Form 1065 K-2 Instructions

Form 1065 K-2 Instructions - Web where to file your taxes for form 1065. If the partnership's principal business, office, or agency is located in: Web the 2022 form 1065 is an information return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023. Web although the partnership generally isn't subject to income tax, you may be liable for tax on your share of the partnership income, whether or not distributed. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. They are extensions of schedule k and are used to report items of international tax relevance from the operation of a partnership. Web 3 rows for tax year 2022, please see the 2022 instructions. Web the partnership should use this code to report your share of income/gain that comes from your total net section 743 (b) basis adjustments. And the total assets at the end of the tax year. Return of partnership income, were first required to be filed for the 2021 tax year.

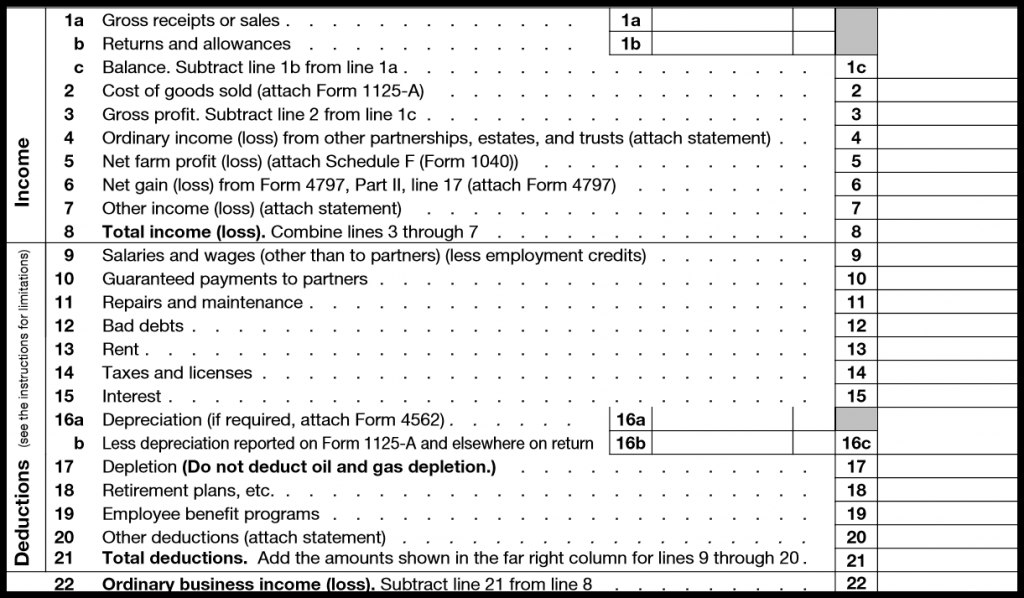

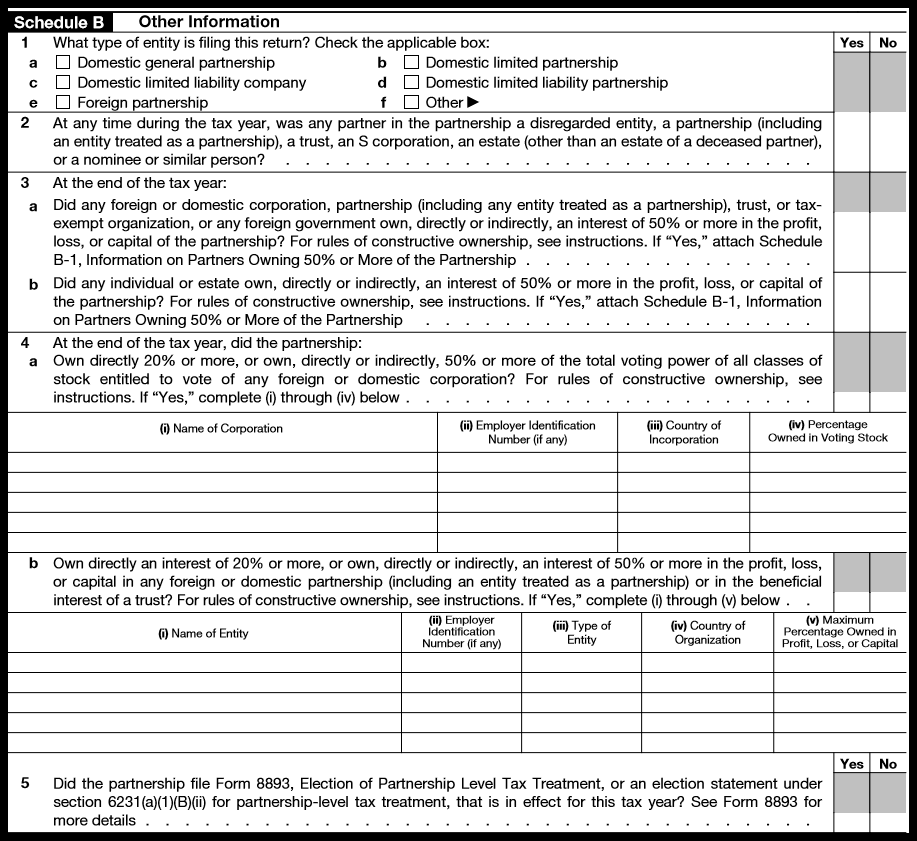

They are extensions of schedule k and are used to report items of international tax relevance from the operation of a partnership. Web where to file your taxes for form 1065. 2 schedule b other information 1. 1065 (2022) form 1065 (2022) page. Web although the partnership generally isn't subject to income tax, you may be liable for tax on your share of the partnership income, whether or not distributed. Complete, edit or print tax forms instantly. For a fiscal year or a short tax year, fill in the. Web 3 rows for tax year 2022, please see the 2022 instructions. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. If the partnership's principal business, office, or agency is located in:

Complete, edit or print tax forms instantly. This code will let you know if you should. They are extensions of schedule k and are used to report items of international tax relevance from the operation of a partnership. Web form 1065 (2000) page 2 cost of goods sold (see page 17 of the instructions) 1 inventory at beginning of year 1 2 purchases less cost of items withdrawn for personal use 2 3. Web although the partnership generally isn't subject to income tax, you may be liable for tax on your share of the partnership income, whether or not distributed. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. Return of partnership income, were first required to be filed for the 2021 tax year. For a fiscal year or a short tax year, fill in the. Web for paperwork reduction act notice, see separate instructions. If the partnership's principal business, office, or agency is located in:

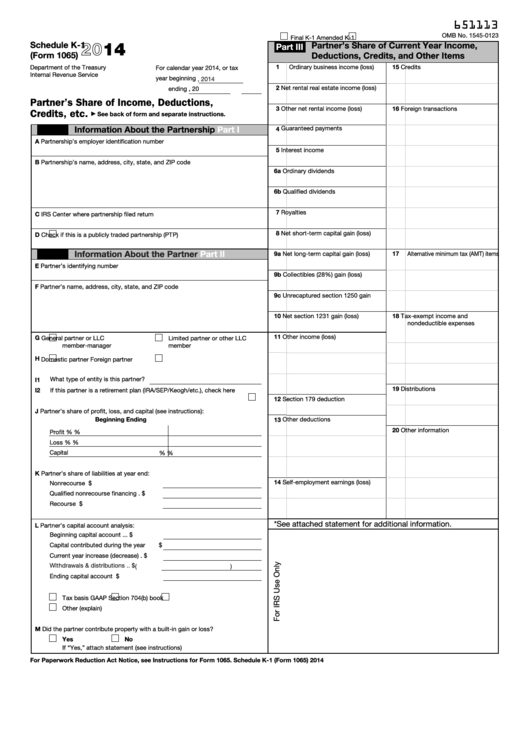

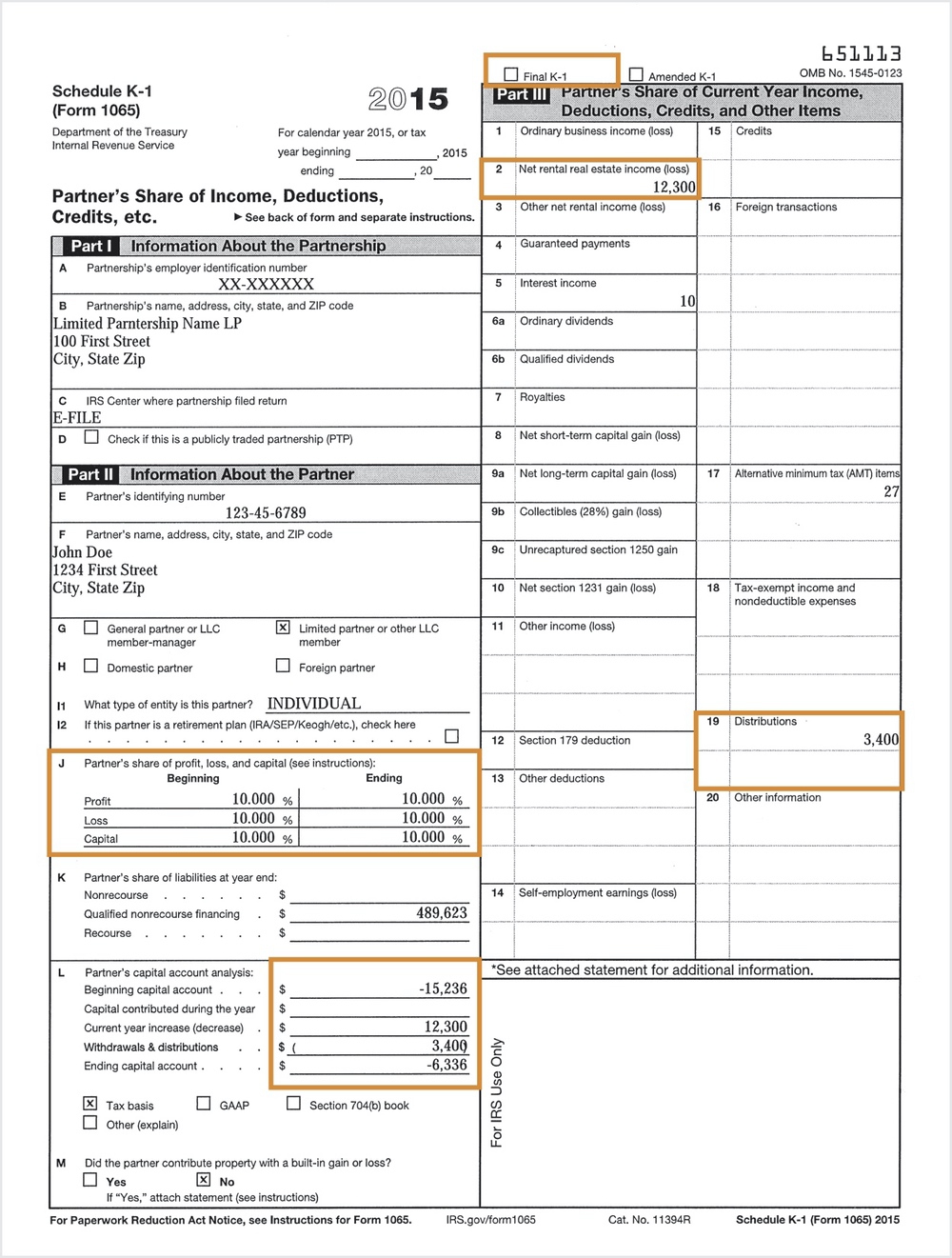

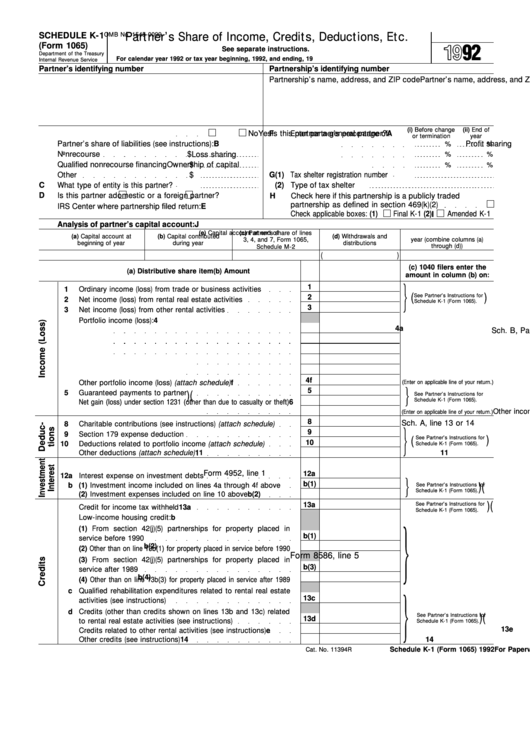

How to Fill out Schedule K1 (IRS Form 1065) YouTube

If the partnership's principal business, office, or agency is located in: 2 schedule b other information 1. And the total assets at the end of the tax year. Web the 2022 form 1065 is an information return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023. They are extensions of schedule k and are.

Form 1065 Instructions in 8 Steps (+ Free Checklist)

Web form 1065 (2000) page 2 cost of goods sold (see page 17 of the instructions) 1 inventory at beginning of year 1 2 purchases less cost of items withdrawn for personal use 2 3. 2 schedule b other information 1. Web where to file your taxes for form 1065. They are extensions of schedule k and are used to.

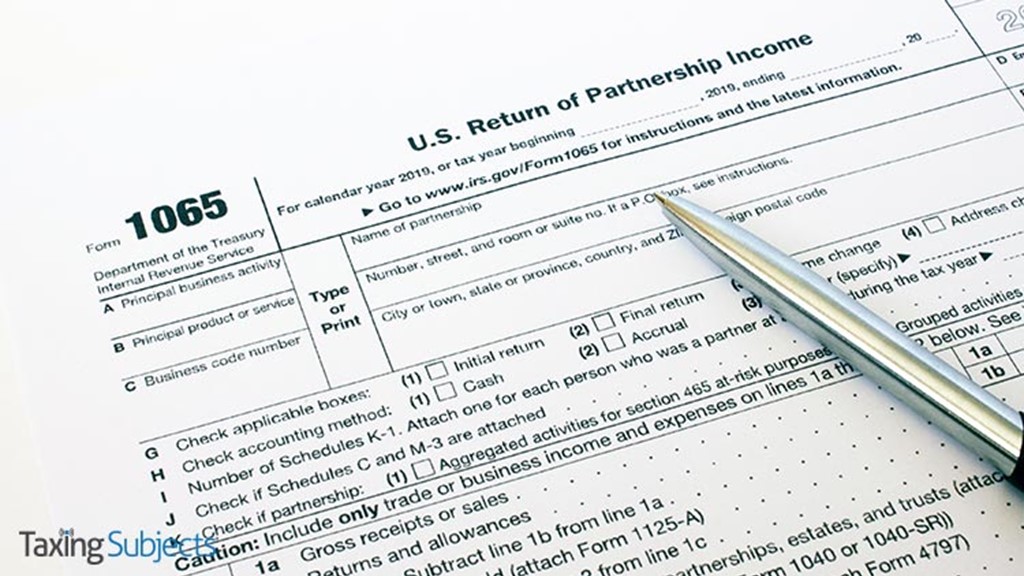

How To Complete Form 1065 With Instructions

Return of partnership income, were first required to be filed for the 2021 tax year. Web where to file your taxes for form 1065. For a fiscal year or a short tax year, fill in the. If the partnership's principal business, office, or agency is located in: Web although the partnership generally isn't subject to income tax, you may be.

3.11.15 Return of Partnership Internal Revenue Service

Web 3 rows for tax year 2022, please see the 2022 instructions. They are extensions of schedule k and are used to report items of international tax relevance from the operation of a partnership. Web the 2022 form 1065 is an information return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023. 1065 (2022).

schedule k1 Taxing Subjects

Web where to file your taxes for form 1065. For a fiscal year or a short tax year, fill in the. 1065 (2022) form 1065 (2022) page. Complete, edit or print tax forms instantly. Web the partnership should use this code to report your share of income/gain that comes from your total net section 743 (b) basis adjustments.

Llc Tax Form 1065 Universal Network

2 schedule b other information 1. Web form 1065 (2000) page 2 cost of goods sold (see page 17 of the instructions) 1 inventory at beginning of year 1 2 purchases less cost of items withdrawn for personal use 2 3. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. Web the 2022 form 1065.

Form 1065 Instructions & Information for Partnership Tax Returns

This code will let you know if you should. Web the 2022 form 1065 is an information return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023. Web form 1065 (2000) page 2 cost of goods sold (see page 17 of the instructions) 1 inventory at beginning of year 1 2 purchases less cost.

Fillable Schedule K1 (Form 1065) Partner'S Share Of

Web although the partnership generally isn't subject to income tax, you may be liable for tax on your share of the partnership income, whether or not distributed. 1065 (2022) form 1065 (2022) page. Return of partnership income, were first required to be filed for the 2021 tax year. 2 schedule b other information 1. Web for paperwork reduction act notice,.

Schedule K1 / 1065 Tax Form Guide LP Equity

Return of partnership income, were first required to be filed for the 2021 tax year. 2 schedule b other information 1. 1065 (2022) form 1065 (2022) page. Web 3 rows for tax year 2022, please see the 2022 instructions. Web although the partnership generally isn't subject to income tax, you may be liable for tax on your share of the.

Shedule K1 (Form 1065) Partner'S Share Of Credits

Web although the partnership generally isn't subject to income tax, you may be liable for tax on your share of the partnership income, whether or not distributed. Web the partnership should use this code to report your share of income/gain that comes from your total net section 743 (b) basis adjustments. They are extensions of schedule k and are used.

Web For Paperwork Reduction Act Notice, See Separate Instructions.

Complete, edit or print tax forms instantly. Web form 1065 (2000) page 2 cost of goods sold (see page 17 of the instructions) 1 inventory at beginning of year 1 2 purchases less cost of items withdrawn for personal use 2 3. Web the 2022 form 1065 is an information return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023. Web although the partnership generally isn't subject to income tax, you may be liable for tax on your share of the partnership income, whether or not distributed.

Return Of Partnership Income, Were First Required To Be Filed For The 2021 Tax Year.

This code will let you know if you should. 2 schedule b other information 1. Web where to file your taxes for form 1065. If the partnership's principal business, office, or agency is located in:

Web 3 Rows For Tax Year 2022, Please See The 2022 Instructions.

Web the partnership should use this code to report your share of income/gain that comes from your total net section 743 (b) basis adjustments. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. 1065 (2022) form 1065 (2022) page. They are extensions of schedule k and are used to report items of international tax relevance from the operation of a partnership.

For A Fiscal Year Or A Short Tax Year, Fill In The.

And the total assets at the end of the tax year.