Can Irs Form 56 Be Filed Electronically

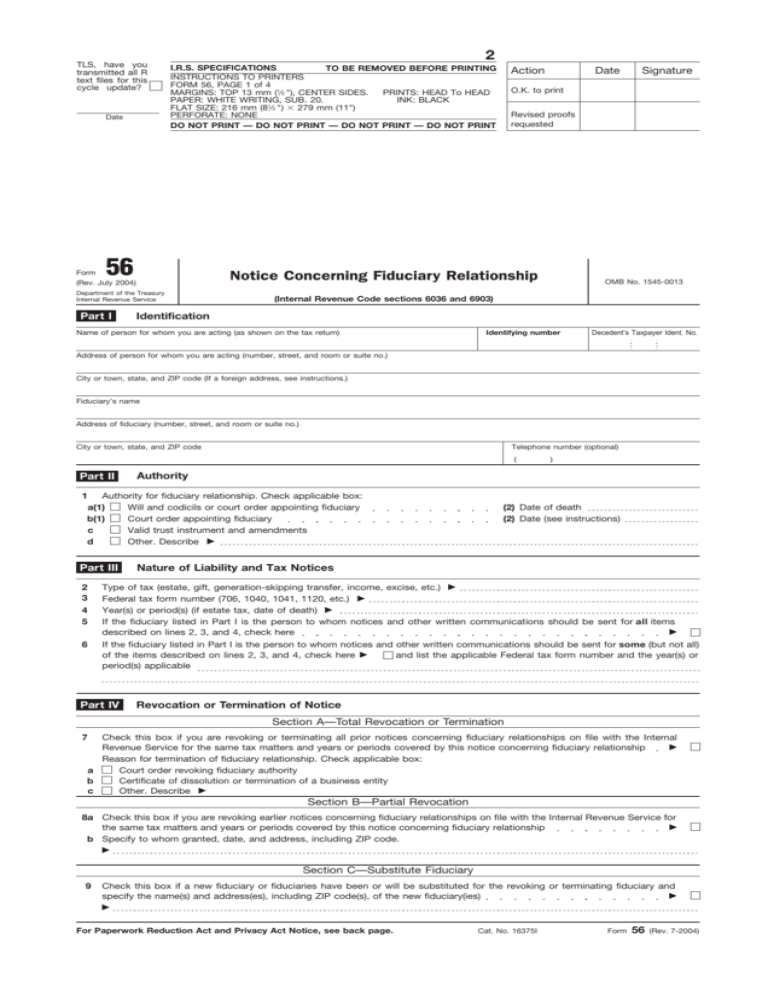

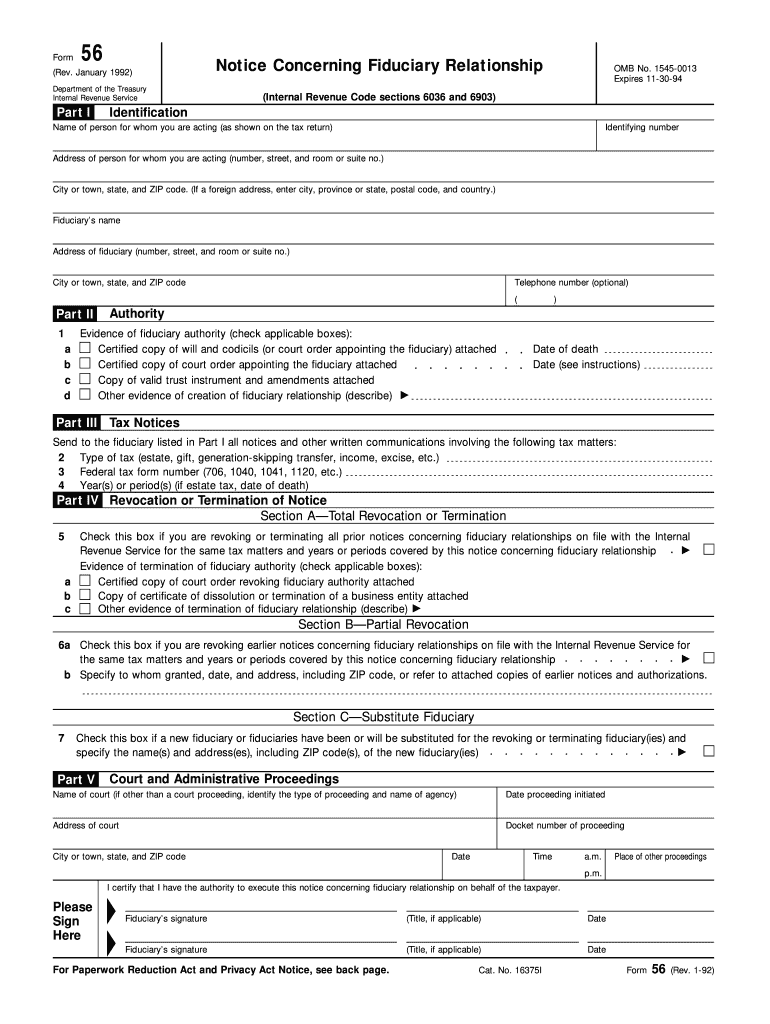

Can Irs Form 56 Be Filed Electronically - 16 to file, though tax payments are still due by july 31. Web washington — to protect the health of taxpayers and tax professionals, the internal revenue service today announced pdf it will temporarily allow the use of. However, you must attach to his return a copy of the court certificate showing your appointment. Filing an electronic tax return (often called. & more fillable forms, register and subscribe now! Get ready for tax season deadlines by completing any required tax forms today. Form 56, notice concerning fiduciary. Answer at this time, the irs does not accept form 56 electronically. Web file form 56 at internal revenue service center where the person for whom you are acting is required to file tax returns. Through october 31, 2023, you and your authorized representatives may electronically sign documents and email.

Web each year, most people who work are required to file a federal income tax return. 16 to file, though tax payments are still due by july 31. Complete, edit or print tax forms instantly. Web in most cases, individuals who meet any of the filing requirements as defined by the internal revenue service may electronically file income taxes. Web to protect the health of taxpayers and tax professionals, the irs is temporarily allowing the use of digital signatures on some tax forms that can't be filed electronically. Web file form 1310 to claim the refund on mr. Ad access irs tax forms. Web yes, you can file an original form 1040 series tax return electronically using any filing status. Web documents needed to file itr; Web form 56 allows the personal representative to assume the powers, rights, duties and privileges of the decedent and allows the irs to mail the representative all tax.

However, you must attach to his return a copy of the court certificate showing your appointment. 16 to file, though tax payments are still due by july 31. Web each year, most people who work are required to file a federal income tax return. The first step of filing itr is to collect all the documents related to the process. Web in most cases, individuals who meet any of the filing requirements as defined by the internal revenue service may electronically file income taxes. Complete, edit or print tax forms instantly. Appointment of a trustee for a trust. Web information about form 56, notice concerning fiduciary relationship, including recent updates, related forms, and instructions on how to file. Get form instructions get help instructions for irs form 56 you may need to have a copy of the. Web washington — on august 28, the irs announced that it would temporarily allow the use of digital signatures on certain forms that cannot be filed.

Can IRS Form 7004 be filed electronically? YouTube

Get ready for tax season deadlines by completing any required tax forms today. 16 to file, though tax payments are still due by july 31. Web to protect the health of taxpayers and tax professionals, the irs is temporarily allowing the use of digital signatures on some tax forms that can't be filed electronically. Web form 56 allows the personal.

All About IRS Form 56 Tax Resolution Services

Web form 56 allows the personal representative to assume the powers, rights, duties and privileges of the decedent and allows the irs to mail the representative all tax. Web in most cases, individuals who meet any of the filing requirements as defined by the internal revenue service may electronically file income taxes. For more information on which 1040 and 1041.

IRS form 56Notice Concerning Fiduciary Relationship

Through october 31, 2023, you and your authorized representatives may electronically sign documents and email. 16 to file, though tax payments are still due by july 31. Filing an electronic tax return (often called. Web file form 1310 to claim the refund on mr. Ad access irs tax forms.

IRS Form 56 (Notice Concerning Fiduciary Relationship) Internal

At this time, the irs does not accept form 56 electronically. Filing an electronic tax return (often called. If you must file, you have two options: Web each year, most people who work are required to file a federal income tax return. 16 to file, though tax payments are still due by july 31.

Which IRS Form Can Be Filed Electronically?

Web sign and send documents electronically. Get form instructions get help instructions for irs form 56 you may need to have a copy of the. Web appointment of an executor for an estate. Web to protect the health of taxpayers and tax professionals, the irs is temporarily allowing the use of digital signatures on some tax forms that can't be.

IRS releasing electronicallyfiled nonprofit tax data • OpenSecrets

Web washington — on august 28, the irs announced that it would temporarily allow the use of digital signatures on certain forms that cannot be filed. Web file form 1310 to claim the refund on mr. If you wish to receive tax notices for more. Form 56 must be attached as a pdf file for electronic returns. Web form 56.

IRS Form 56'nın Amacı Temeller 2021

Web washington — to protect the health of taxpayers and tax professionals, the internal revenue service today announced pdf it will temporarily allow the use of. Through october 31, 2023, you and your authorized representatives may electronically sign documents and email. Web washington — on august 28, the irs announced that it would temporarily allow the use of digital signatures.

Form 56 IRS Template PDF

Web to protect the health of taxpayers and tax professionals, the irs is temporarily allowing the use of digital signatures on some tax forms that can't be filed electronically. Form 56, notice concerning fiduciary. An individual having salary income should collect. Web appointment of an executor for an estate. If you must file, you have two options:

Irs Form 56 Where to Email Fill Out and Sign Printable PDF Template

If you wish to receive tax notices for more. Web washington — on august 28, the irs announced that it would temporarily allow the use of digital signatures on certain forms that cannot be filed. Web documents needed to file itr; However, you must attach to his return a copy of the court certificate showing your appointment. Form 56, notice.

IRS Form 56 Instructions & Overview Community Tax

You can print form 56 directly to a pdf from within the program and attach it to the return in. If you wish to receive tax notices for more. Get ready for tax season deadlines by completing any required tax forms today. Web to protect the health of taxpayers and tax professionals, the irs is temporarily allowing the use of.

If You Are Appointed To Act In A Fiduciary Capacity For Another, You Must File A Written Notice With The Irs Stating This.

Web documents needed to file itr; An individual having salary income should collect. & more fillable forms, register and subscribe now! Ad access irs tax forms.

At This Time, The Irs Does Not Accept Form 56 Electronically.

Filing your return electronically is faster, safer, and more accurate than. Get ready for tax season deadlines by completing any required tax forms today. Web information about form 56, notice concerning fiduciary relationship, including recent updates, related forms, and instructions on how to file. Filing an electronic tax return (often called.

However, You Must Attach To His Return A Copy Of The Court Certificate Showing Your Appointment.

Web washington — on august 28, the irs announced that it would temporarily allow the use of digital signatures on certain forms that cannot be filed. Web to protect the health of taxpayers and tax professionals, the irs is temporarily allowing the use of digital signatures on some tax forms that can't be filed electronically. If you wish to receive tax notices for more. For more information on which 1040 and 1041 forms are not included in the.

Web Yes, You Can File An Original Form 1040 Series Tax Return Electronically Using Any Filing Status.

Form 56 must be attached as a pdf file for electronic returns. Get form instructions get help instructions for irs form 56 you may need to have a copy of the. Web in most cases, individuals who meet any of the filing requirements as defined by the internal revenue service may electronically file income taxes. Web form 56 allows the personal representative to assume the powers, rights, duties and privileges of the decedent and allows the irs to mail the representative all tax.