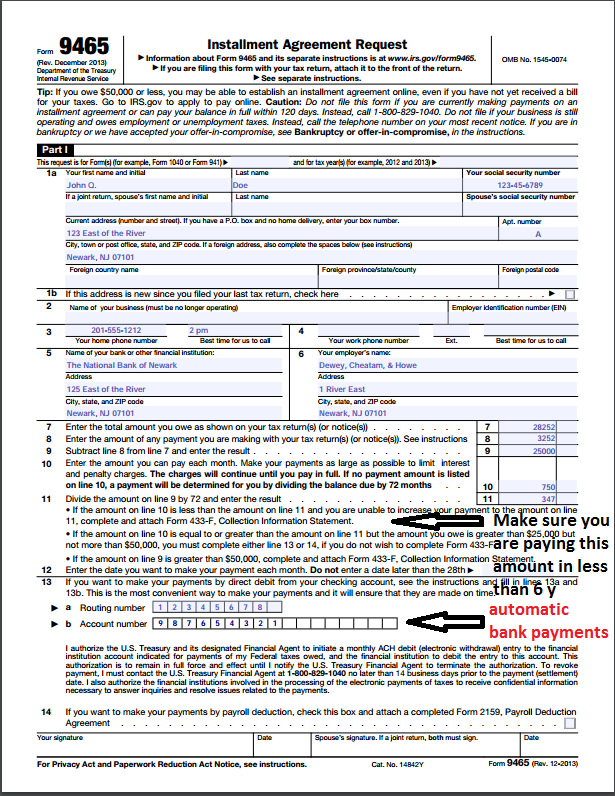

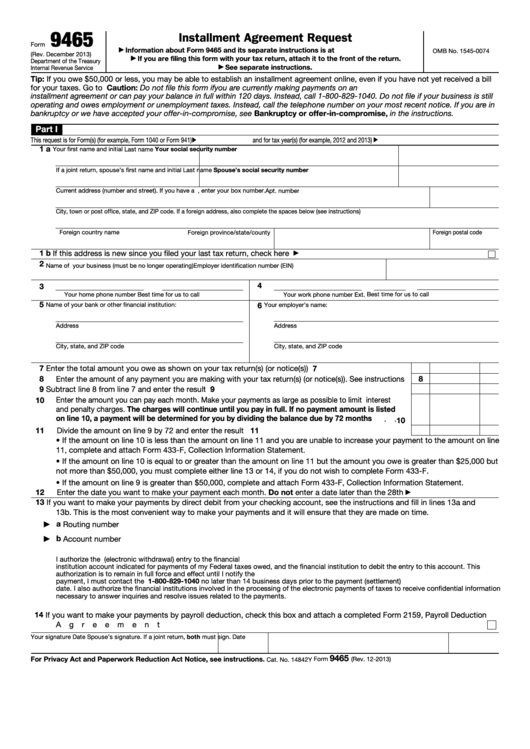

Form 9465 Installment Agreement Request

Form 9465 Installment Agreement Request - For a routine installment agreement, you also need to submit another form: Generally, you can have up to 60 months to pay. Use form 9465 to request a monthly installment plan if you cannot pay the full amount you owe shown on your tax return (or on a notice we sent you). Web how to request an installment agreement using form 9465 in proconnect. Most installment agreements meet our streamlined installment agreement criteria. Web who can file form 9465: Employee's withholding certificate form 941; If you are filing this form with your tax return, attach it to the front of the. Employers engaged in a trade or business who pay compensation form 9465; Web use form 9465 to request a monthly installment plan if you cannot pay the full amount you owe shown on your tax return (or on a notice we sent you).

Web who can file form 9465: Generally, you can have up to 60 months to pay. September 2020) installment agreement request department of the treasury internal revenue service go to www.irs.gov/form9465 for instructions and the latest information. Web form 9465 is used by taxpayers to request a monthly installment plan if they cannot pay the full amount of tax they owe. Employers engaged in a trade or business who pay compensation form 9465; If you are filing this form with your tax return, attach it to the front of the. Web if your new monthly payment amount does not meet the requirements, you will be prompted to revise the payment amount. Use form 9465 to request a monthly installment plan if you cannot pay the full amount you owe shown on your tax return (or on a notice we sent you). In certain circumstances, you can have longer to pay or your agreement can be approved for an amount that is less than the amount of tax you owe. Employee's withholding certificate form 941;

Web if your new monthly payment amount does not meet the requirements, you will be prompted to revise the payment amount. In certain circumstances, you can have longer to pay or your agreement can be approved for an amount that is less than the amount of tax you owe. September 2020) installment agreement request department of the treasury internal revenue service go to www.irs.gov/form9465 for instructions and the latest information. If you are filing this form with your tax return, attach it to the front of the. Use form 9465 to request a monthly installment plan if you cannot pay the full amount you owe shown on your tax return (or on a notice we sent you). Generally, you can have up to 60 months to pay. Employee's withholding certificate form 941; Web use form 9465 to request a monthly installment plan if you cannot pay the full amount you owe shown on your tax return (or on a notice we sent you). Web if you can’t or choose not to use the online system, you can complete the paper irs form 9465, installment agreement request, and submit it with all required documents to the address listed in the instructions. Taxpayers who can't pay their tax obligation can file form 9465 to set up a monthly installment payment plan if they meet certain conditions.

Form 9465Installment Agreement Request

Employee's withholding certificate form 941; Taxpayers who can't pay their tax obligation can file form 9465 to set up a monthly installment payment plan if they meet certain conditions. Web if your new monthly payment amount does not meet the requirements, you will be prompted to revise the payment amount. Web use form 9465 to request a monthly installment plan.

How To Submit Form 9465 Santos Czerwinski's Template

September 2020) installment agreement request department of the treasury internal revenue service go to www.irs.gov/form9465 for instructions and the latest information. Employee's withholding certificate form 941; In certain circumstances, you can have longer to pay or your agreement can be approved for an amount that is less than the amount of tax you owe. Web who can file form 9465:.

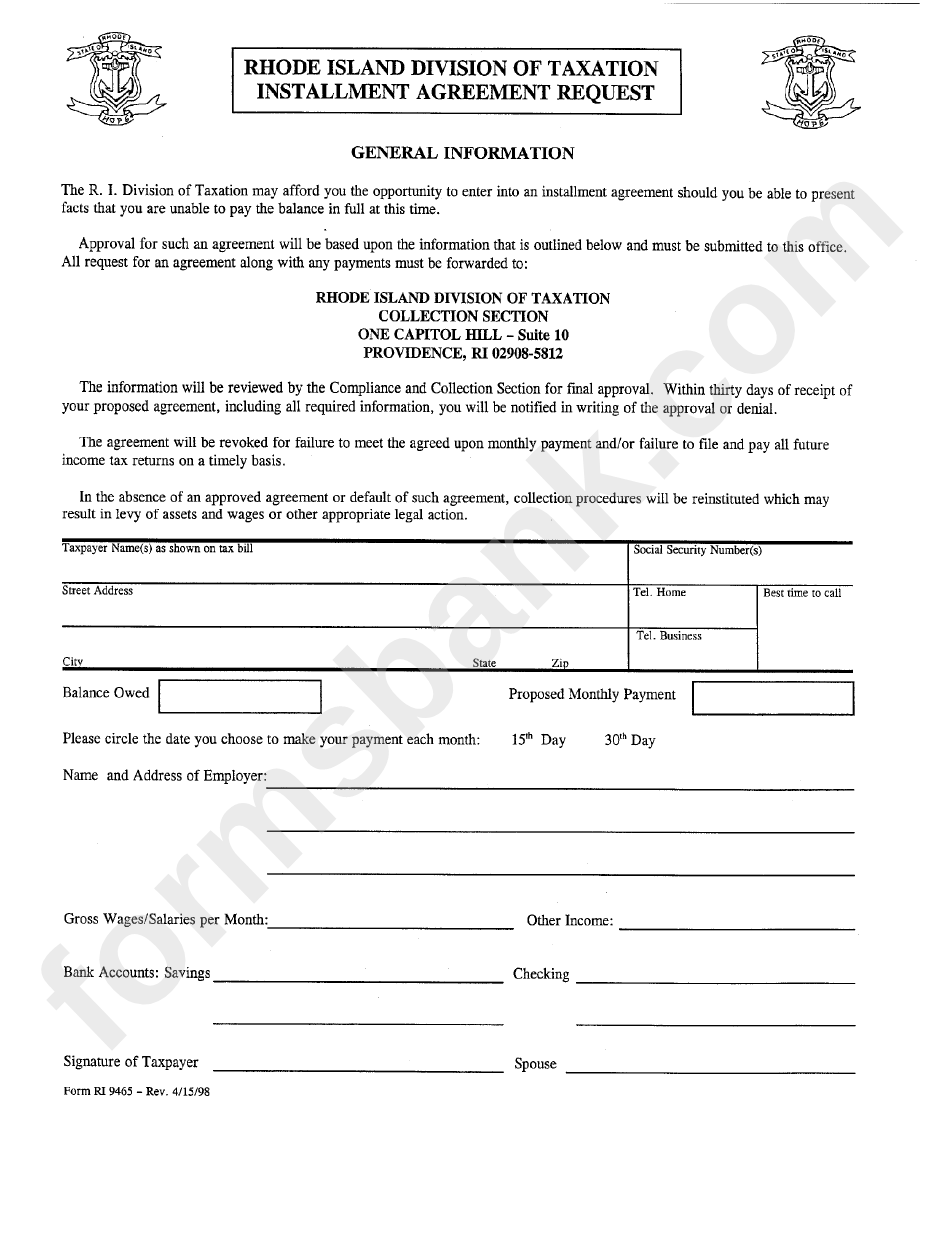

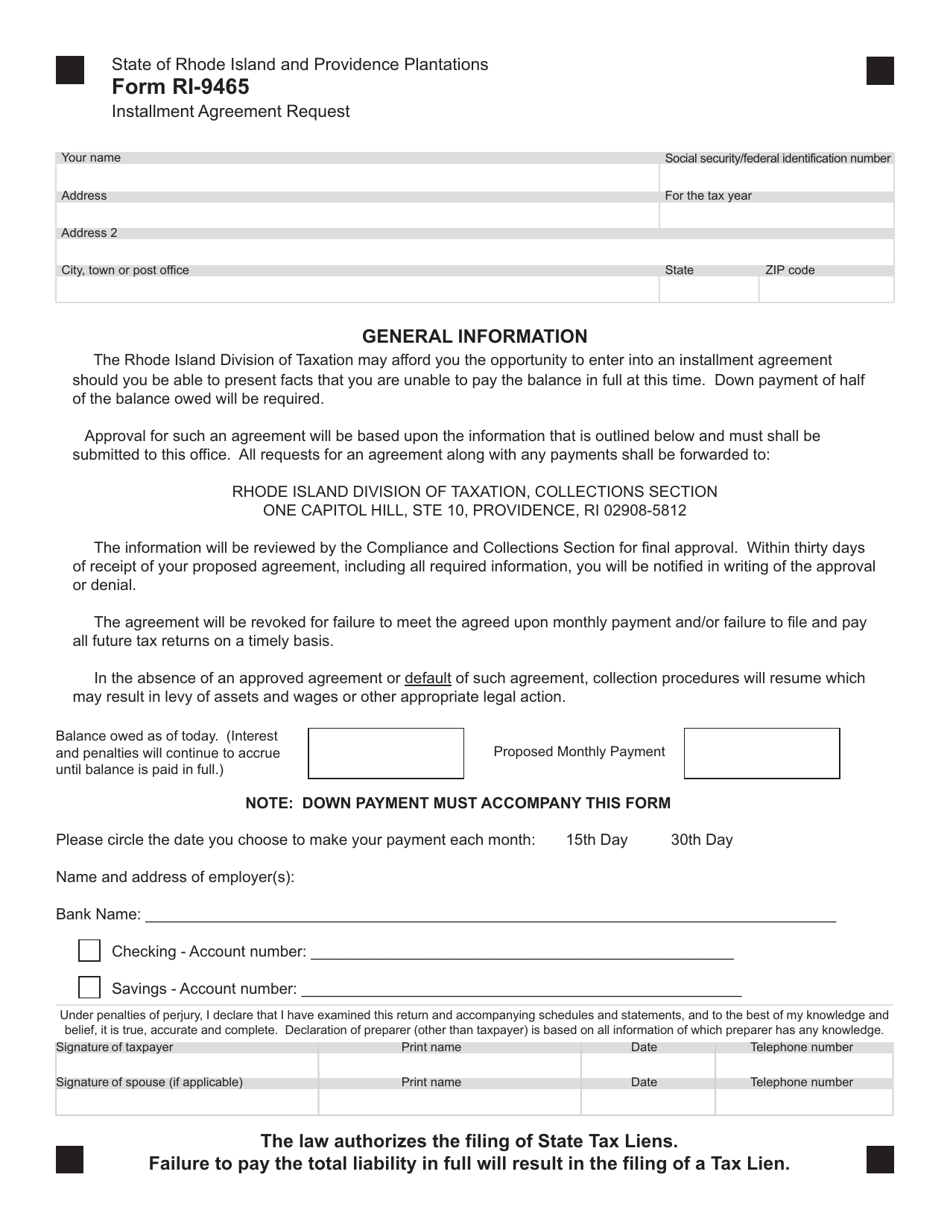

Form Ri 9465 Installment Agreement Request printable pdf download

Generally, you can have up to 60 months to pay. Web who can file form 9465: If the taxpayer can't pay the total tax currently due but would like to pay the tax due through form 9465, installment agreement request, use the steps below to request an installment agreement in intuit proconnect. If you are filing this form with your.

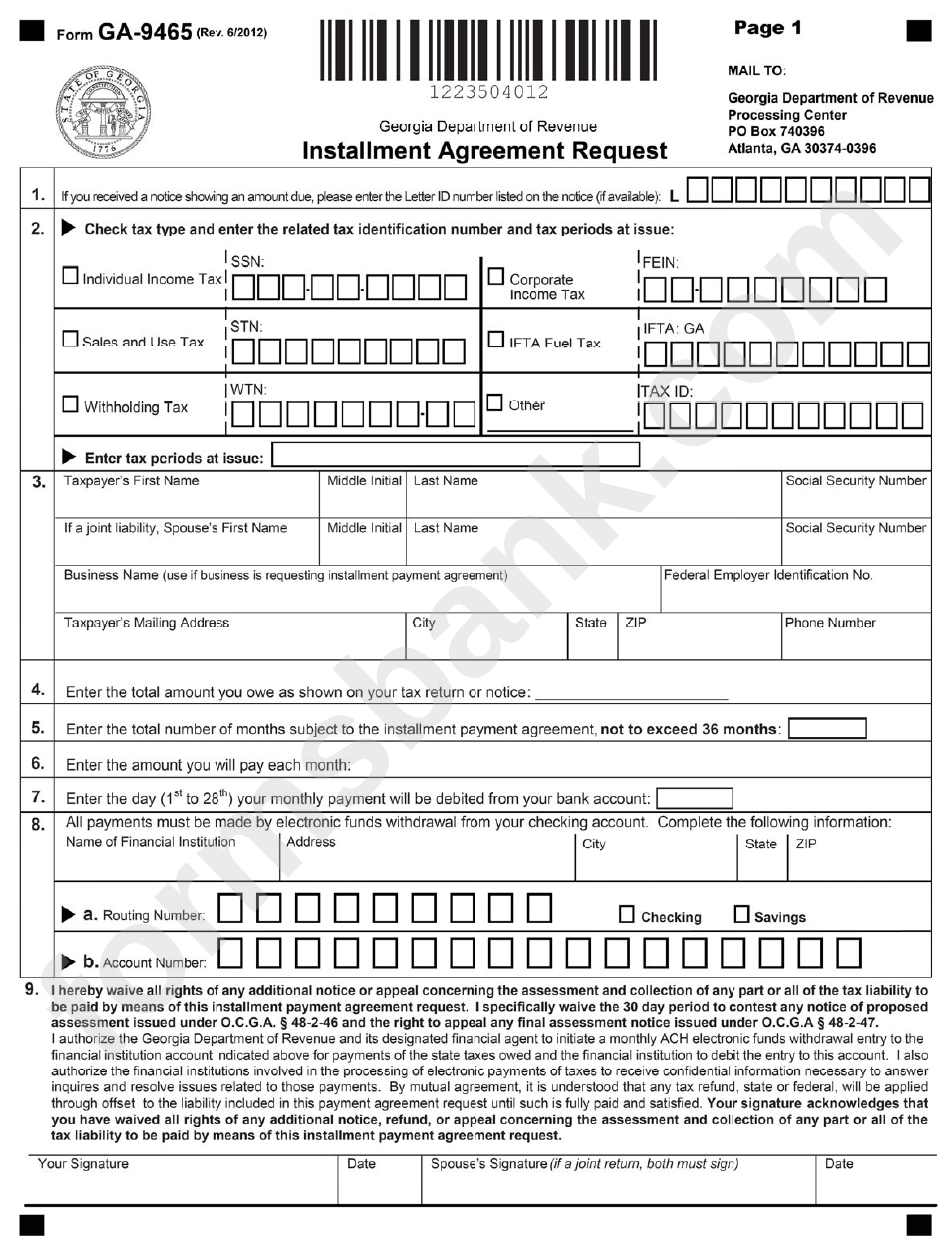

Form Ga9465 Installment Agreement Request printable pdf download

Web how to request an installment agreement using form 9465 in proconnect. Web if you can’t or choose not to use the online system, you can complete the paper irs form 9465, installment agreement request, and submit it with all required documents to the address listed in the instructions. Employee's withholding certificate form 941; Use form 9465 to request a.

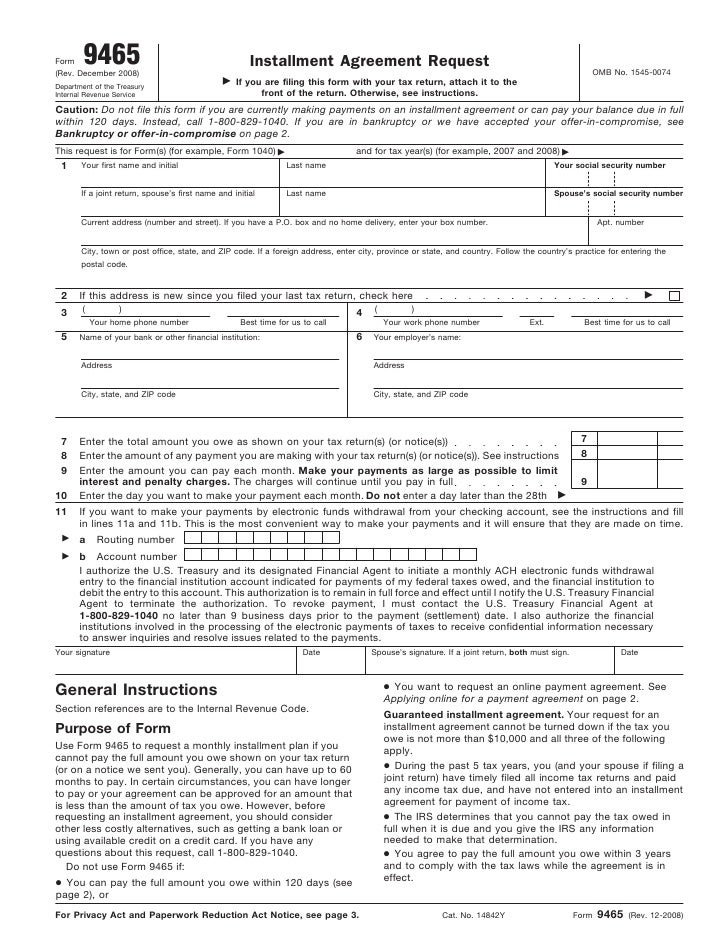

Form 9465FS Installment Agreement Request (2011) Free Download

Web form 9465 is used by taxpayers to request a monthly installment plan if they cannot pay the full amount of tax they owe. If the taxpayer can't pay the total tax currently due but would like to pay the tax due through form 9465, installment agreement request, use the steps below to request an installment agreement in intuit proconnect..

Form 9465Installment Agreement Request

Taxpayers who can't pay their tax obligation can file form 9465 to set up a monthly installment payment plan if they meet certain conditions. For a routine installment agreement, you also need to submit another form: Most installment agreements meet our streamlined installment agreement criteria. If you are filing this form with your tax return, attach it to the front.

Irs Installment Agreement Form 9465 Instructions Erin Anderson's Template

For a routine installment agreement, you also need to submit another form: Web use form 9465 to request a monthly installment plan if you cannot pay the full amount you owe shown on your tax return (or on a notice we sent you). Web how to request an installment agreement using form 9465 in proconnect. Web use form 9465 to.

Fillable Form 9465 Installment Agreement Request printable pdf download

Web how to request an installment agreement using form 9465 in proconnect. Use form 9465 to request a monthly installment plan if you cannot pay the full amount you owe shown on your tax return (or on a notice we sent you). Web if your new monthly payment amount does not meet the requirements, you will be prompted to revise.

Form RI9465 Download Printable PDF or Fill Online Installment

Web how to request an installment agreement using form 9465 in proconnect. Employers engaged in a trade or business who pay compensation form 9465; Taxpayers who can't pay their tax obligation can file form 9465 to set up a monthly installment payment plan if they meet certain conditions. Use form 9465 to request a monthly installment plan if you cannot.

Form 9465FS Installment Agreement Request (2011) Free Download

In certain circumstances, you can have longer to pay or your agreement can be approved for an amount that is less than the amount of tax you owe. Web how to request an installment agreement using form 9465 in proconnect. If you are filing this form with your tax return, attach it to the front of the return. Web use.

Web If Your New Monthly Payment Amount Does Not Meet The Requirements, You Will Be Prompted To Revise The Payment Amount.

September 2020) installment agreement request department of the treasury internal revenue service go to www.irs.gov/form9465 for instructions and the latest information. Web use form 9465 to request a monthly installment agreement (payment plan) if you can’t pay the full amount you owe shown on your tax return (or on a notice we sent you). If the taxpayer can't pay the total tax currently due but would like to pay the tax due through form 9465, installment agreement request, use the steps below to request an installment agreement in intuit proconnect. Employers engaged in a trade or business who pay compensation form 9465;

Taxpayers Who Can't Pay Their Tax Obligation Can File Form 9465 To Set Up A Monthly Installment Payment Plan If They Meet Certain Conditions.

Web use form 9465 to request a monthly installment plan if you cannot pay the full amount you owe shown on your tax return (or on a notice we sent you). Employee's withholding certificate form 941; In certain circumstances, you can have longer to pay or your agreement can be approved for an amount that is less than the amount of tax you owe. If you are filing this form with your tax return, attach it to the front of the.

Web How To Request An Installment Agreement Using Form 9465 In Proconnect.

Use form 9465 to request a monthly installment plan if you cannot pay the full amount you owe shown on your tax return (or on a notice we sent you). Most installment agreements meet our streamlined installment agreement criteria. For a routine installment agreement, you also need to submit another form: Web if you can’t or choose not to use the online system, you can complete the paper irs form 9465, installment agreement request, and submit it with all required documents to the address listed in the instructions.

If You Are Filing This Form With Your Tax Return, Attach It To The Front Of The Return.

Generally, you can have up to 60 months to pay. Web who can file form 9465: Web form 9465 is used by taxpayers to request a monthly installment plan if they cannot pay the full amount of tax they owe.