How To File Form 1040Nr

How To File Form 1040Nr - Complete, edit or print tax forms instantly. Web you're a us citizen you're a resident of the us or puerto rico you have a permanent resident card (green card) 2022 days + (2021 days)/3 + (2020 days)/6. Web per irs instructions, form 1040x is used to amend form 1040nr. Enter your name, current address, and social security number (ssn) or individual taxpayer. Individual income tax return, is filled in as you work on your return in your efile account, thus you do not need to manually fill in this form or have. Nonresident alien income tax return can be filed electronically using ultratax cs. Start basic federal filing for free. File your federal taxes for free, no matter how complex your return is. Click on miscellaneous forms on. Web the 1040nr can only be generated in an individual (1040) return.

Web the 1040nr can only be generated in an individual (1040) return. 1a b enter the smaller of line 1a or $10,000 ($5,000 if you checked. Complete, edit or print tax forms instantly. Extensions for form 1040nr can also be filed electronically. Web file form 1040x to change a return you already filed. File your federal taxes for free, no matter how complex your return is. Individual income tax return, is filled in as you work on your return in your efile account, thus you do not need to manually fill in this form or have. Resident return), you must report, and are subject to taxation on your worldwide income. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Ad over 90 million taxes filed with taxact.

Complete, edit or print tax forms instantly. File your federal taxes for free, no matter how complex your return is. Web you must file form 1040, u.s. Individual income tax return, is filled in as you work on your return in your efile account, thus you do not need to manually fill in this form or have. Web filing requirements resident or nonresident alien when and where should you file? Get ready for tax season deadlines by completing any required tax forms today. Start basic federal filing for free. Click on miscellaneous forms on. Web you're a us citizen you're a resident of the us or puerto rico you have a permanent resident card (green card) 2022 days + (2021 days)/3 + (2020 days)/6. Ad over 90 million taxes filed with taxact.

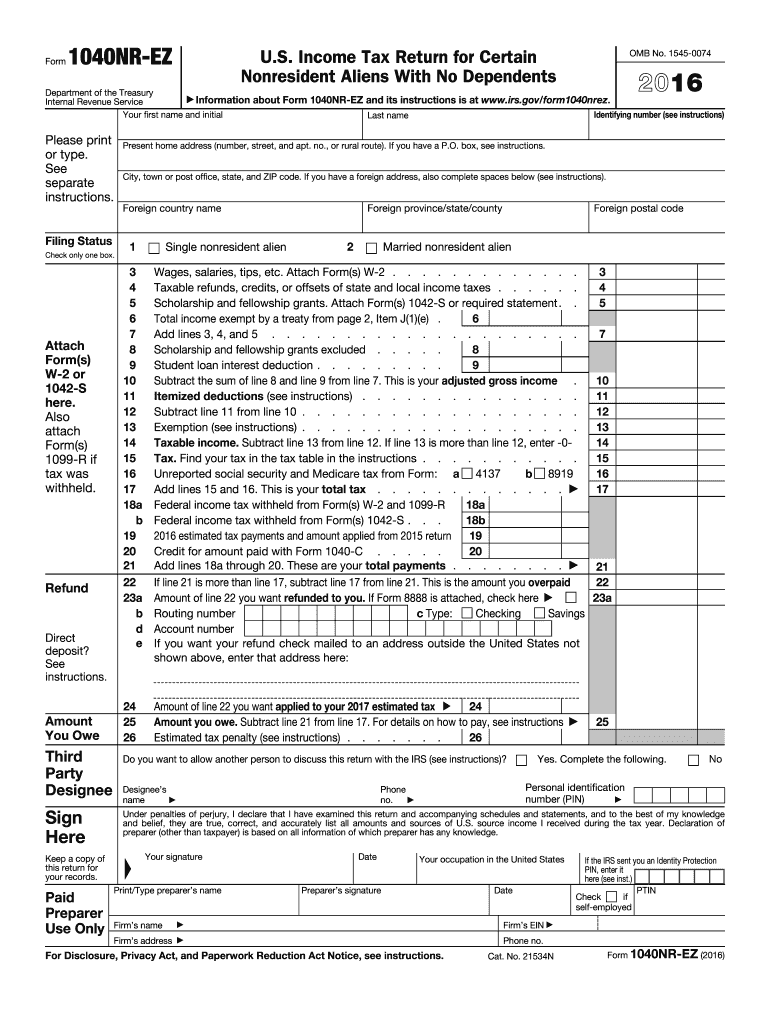

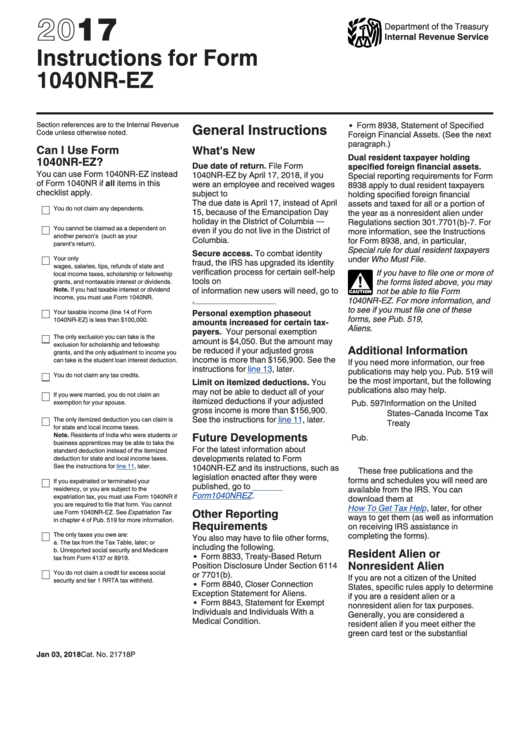

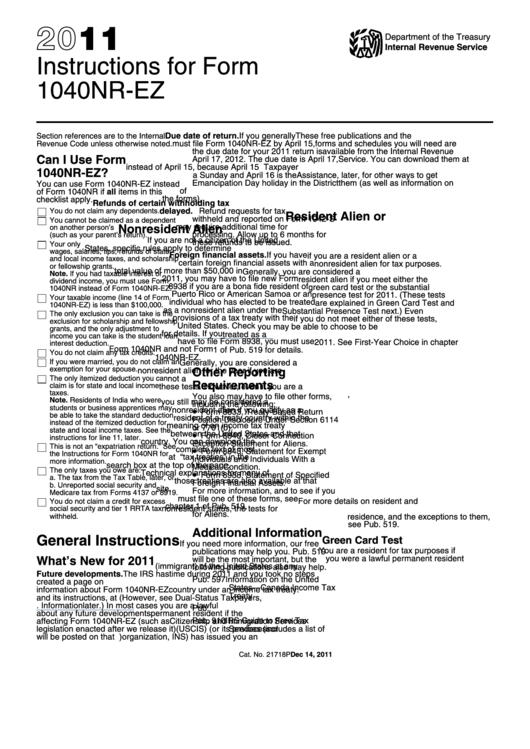

Instructions For Form 1040nrEz U.s. Tax Return For Certain

Get ready for tax season deadlines by completing any required tax forms today. Web the irs form 1040, u.s. Web filing requirements resident or nonresident alien when and where should you file? Web you must file form 1040, u.s. Follow these steps to generate form 1040nr:

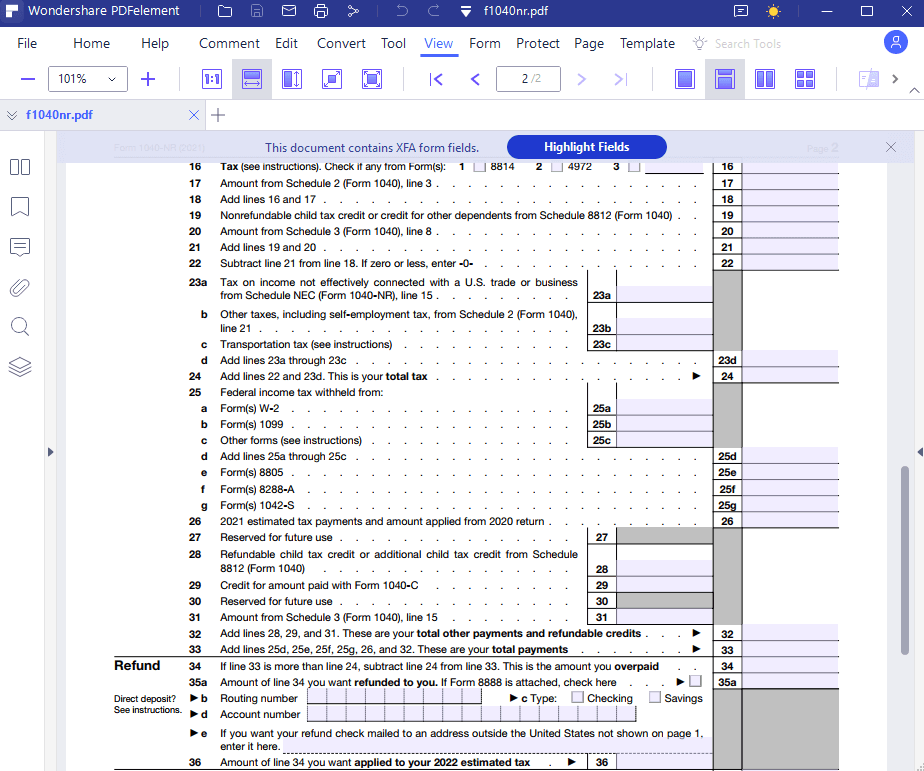

1040 vs 1040NR vs 1040NREZ Which Form to File? [2023]

Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Web the 1040nr can only be generated in an individual (1040) return. Were a nonresident alien engaged in a trade or business in the united states. Get ready for tax season deadlines.

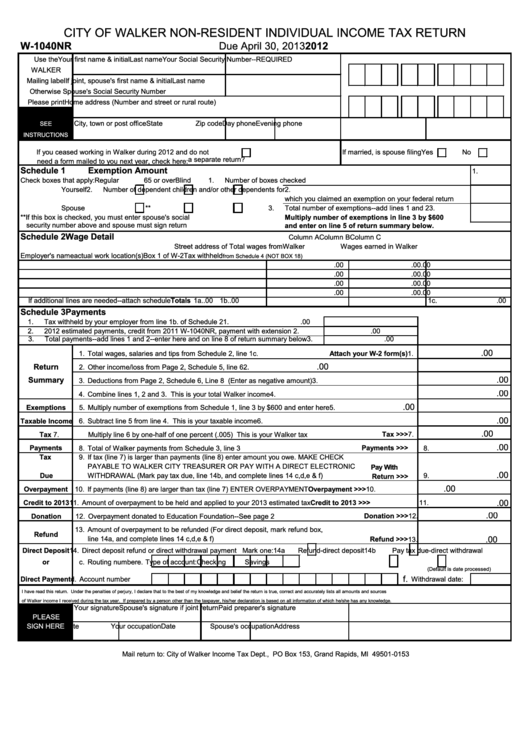

Fillable Form W1040nr City Of Walker NonResident Individual

Web per irs instructions, form 1040x is used to amend form 1040nr. Resident during the year and who is a resident of the u.s. File your federal taxes for free, no matter how complex your return is. Ad over 90 million taxes filed with taxact. Web the irs form 1040, u.s.

1040Nr Ez Fill Out and Sign Printable PDF Template signNow

Single, married filing separately (mfs), or qualifying surviving spouse. Ad over 90 million taxes filed with taxact. Also, use form 1040x if you filed form 1040nr and you should have filed form 1040, or vice versa. Web the 1040nr can only be generated in an individual (1040) return. Get ready for tax season deadlines by completing any required tax forms.

1040NR Tax return preparation by YouTube

Filing your taxes just became easier. Web you're a us citizen you're a resident of the us or puerto rico you have a permanent resident card (green card) 2022 days + (2021 days)/3 + (2020 days)/6. Represented a deceased person who would have. Single, married filing separately (mfs), or qualifying surviving spouse. File your federal taxes for free, no matter.

Us tax form 1040nr instructions

The due date for irs tax returns is april 15 and the last. Also, use form 1040x if you filed form 1040nr and you should have filed form 1040, or vice versa. Go to the input return tab. Start basic federal filing for free. Nonresident alien income tax return only if you have income that is subject to tax, such.

Fillable Form 1040nr Form Resume Examples 3nOlvQRDa0

Go to the input return tab. Individual income tax return, is filled in as you work on your return in your efile account, thus you do not need to manually fill in this form or have. Ad over 90 million taxes filed with taxact. Get ready for tax season deadlines by completing any required tax forms today. Single, married filing.

Form 1040nr Edit, Fill, Sign Online Handypdf

Web filing requirements resident or nonresident alien when and where should you file? Web per irs instructions, form 1040x is used to amend form 1040nr. Single, married filing separately (mfs), or qualifying surviving spouse. Go to the input return tab. Complete, edit or print tax forms instantly.

Instructions For Form 1040nrEz U.s. Tax Return For Certain

Follow these steps to generate form 1040nr: Represented a deceased person who would have. Web per irs instructions, form 1040x is used to amend form 1040nr. Resident during the year and who is a resident of the u.s. File your federal taxes for free, no matter how complex your return is.

IRS Form 1040NR Read the Filling Instructions Before Filing it

Single, married filing separately (mfs), or qualifying surviving spouse. 1a b enter the smaller of line 1a or $10,000 ($5,000 if you checked. Follow these steps to generate form 1040nr: Web per irs instructions, form 1040x is used to amend form 1040nr. The due date for irs tax returns is april 15 and the last.

Go To The Input Return Tab.

Follow these steps to generate form 1040nr: Nonresident alien income tax return can be filed electronically using ultratax cs. Resident during the year and who is a resident of the u.s. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due.

Individual Income Tax Return, Is Filled In As You Work On Your Return In Your Efile Account, Thus You Do Not Need To Manually Fill In This Form Or Have.

Get ready for tax season deadlines by completing any required tax forms today. Filing your taxes just became easier. Ad access irs tax forms. Click on miscellaneous forms on.

Web File Form 1040X To Change A Return You Already Filed.

Web filing requirements resident or nonresident alien when and where should you file? Ad over 90 million taxes filed with taxact. Complete, edit or print tax forms instantly. Enter your name, current address, and social security number (ssn) or individual taxpayer.

Represented A Deceased Person Who Would Have.

Nonresident alien income tax return only if you have income that is subject to tax, such as wages, tips, scholarship and. Web the 1040nr can only be generated in an individual (1040) return. Start basic federal filing for free. Were a nonresident alien engaged in a trade or business in the united states.

![1040 vs 1040NR vs 1040NREZ Which Form to File? [2023]](https://blog.sprintax.com/wp-content/uploads/2021/04/1040NR-2021.jpg)