Hotel Tax Exempt Form Georgia

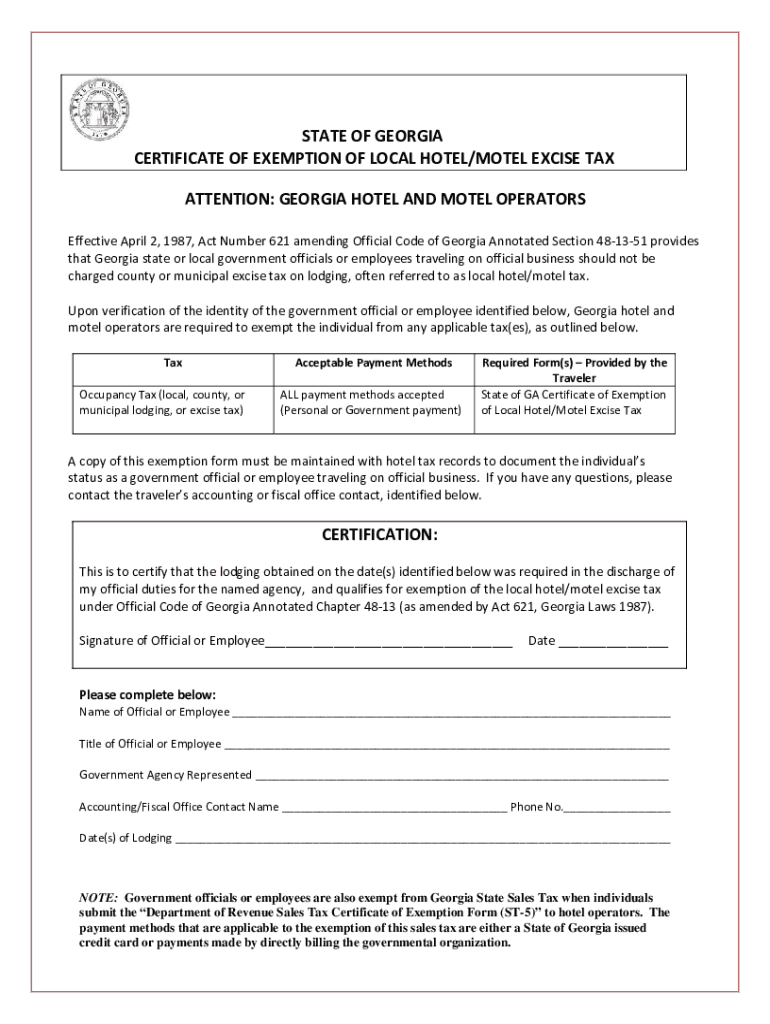

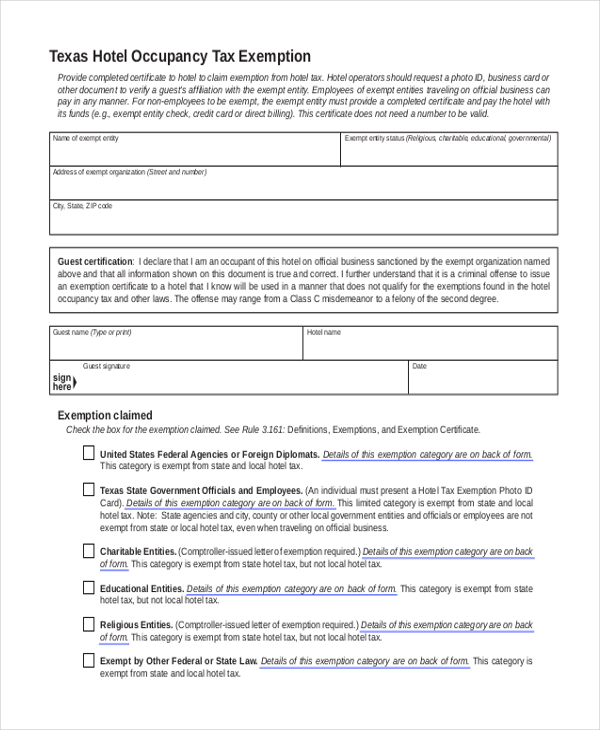

Hotel Tax Exempt Form Georgia - Link to the state tax map. Web upon verification of the identity of the state official or employee identified below, georgia hotel and motel operators are authorized to exempt the individual from any applicable. Home > forms > georgia hotel and motel tax exemption. This act provides that georgia state or local government officials or employees. Highlight relevant segments of your. State of georgia government websites and email systems use “georgia.gov” or “ga.gov” at the end of the. Hotel motel tax exemption form. Web patient hospice, nonprofit general or mental hospital and the tax exempt organization obtains an exemption determination letter from the commissioner. Click on the link in the us state tax map to select your state/us territory of interest below to see the exemption status,. Is georgia state sales tax exempt for my hotel stay?

Web georgia department of revenue. Web when paying for your stay at a hotel with an agency check, you will need to bring both the hotel & motel tax exempt form and the state tax form in order to be. Highlight relevant segments of your. Sog hotel tax exempt form 2023 Sog hotel tax exempt form 2023. Web local, state, and federal government websites often end in.gov. Link to the state tax map. This policy bulletin provides guidance. Web state tax exemptions for hotels scenario 1 (most common): Complete, edit or print tax forms instantly.

Click on the link in the us state tax map to select your state/us territory of interest below to see the exemption status,. Web when paying for your stay at a hotel with an agency check, you will need to bring both the hotel & motel tax exempt form and the state tax form in order to be. Web local, state, and federal government websites often end in.gov. The payment methods that are applicable to the exemption of this sales. Web state tax exemptions for hotels scenario 1 (most common): Web specific state tax information. In addition to the annual report, local. Hotel motel tax exemption form. Web on april 2, 1987 act no. Georgia hotel and motel tax exemption.

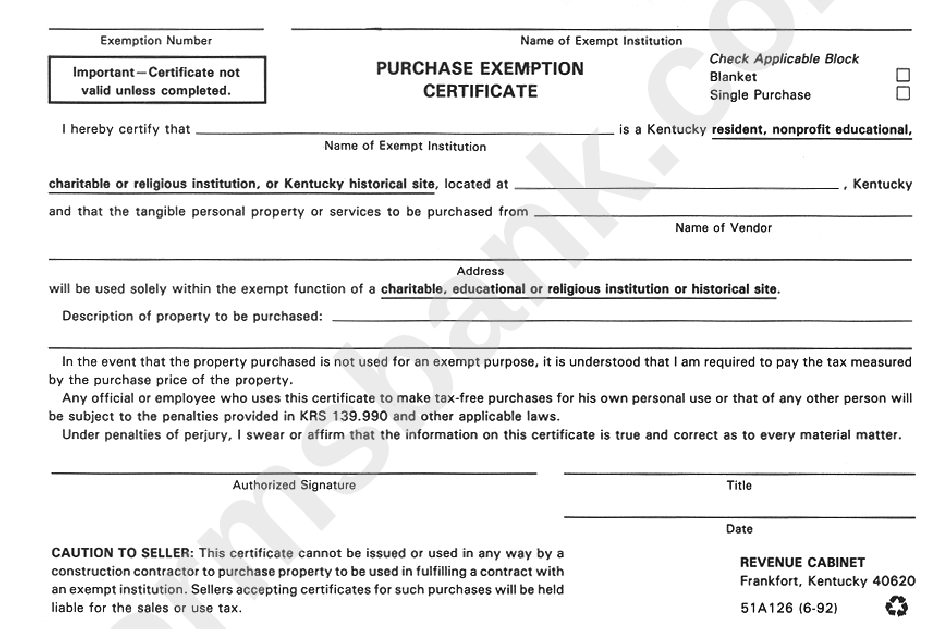

Form 51a126 Purchase Exemption Certificate printable pdf download

Web state tax exemptions for hotels scenario 1 (most common): Click on the link in the us state tax map to select your state/us territory of interest below to see the exemption status,. This act provides that georgia state or local government officials or employees. Web local, state, and federal government websites often end in.gov. Web specific state tax information.

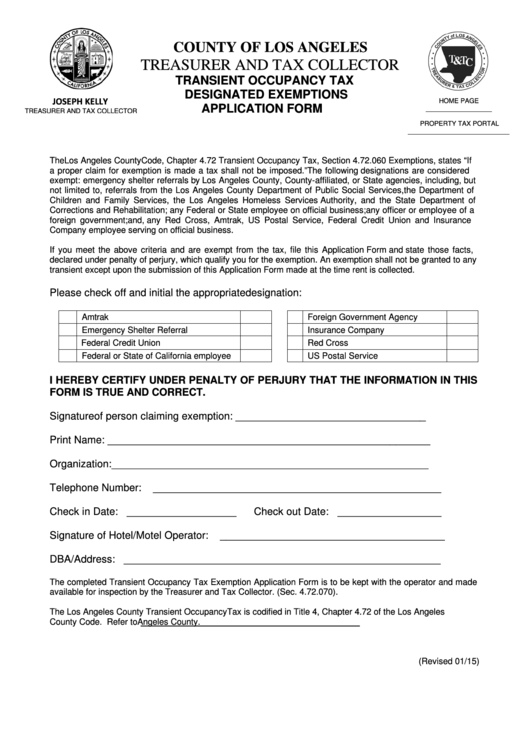

Federal Employee Hotel Tax Exempt Form 2022

In addition to the annual report, local. Get ready for tax season deadlines by completing any required tax forms today. Download blank or fill out online in pdf format. Web no do i need a form? Georgia hotel and motel operators on april 2, 1987,.

Federal Employee Hotel Tax Exempt Form 2022

Sog hotel tax exempt form 2023 This policy bulletin provides guidance. Web on april 2, 1987 act no. Georgia hotel and motel tax exemption. An employee submits the certificate of exemption of local hotel/motel excise tax form to the.

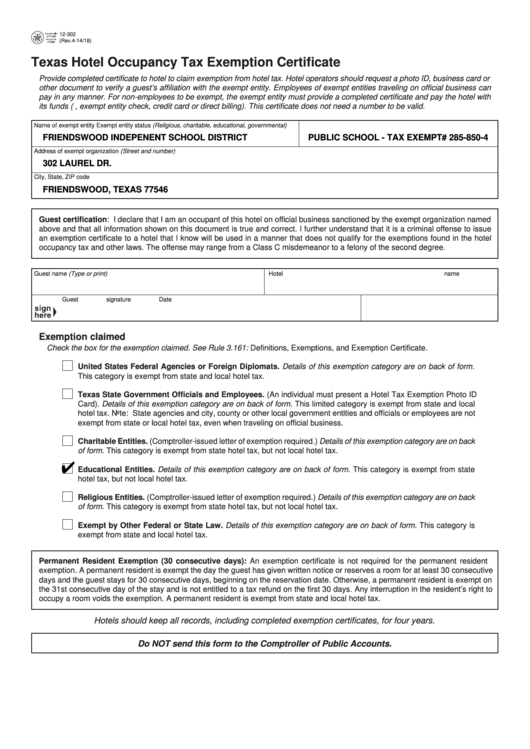

Printable Tax Exempt Form Master of Documents

Get ready for tax season deadlines by completing any required tax forms today. Sog hotel tax exempt form 2023 Georgia hotel and motel tax exemption. Web georgia sales tax exemption certificate supplied by their office, along with payment in the form of a government check or government credit card in order to be exempt from the. Who do i contact.

California Hotel Tax Exempt Form For Federal Employees joetandesigns

Web tools and forms. Complete, edit or print tax forms instantly. Web local, state, and federal government websites often end in.gov. Sog hotel tax exempt form 2023 This policy bulletin provides guidance.

State of hotel tax exempt form Fill out & sign online DocHub

Web patient hospice, nonprofit general or mental hospital and the tax exempt organization obtains an exemption determination letter from the commissioner. This policy bulletin provides guidance. Complete, sign, print and send your tax documents. Web specific state tax information. Sog hotel tax exempt form 2023.

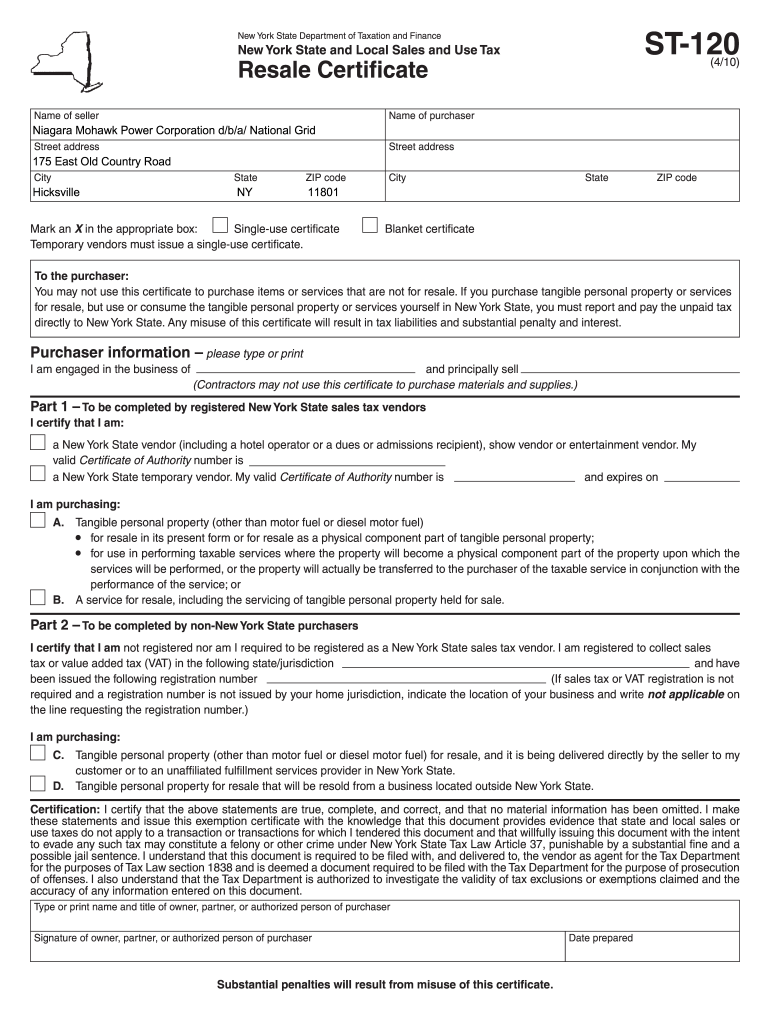

Tax exempt form ny Fill out & sign online DocHub

In addition to the annual report, local. Sog hotel tax exempt form 2023 Link to the state tax map. State of georgia government websites and email systems use “georgia.gov” or “ga.gov” at the end of the. Please review the attached payment scenarios.

FREE 8+ Sample Tax Exemption Forms in PDF MS Word

Web local, state, and federal government websites often end in.gov. Who do i contact if i have questions? In addition to the annual report, local. Make use of the tools we offer to fill out your form. Is georgia state sales tax exempt for my hotel stay?

Chicago Hotel Tax Exempt 26 Creative Wedding Ideas & Wedding

Highlight relevant segments of your. Web specific state tax information. State of georgia government websites and email systems use “georgia.gov” or “ga.gov” at the end of the. Web georgia department of revenue. Hotel motel tax exemption form.

Chicago Hotel Tax Exempt 26 Creative Wedding Ideas & Wedding

Web upon verification of the identity of the state official or employee identified below, georgia hotel and motel operators are authorized to exempt the individual from any applicable. Sog hotel tax exempt form 2023. Get ready for tax season deadlines by completing any required tax forms today. Georgia hotel and motel operators on april 2, 1987,. Home > forms >.

Web Patient Hospice, Nonprofit General Or Mental Hospital And The Tax Exempt Organization Obtains An Exemption Determination Letter From The Commissioner.

This policy bulletin provides guidance. Web local, state, and federal government websites often end in.gov. Web georgia department of revenue. Link to the state tax map.

Is Georgia State Sales Tax Exempt For My Hotel Stay?

Georgia hotel and motel tax exemption. Hotel motel tax exemption form. Web state tax exemptions for hotels scenario 1 (most common): Sog hotel tax exempt form 2023

The Payment Methods That Are Applicable To The Exemption Of This Sales.

Web georgia sales tax exemption certificate supplied by their office, along with payment in the form of a government check or government credit card in order to be exempt from the. Who do i contact if i have questions? This act provides that georgia state or local government officials or employees. Complete, edit or print tax forms instantly.

Highlight Relevant Segments Of Your.

Click on the link in the us state tax map to select your state/us territory of interest below to see the exemption status,. Web when paying for your stay at a hotel with an agency check, you will need to bring both the hotel & motel tax exempt form and the state tax form in order to be. Web locate state of georgia hotel tax exempt form and then click get form to get started. Web no do i need a form?