Form 8958 Texas

Form 8958 Texas - Web community property states include arizona, california, idaho, louisiana, nevada, new mexico, texas, washington, and wisconsin. Web if your resident state is a community property state, and you file a federal tax return separately from your spouse or registered domestic partner, use form 8958 to report half. The laws of your state govern whether you have community or separate property and income. Form 8958 allocation of tax amounts. Web bought with separate funds. My wife and i are filing married, filing. I got married in nov 2021. Web form 8958 is also needed for the two separately filed tax returns of registered domestic partners in a community property state who are filing as single, head of household, or. Use the appropriate community property law to determine what is. Web how to properly fill out form 8958 i moved to nevada in feb 2021 from north carolina.

Web form 8958 allocation of tax amounts between certain individuals in community property states allocates income between spouses/partners when filing a separate return. Web if the filing status on an individual tax return is married filing separately and the taxpayer lives in a community property state (arizona, california, idaho, louisiana, nevada, new. Use the appropriate community property law to determine what is. Web bought with separate funds. Web if your resident state is a community property state, and you file a federal tax return separately from your spouse or registered domestic partner, use form 8958 to report half. Web use form 8958 to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community property rights. For federal tax purposes, the term spouse. Web form 8958 allocation of tax amounts between certain individuals in community property states allocates income between spouses/partners when filing a separate return. Web community property states include arizona, california, idaho, louisiana, nevada, new mexico, texas, washington, and wisconsin. Web form 8958 allocation of tax amounts between certain individuals in community property states allocates income between spouses/partners when filing a separate return.

Web forms (and instructions) 8857 request for innocent spouse relief 8958 allocation of tax amounts between certain individuals in community property states. Web if the filing status on an individual tax return is married filing separately and the taxpayer lives in a community property state (arizona, california, idaho, louisiana, nevada, new. Web if your resident state is a community property state, and you file a federal tax return separately from your spouse or registered domestic partner, use form 8958 to report half. Form 8958 allocation of tax amounts. Web form 8958 allocation of tax amounts between certain individuals in community property states allocates income between spouses/partners when filing a separate return. My wife and i are filing married, filing. The laws of your state govern whether you have community or separate property and income. Web form 8958 allocation of tax amounts between certain individuals in community property states allocates income between spouses/partners when filing a separate return. Web for federal tax purposes, marriages of couples of the same sex are treated the same as marriages of couples of the opposite sex. Web community property states include arizona, california, idaho, louisiana, nevada, new mexico, texas, washington, and wisconsin.

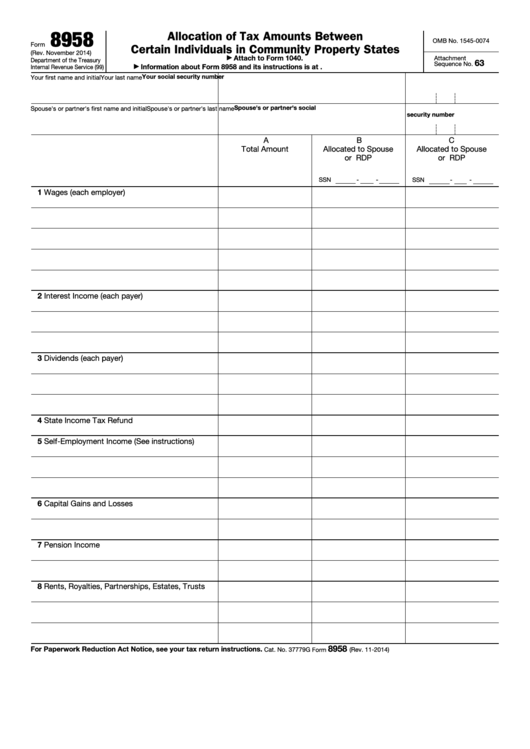

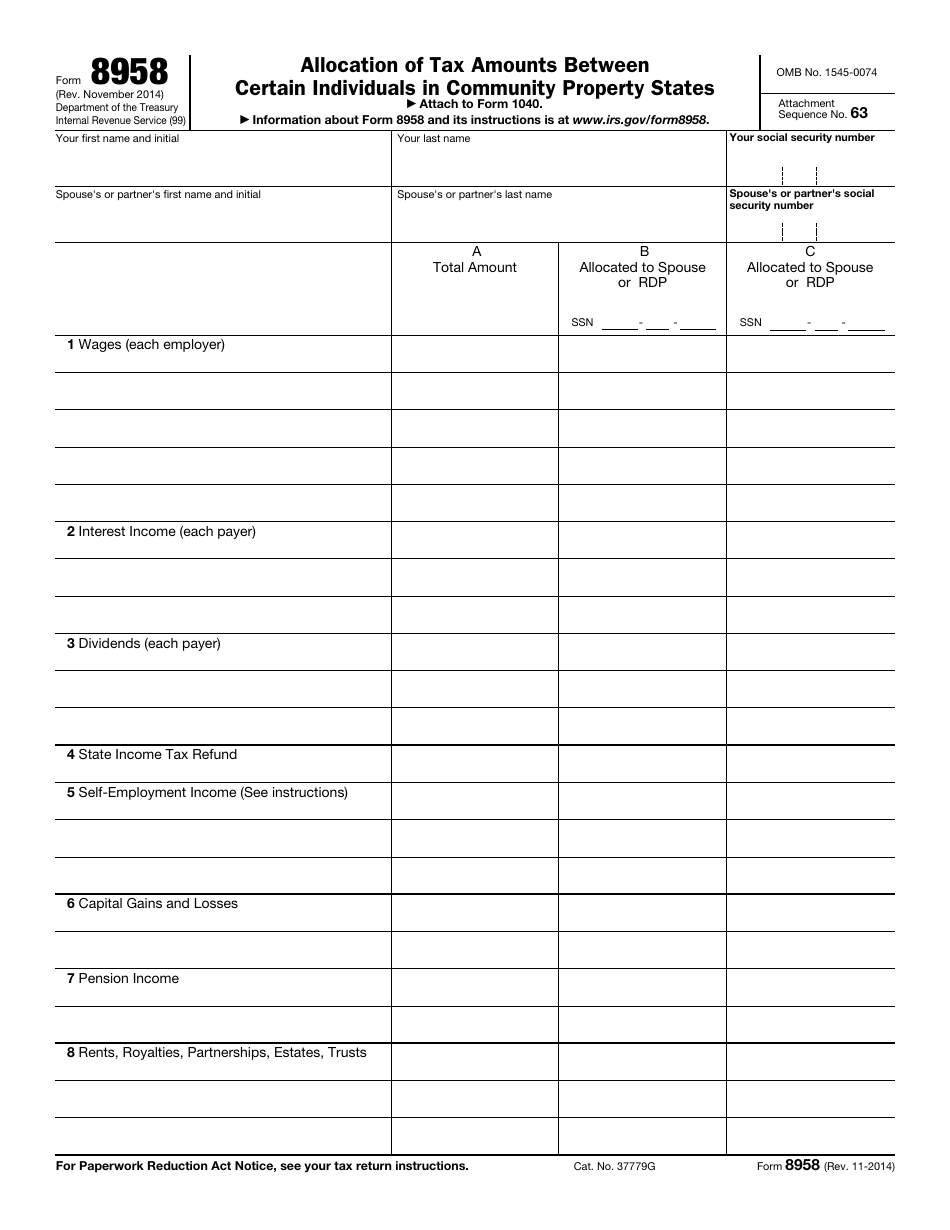

Form 8958 Allocation of Tax Amounts between Certain Individuals in

Web if the filing status on an individual tax return is married filing separately and the taxpayer lives in a community property state (arizona, california, idaho, louisiana, nevada, new. Form 8958 allocation of tax amounts. Web for federal tax purposes, marriages of couples of the same sex are treated the same as marriages of couples of the opposite sex. Web.

Form 8958 Allocation of Tax Amounts between Certain Individuals in

Web form 8958 allocation of tax amounts between certain individuals in community property states allocates income between spouses/partners when filing a separate return. Form 8958 allocation of tax amounts. Web if your resident state is a community property state, and you file a federal tax return separately from your spouse or registered domestic partner, use form 8958 to report half..

Community Property Rules and Registered Domestic Partners

Web if the filing status on an individual tax return is married filing separately and the taxpayer lives in a community property state (arizona, california, idaho, louisiana, nevada, new. My wife and i are filing married, filing. Web forms (and instructions) 8857 request for innocent spouse relief 8958 allocation of tax amounts between certain individuals in community property states. Web.

Form 8958 Allocation of Tax Amounts between Certain Individuals in

Use the appropriate community property law to determine what is. Web if the filing status on an individual tax return is married filing separately and the taxpayer lives in a community property state (arizona, california, idaho, louisiana, nevada, new. I got married in nov 2021. Web community property states include arizona, california, idaho, louisiana, nevada, new mexico, texas, washington, and.

Form 8958 Fill Out and Sign Printable PDF Template signNow

Web form 8958 allocation of tax amounts between certain individuals in community property states allocates income between spouses/partners when filing a separate return. Web how to properly fill out form 8958 i moved to nevada in feb 2021 from north carolina. Web form 8958 allocation of tax amounts between certain individuals in community property states allocates income between spouses/partners when.

Fillable Form 8958 Allocation Of Tax Amounts Between Certain

Web forms (and instructions) 8857 request for innocent spouse relief 8958 allocation of tax amounts between certain individuals in community property states. I got married in nov 2021. Web community property states include arizona, california, idaho, louisiana, nevada, new mexico, texas, washington, and wisconsin. The laws of your state govern whether you have community or separate property and income. Web.

Form 8958 Allocation of Tax Amounts between Certain Individuals in

Web form 8958 allocation of tax amounts between certain individuals in community property states allocates income between spouses/partners when filing a separate return. Web how to properly fill out form 8958 i moved to nevada in feb 2021 from north carolina. Web form 8958 is also needed for the two separately filed tax returns of registered domestic partners in a.

IRS Form 8958 Download Fillable PDF or Fill Online Allocation of Tax

Web form 8958 allocation of tax amounts between certain individuals in community property states allocates income between spouses/partners when filing a separate return. Web for federal tax purposes, marriages of couples of the same sex are treated the same as marriages of couples of the opposite sex. Use the appropriate community property law to determine what is. The laws of.

Form 8958 Fillable ≡ Fill Out Printable PDF Forms Online

Web if the filing status on an individual tax return is married filing separately and the taxpayer lives in a community property state (arizona, california, idaho, louisiana, nevada, new. Web use form 8958 to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community property rights. Web form 8958 allocation of tax.

Form 8958 Allocation of Tax Amounts between Certain Individuals in

Web bought with separate funds. Form 8958 allocation of tax amounts. Web use form 8958 to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community property rights. Web form 8958 is also needed for the two separately filed tax returns of registered domestic partners in a community property state who are.

Web Form 8958 Allocation Of Tax Amounts Between Certain Individuals In Community Property States Allocates Income Between Spouses/Partners When Filing A Separate Return.

Web for federal tax purposes, marriages of couples of the same sex are treated the same as marriages of couples of the opposite sex. Web form 8958 allocation of tax amounts between certain individuals in community property states allocates income between spouses/partners when filing a separate return. Web forms (and instructions) 8857 request for innocent spouse relief 8958 allocation of tax amounts between certain individuals in community property states. Web bought with separate funds.

Web If Your Resident State Is A Community Property State, And You File A Federal Tax Return Separately From Your Spouse Or Registered Domestic Partner, Use Form 8958 To Report Half.

For federal tax purposes, the term spouse. Form 8958 allocation of tax amounts. Web income from sp's (or former spouse's) separate property (other than income described in (a), (b), or (c)). Use the appropriate community property law to determine what is.

Web Use Form 8958 To Determine The Allocation Of Tax Amounts Between Married Filing Separate Spouses Or Registered Domestic Partners (Rdps) With Community Property Rights.

The laws of your state govern whether you have community or separate property and income. Web how to properly fill out form 8958 i moved to nevada in feb 2021 from north carolina. Web form 8958 is also needed for the two separately filed tax returns of registered domestic partners in a community property state who are filing as single, head of household, or. Web community property states include arizona, california, idaho, louisiana, nevada, new mexico, texas, washington, and wisconsin.

Web Form 8958 Allocation Of Tax Amounts Between Certain Individuals In Community Property States Allocates Income Between Spouses/Partners When Filing A Separate Return.

Web if the filing status on an individual tax return is married filing separately and the taxpayer lives in a community property state (arizona, california, idaho, louisiana, nevada, new. My wife and i are filing married, filing. I got married in nov 2021.