Ky Form 740

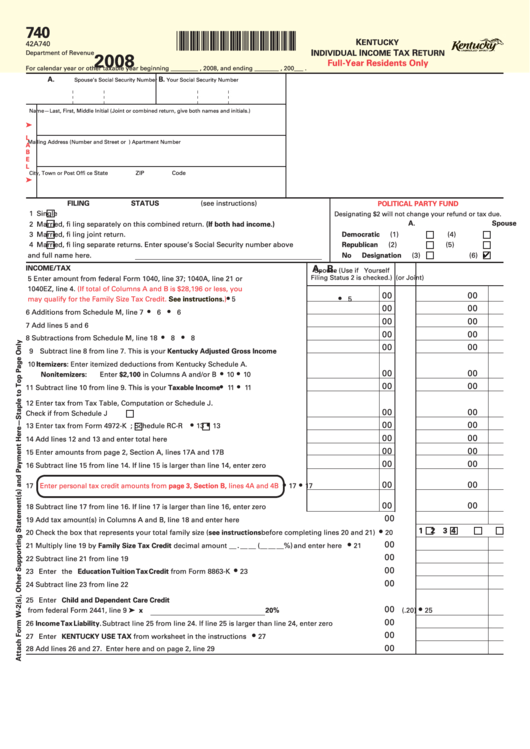

Ky Form 740 - Users can file the current year tax return, as well as tax years 2020 and 2019. The kentucky department of revenue conducts work under the authority of the finance and administration cabinet. Web commonwealth of kentucky petitioner vs. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Web download the taxpayer bill of rights. Copy of 1040x, if applicable.) check if deceased: • moved into or out of kentucky during the. Amended (enclose copy of 1040x, if applicable.) check if deceased: Web form 740, line 9, is more than $100,000 ($50,000 if married filing separately on combined return or separate return), your deduction is limited and you must use the worksheet.

Refund checks are available through ky. Web attached files should not be password protected or encrypted. Complete, edit or print tax forms instantly. • moved into or out of kentucky during the. The kentucky department of revenue conducts work under the authority of the finance and administration cabinet. Web 740 2020 commonwealth of kentucky department of revenue form check if applicable: You can download or print current or. Commonwealth of kentucky court of justice. • had income from kentucky sources. This pdf packet includes form 740, supplemental schedules, and tax instructions combined in one.

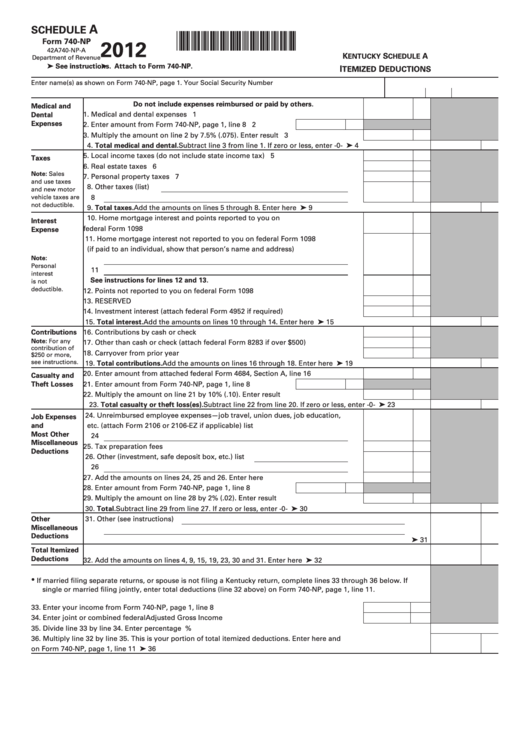

Ky file users should familiarize themselves with kentucky forms by reading the instructions. You can download or print. Web attached files should not be password protected or encrypted. Complete, edit or print tax forms instantly. • moved into or out of kentucky during the. Web download the taxpayer bill of rights. Web commonwealth of kentucky petitioner vs. Get ready for tax season deadlines by completing any required tax forms today. Commonwealth of kentucky court of justice. Web we last updated the kentucky itemized deductions in february 2023, so this is the latest version of schedule a (740), fully updated for tax year 2022.

Fillable Form 740 Kentucky Individual Tax Return FullYear

• moved into or out of kentucky during the. Web download the taxpayer bill of rights. This pdf packet includes form 740, supplemental schedules, and tax instructions combined in one. 740 42a740 department of revenue *1600010001* for calendar year or other taxable year beginning ,. Users can file the current year tax return, as well as tax years 2020 and.

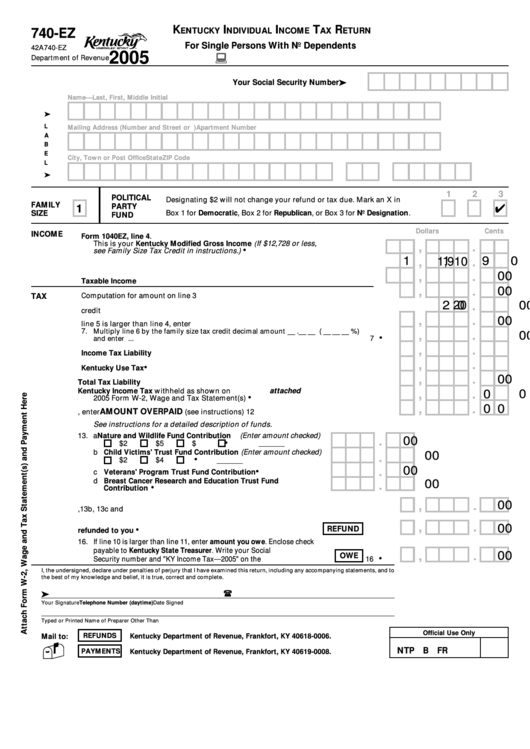

Fillable Form 740Ez Kentucky Individual Tax Return 2005

Web attached files should not be password protected or encrypted. 740 42a740 department of revenue *1600010001* for calendar year or other taxable year beginning ,. Web 2016 kentucky form 740. • moved into or out of kentucky during the. Commonwealth of kentucky court of justice.

740V Kentucky Department Of Revenue Revenue Ky Fill and Sign

Web attached files should not be password protected or encrypted. Web 740 2020 commonwealth of kentucky department of revenue form check if applicable: Ky file users should familiarize themselves with kentucky forms by reading the instructions. Commonwealth of kentucky court of justice. Web form 740 is the kentucky income tax return for use by all taxpayers.

Fillable Form 740Np Kentucky Schedule A Itemized Deductions 2012

You can download or print current or. Web form 740 is the kentucky income tax return for use by all taxpayers. Web commonwealth of kentucky petitioner vs. Web 2016 kentucky form 740. You can download or print.

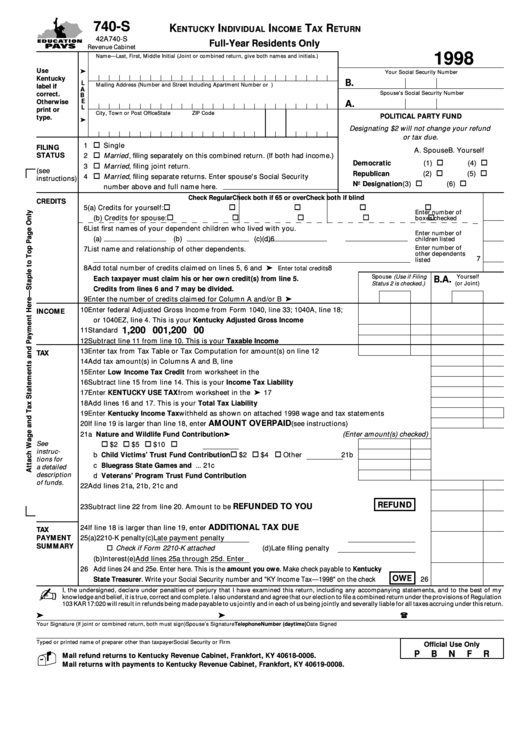

Fillable Form 740S Kentucky Individual Tax Return FullYear

Web form 740, line 9, is more than $100,000 ($50,000 if married filing separately on combined return or separate return), your deduction is limited and you must use the worksheet. The kentucky department of revenue conducts work under the authority of the finance and administration cabinet. Copy of 1040x, if applicable.) check if deceased: Get ready for tax season deadlines.

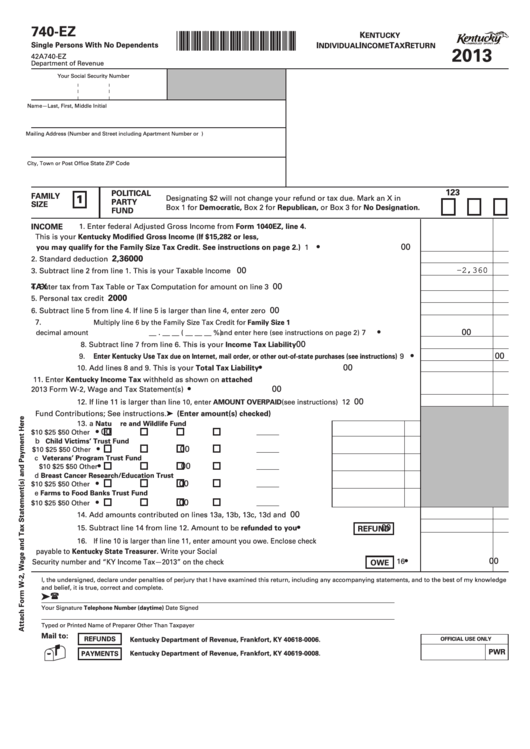

Fillable Form 740Ez Kentucky Individual Tax Return 2013

Complete, edit or print tax forms instantly. Commonwealth of kentucky court of justice. Web form 740, line 9, is more than $100,000 ($50,000 if married filing separately on combined return or separate return), your deduction is limited and you must use the worksheet. Web download the taxpayer bill of rights. Web form 740 is the kentucky income tax return for.

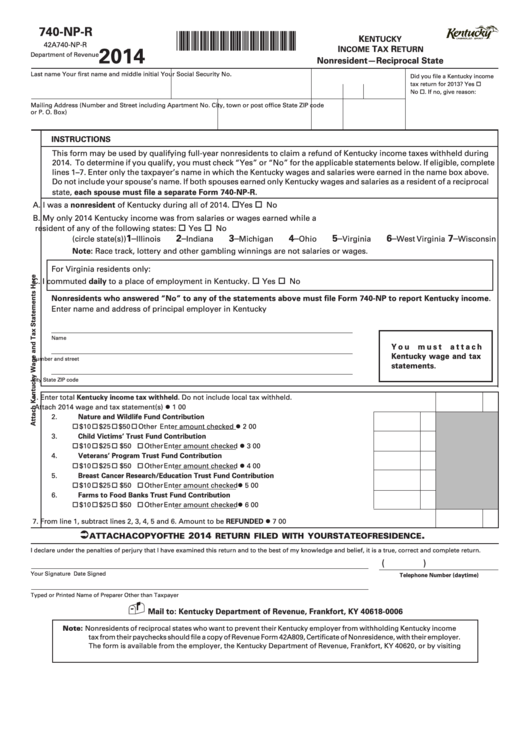

Fillable Form 740NpR NonresidentReciprocal State Kentucky

Web we last updated the kentucky itemized deductions in february 2023, so this is the latest version of schedule a (740), fully updated for tax year 2022. Web attached files should not be password protected or encrypted. Web commonwealth of kentucky petitioner vs. Web form 740 is the kentucky income tax return for use by all taxpayers. Web download the.

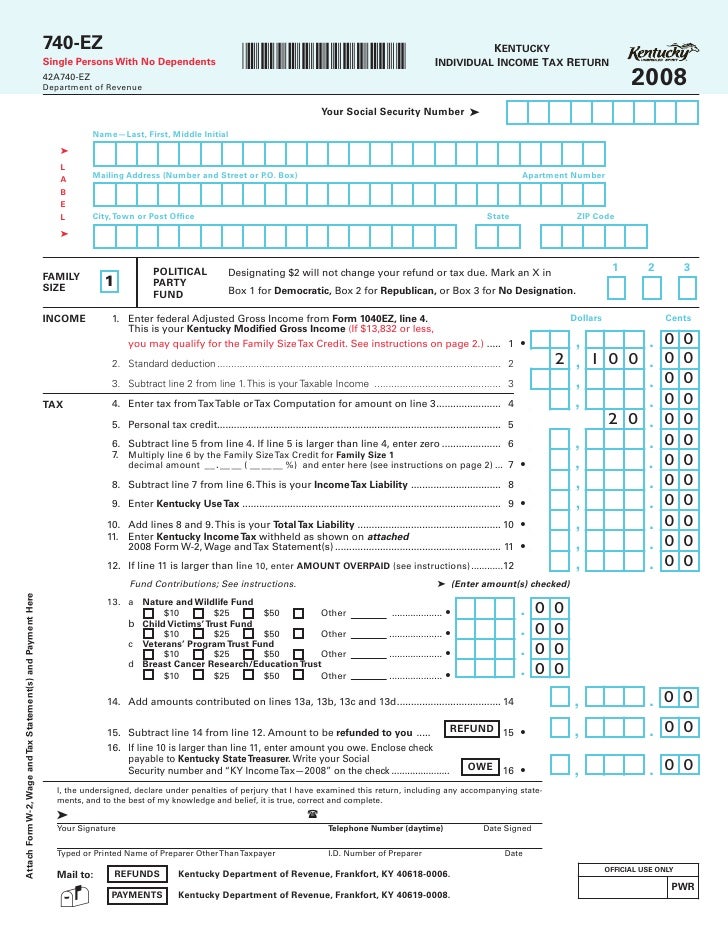

740EZ 2008 Kentucky Individual Tax Return Form 42A740EZ

• moved into or out of kentucky during the. Refund checks are available through ky. Web we last updated the kentucky itemized deductions in february 2023, so this is the latest version of schedule a (740), fully updated for tax year 2022. This pdf packet includes form 740, supplemental schedules, and tax instructions combined in one. Commonwealth of kentucky court.

Ky Forms 740 Es For 2019 justgoing 2020

Copy of 1040x, if applicable.) check if deceased: Complete, edit or print tax forms instantly. Web download the taxpayer bill of rights. Web you are required to complete form 740, schedule p if you meet this criteria and your pension exceeds $31,110. Commonwealth of kentucky court of justice.

740EZ 2008 Kentucky Individual Tax Return Form 42A740EZ

You can download or print. Web 740 2020 commonwealth of kentucky department of revenue form check if applicable: Web we last updated the form 740 individual full year resident income tax instructions packet in february 2023, so this is the latest version of income tax instructions, fully updated. This pdf packet includes form 740, supplemental schedules, and tax instructions combined.

Web Commonwealth Of Kentucky Petitioner Vs.

Web form 740, line 9, is more than $100,000 ($50,000 if married filing separately on combined return or separate return), your deduction is limited and you must use the worksheet. Users can file the current year tax return, as well as tax years 2020 and 2019. Ky file users should familiarize themselves with kentucky forms by reading the instructions. Web attached files should not be password protected or encrypted.

Web You Are Required To Complete Form 740, Schedule P If You Meet This Criteria And Your Pension Exceeds $31,110.

Refund checks are available through ky. • moved into or out of kentucky during the. Commonwealth of kentucky court of justice. The kentucky department of revenue conducts work under the authority of the finance and administration cabinet.

Web We Last Updated The Form 740 Individual Full Year Resident Income Tax Instructions Packet In February 2023, So This Is The Latest Version Of Income Tax Instructions, Fully Updated.

Web form 740 is the kentucky income tax return for use by all taxpayers. Web download the taxpayer bill of rights. You can download or print. • had income from kentucky sources.

Copy Of 1040X, If Applicable.) Check If Deceased:

Web we last updated the kentucky itemized deductions in february 2023, so this is the latest version of schedule a (740), fully updated for tax year 2022. Am i allowed to deduct my health insurance premiums paid on. Complete, edit or print tax forms instantly. This pdf packet includes form 740, supplemental schedules, and tax instructions combined in one.