Form 3520A Instructions

Form 3520A Instructions - Web go to www.irs.gov/form3520a for instructions and the latest information omb no. 1) a court or courts within the u.s. As provided by the irs: Web form 3520 & instructions: What is a grantor trust? Owner, including recent updates, related forms and instructions on how to file. The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person. It does not have to be a “foreign gift.” rather,. A grantor trust is any trust to the extent that the. Show all amounts in u.s.

Owner, including recent updates, related forms and instructions on how to file. Web us citizens file the form 3520 to report any transactions with foreign trusts and large gifts or bequests from non us citizens who reside abroad such as inheritance. However, the trust can request an. It does not have to be a “foreign gift.” rather,. Web the following persons are required to file form 3520 to report certain distributions (or deemed distributions) during the tax year from foreign trusts: All information must be in english. Web form 3520 department of the treasury internal revenue service annual return to report transactions with foreign trusts and receipt of certain foreign gifts go to. For a trust with a calendar year, the due date is march 15th. What is a grantor trust? The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person.

All information must be in english. What is a grantor trust? Show all amounts in u.s. It does not have to be a “foreign gift.” rather,. The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person. All information must be in english. Web the following persons are required to file form 3520 to report certain distributions (or deemed distributions) during the tax year from foreign trusts: Web you are required to complete part ii even if there have been no transactions involving the trust during the tax year. Web form 3520 & instructions: Owner, including recent updates, related forms and instructions on how to file.

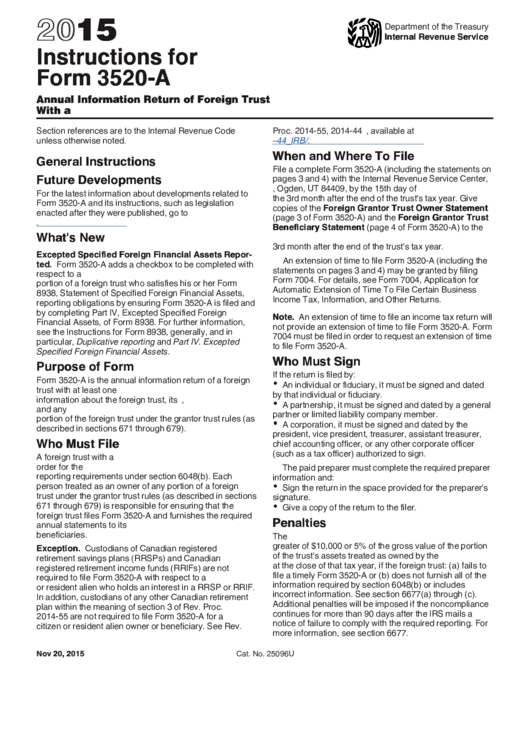

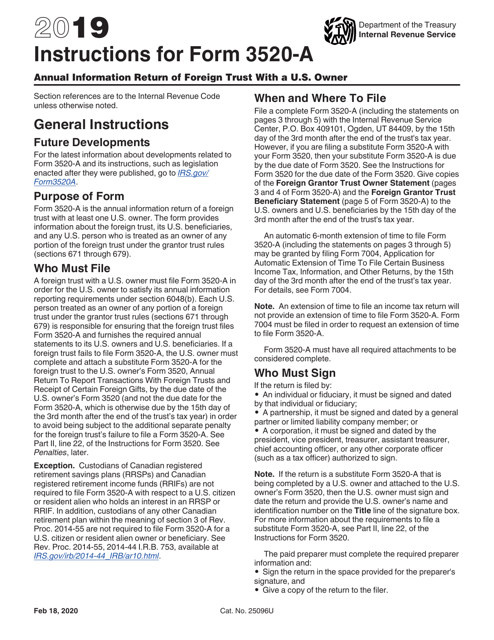

Instructions For Form 3520A Annual Information Return Of Foreign

Web go to www.irs.gov/form3520a for instructions and the latest information omb no. As provided by the irs: Web according to the internal revenue code, a trust is a foreign trust unless both of the following conditions are satisfied: Web form 3520 & instructions: Web form 3520 department of the treasury internal revenue service annual return to report transactions with foreign.

Download Instructions for IRS Form 3520A Annual Information Return of

What is a grantor trust? A grantor trust is any trust to the extent that the. Show all amounts in u.s. You may also be required to complete a substitute form 3520. Web you are required to complete part ii even if there have been no transactions involving the trust during the tax year.

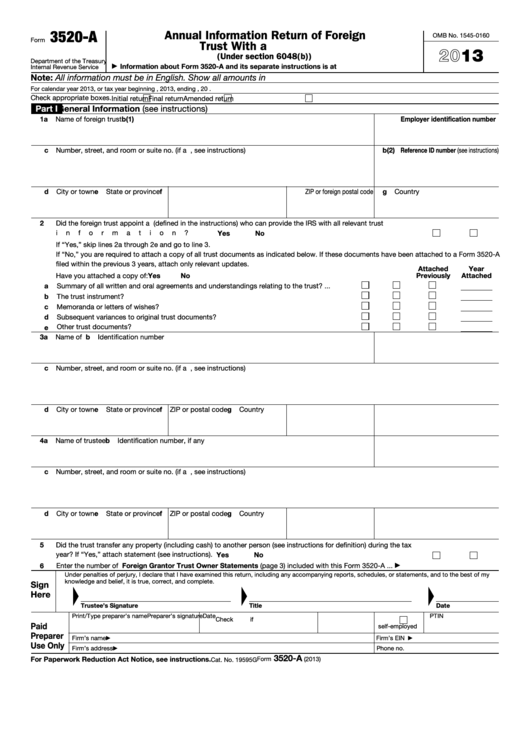

Fillable Form 3520A Annual Information Return Of Foreign Trust With

As provided by the irs: Web us citizens file the form 3520 to report any transactions with foreign trusts and large gifts or bequests from non us citizens who reside abroad such as inheritance. It does not have to be a “foreign gift.” rather,. All information must be in english. Web you are required to complete part ii even if.

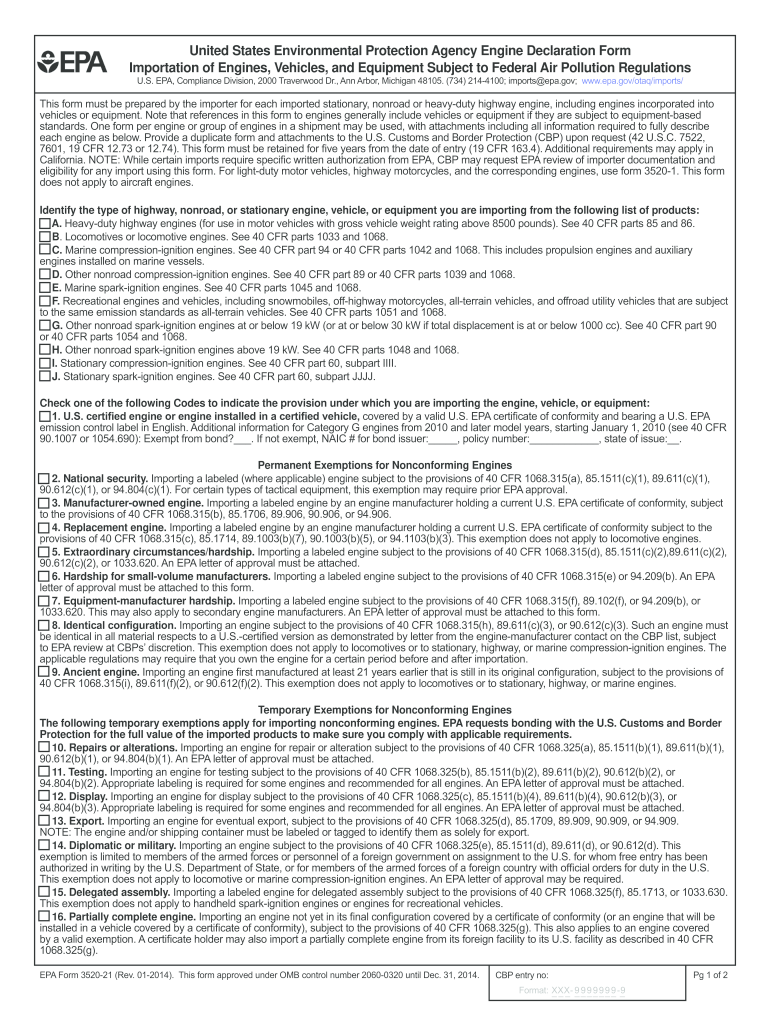

20142020 Form EPA 352021 Fill Online, Printable, Fillable, Blank

Show all amounts in u.s. All information must be in english. Web us citizens file the form 3520 to report any transactions with foreign trusts and large gifts or bequests from non us citizens who reside abroad such as inheritance. The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person..

Oregon Cat Tax Form Instructions Cat Meme Stock Pictures and Photos

As provided by the irs: Show all amounts in u.s. Web according to the internal revenue code, a trust is a foreign trust unless both of the following conditions are satisfied: All information must be in english. Web the following persons are required to file form 3520 to report certain distributions (or deemed distributions) during the tax year from foreign.

Form 3520A Annual Information Return of Foreign Trust with a U.S

As provided by the irs: Show all amounts in u.s. Web form 3520 & instructions: Web you are required to complete part ii even if there have been no transactions involving the trust during the tax year. 1) a court or courts within the u.s.

Instructions For Form 3520A Annual Information Return Of Foreign

Owner, including recent updates, related forms and instructions on how to file. Web go to www.irs.gov/form3520a for instructions and the latest information omb no. Web go to www.irs.gov/form3520a for instructions and the latest information omb no. However, the trust can request an. Web us citizens file the form 3520 to report any transactions with foreign trusts and large gifts or.

Form 3520A Annual Information Return of Foreign Trust with a U.S

A grantor trust is any trust to the extent that the. Show all amounts in u.s. You may also be required to complete a substitute form 3520. It does not have to be a “foreign gift.” rather,. Web according to the internal revenue code, a trust is a foreign trust unless both of the following conditions are satisfied:

Form 7004 Instructions 2021 2022 IRS Forms TaxUni

Web us citizens file the form 3520 to report any transactions with foreign trusts and large gifts or bequests from non us citizens who reside abroad such as inheritance. However, the trust can request an. Show all amounts in u.s. As provided by the irs: Web go to www.irs.gov/form3520a for instructions and the latest information omb no.

Instructions For Form 3520A Annual Information Return Of Foreign

The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person. As provided by the irs: Web go to www.irs.gov/form3520a for instructions and the latest information omb no. Show all amounts in u.s. 1) a court or courts within the u.s.

Owner, Including Recent Updates, Related Forms And Instructions On How To File.

For a trust with a calendar year, the due date is march 15th. Web go to www.irs.gov/form3520a for instructions and the latest information omb no. As provided by the irs: All information must be in english.

Web Us Citizens File The Form 3520 To Report Any Transactions With Foreign Trusts And Large Gifts Or Bequests From Non Us Citizens Who Reside Abroad Such As Inheritance.

1) a court or courts within the u.s. Web information about form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts, including recent updates, related forms, and. Show all amounts in u.s. Web you are required to complete part ii even if there have been no transactions involving the trust during the tax year.

Web According To The Internal Revenue Code, A Trust Is A Foreign Trust Unless Both Of The Following Conditions Are Satisfied:

Web form 3520 department of the treasury internal revenue service annual return to report transactions with foreign trusts and receipt of certain foreign gifts go to. Web form 3520 & instructions: Web go to www.irs.gov/form3520a for instructions and the latest information omb no. You may also be required to complete a substitute form 3520.

Web The Following Persons Are Required To File Form 3520 To Report Certain Distributions (Or Deemed Distributions) During The Tax Year From Foreign Trusts:

Show all amounts in u.s. The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person. What is a grantor trust? However, the trust can request an.