7004 Extension Form

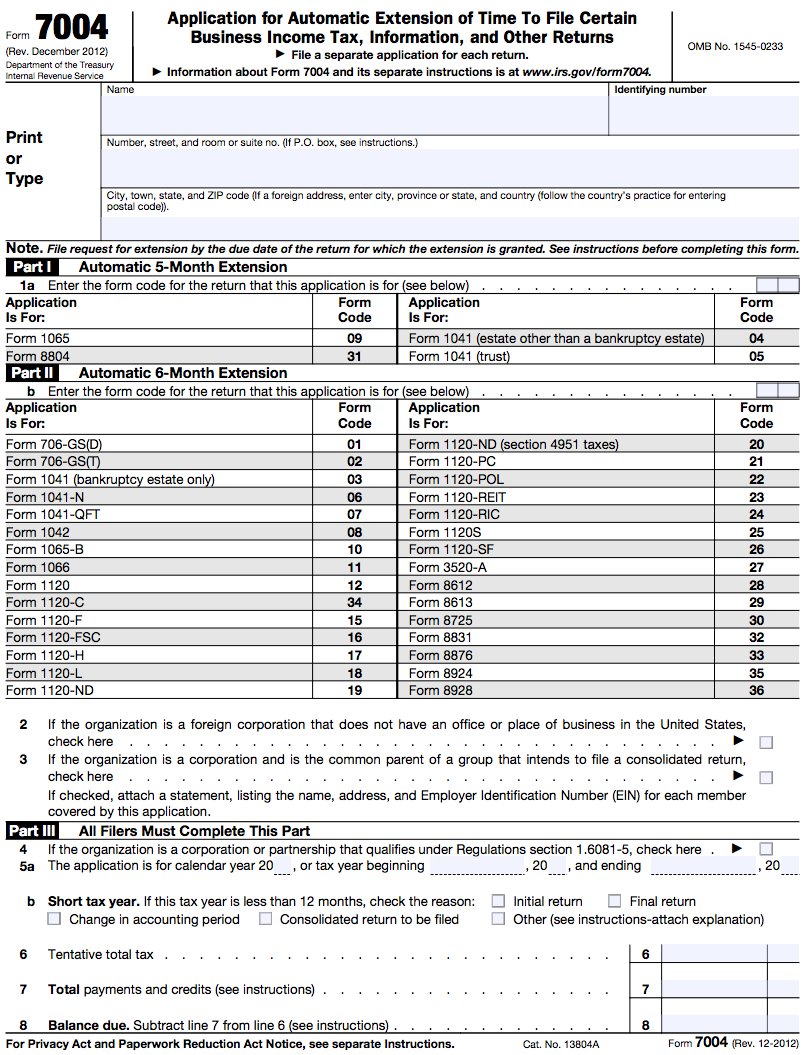

7004 Extension Form - The extension will be granted if you complete form 7004 properly, make a proper estimate of the tax (if applicable), file form 7004 by the due date of the return for which the extension is. File form 7004 before or on the deadline of the appropriate tax form; Application for automatic extension of time to file certain business income tax, information, and other returns. Web use the chart to determine where to file form 7004 based on the tax form you complete. All the returns shown on form 7004 are eligible for an automatic extension of time to file from the due date of the return. Web the 7004 form is an irs document used to request an automatic extension of time to file certain business income tax returns. For instructions and the latest information. Select the appropriate form from the table below to determine where to send the form 7004, application for automatic extension of time to file certain business income tax, information, and other returns Make sure you calculate your tax bill right. You can file an irs form 7004 electronically for most returns.

Web purpose of form. Select the appropriate form from the table below to determine where to send the form 7004, application for automatic extension of time to file certain business income tax, information, and other returns 5.5 months (to september 30, 2023) for form 1041, us income tax return for estates and trusts For instructions and the latest information. File a separate application for each return. December 2017) application for automatic extension of time to file certain business income tax, information, and other returns section references are to the internal revenue code unless otherwise noted. Web the 7004 form is an irs document used to request an automatic extension of time to file certain business income tax returns. Web instructions for form 7004 department of the treasury internal revenue service (rev. 5 months (to september 15, 2023) for forms 1065, us return of partnership income and 1120s, us income tax return for an s corporation; The extension will be granted if you complete form 7004 properly, make a proper estimate of the tax (if applicable), file form 7004 by the due date of the return for which the extension is.

Web irs form 7004 extends the filing deadline for another: Web use the chart to determine where to file form 7004 based on the tax form you complete. Web form 7004 is used to request an automatic extension to file the certain returns. For instructions and the latest information. December 2018) department of the treasury internal revenue service. File form 7004 before or on the deadline of the appropriate tax form; 5.5 months (to september 30, 2023) for form 1041, us income tax return for estates and trusts The extension will be granted if you complete form 7004 properly, make a proper estimate of the tax (if applicable), file form 7004 by the due date of the return for which the extension is. Make sure you calculate your tax bill right. The irs may charge penalties and interest on unpaid tax balances until you pay up.

Tax extension form 7004

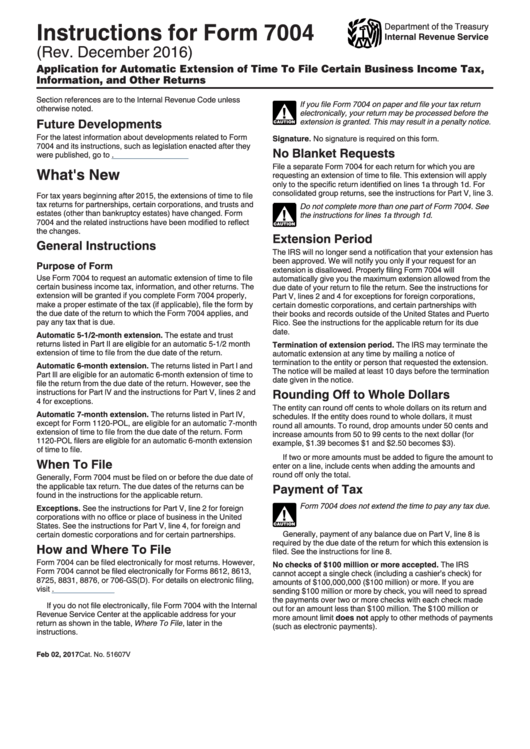

December 2017) application for automatic extension of time to file certain business income tax, information, and other returns section references are to the internal revenue code unless otherwise noted. Select the appropriate form from the table below to determine where to send the form 7004, application for automatic extension of time to file certain business income tax, information, and other.

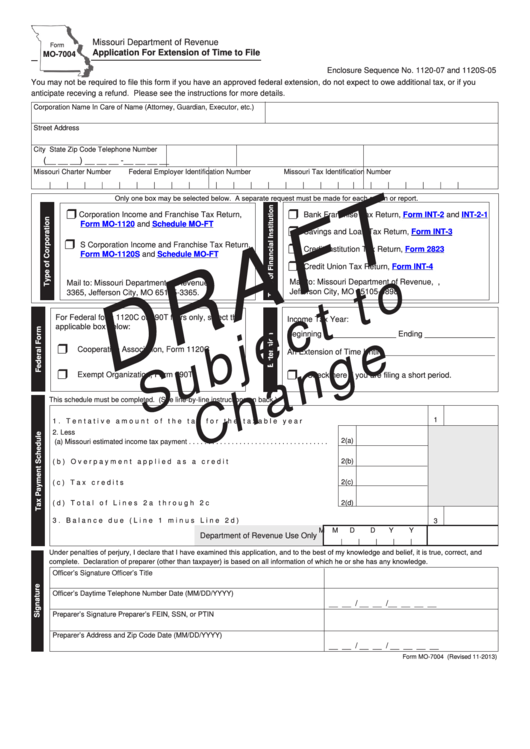

Form Mo7004 Application For Extension Of Time To File printable pdf

Web to successfully use form 7004, you’ll have to: Web purpose of form. 5 months (to september 15, 2023) for forms 1065, us return of partnership income and 1120s, us income tax return for an s corporation; Web use the chart to determine where to file form 7004 based on the tax form you complete. 5.5 months (to september 30,.

Instructions For Form 7004 Application For Automatic Extension Of

Use form 7004 to request an automatic extension of time to file certain business income tax, information, and other returns. Web instructions for form 7004 department of the treasury internal revenue service (rev. You can file an irs form 7004 electronically for most returns. December 2017) application for automatic extension of time to file certain business income tax, information, and.

Get an Extension on Your Business Taxes with Form 7004 Excel Capital

December 2017) application for automatic extension of time to file certain business income tax, information, and other returns section references are to the internal revenue code unless otherwise noted. Web purpose of form. Estimate and pay the taxes you owe; All the returns shown on form 7004 are eligible for an automatic extension of time to file from the due.

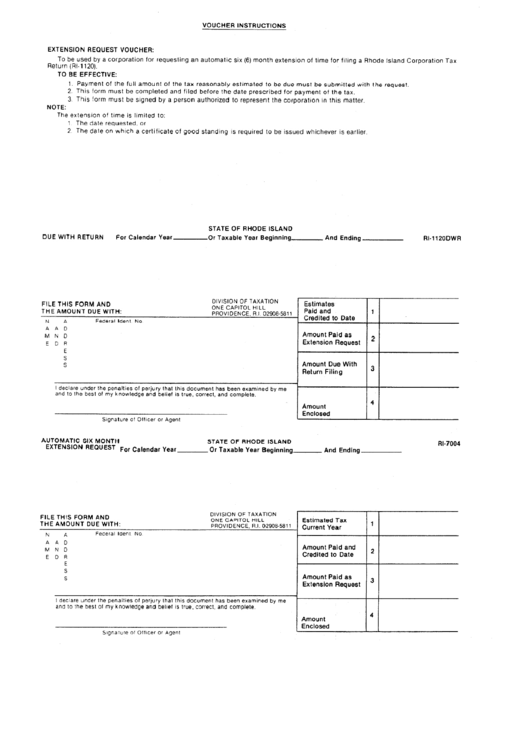

Fillable Form Ri7004 Extension Request Voucher printable pdf download

You can file an irs form 7004 electronically for most returns. Web instructions for form 7004 department of the treasury internal revenue service (rev. Web irs form 7004 extends the filing deadline for another: December 2017) application for automatic extension of time to file certain business income tax, information, and other returns section references are to the internal revenue code.

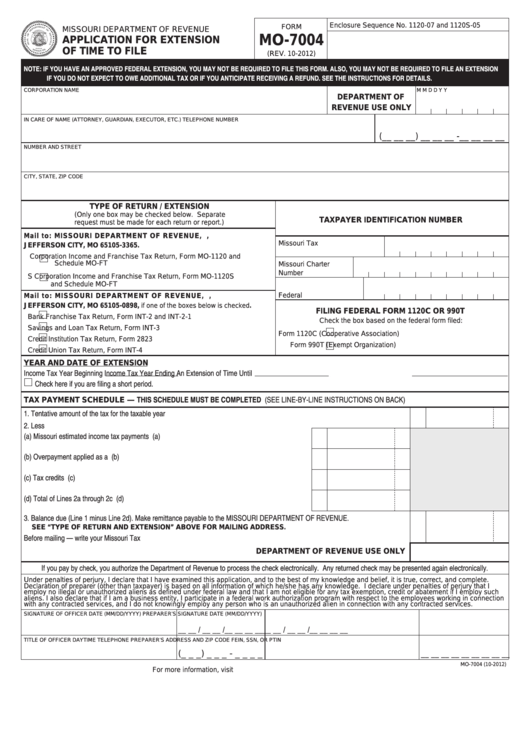

Fillable Form Mo7004 Application For Extension Of Time To File

See the form 7004 instructions for a list of the exceptions. Web to successfully use form 7004, you’ll have to: The irs may charge penalties and interest on unpaid tax balances until you pay up. File a separate application for each return. Web the 7004 form is an irs document used to request an automatic extension of time to file.

How to file an LLC Tax extension Form 7004 Bette Hochberger, CPA, CGMA

5 months (to september 15, 2023) for forms 1065, us return of partnership income and 1120s, us income tax return for an s corporation; Application for automatic extension of time to file certain business income tax, information, and other returns. Web form 7004 is used to request an automatic extension to file the certain returns. Web purpose of form. You.

TAX EXTENSION FORM 7004 by Express Extension Issuu

See the form 7004 instructions for a list of the exceptions. Web irs form 7004 extends the filing deadline for another: Web to successfully use form 7004, you’ll have to: Web form 7004 is used to request an automatic extension to file the certain returns. 5.5 months (to september 30, 2023) for form 1041, us income tax return for estates.

How to Fill Out IRS Form 7004

Web form 7004 is used to request an automatic extension to file the certain returns. Web to successfully use form 7004, you’ll have to: Use form 7004 to request an automatic extension of time to file certain business income tax, information, and other returns. Make sure you calculate your tax bill right. Web purpose of form.

IRS Form 7004 Automatic Extension for Business Tax Returns

Web irs form 7004 extends the filing deadline for another: December 2018) department of the treasury internal revenue service. December 2017) application for automatic extension of time to file certain business income tax, information, and other returns section references are to the internal revenue code unless otherwise noted. Web use the chart to determine where to file form 7004 based.

File Form 7004 Before Or On The Deadline Of The Appropriate Tax Form;

All the returns shown on form 7004 are eligible for an automatic extension of time to file from the due date of the return. December 2018) department of the treasury internal revenue service. December 2017) application for automatic extension of time to file certain business income tax, information, and other returns section references are to the internal revenue code unless otherwise noted. Web form 7004 is used to request an automatic extension to file the certain returns.

File A Separate Application For Each Return.

The irs may charge penalties and interest on unpaid tax balances until you pay up. Estimate and pay the taxes you owe; Use form 7004 to request an automatic extension of time to file certain business income tax, information, and other returns. Who can file form 7004?.

5 Months (To September 15, 2023) For Forms 1065, Us Return Of Partnership Income And 1120S, Us Income Tax Return For An S Corporation;

Web instructions for form 7004 department of the treasury internal revenue service (rev. For instructions and the latest information. Web the 7004 form is an irs document used to request an automatic extension of time to file certain business income tax returns. Web to successfully use form 7004, you’ll have to:

Web Irs Form 7004 Extends The Filing Deadline For Another:

Web use the chart to determine where to file form 7004 based on the tax form you complete. Application for automatic extension of time to file certain business income tax, information, and other returns. The extension will be granted if you complete form 7004 properly, make a proper estimate of the tax (if applicable), file form 7004 by the due date of the return for which the extension is. Select the appropriate form from the table below to determine where to send the form 7004, application for automatic extension of time to file certain business income tax, information, and other returns