2022 Form 2210

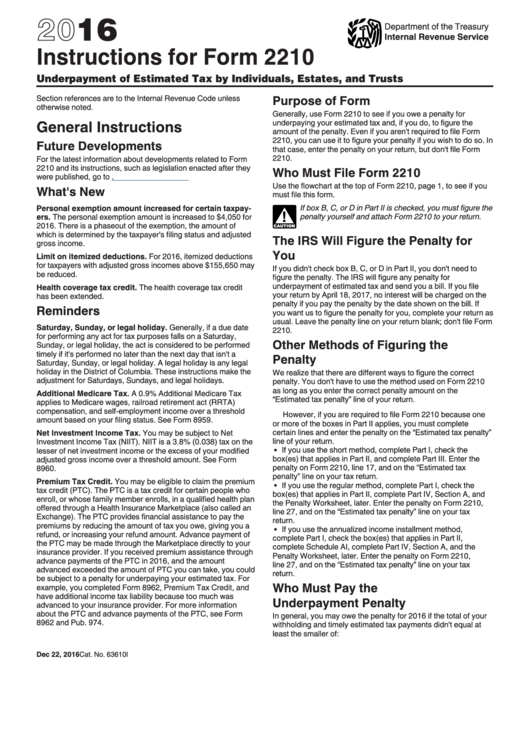

2022 Form 2210 - Web you only need to file form 2210 if one or more boxes in part ii apply to you. Is line 4 or line 7 less than. Web to complete form 2210, you must enter your prior year tax which is found on line 24 of your prior year 1040 and check any corresponding boxes if they relate to your situation. Underpayment of estimated tax by individuals, estates, and trusts. Use form 2210 to determine the amount of underpaid estimated tax and resulting penalties as well as for requesting a waiver of the penalties. Department of the treasury internal revenue service. Complete, edit or print tax forms instantly. Web 2020 attachment sequence no. This form is for income earned in tax year 2022, with tax returns due in april. Web purpose of form use form 2210 to see if you owe a penalty for underpaying your estimated tax.

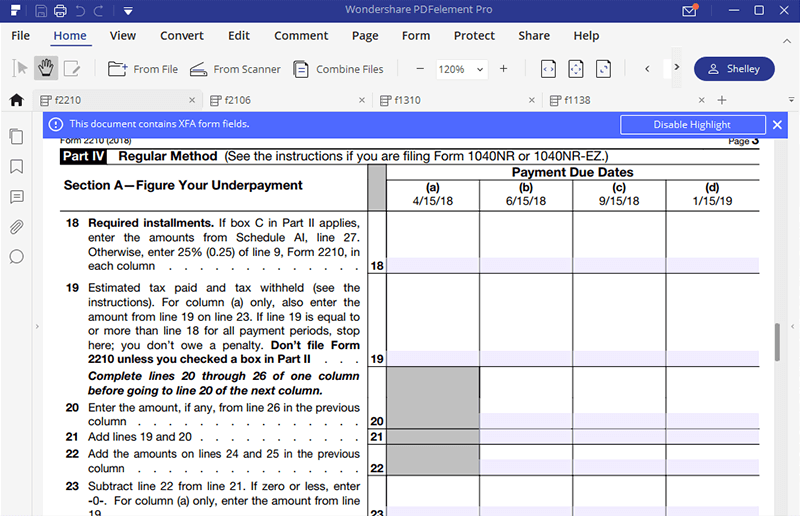

Complete lines 1 through 7 below. Underpayment of estimated tax by individuals, estates, and trusts. 1722 w 10th st, brooklyn, ny is a single family home that contains 1,448 sq ft and was built in 1915. It contains 1 bedroom and 1 bathroom. Use form 2210 to determine the amount of underpaid estimated tax and resulting penalties as well as for requesting a waiver of the penalties. Complete, edit or print tax forms instantly. Web purpose of form use form 2210 to see if you owe a penalty for underpaying your estimated tax. Ad upload, modify or create forms. Enter the penalty on form 2210, line 19, and on the “estimated tax penalty” line on your tax return. The irs will calculate your.

Try it for free now! Web purpose of form use form 2210 to see if you owe a penalty for underpaying your estimated tax. Web you can use form 2210, underpayment of estimated tax by individuals, estates, and trusts, as well as a worksheet from the form 2210 instructions to calculate. You had most of your income tax withheld early in the year instead of spreading it equally through the. Try it for free now! You may qualify for the short method to calculate your penalty. Web to complete form 2210, you must enter your prior year tax which is found on line 24 of your prior year 1040 and check any corresponding boxes if they relate to your situation. Web who must file irs form 2210? Enter the penalty on form 2210, line 19, and on the “estimated tax penalty” line on your tax return. Web sold jun 3, 2022.

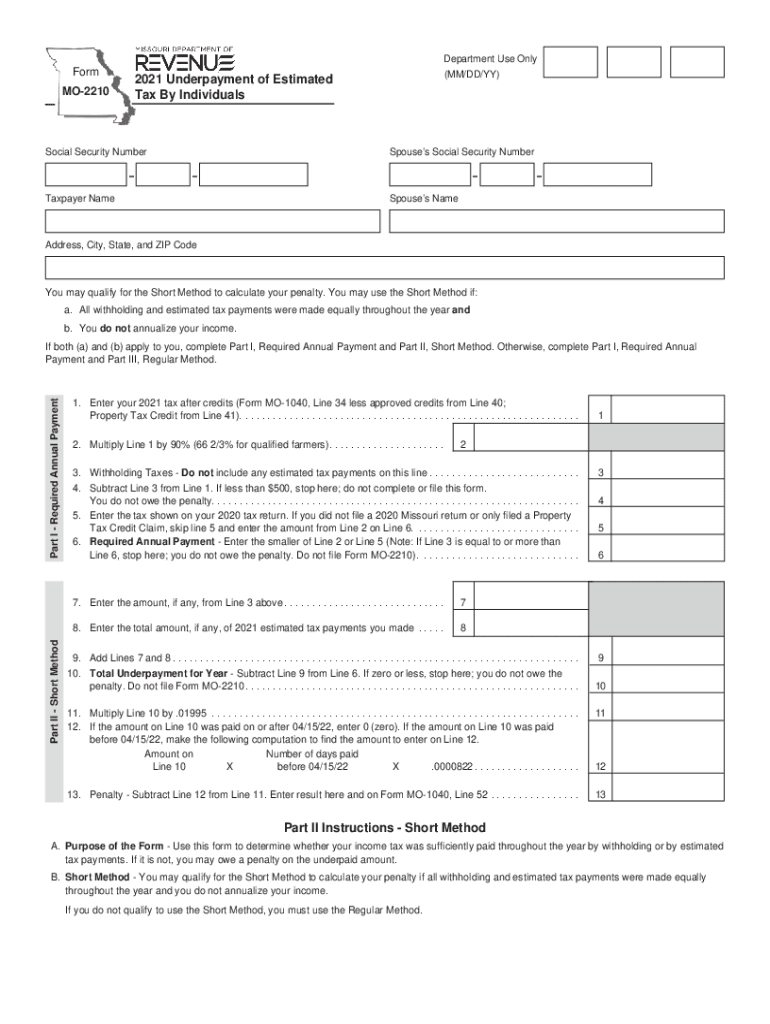

Mo 2210 Fill Out and Sign Printable PDF Template signNow

Web 2022 underpayment of estimated. Web who must file irs form 2210? Web purpose of form use form 2210 to see if you owe a penalty for underpaying your estimated tax. Listing by momentum real estate llc. Enter the penalty on form 2210, line 19, and on the “estimated tax penalty” line on your tax return.

Ssurvivor Form 2210 Instructions 2020

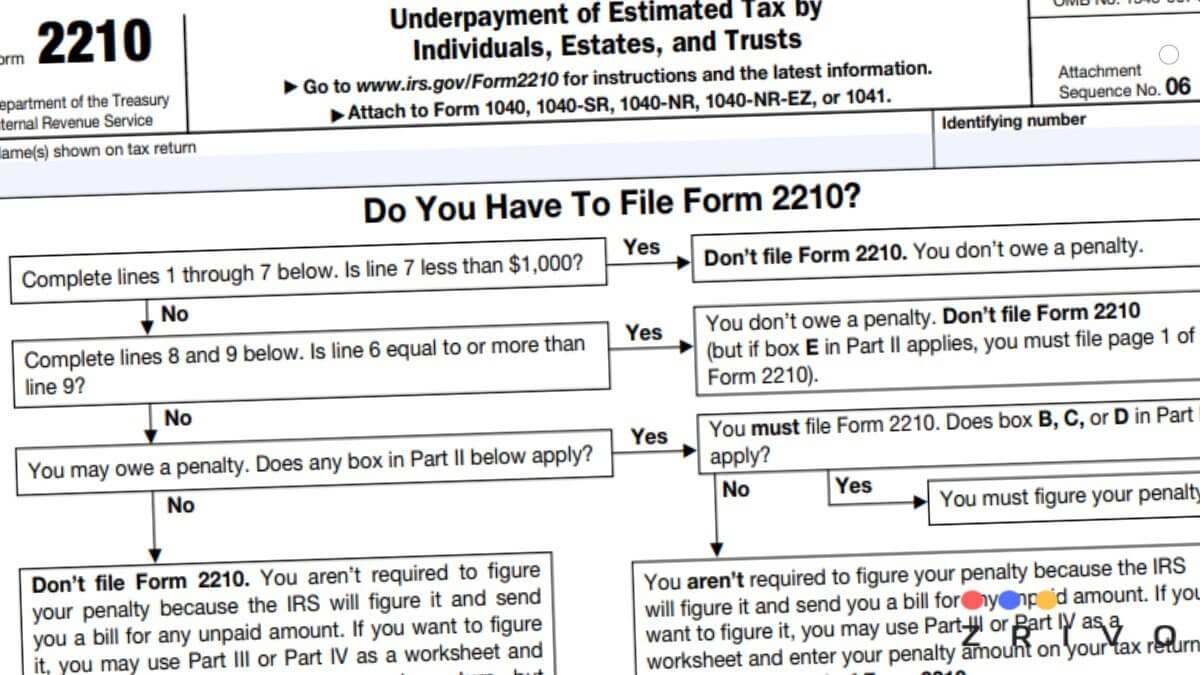

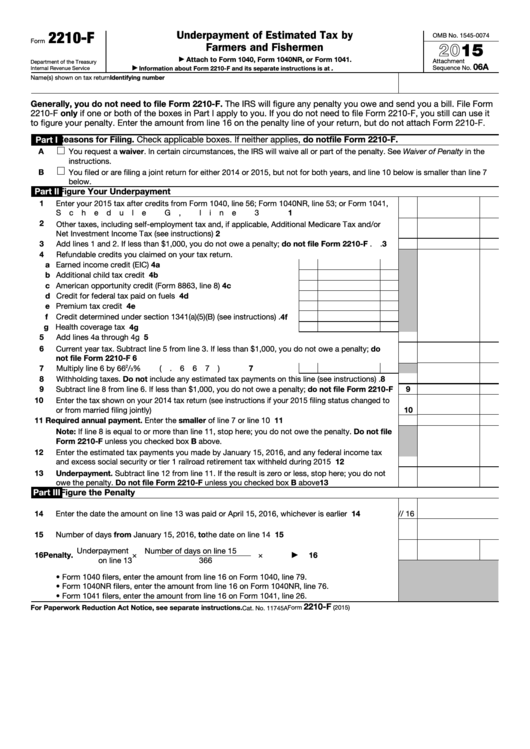

If box a or e applies, you do not need to figure your penalty. The top of form 2210 contains a flowchart to help a taxpayer determine if they are required to file the form. Ad upload, modify or create forms. Underpayment of estimated tax by farmers and fishermen. Try it for free now!

2210 Form 2022 2023

Try it for free now! 1722 w 10th st, brooklyn, ny is a single family home that contains 1,448 sq ft and was built in 1915. 1738 w 4th st, brooklyn, ny 11223. Complete lines 1 through 7 below. The top of form 2210 contains a flowchart to help a taxpayer determine if they are required to file the form.

Fillable Form 2210F Underpayment Of Estimated Tax By Farmers And

Web for form 2210, part iii, section b—figure the penalty), later. Web 2020 attachment sequence no. This form is for income earned in tax year 2022, with tax returns due in april. Web irs form 2210, underpayment of estimated tax by individuals, estates, and trusts, is a tax document that some taxpayers are required to file to determine if they.

Ssurvivor Irs Form 2210 For 2018

According to the flow chart. Department of the treasury internal revenue service. Web for form 2210, part iii, section b—figure the penalty), later. Try it for free now! 1722 w 10th st, brooklyn, ny is a single family home that contains 1,448 sq ft and was built in 1915.

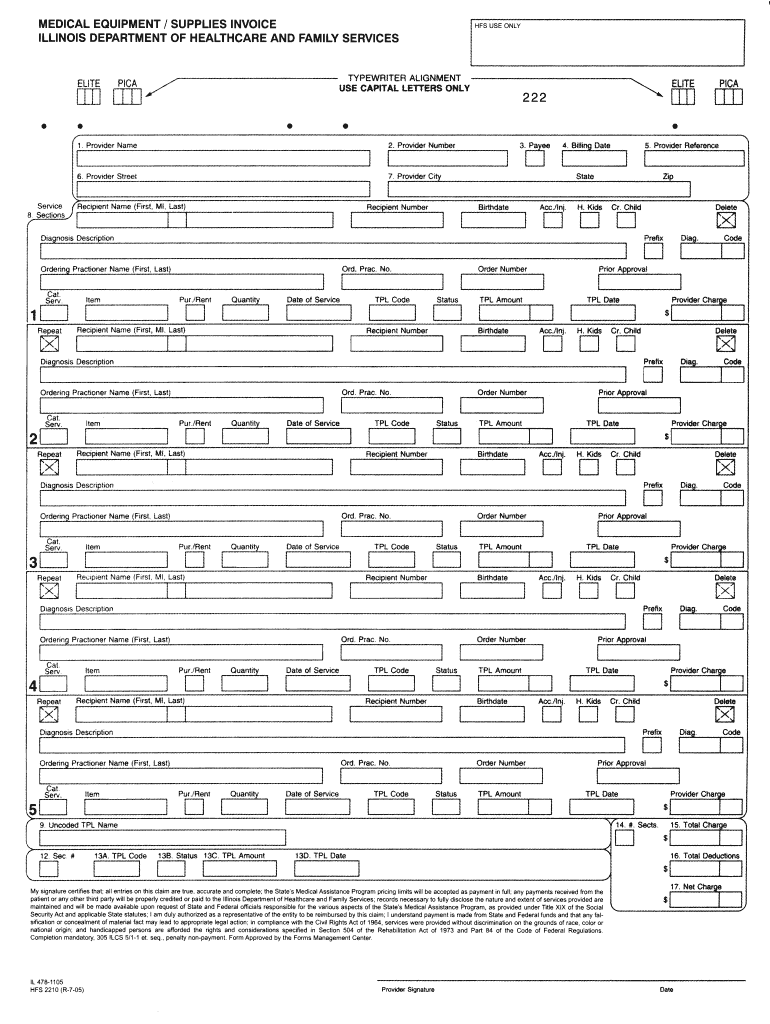

Hfs 2210 Fill Fill Out and Sign Printable PDF Template signNow

Ad upload, modify or create forms. Web we last updated federal form 2210 in december 2022 from the federal internal revenue service. Web to complete form 2210, you must enter your prior year tax which is found on line 24 of your prior year 1040 and check any corresponding boxes if they relate to your situation. The irs will generally.

Instructions For Form 2210 Underpayment Of Estimated Tax By

You may use the short method if: Web we last updated federal form 2210 in december 2022 from the federal internal revenue service. Try it for free now! It contains 1 bedroom and 1 bathroom. According to the flow chart.

Ssurvivor Irs Form 2210 Instructions 2020

This form is for income earned in tax year 2022, with tax returns due in april. 06 name(s) shown on tax return identifying number do you have to file form 2210? The irs will generally figure your penalty for you and you should not file form 2210. Try it for free now! You had most of your income tax withheld.

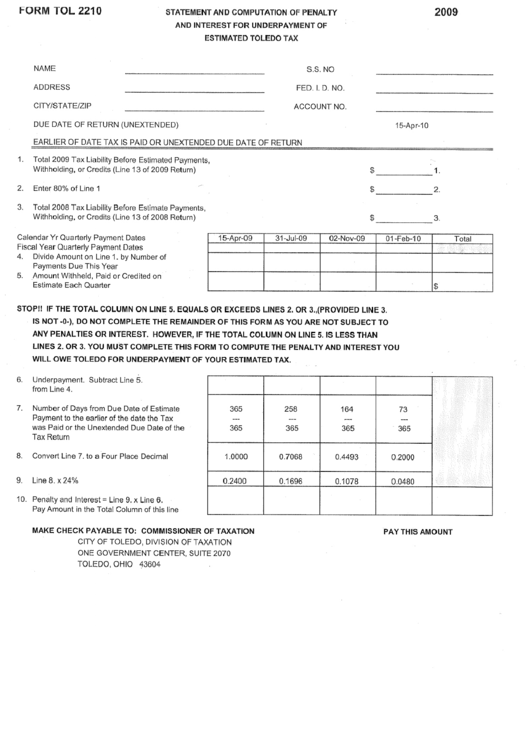

Form Tol 2210 Statement And Computation Of Penalty And Interest

Web purpose of form use form 2210 to see if you owe a penalty for underpaying your estimated tax. Web sold jun 3, 2022. In order to complete schedule ai in the taxact program, you first need to complete the underpayment. Web 2022 underpayment of estimated. Web we last updated federal form 2210 in december 2022 from the federal internal.

Instructions for IRS Form 2210 Underpayment of Estimated Tax by

The irs will generally figure your penalty for you and you should not file form 2210. It contains 1 bedroom and 1 bathroom. Web we last updated federal form 2210 in december 2022 from the federal internal revenue service. Department of the treasury internal revenue service. If box a or e applies, you do not need to figure your penalty.

Web Nearby Homes Similar To 23710 22Nd St Ne Have Recently Sold Between $590K To $1M At An Average Of $385 Per Square Foot.

Try it for free now! Web you can use form 2210, underpayment of estimated tax by individuals, estates, and trusts, as well as a worksheet from the form 2210 instructions to calculate. Web to complete form 2210, you must enter your prior year tax which is found on line 24 of your prior year 1040 and check any corresponding boxes if they relate to your situation. Listing by momentum real estate llc.

Web Sold Jun 3, 2022.

Web purpose of form use form 2210 to see if you owe a penalty for underpaying your estimated tax. It contains 1 bedroom and 1 bathroom. You may use the short method if: Is line 4 or line 7 less than.

Upload, Modify Or Create Forms.

Underpayment of estimated tax by individuals, estates, and trusts. Underpayment of estimated tax by farmers and fishermen. According to the flow chart. Web we last updated federal form 2210 in december 2022 from the federal internal revenue service.

1738 W 4Th St, Brooklyn, Ny 11223.

Enter the penalty on form 2210, line 19, and on the “estimated tax penalty” line on your tax return. 06 name(s) shown on tax return identifying number do you have to file form 2210? Web see waiver of penalty in instructions for form 2210 pdf. The irs will calculate your.