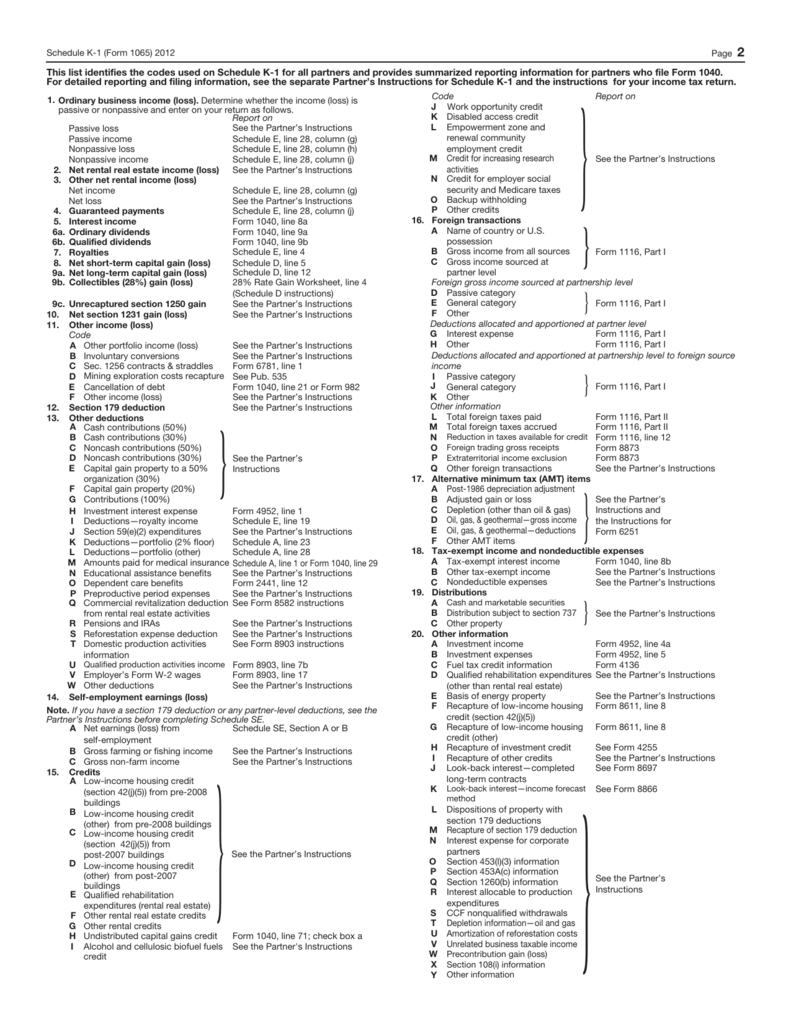

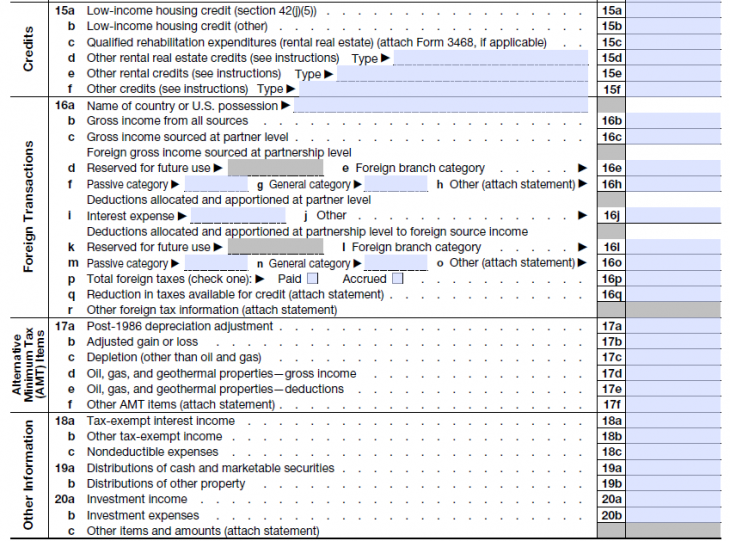

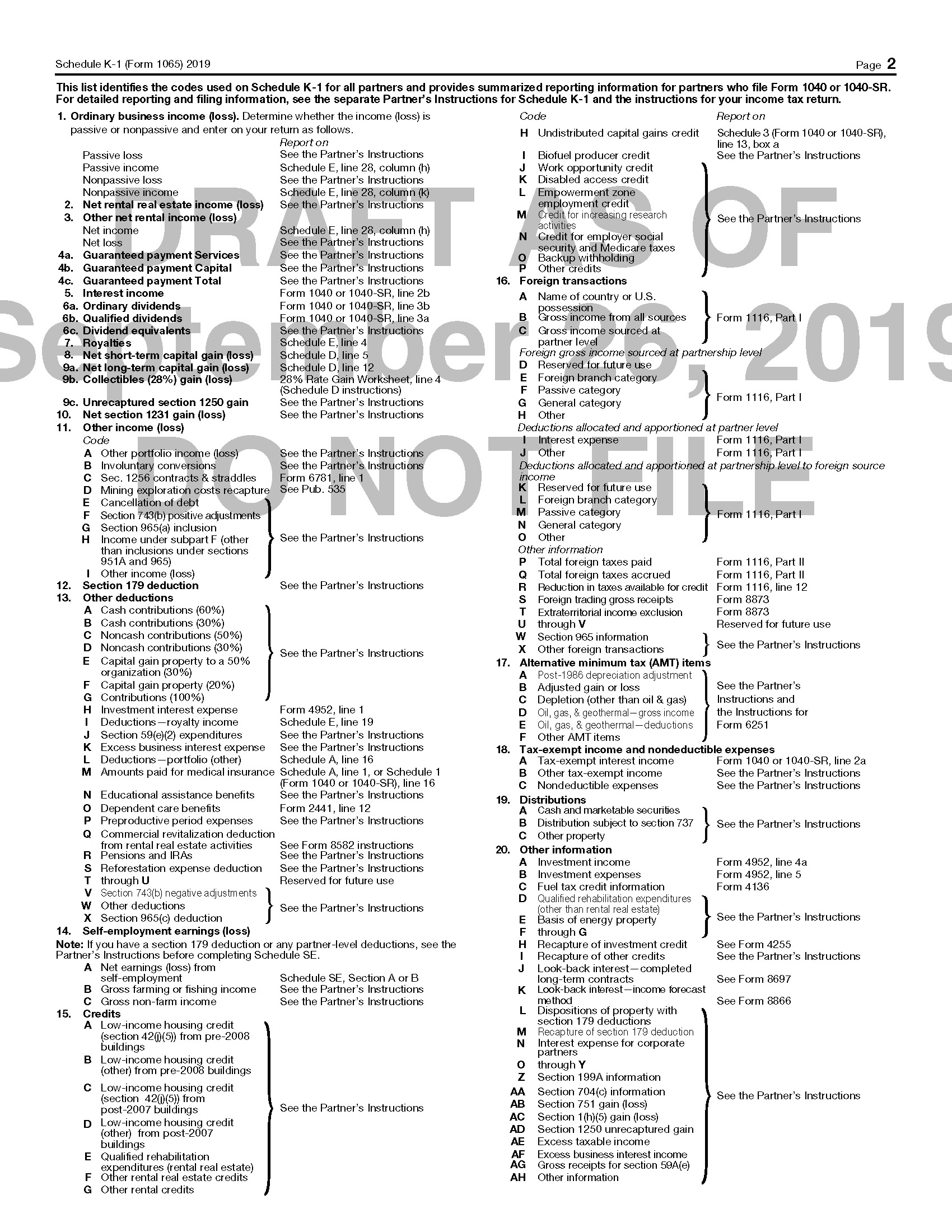

Form 1065 Codes

Form 1065 Codes - Agriculture, forestry, fishing and hunting. If the partnership's principal business, office, or agency is located in: Other deductions, for an individual return in intuit. Codes for principal business activity and principal product or service. Web find irs mailing addresses by state to file form 1065. See items e and f and other information (code ah),. This section of the program contains information for part iii of the schedule k. Web business activity codes the codes listed in this section are a selection from the north code for the activity you are trying to categorize, select the (beginning with 90) are not. And the total assets at the end of the. Page numbers refer to this instruction.

Ad file partnership and llc form 1065 fed and state taxes with taxact® business. 1 ordinary business income (loss) a, b form 8582 lines 1 or 3. Web find irs mailing addresses by state to file form 1065. Page numbers refer to this instruction. If the partnership's principal business, office, or agency is located in: Web building your business form 1065 instructions: Code y is used to report information related to the net investment income tax. Web 651121 for paperwork reduction act notice, see the instructions for form 1065. Other deductions, for an individual return in intuit. This section of the program contains information for part iii of the schedule k.

Codes for principal business activity and principal product or service. Web business taxable income to an ira partner on line 20, code v, the partnership must report the ira's ein on line 20, code ah. Agriculture, forestry, fishing and hunting. This section of the program contains information for part iii of the schedule k. The new schedules are designed to provide greater clarity for partners on how to compute their u.s. A description of the credit items. See items e and f and other information (code ah),. It is used to report the partnership’s income, gains, losses, deductions, and credits to the irs. This article will help you: Web business activity codes the codes listed in this section are a selection from the north code for the activity you are trying to categorize, select the (beginning with 90) are not.

Form 1065X Amended Return or Administrative Adjustment Request (2012

Web business taxable income to an ira partner on line 20, code v, the partnership must report the ira's ein on line 20, code ah. See items e and f and other information (code ah),. If the partnership's principal business, office, or agency is located in: This section of the program contains information for part iii of the schedule k..

Form 13 Transcript Five Ugly Truth About Form 13 Transcript AH

Ad file partnership and llc form 1065 fed and state taxes with taxact® business. See items e and f and other information (code ah),. 1 ordinary business income (loss) a, b form 8582 lines 1 or 3. A description of the credit items. Web a 1065 form is the annual us tax return filed by partnerships.

Can I File Form 1065 Online Universal Network

Web form 1065 is the first step for paying taxes on income earned by the partnership. Code y is used to report information related to the net investment income tax. Web find irs mailing addresses by state to file form 1065. A description of the credit items. 1 ordinary business income (loss) a, b form 8582 lines 1 or 3.

2012 Form 1065 (Schedule K1)

It is used to report the partnership’s income, gains, losses, deductions, and credits to the irs. Web form 1065 is the first step for paying taxes on income earned by the partnership. Agriculture, forestry, fishing and hunting. Web quickfinder® åo»é1⁄4åèè¿ä1¿æ·âëé¿ä»éé1ê¿ì¿êï·äoè¿ä1¿æ·âèåoë1êåè form 1065 principal business activity »èì¿1» codes—2020 ƺåäê¿äë»oƻ returns. Income tax liability with respect to items of.

Form 1065 Instructions in 8 Steps (+ Free Checklist)

Income tax liability with respect to items of. Codes for principal business activity and principal product or service. Page numbers refer to this instruction. Web form 1065 is the first step for paying taxes on income earned by the partnership. Web quickfinder® åo»é1⁄4åèè¿ä1¿æ·âëé¿ä»éé1ê¿ì¿êï·äoè¿ä1¿æ·âèåoë1êåè form 1065 principal business activity »èì¿1» codes—2020 ƺåäê¿äë»oƻ returns.

Fill out the Form 1065 for a limited liability company YouTube

Web find irs mailing addresses by state to file form 1065. See items e and f and other information (code ah),. Other deductions, for an individual return in intuit. Web 2 quickfinder® handbooks | form 1065 principal business activity codes—2022 returns copyrit 2023 omson reuters quick nder® form 1065 principal business activity. Income tax liability with respect to items of.

IRS Form 1065 (Schedule D) 2019 Fill out and Edit Online PDF Template

Web 2 quickfinder® handbooks | form 1065 principal business activity codes—2022 returns copyrit 2023 omson reuters quick nder® form 1065 principal business activity. Web business taxable income to an ira partner on line 20, code v, the partnership must report the ira's ein on line 20, code ah. This article will help you: Web form 1065 is the first step.

Drafts of 2019 Forms 1065 and 1120S, As Well As K1s, Issued by IRS

Web quickfinder® åo»é1⁄4åèè¿ä1¿æ·âëé¿ä»éé1ê¿ì¿êï·äoè¿ä1¿æ·âèåoë1êåè form 1065 principal business activity »èì¿1» codes—2020 ƺåäê¿äë»oƻ returns. Web a 1065 form is the annual us tax return filed by partnerships. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. Web form 1065 is the first step for paying taxes on income earned by the partnership. This section of the program.

Form 1065 K 1 Instructions 2020 Fill Out and Sign Printable PDF

Web find irs mailing addresses by state to file form 1065. 1 ordinary business income (loss) a, b form 8582 lines 1 or 3. See items e and f and other information (code ah),. Income tax liability with respect to items of. It is used to report the partnership’s income, gains, losses, deductions, and credits to the irs.

2008 Form 1065 Edit, Fill, Sign Online Handypdf

Web 2 quickfinder® handbooks | form 1065 principal business activity codes—2022 returns copyrit 2023 omson reuters quick nder® form 1065 principal business activity. Web 651121 for paperwork reduction act notice, see the instructions for form 1065. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. Web quickfinder® åo»é1⁄4åèè¿ä1¿æ·âëé¿ä»éé1ê¿ì¿êï·äoè¿ä1¿æ·âèåoë1êåè form 1065 principal business activity »èì¿1» codes—2020.

A Description Of The Credit Items.

See items e and f and other information (code ah),. Web quickfinder® åo»é1⁄4åèè¿ä1¿æ·âëé¿ä»éé1ê¿ì¿êï·äoè¿ä1¿æ·âèåoë1êåè form 1065 principal business activity »èì¿1» codes—2020 ƺåäê¿äë»oƻ returns. And the total assets at the end of the. Income tax liability with respect to items of.

Ad File Partnership And Llc Form 1065 Fed And State Taxes With Taxact® Business.

Codes for principal business activity and principal product or service. 1 ordinary business income (loss) a, b form 8582 lines 1 or 3. The new schedules are designed to provide greater clarity for partners on how to compute their u.s. If the partnership's principal business, office, or agency is located in:

Web A 1065 Form Is The Annual Us Tax Return Filed By Partnerships.

Web business taxable income to an ira partner on line 20, code v, the partnership must report the ira's ein on line 20, code ah. This article will help you: Web 2 quickfinder® handbooks | form 1065 principal business activity codes—2022 returns copyrit 2023 omson reuters quick nder® form 1065 principal business activity. Web form 1065 is the first step for paying taxes on income earned by the partnership.

Web Find Irs Mailing Addresses By State To File Form 1065.

Web building your business form 1065 instructions: Other deductions, for an individual return in intuit. Agriculture, forestry, fishing and hunting. This section of the program contains information for part iii of the schedule k.