Form 5471 Schedule M Instructions

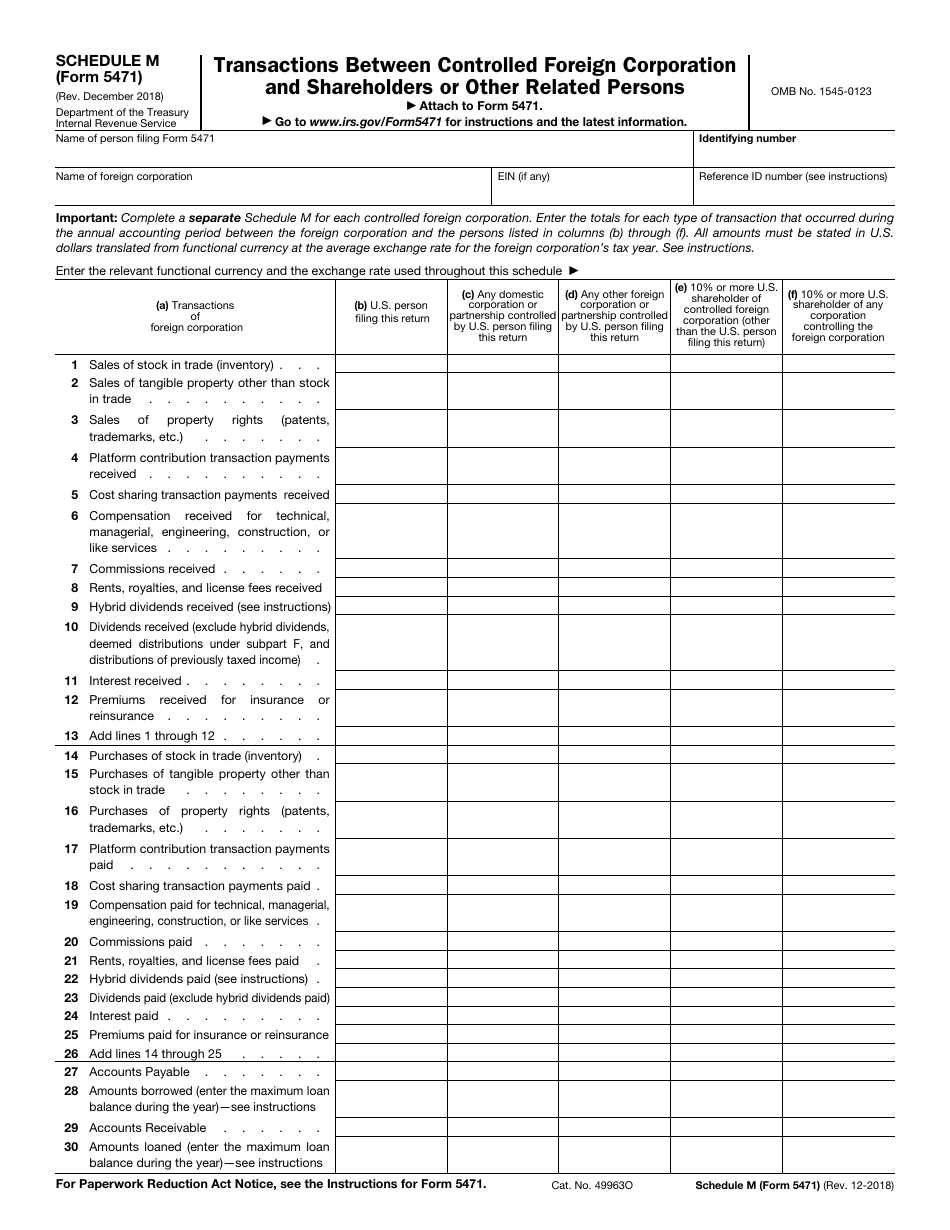

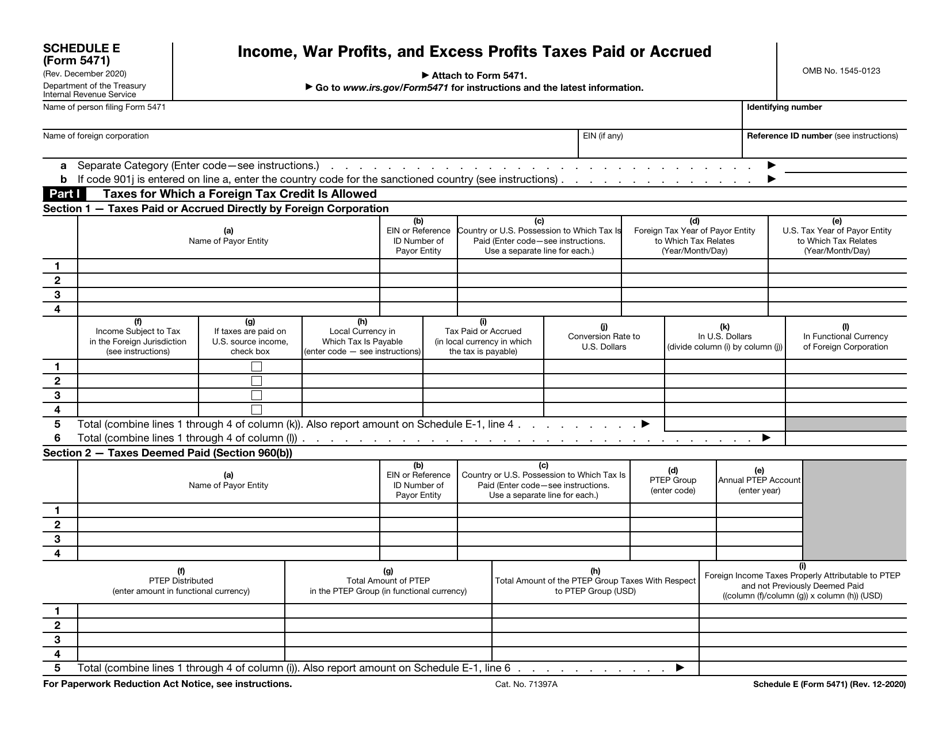

Form 5471 Schedule M Instructions - File form 5471 to satisfy the reporting requirements of sections 6038 and 6046, and the related regulations. December 2021) department of the treasury internal revenue. Web instructions for form 5471(rev. See instructions for form 5471. Changes to separate schedule o (form 5471). Persons with respect to certain foreign corporations, including recent updates, related forms, and instructions on how to file. Form 5471 (schedule e) income, war profits, and excess profits taxes paid or accrued : Persons with respect to certain foreign corporations Persons that are direct owners, indirect owners. Web changes to separate schedule m (form 5471).

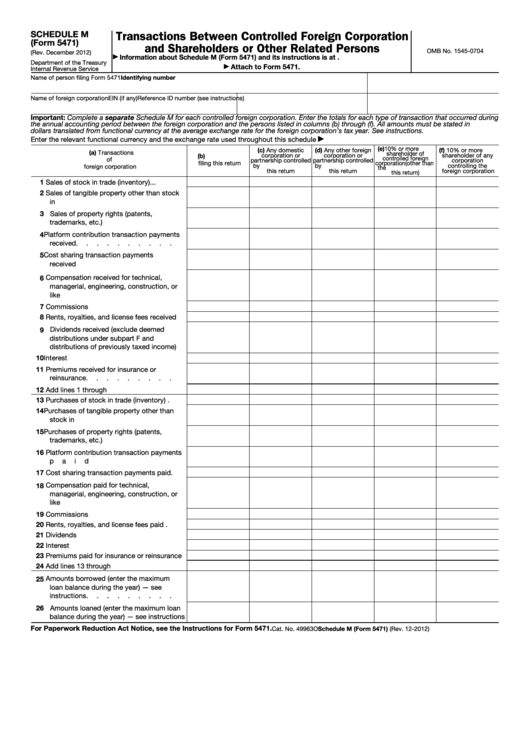

December 2005) department of the treasury internal revenue service attach to form 5471. Also, new lines 14 and 29 were added for reporting “other amounts received” (line 14) and “other amounts paid” (line 29). Web information about form 5471, information return of u.s. Web changes to separate schedule m (form 5471). Web schedule m (form 5471) (rev. Web schedule m (form 5471) transactions between controlled foreign corporation and shareholders or other related persons (rev. Who must complete schedule m. And the december 2012 revision of separate schedule o.) information return of u.s. See instructions for form 5471. New lines 13 and 28 were added for reporting loan guarantee fees received (line 13) and loan guarantee fees paid (line 28).

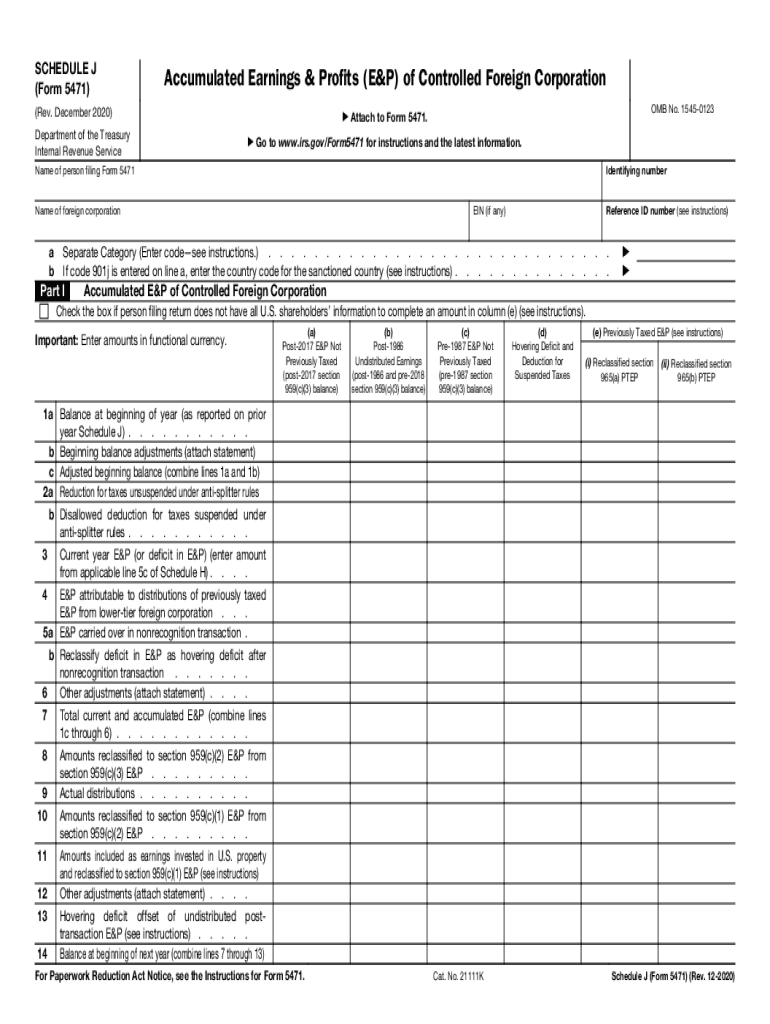

Changes to separate schedule o (form 5471). Persons with respect to certain foreign corporations Go to www.irs.gov/form5471 for instructions and the latest information. The december 2020 revision of separate schedules j, p, q, and r; Use the december 2012 revision. December 2021) department of the treasury internal revenue service name of person filing form 5471 omb no. Name of person filing form 5471 identifying number name of foreign corporation important: December 2021) department of the treasury internal revenue. File form 5471 to satisfy the reporting requirements of sections 6038 and 6046, and the related regulations. Form 5471 and its accompanying schedules must be completed and filed by the following categories of persons:

A LinebyLine Review of the IRS Form 5471 Schedule M SF Tax Counsel

No changes have been made to schedule m (form 5471). The december 2020 revision of separate schedules j, p, q, and r; Persons with respect to certain foreign corporations, including recent updates, related forms, and instructions on how to file. Web schedule m (form 5471) transactions between controlled foreign corporation and shareholders or other related persons (rev. Web popular forms.

The Tax Times IRS Issues Updated New Form 5471 What's New?

Persons with respect to certain foreign corporations Use the december 2018 revision. And the december 2012 revision of separate schedule o.) information return of u.s. Who must complete schedule m. Form 5471 and its accompanying schedules must be completed and filed by the following categories of persons:

Editable IRS Form 5471 2018 2019 Create A Digital Sample in PDF

Name of person filing form 5471 identifying number name of foreign corporation important: No changes have been made to schedule o (form 5471). Complete a separate schedule m for each controlled foreign corporation. Web changes to separate schedule m (form 5471). Schedule m contains information about related party transactions between the cfc and u.s.

IRS Form 5471 Schedule M Download Fillable PDF or Fill Online

Persons with respect to certain foreign corporations, including recent updates, related forms, and instructions on how to file. Persons that are direct owners, indirect owners. December 2021) department of the treasury internal revenue service name of person filing form 5471 omb no. Web schedule m (form 5471) (rev. Individual tax return form 1040 instructions;

20122021 Form IRS 5471 Schedule O Fill Online, Printable, Fillable

Persons that are direct owners, indirect owners. Enter the totals for each type of transaction that Web information about form 5471, information return of u.s. File form 5471 to satisfy the reporting requirements of sections 6038 and 6046, and the related regulations. Web instructions for form 5471(rev.

Form 5471 Fill Out and Sign Printable PDF Template signNow

December 2021) department of the treasury internal revenue. Persons with respect to certain foreign corporations December 2005) department of the treasury internal revenue service attach to form 5471. No changes have been made to schedule o (form 5471). Use the december 2018 revision.

IRS Form 5471 Schedule E Download Fillable PDF or Fill Online

Persons with respect to certain foreign corporations, including recent updates, related forms, and instructions on how to file. Web information about form 5471, information return of u.s. Who must complete schedule m. Schedule m contains information about related party transactions between the cfc and u.s. Use the december 2012 revision.

form 5471 schedule e1 Fill Online, Printable, Fillable Blank form

Web popular forms & instructions; Schedule m contains information about related party transactions between the cfc and u.s. File form 5471 to satisfy the reporting requirements of sections 6038 and 6046, and the related regulations. Changes to separate schedule p (form 5471). Persons with respect to certain foreign corporations, including recent updates, related forms, and instructions on how to file.

Fillable Form 5471 Schedule M Transactions Between Controlled

Web schedule m (form 5471) (rev. Also, new lines 14 and 29 were added for reporting “other amounts received” (line 14) and “other amounts paid” (line 29). December 2021) department of the treasury internal revenue. File form 5471 to satisfy the reporting requirements of sections 6038 and 6046, and the related regulations. Web this article is designed to provide a.

Download Instructions for IRS Form 5471 Information Return of U.S

Use the december 2018 revision. Enter the totals for each type of transaction that December 2021) department of the treasury internal revenue service name of person filing form 5471 omb no. File form 5471 to satisfy the reporting requirements of sections 6038 and 6046, and the related regulations. See instructions for form 5471.

Changes To Separate Schedule O (Form 5471).

No changes have been made to schedule m (form 5471). Individual tax return form 1040 instructions; No changes have been made to schedule o (form 5471). December 2021) department of the treasury internal revenue service name of person filing form 5471 omb no.

Persons With Respect To Certain Foreign Corporations, Including Recent Updates, Related Forms, And Instructions On How To File.

Complete a separate schedule m for each controlled foreign corporation. Web changes to separate schedule m (form 5471). File form 5471 to satisfy the reporting requirements of sections 6038 and 6046, and the related regulations. New lines 13 and 28 were added for reporting loan guarantee fees received (line 13) and loan guarantee fees paid (line 28).

Web This Article Is Designed To Provide A Basic Overview Of The Internal Revenue Service (“Irs”) Form 5471, Schedule M.

Use the december 2018 revision. Who must complete schedule m. Request for taxpayer identification number (tin) and certification. Web changes to separate schedule m (form 5471).

December 2021) Department Of The Treasury Internal Revenue.

Persons that are direct owners, indirect owners. Changes to separate schedule p (form 5471). See instructions for form 5471. Enter the totals for each type of transaction that