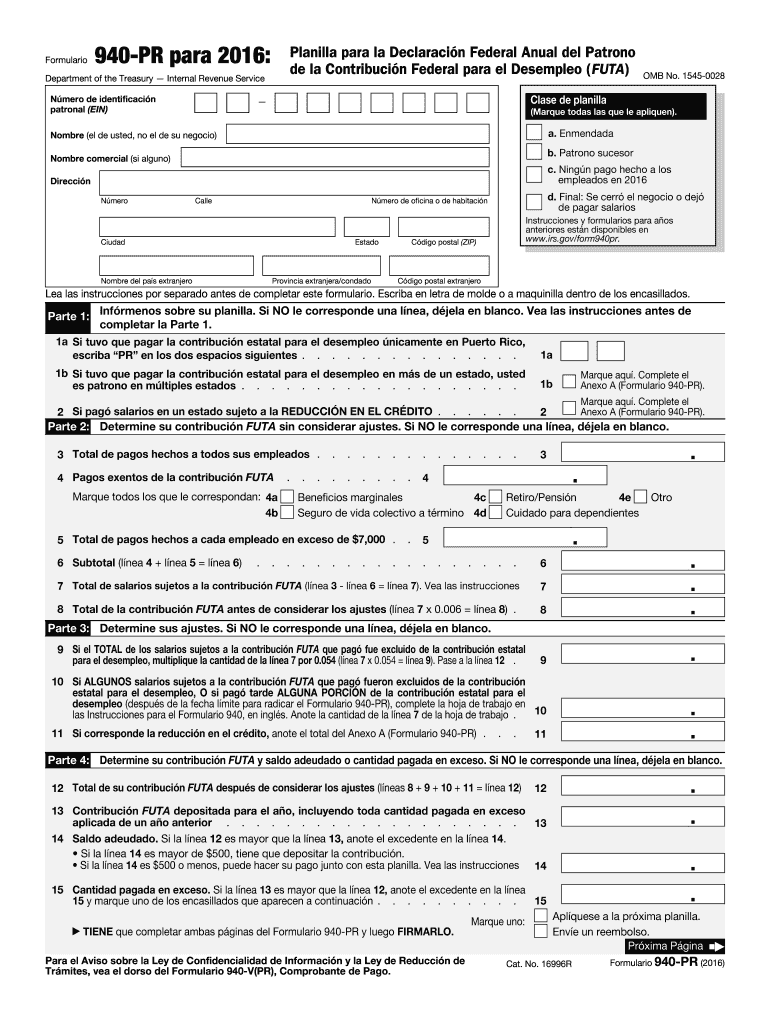

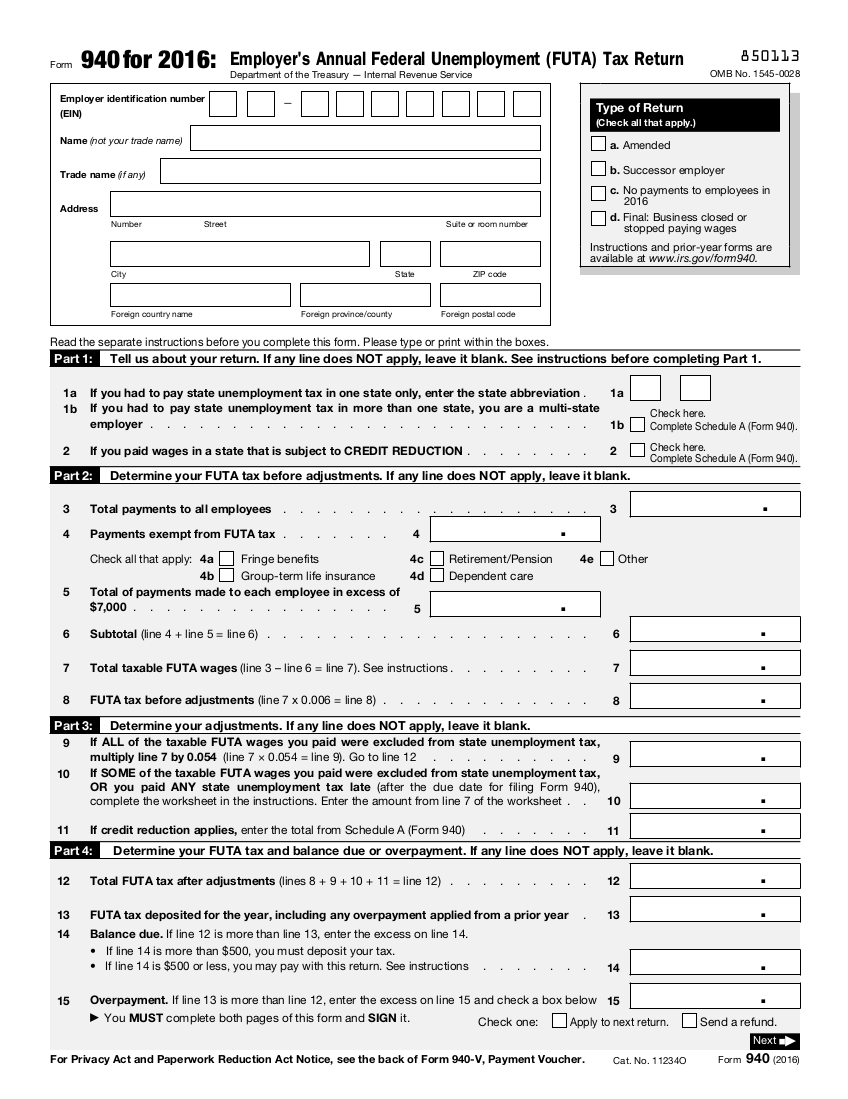

2016 Form 940 - Use form 940 to report your annual federal unemployment tax act (futa) tax. Web schedule a (form 940) for 2016: Form 940 is used to determine the amount of the taxes that you. Web for 2016, there are credit reduction states. Web schedule a (form 940) for 2016: Web to avoid a penalty, make your payment with your 2016 form 940 only if your futa tax for the fourth quarter (plus any undeposited amounts from earlier quarters) is $500 or less. If you paid any wages that are subject to the unemployment compensation laws of a credit reduction state, your credit against federal unemployment tax will be reduced based on the credit reduction rate for that credit reduction state. If your total futa tax after adjustments (form 940, line 12) is more than $500, you must make deposits by electronic funds transfer. Instructions for form 940, employer's annual federal unemployment (futa) tax return 2016 form 940: Web we ask for the information on form 940 to carry out the internal revenue laws of the united states.

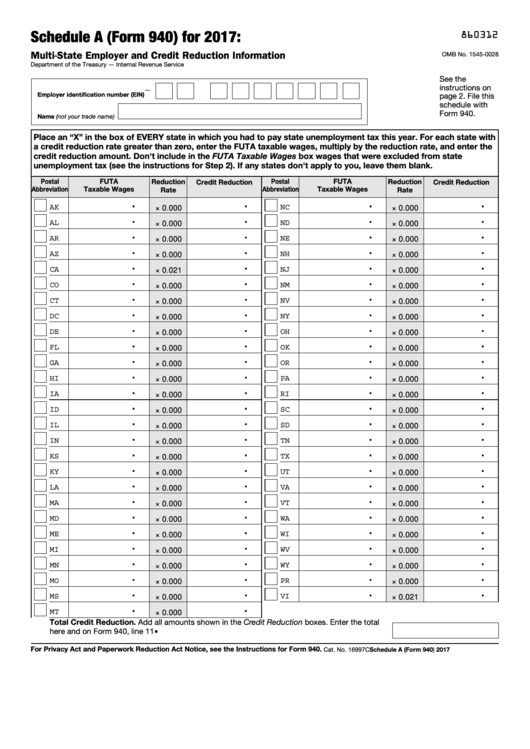

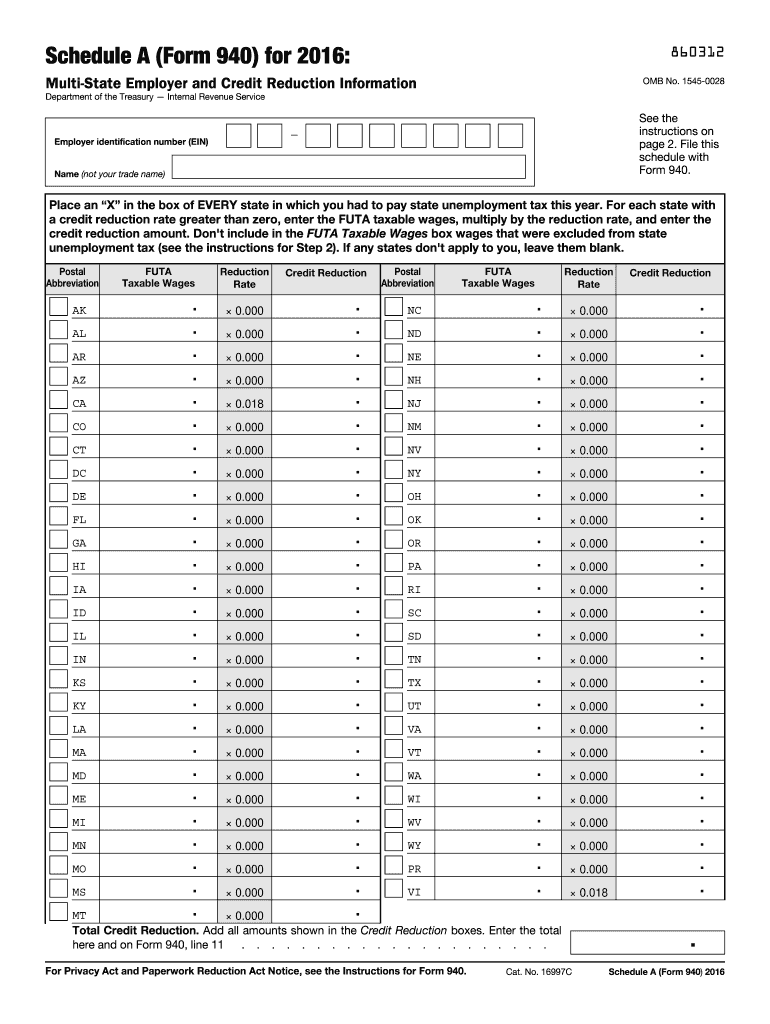

Use schedule a (form 940) to figure the credit reduction. Web we ask for the information on form 940 to carry out the internal revenue laws of the united states. Subtitle c, employment taxes, of the internal revenue code imposes unemployment tax under the federal unemployment tax act. Web to avoid a penalty, make your payment with your 2016 form 940 only if your futa tax for the fourth quarter (plus any undeposited amounts from earlier quarters) is $500 or less. Web schedule a (form 940) for 2016: Use form 940 to report your annual federal unemployment tax act (futa) tax. For employers who withhold taxes from employee's paychecks or who must pay the employer's portion of social security or medicare tax. To avoid a penalty, make your payment with your 2016 form 940. Employer identification number (ein) — name (not your trade name) see the instructions on page 2. Web schedule a (form 940) for 2016:

Web making payments with form 940. If your total futa tax after adjustments (form 940, line 12) is more than $500, you must make deposits by electronic funds transfer. Employer identification number (ein) — name (not your trade name) see the instructions on page 2. If your total futa tax after adjustments (form 940, line 12) is more than $500, you must make deposits by electronic funds transfer. Your futa tax for the fourth quarter (plus any undeposited amounts from earlier quarters) is $500 or less. For employers who withhold taxes from employee's paychecks or who must pay the employer's portion of social security or medicare tax. Web for 2016, there are credit reduction states. Employer's annual federal unemployment (futa) tax return 2015 inst 940: We need it to figure and collect the right amount of tax. Form 940 is used to determine the amount of the taxes that you.

Fillable Schedule A (Form 940) MultiState Employer And Credit

Subtitle c, employment taxes, of the internal revenue code imposes unemployment tax under the federal unemployment tax act. For employers who withhold taxes from employee's paychecks or who must pay the employer's portion of social security or medicare tax. Web form 940 (2020) employer's annual federal unemployment (futa) tax return. Use schedule a (form 940) to figure the credit reduction..

What Is Form 940? When Do I Need to File a FUTA Tax Return? Ask Gusto

Web for 2016, there are credit reduction states. If your total futa tax after adjustments (form 940, line 12) is more than $500, you must make deposits by electronic funds transfer. Form 940 is used to determine the amount of the taxes that you. To avoid a penalty, make your payment with your 2016 form 940. If your total futa.

Form 940 Edit, Fill, Sign Online Handypdf

Web schedule a (form 940) for 2016: If you paid any wages that are subject to the unemployment compensation laws of a credit reduction state, your credit against federal unemployment tax will be reduced based on the credit reduction rate for that credit reduction state. Web for 2016, there are credit reduction states. Together with state unemployment tax systems, the.

940 Pr Form Fill Out and Sign Printable PDF Template signNow

Employer identification number (ein) — name (not your trade name) see the instructions on page 2. We need it to figure and collect the right amount of tax. File this schedule with form 940. Instructions for form 940 (2020) pdf. Use schedule a (form 940) to figure the credit reduction.

940 Form 2021 IRS Forms

Use schedule a (form 940) to figure the credit reduction. Subtitle c, employment taxes, of the internal revenue code imposes unemployment tax under the federal unemployment tax act. Your futa tax for the fourth quarter (plus any undeposited amounts from earlier quarters) is $500 or less. Web for 2016, there are credit reduction states. Web making payments with form 940.

Form 940 Instructions StepbyStep Guide Fundera

Instructions for form 940, employer's annual federal unemployment (futa) tax return 2015 form 940 Instructions for form 940 (2020) pdf. Subtitle c, employment taxes, of the internal revenue code imposes unemployment tax under the federal unemployment tax act. Use form 940 to report your annual federal unemployment tax act (futa) tax. Web for 2016, there are credit reduction states.

940 (2016) Edit Forms Online PDFFormPro

Instructions for form 940, employer's annual federal unemployment (futa) tax return 2016 form 940: Employer's annual federal unemployment (futa) tax return 2015 inst 940: If your total futa tax after adjustments (form 940, line 12) is more than $500, you must make deposits by electronic funds transfer. Web for 2016, there are credit reduction states. We need it to figure.

Form 940 YouTube

File this schedule with form 940. Employer's annual federal unemployment (futa) tax return 2015 inst 940: Form 940 is used to determine the amount of the taxes that you. Together with state unemployment tax systems, the futa tax provides funds for paying unemployment compensation to workers who have. Web schedule a (form 940) for 2016:

Form 940 Instructions StepbyStep Guide Fundera

Web for 2016, there are credit reduction states. For employers who withhold taxes from employee's paychecks or who must pay the employer's portion of social security or medicare tax. File this schedule with form 940. Instructions for form 940, employer's annual federal unemployment (futa) tax return 2015 form 940 Web we ask for the information on form 940 to carry.

2016 Form IRS 940 Schedule A Fill Online, Printable, Fillable, Blank

We need it to figure and collect the right amount of tax. File this schedule with form 940. Web making payments with form 940. If your total futa tax after adjustments (form 940, line 12) is more than $500, you must make deposits by electronic funds transfer. Web we ask for the information on form 940 to carry out the.

Web Schedule A (Form 940) For 2016:

If you paid any wages that are subject to the unemployment compensation laws of a credit reduction state, your credit against federal unemployment tax will be reduced based on the credit reduction rate for that credit reduction state. Web form 940 (2020) employer's annual federal unemployment (futa) tax return. To avoid a penalty, make your payment with your 2016 form 940. For employers who withhold taxes from employee's paychecks or who must pay the employer's portion of social security or medicare tax.

File This Schedule With Form 940.

If your total futa tax after adjustments (form 940, line 12) is more than $500, you must make deposits by electronic funds transfer. Web making payments with form 940. We need it to figure and collect the right amount of tax. Web to avoid a penalty, make your payment with your 2016 form 940 only if your futa tax for the fourth quarter (plus any undeposited amounts from earlier quarters) is $500 or less.

Employer's Annual Federal Unemployment (Futa) Tax Return 2015 Inst 940:

Web we ask for the information on form 940 to carry out the internal revenue laws of the united states. Your futa tax for the fourth quarter (plus any undeposited amounts from earlier quarters) is $500 or less. Use form 940 to report your annual federal unemployment tax act (futa) tax. Subtitle c, employment taxes, of the internal revenue code imposes unemployment tax under the federal unemployment tax act.

Instructions For Form 940, Employer's Annual Federal Unemployment (Futa) Tax Return 2015 Form 940

Employer identification number (ein) — name (not your trade name) see the instructions on page 2. Use schedule a (form 940) to figure the credit reduction. Together with state unemployment tax systems, the futa tax provides funds for paying unemployment compensation to workers who have. Web schedule a (form 940) for 2016: