Form 8996 Instructions

Form 8996 Instructions - Web february 25, 2022 podcast taxpayers can defer taxes by reinvesting capital gains from an asset sale into a qof. Web the irs further explained that to correct the annual maintenance certification of the investment standard, taxpayers must file an amended return or an administrative adjustment request (aar). December 2021) department of the treasury internal revenue service. December 2019 (draft as of october 30, 2019) access form. If an entity that receives the letter fails to act, the irs may refer its tax account for examination. Form 8996 initial and annual statement of qualified opportunity fund (qof) investments jan. It is also used to annually report whether the qof met the investment standard during its tax year. Web use form 8996 to certify that the corporation or partnership is a qualified opportunity fund (qof). Add columns (a) through (l) of line 7. Web investment standard calculation part iii qualified opportunity fund average and penalty for paperwork reduction act notice, see your tax return instructions.

If an entity that receives the letter fails to act, the irs may refer its tax account for examination. For instructions and the latest information. Taxpayers will calculate the percentage of qualified opportunity zone property that’s held in both the first six months and last six months of the tax year. December 2022) qualified opportunity fund department of the treasury internal revenue service section references are to the internal revenue code unless otherwise noted. January 2020 (draft as of january 13, 2020) access instructions. Add columns (a) through (l) of line 7. Attach to your tax return. Form 8996 initial and annual statement of qualified opportunity fund (qof) investments jan. December 2021) department of the treasury internal revenue service. Guidance on how to fill out this form will eliminate inconsistencies prior to submission.

Form 8996 qualified opportunity fund jan. Attach to your tax return. Web investment standard calculation part iii qualified opportunity fund average and penalty for paperwork reduction act notice, see your tax return instructions. Web form 8997 initial and annual statement of qualified opportunity fund (qof) investments 2020. January 2020 (draft as of january 13, 2020) access instructions. Taxpayers will calculate the percentage of qualified opportunity zone property that’s held in both the first six months and last six months of the tax year. General instructions future developments for the latest information about developments related to form 8996 and its instructions, such as. Form 8996 initial and annual statement of qualified opportunity fund (qof) investments jan. December 2022) qualified opportunity fund department of the treasury internal revenue service section references are to the internal revenue code unless otherwise noted. December 2021) department of the treasury internal revenue service.

IRS Form 8996 Qualified Opportunity Fund Lies on Flat Lay Office Table

For instructions and the latest information. Web february 25, 2022 podcast taxpayers can defer taxes by reinvesting capital gains from an asset sale into a qof. It is also used to annually report whether the qof met the investment standard during its tax year. Web form 8997 initial and annual statement of qualified opportunity fund (qof) investments 2020. Guidance on.

Download Instructions for IRS Form 8996 Qualified Opportunity Fund PDF

Attach to your tax return. January 2020 (draft as of january 13, 2020) access instructions. Instructions for form 8996, qualified opportunity fund jan. Web february 25, 2022 podcast taxpayers can defer taxes by reinvesting capital gains from an asset sale into a qof. If an entity that receives the letter fails to act, the irs may refer its tax account.

IRS form 8996 Qualified opportunity fund lies on flat lay office table

For instructions and the latest information. It is also used to annually report whether the qof met the investment standard during its tax year. Instructions for form 8996, qualified opportunity fund jan. Web form 8997 initial and annual statement of qualified opportunity fund (qof) investments 2020. It is also used to annually report whether the qof met the investment standard.

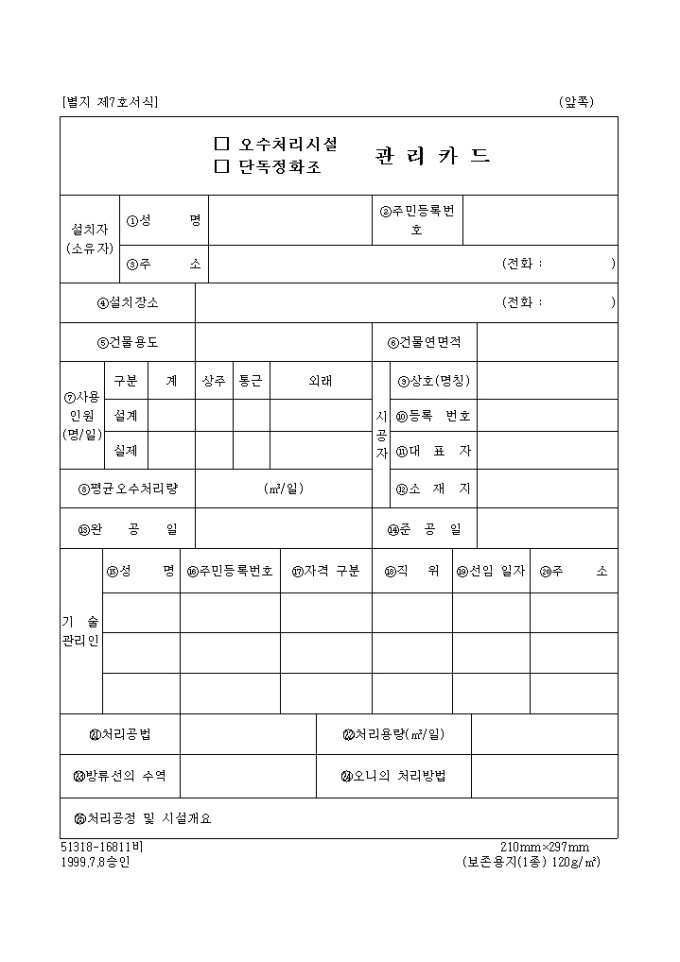

오수처리시설.단독정화조 관리카드 샘플, 양식 다운로드

December 2020 (draft as of december 18, 2020) access form. If an entity that receives the letter fails to act, the irs may refer its tax account for examination. January 2020 (draft as of january 13, 2020) access instructions. General instructions future developments for the latest information about developments related to form 8996 and its instructions, such as. It is.

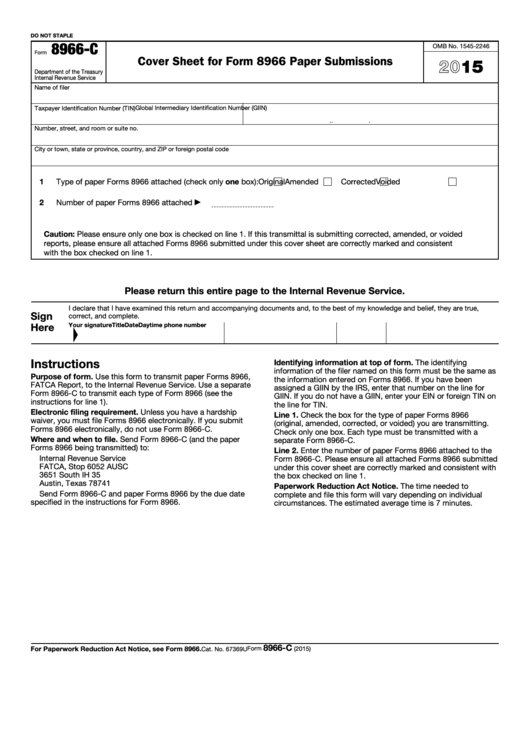

Fillable Form 8966C Cover Sheet For Form 8966 Paper Submissions

December 2019 (draft as of october 30, 2019) access form. Web form 8997 initial and annual statement of qualified opportunity fund (qof) investments 2020. For instructions and the latest information. Form 8996 qualified opportunity fund jan. Taxpayers will calculate the percentage of qualified opportunity zone property that’s held in both the first six months and last six months of the.

Fill Free fillable Form 8996 Qualified Opportunity Fund (IRS) PDF form

Guidance on how to fill out this form will eliminate inconsistencies prior to submission. Web investment standard calculation part iii qualified opportunity fund average and penalty for paperwork reduction act notice, see your tax return instructions. December 2022) qualified opportunity fund department of the treasury internal revenue service section references are to the internal revenue code unless otherwise noted. It.

IRS Form 8996 Qualified Opportunity Fund Lies on Flat Lay Office Table

December 2019 (draft as of october 30, 2019) access form. Attach to your tax return. Web this second part of form 8996 is used to determine if the corporation or partnership has met the 90 percent minimum investment requirement. It is also used to annually report whether the qof met the investment standard during its tax year. Web investment standard.

forms to fill

Web this second part of form 8996 is used to determine if the corporation or partnership has met the 90 percent minimum investment requirement. It is also used to annually report whether the qof met the investment standard during its tax year. Form 8996 initial and annual statement of qualified opportunity fund (qof) investments jan. Form 8996 qualified opportunity fund.

LEGO instructions Bionicle 8996 Skopio XV1 (Book 1) YouTube

December 2021) department of the treasury internal revenue service. Web this second part of form 8996 is used to determine if the corporation or partnership has met the 90 percent minimum investment requirement. December 2022) qualified opportunity fund department of the treasury internal revenue service section references are to the internal revenue code unless otherwise noted. Add columns (a) through.

Download Instructions for IRS Form 8996 Qualified Opportunity Fund PDF

Web investment standard calculation part iii qualified opportunity fund average and penalty for paperwork reduction act notice, see your tax return instructions. General instructions future developments for the latest information about developments related to form 8996 and its instructions, such as. Web february 25, 2022 podcast taxpayers can defer taxes by reinvesting capital gains from an asset sale into a.

Attach To Your Tax Return.

For instructions and the latest information. If an entity that receives the letter fails to act, the irs may refer its tax account for examination. Form 8996 qualified opportunity fund jan. To do so, irs form 8996 must be filed by all taxpayers holding an opportunity fund investment.

Web Investment Standard Calculation Part Iii Qualified Opportunity Fund Average And Penalty For Paperwork Reduction Act Notice, See Your Tax Return Instructions.

Web the irs further explained that to correct the annual maintenance certification of the investment standard, taxpayers must file an amended return or an administrative adjustment request (aar). Taxpayers will calculate the percentage of qualified opportunity zone property that’s held in both the first six months and last six months of the tax year. December 2022) qualified opportunity fund department of the treasury internal revenue service section references are to the internal revenue code unless otherwise noted. Add columns (a) through (l) of line 7.

Form 8996 Initial And Annual Statement Of Qualified Opportunity Fund (Qof) Investments Jan.

Web february 25, 2022 podcast taxpayers can defer taxes by reinvesting capital gains from an asset sale into a qof. Web use form 8996 to certify that the corporation or partnership is a qualified opportunity fund (qof). December 2021) department of the treasury internal revenue service. December 2019 (draft as of october 30, 2019) access form.

Web Instructions For Form 8996(Rev.

December 2020 (draft as of december 18, 2020) access form. Guidance on how to fill out this form will eliminate inconsistencies prior to submission. It is also used to annually report whether the qof met the investment standard during its tax year. It is also used to annually report whether the qof met the investment standard during its tax year.