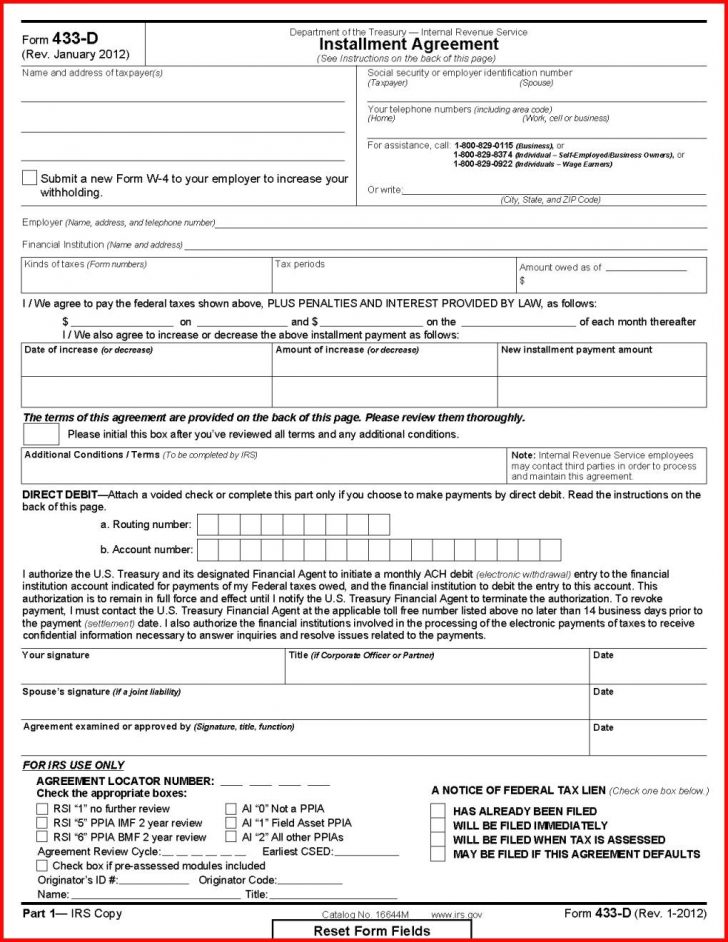

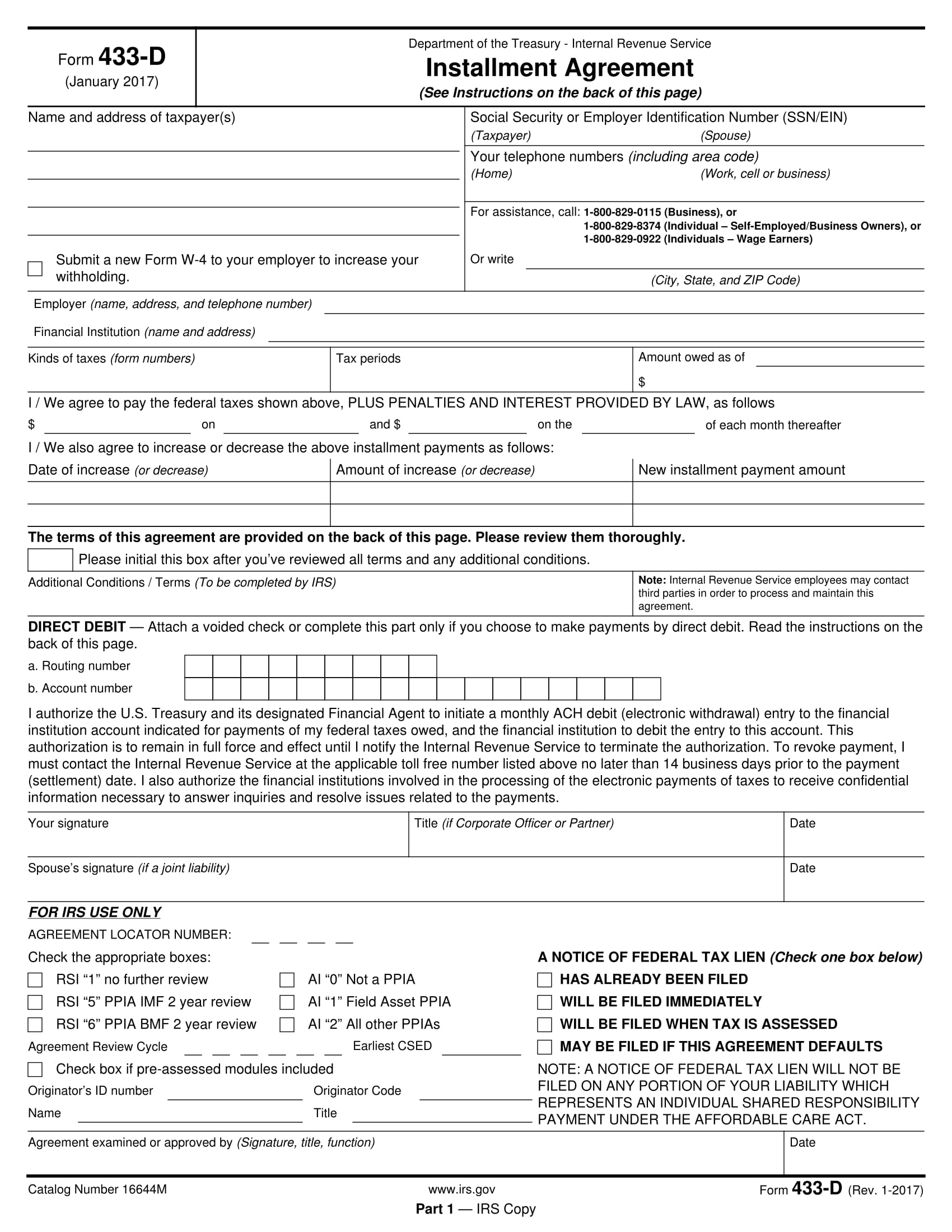

Where To Mail Irs Installment Agreement Form 433 D

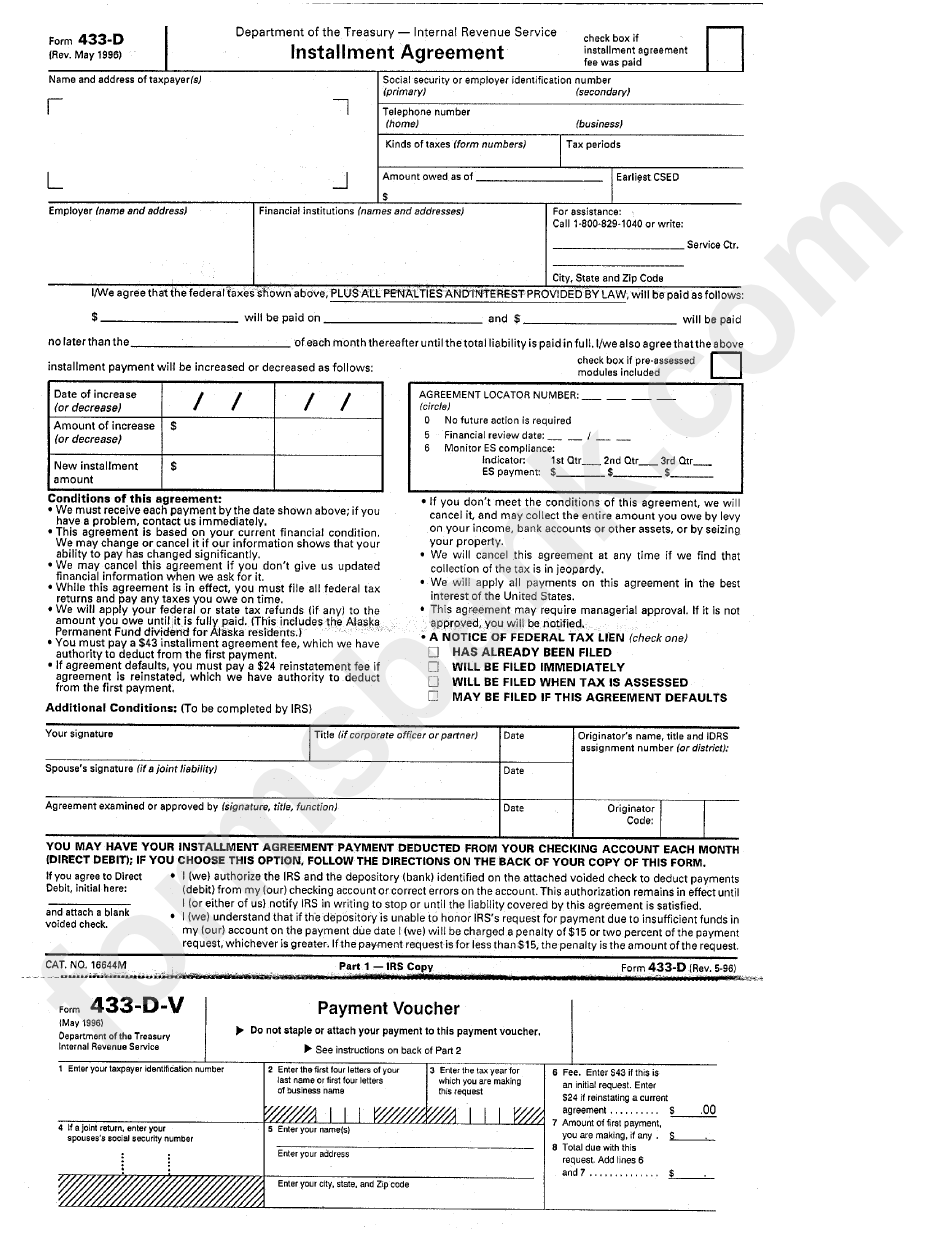

Where To Mail Irs Installment Agreement Form 433 D - File an extension in turbotax online before the deadline to avoid a late filing penalty. It asks for your name, address, social security or employee identification number, and your phone. You can download or print current or past. Web form 9465 allows taxpayers to set up a monthly installment agreement whereby they mail payments (by check, money order, or direct debit) on a monthly basis. Web may 31, 2019 5:46 pm. Web refer to file a notice of federal tax lien. Turn page to continue catalog number. By mail mail form 433. Web under 65 65 and over if you or your spouse are self employed or have self employment income, provide the following information: If you are requesting an initial installment agreement, i suggest you use form 9465 and the mailing address for form 9465 is.

Web may 31, 2019 5:46 pm. It asks for your name, address, social security or employee identification number, and your phone. Web under 65 65 and over if you or your spouse are self employed or have self employment income, provide the following information: Web refer to file a notice of federal tax lien. File an extension in turbotax online before the deadline to avoid a late filing penalty. How do i clear and. Web electronically there’s not a way to submit this form electronically, but you can view and pay your balance by going to irs.gov/directpay. Web first, make sure you download a copy of the form. By mail mail form 433. Web how do i file an irs extension (form 4868) in turbotax online?

Web may 31, 2019 5:46 pm. Turn page to continue catalog number. How do i clear and. It asks for your name, address, social security or employee identification number, and your phone. Form 433d installment agreement is used to finalize an irs installment agreement and irs payment plans. Web first, make sure you download a copy of the form. Next, fill out the top section. Web electronically there’s not a way to submit this form electronically, but you can view and pay your balance by going to irs.gov/directpay. By mail mail form 433. Web refer to file a notice of federal tax lien.

Irs Installment Agreement Online Irs Payment Plan Form Online

Next, fill out the top section. Form 433d installment agreement is used to finalize an irs installment agreement and irs payment plans. Turn page to continue catalog number. Web refer to file a notice of federal tax lien. File an extension in turbotax online before the deadline to avoid a late filing penalty.

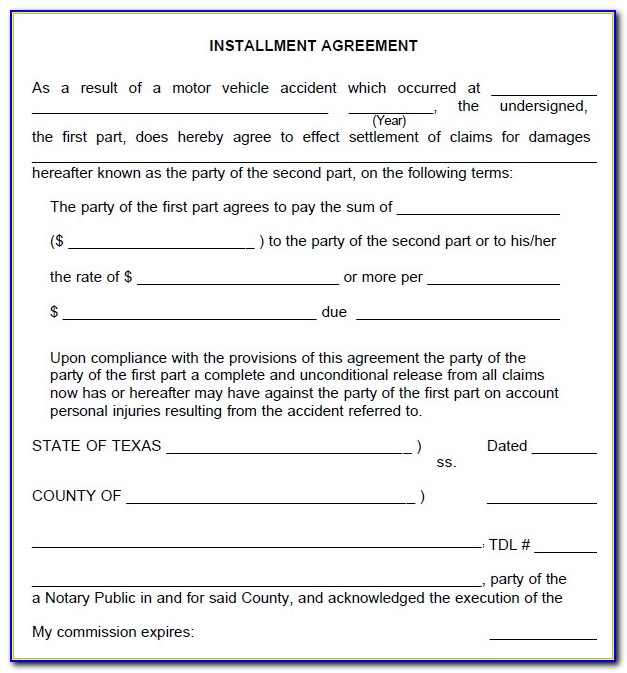

Installment Payment Agreement Template Doc

How do i clear and. By mail mail form 433. If you are requesting an initial installment agreement, i suggest you use form 9465 and the mailing address for form 9465 is. Web under 65 65 and over if you or your spouse are self employed or have self employment income, provide the following information: Web may 31, 2019 5:46.

Where Do I Mail Medicare Form Cms 1763 Form Resume Examples G28BAjpr3g

Turn page to continue catalog number. Web under 65 65 and over if you or your spouse are self employed or have self employment income, provide the following information: Web refer to file a notice of federal tax lien. Web may 31, 2019 5:46 pm. If you are requesting an initial installment agreement, i suggest you use form 9465 and.

Financial Payment Plan Agreement Template

You can download or print current or past. Next, fill out the top section. Turn page to continue catalog number. Web how do i file an irs extension (form 4868) in turbotax online? Web refer to file a notice of federal tax lien.

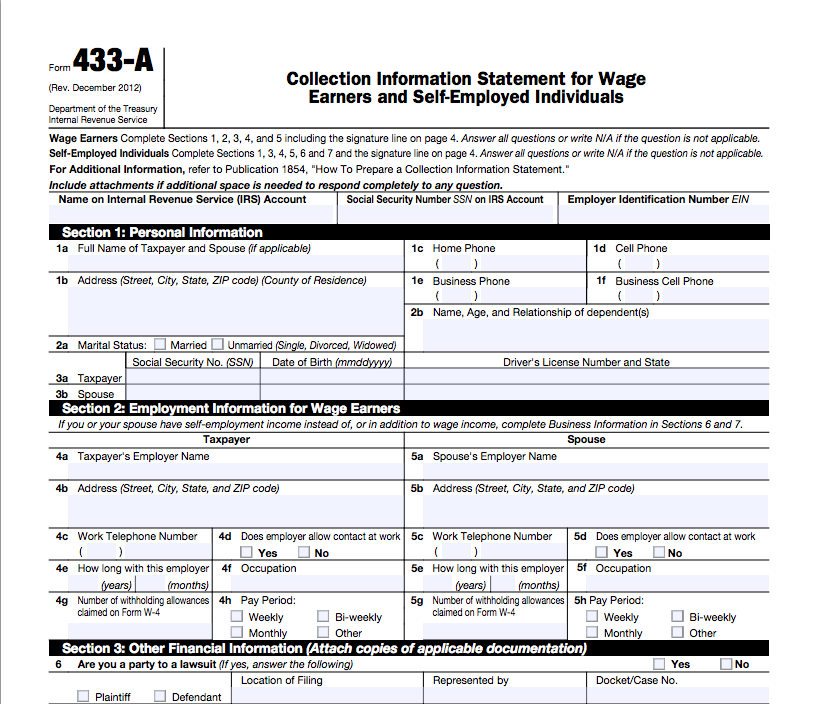

The Form 433a and IRS Collection Actions Mackay, Caswell & Callahan

If you are requesting an initial installment agreement, i suggest you use form 9465 and the mailing address for form 9465 is. You can download or print current or past. Web may 31, 2019 5:46 pm. Web refer to file a notice of federal tax lien. Web under 65 65 and over if you or your spouse are self employed.

A Simple Guide To The IRS Form 433D Installment Agreement Silver Tax

Web installment agreement for individuals and businesses. Form 433d installment agreement is used to finalize an irs installment agreement and irs payment plans. Web form 9465 allows taxpayers to set up a monthly installment agreement whereby they mail payments (by check, money order, or direct debit) on a monthly basis. It asks for your name, address, social security or employee.

Form 433 d Fill out & sign online DocHub

How do i clear and. Web installment agreement for individuals and businesses. Form 433d installment agreement is used to finalize an irs installment agreement and irs payment plans. It asks for your name, address, social security or employee identification number, and your phone. Web refer to file a notice of federal tax lien.

Form 433D Installment Agreement printable pdf download

Web how do i file an irs extension (form 4868) in turbotax online? Web electronically there’s not a way to submit this form electronically, but you can view and pay your balance by going to irs.gov/directpay. Web under 65 65 and over if you or your spouse are self employed or have self employment income, provide the following information: Next,.

Interest Rates For Irs Installment Agreements Rating Walls

Web may 31, 2019 5:46 pm. It asks for your name, address, social security or employee identification number, and your phone. By mail mail form 433. Web how do i file an irs extension (form 4868) in turbotax online? You can download or print current or past.

IRS Form 433H Download Fillable PDF or Fill Online Installment

How do i clear and. Web first, make sure you download a copy of the form. Web under 65 65 and over if you or your spouse are self employed or have self employment income, provide the following information: Next, fill out the top section. You can download or print current or past.

Web Installment Agreement For Individuals And Businesses.

Next, fill out the top section. How do i clear and. Turn page to continue catalog number. Web form 9465 allows taxpayers to set up a monthly installment agreement whereby they mail payments (by check, money order, or direct debit) on a monthly basis.

By Mail Mail Form 433.

Web how do i file an irs extension (form 4868) in turbotax online? You can download or print current or past. File an extension in turbotax online before the deadline to avoid a late filing penalty. Web refer to file a notice of federal tax lien.

Form 433D Installment Agreement Is Used To Finalize An Irs Installment Agreement And Irs Payment Plans.

Web may 31, 2019 5:46 pm. Web first, make sure you download a copy of the form. Web electronically there’s not a way to submit this form electronically, but you can view and pay your balance by going to irs.gov/directpay. It asks for your name, address, social security or employee identification number, and your phone.

Web Under 65 65 And Over If You Or Your Spouse Are Self Employed Or Have Self Employment Income, Provide The Following Information:

If you are requesting an initial installment agreement, i suggest you use form 9465 and the mailing address for form 9465 is.

/9465-InstallmentAgreementRequest-1-ad4522a907c94ba7a959e9bc7549e14d.png)