Can I File Form 5329 By Itself

Can I File Form 5329 By Itself - Web you want to file the 2018 form 5329. Iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps,. Web while you can still file a 5329 for prior years because there are no statute of limitations for excess contributions, you would not file a blank form. Upload, modify or create forms. The excess contributions plus earnings attributable to the excess contributions. Web question how do i file form 5329 with an amended return? Can i file form 5329 on its own? If you have already filed a 1040 for 2007, then you will need to file an amended 1040 with the 5329 attached. Regarding line 55 you can attach an explanation that you. So i made erroneous roth ira contributions in 2020 when i had no earned income, but withdrew all my.

February 2021) department of the treasury internal. Purpose of form use form 5329 to report additional taxes on: Web question how do i file form 5329 with an amended return? Web while you can still file a 5329 for prior years because there are no statute of limitations for excess contributions, you would not file a blank form. Web you cannot file the 5329 by itself. Complete, edit or print tax forms instantly. Web current revision form 5329 pdf instructions for form 5329 pdf ( html) recent developments rollover relief for waived required minimum distributions under cares. See form 5329 where it states you can file the form by itself. Regarding line 55 you can attach an explanation that you. Try it for free now!

Web while you can still file a 5329 for prior years because there are no statute of limitations for excess contributions, you would not file a blank form. You cannot efile an amended return. Can i file form 5329 on its own? Regarding line 55 you can attach an explanation that you. Web to enter, review, or delete information for form 5329: Answer first complete the steps detailed in completing amended returns in ultratax cs. If you have already filed a 1040 for 2007, then you will need to file an amended 1040 with the 5329 attached. Web current revision form 5329 pdf instructions for form 5329 pdf ( html) recent developments rollover relief for waived required minimum distributions under cares. From within your taxact return ( online or desktop), click federal. February 2021) department of the treasury internal.

Form 5329 Instructions & Exception Information for IRS Form 5329

If you have already filed a 1040 for 2007, then you will need to file an amended 1040 with the 5329 attached. Web you cannot file the 5329 by itself. Purpose of form use form 5329 to report additional taxes on: Upload, modify or create forms. So i made erroneous roth ira contributions in 2020 when i had no earned.

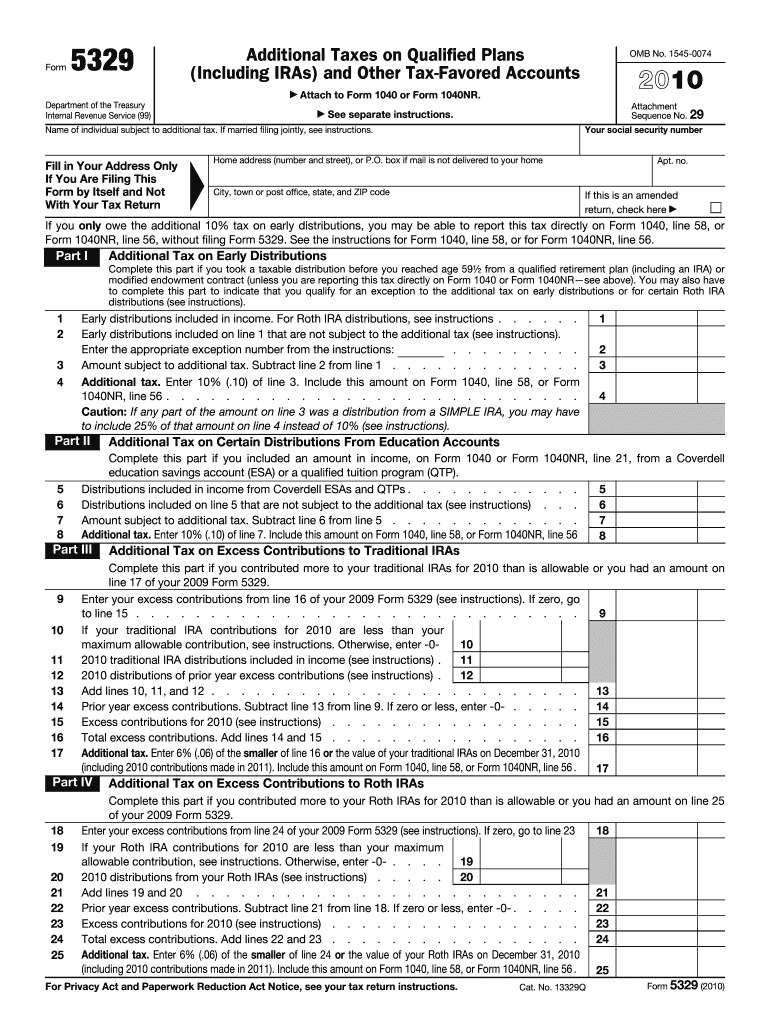

2010 Form IRS 5329 Fill Online, Printable, Fillable, Blank pdfFiller

Regarding line 55 you can attach an explanation that you. See form 5329 where it states you can file the form by itself. Try it for free now! You cannot efile an amended return. The excess contributions plus earnings attributable to the excess contributions.

What is Tax Form 5329? Lively

Try it for free now! Answer first complete the steps detailed in completing amended returns in ultratax cs. Web question how do i file form 5329 with an amended return? Upload, modify or create forms. Web current revision form 5329 pdf instructions for form 5329 pdf ( html) recent developments rollover relief for waived required minimum distributions under cares.

Turbotax 2017 tax year garrymls

You cannot efile an amended return. Try it for free now! The excess contributions plus earnings attributable to the excess contributions. Web while you can still file a 5329 for prior years because there are no statute of limitations for excess contributions, you would not file a blank form. Can i file form 5329 on its own?

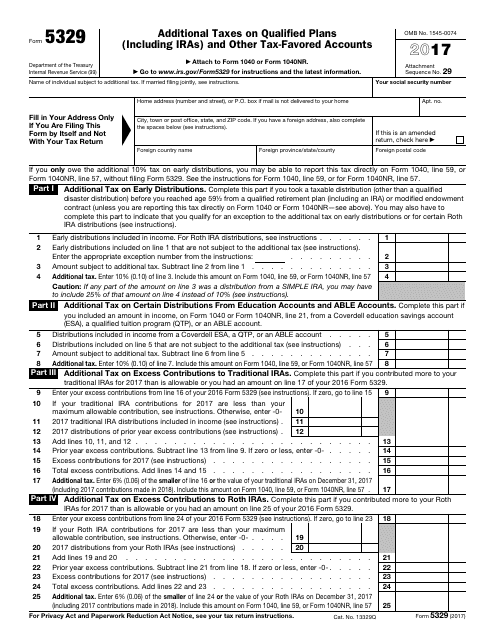

IRS Form 5329 Download Fillable PDF 2017, Additional Taxes on Qualified

Iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps,. Answer first complete the steps detailed in completing amended returns in ultratax cs. Web you want to file the 2018 form 5329. Web to enter, review, or delete information for form 5329: Web current revision form 5329 pdf instructions for form 5329 pdf ( html) recent developments rollover relief.

Form 5329 Instructions & Exception Information for IRS Form 5329

The excess contributions plus earnings attributable to the excess contributions. Complete, edit or print tax forms instantly. You cannot efile an amended return. Upload, modify or create forms. Web to enter, review, or delete information for form 5329:

How Much Does It Cost To Get A Copy Of My Naturalization Certificate

Try it for free now! Iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps,. Regarding line 55 you can attach an explanation that you. Web what do i do now? Web while you can still file a 5329 for prior years because there are no statute of limitations for excess contributions, you would not file a blank form.

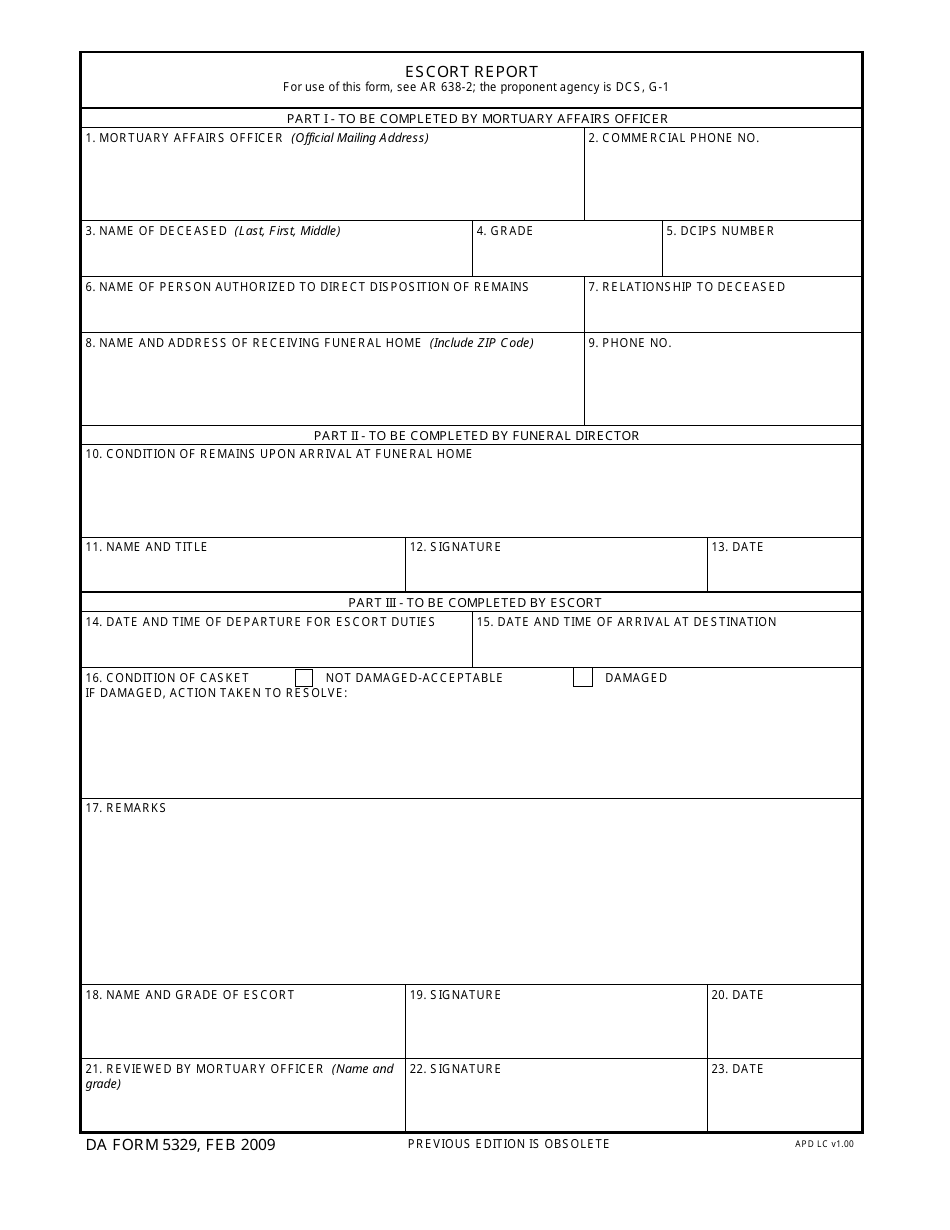

DA Form 5329 Download Fillable PDF or Fill Online Escort Report

Web you cannot file the 5329 by itself. Web what do i do now? Web current revision form 5329 pdf instructions for form 5329 pdf ( html) recent developments rollover relief for waived required minimum distributions under cares. February 2021) department of the treasury internal. Complete, edit or print tax forms instantly.

Form 5329 Instructions & Exception Information for IRS Form 5329

February 2021) department of the treasury internal. So i made erroneous roth ira contributions in 2020 when i had no earned income, but withdrew all my. Web to enter, review, or delete information for form 5329: If you have already filed a 1040 for 2007, then you will need to file an amended 1040 with the 5329 attached. Try it.

Form 5329 Additional Taxes on Qualified Plans and Other TaxFavored

Can i file form 5329 on its own? Web to enter, review, or delete information for form 5329: The excess contributions plus earnings attributable to the excess contributions. Web current revision form 5329 pdf instructions for form 5329 pdf ( html) recent developments rollover relief for waived required minimum distributions under cares. Regarding line 55 you can attach an explanation.

Web You Want To File The 2018 Form 5329.

You cannot efile an amended return. From within your taxact return ( online or desktop), click federal. Complete, edit or print tax forms instantly. Iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps,.

Upload, Modify Or Create Forms.

Answer first complete the steps detailed in completing amended returns in ultratax cs. Web question how do i file form 5329 with an amended return? Purpose of form use form 5329 to report additional taxes on: Web to enter, review, or delete information for form 5329:

See Form 5329 Where It States You Can File The Form By Itself.

If you have already filed a 1040 for 2007, then you will need to file an amended 1040 with the 5329 attached. Can i file form 5329 on its own? Regarding line 55 you can attach an explanation that you. Web you cannot file the 5329 by itself.

Try It For Free Now!

So i made erroneous roth ira contributions in 2020 when i had no earned income, but withdrew all my. Web what do i do now? The excess contributions plus earnings attributable to the excess contributions. Web current revision form 5329 pdf instructions for form 5329 pdf ( html) recent developments rollover relief for waived required minimum distributions under cares.