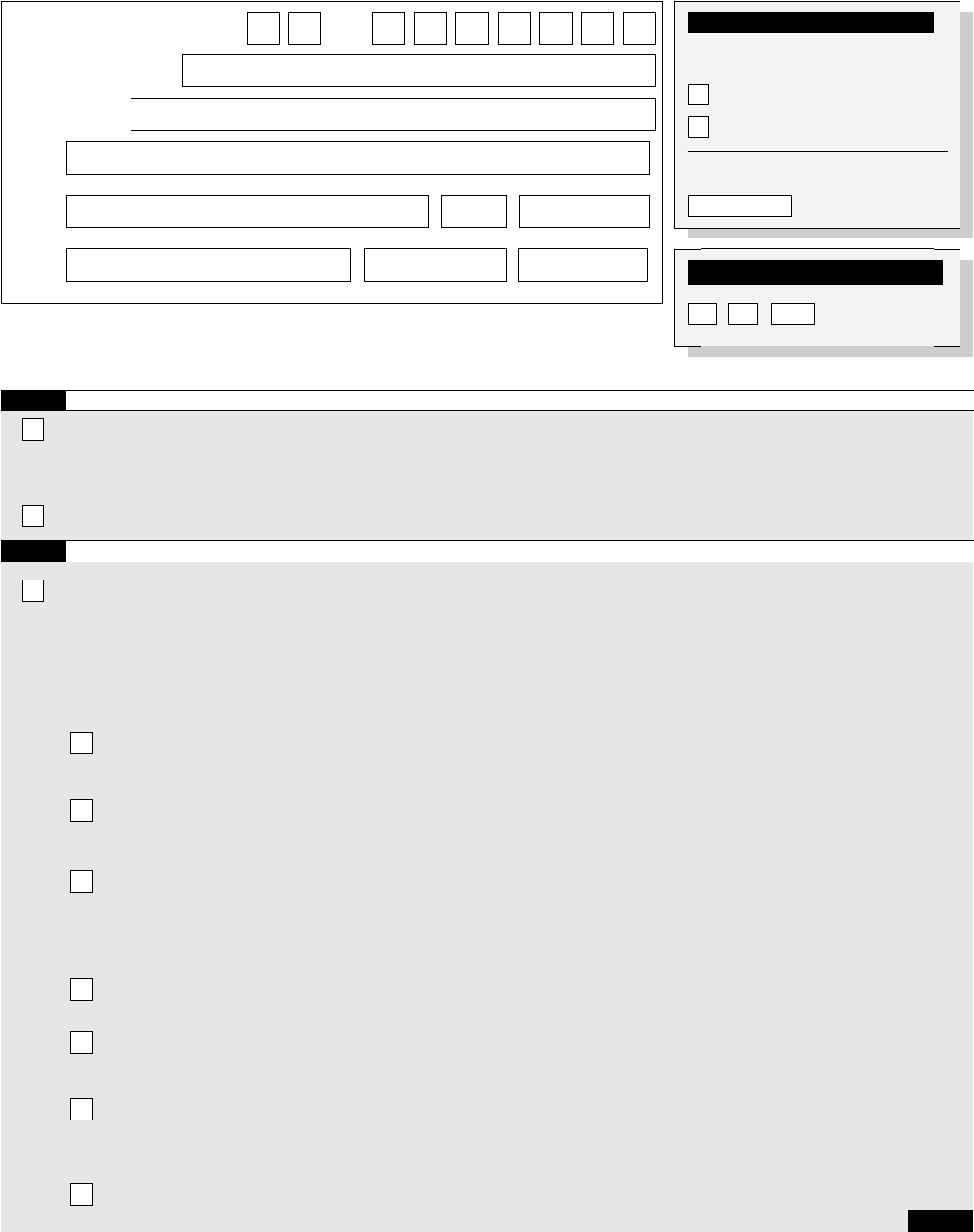

Form 944-X

Form 944-X - Adjusted employer's annual federal tax return or claim for refund 2012. Adjusted employer's annual federal tax return or claim for. Form 944 allows small employers. Form 944 is an irs tax form that reports the taxes — including federal income tax, social security tax and medicare tax — that you’ve. This checklist provides guidance for preparing and reviewing the 2022 form 944 (employer’s annual federal tax return). Web what is irs form 944? Form 944 is available for processing only when the employer type for. Revised draft instructions for form 944. The information on form 944 will be collected to ensure the smallest nonagricultural and non. “no” answers indicate possible errors in.

Adjusted employer's annual federal tax return or claim for refund 2012. Form 944 allows small employers. Form 944 is available for processing only when the employer type for. Web what is irs form 944? “no” answers indicate possible errors in. The information on form 944 will be collected to ensure the smallest nonagricultural and non. Revised draft instructions for form 944. Or claim for refund, to replace form 941c, supporting statement to correct information. Adjusted employer's annual federal tax return or claim for. The information on form 944 will be collected to ensure the smallest nonagricultural and non.

This checklist provides guidance for preparing and reviewing the 2022 form 944 (employer’s annual federal tax return). Form 944 allows small employers. Adjusted employer's annual federal tax return or claim for refund 2012. Web information about form 944, employer's annual federal tax return, including recent updates, related forms, and instructions on how to file. Form 944 is available for processing only when the employer type for. Or claim for refund, to replace form 941c, supporting statement to correct information. The information on form 944 will be collected to ensure the smallest nonagricultural and non. Form 944 is an irs tax form that reports the taxes — including federal income tax, social security tax and medicare tax — that you’ve. Revised draft instructions for form 944. The information on form 944 will be collected to ensure the smallest nonagricultural and non.

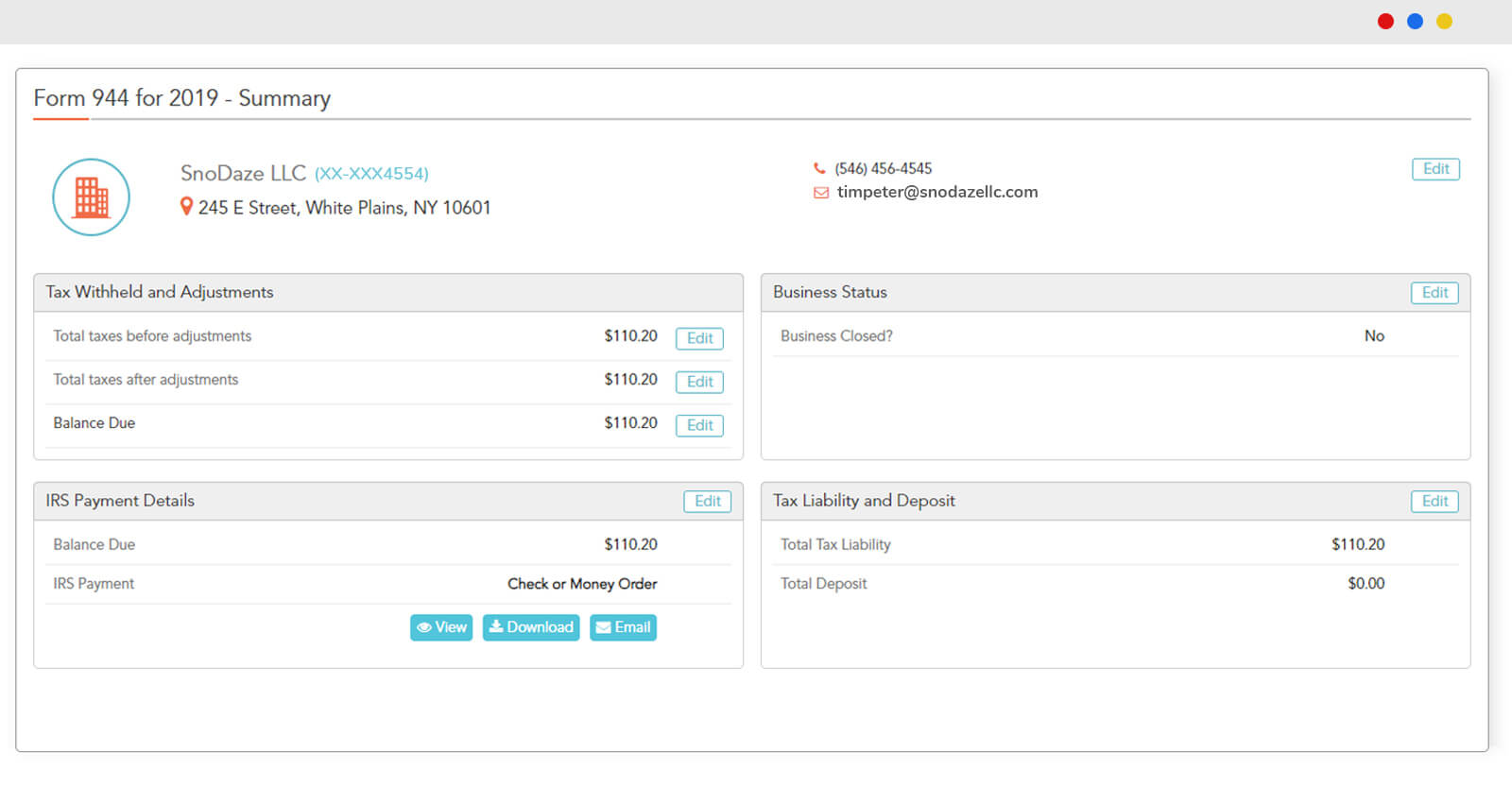

File Form 944 Online EFile 944 Form 944 for 2021

This checklist provides guidance for preparing and reviewing the 2022 form 944 (employer’s annual federal tax return). “no” answers indicate possible errors in. Adjusted employer's annual federal tax return or claim for. Adjusted employer's annual federal tax return or claim for refund 2012. Form 944 allows small employers.

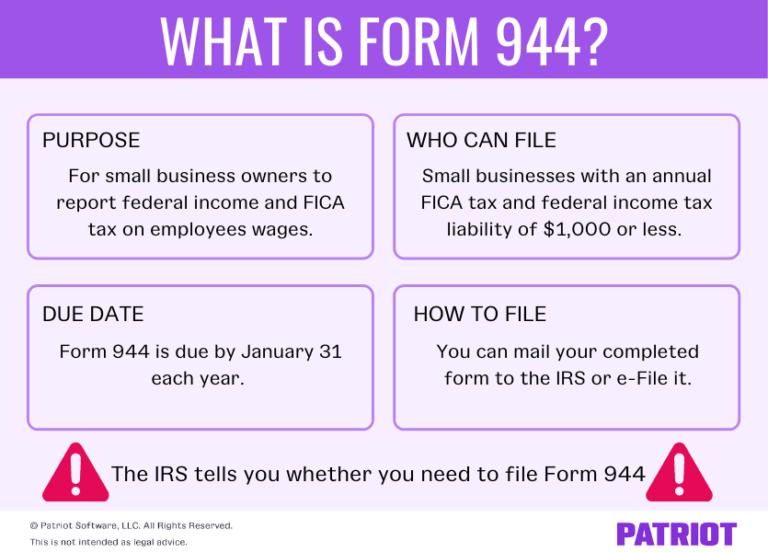

What Is Form 944 What Is Federal Form 944 For Employers How To

The information on form 944 will be collected to ensure the smallest nonagricultural and non. This checklist provides guidance for preparing and reviewing the 2022 form 944 (employer’s annual federal tax return). Form 944 allows small employers. Adjusted employer's annual federal tax return or claim for refund 2012. Web information about form 944, employer's annual federal tax return, including recent.

Form 944X Adjusted Employer's Annual Federal Tax Return or Claim fo…

Form 944 allows small employers. Adjusted employer's annual federal tax return or claim for refund 2012. Or claim for refund, to replace form 941c, supporting statement to correct information. This checklist provides guidance for preparing and reviewing the 2022 form 944 (employer’s annual federal tax return). Revised draft instructions for form 944.

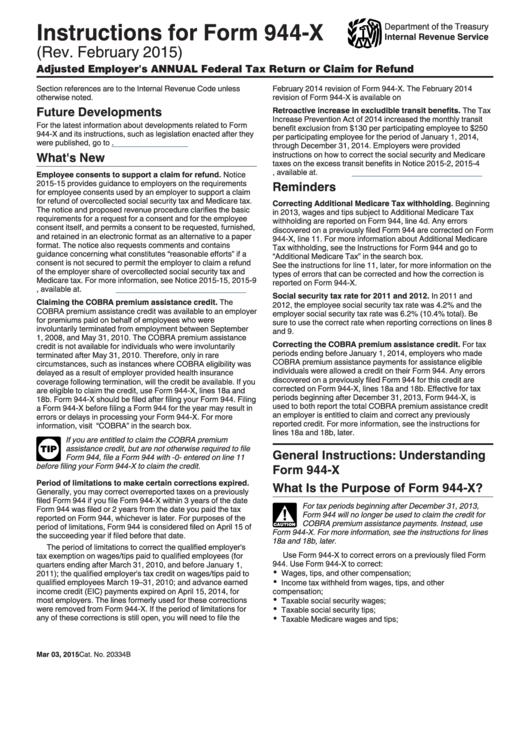

Instructions For Form 944X (Rev. February 2015) printable pdf download

The information on form 944 will be collected to ensure the smallest nonagricultural and non. Form 944 is available for processing only when the employer type for. Web information about form 944, employer's annual federal tax return, including recent updates, related forms, and instructions on how to file. Form 944 is an irs tax form that reports the taxes —.

Form 944X Adjusted Employer's Annual Federal Tax Return or Claim fo…

“no” answers indicate possible errors in. Adjusted employer's annual federal tax return or claim for. Form 944 is available for processing only when the employer type for. Form 944 is an irs tax form that reports the taxes — including federal income tax, social security tax and medicare tax — that you’ve. Adjusted employer's annual federal tax return or claim.

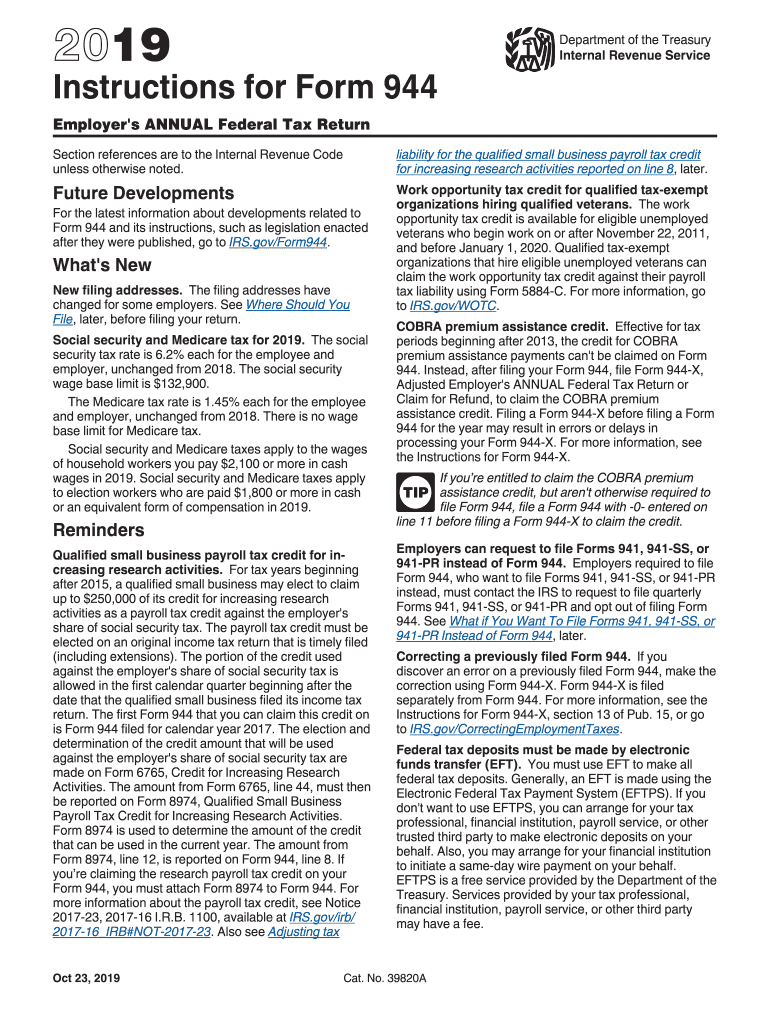

IRS 944 Instructions 2019 Fill and Sign Printable Template Online

“no” answers indicate possible errors in. Form 944 allows small employers. The information on form 944 will be collected to ensure the smallest nonagricultural and non. Adjusted employer's annual federal tax return or claim for refund 2012. This checklist provides guidance for preparing and reviewing the 2022 form 944 (employer’s annual federal tax return).

Form 944X Edit, Fill, Sign Online Handypdf

This checklist provides guidance for preparing and reviewing the 2022 form 944 (employer’s annual federal tax return). Adjusted employer's annual federal tax return or claim for. Form 944 is available for processing only when the employer type for. Form 944 is an irs tax form that reports the taxes — including federal income tax, social security tax and medicare tax.

Form 944X Edit, Fill, Sign Online Handypdf

Web information about form 944, employer's annual federal tax return, including recent updates, related forms, and instructions on how to file. Web what is irs form 944? Revised draft instructions for form 944. Form 944 allows small employers. Or claim for refund, to replace form 941c, supporting statement to correct information.

Fill Free fillable IRS PDF forms

Web information about form 944, employer's annual federal tax return, including recent updates, related forms, and instructions on how to file. The information on form 944 will be collected to ensure the smallest nonagricultural and non. Form 944 is available for processing only when the employer type for. Revised draft instructions for form 944. Or claim for refund, to replace.

What is Form 944? Reporting Federal & FICA Taxes

Form 944 is an irs tax form that reports the taxes — including federal income tax, social security tax and medicare tax — that you’ve. Web information about form 944, employer's annual federal tax return, including recent updates, related forms, and instructions on how to file. Web what is irs form 944? The information on form 944 will be collected.

Form 944 Is An Irs Tax Form That Reports The Taxes — Including Federal Income Tax, Social Security Tax And Medicare Tax — That You’ve.

This checklist provides guidance for preparing and reviewing the 2022 form 944 (employer’s annual federal tax return). Web what is irs form 944? Form 944 is available for processing only when the employer type for. Revised draft instructions for form 944.

The Information On Form 944 Will Be Collected To Ensure The Smallest Nonagricultural And Non.

Adjusted employer's annual federal tax return or claim for refund 2012. Or claim for refund, to replace form 941c, supporting statement to correct information. Adjusted employer's annual federal tax return or claim for. The information on form 944 will be collected to ensure the smallest nonagricultural and non.

“No” Answers Indicate Possible Errors In.

Form 944 allows small employers. Web information about form 944, employer's annual federal tax return, including recent updates, related forms, and instructions on how to file.