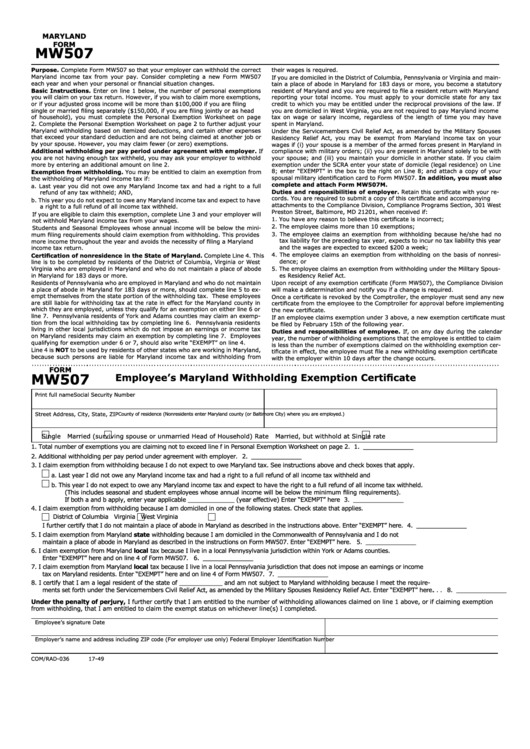

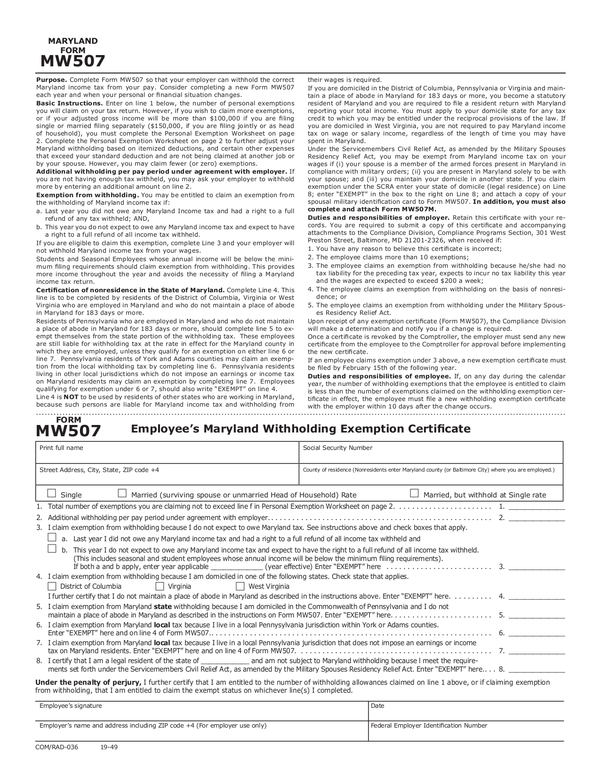

Maryland Form Mw507

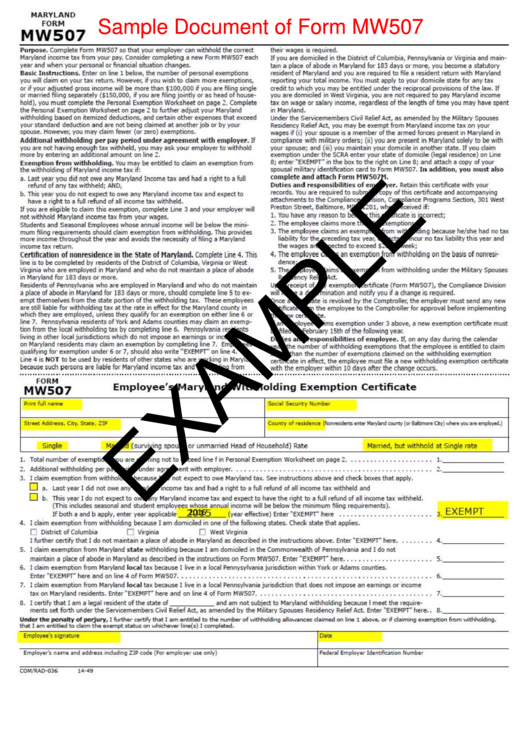

Maryland Form Mw507 - Consider completing a new form mw507 each year and when your personal or financial situation changes. Last year you did not owe any maryland income tax and had a right to a full refund of any tax withheld; Form used by recipients of annuity, sick pay or retirement distribution payments that choose to have maryland income tax withheld from each payment. Failure to fill out the form will result in an employer withholding taxes as if you were filing no deductions, causing you to pay more taxes than is necessary. For maryland state government employees only. Form used by individuals to direct their employer to withhold maryland income tax from their pay. If you are eligible to claim this exemption, your employer will not withhold maryland income tax from. Exemption from maryland withholding tax for a qualified civilian spouse of military: It is not enough that the employee is eligible for the exemption under the act. Employee's maryland withholding exemption certificate:

This exception applies only if you have these forms on file for the employee; Form used by recipients of annuity, sick pay or retirement distribution payments that choose to have maryland income tax withheld from each payment. We last updated the employee's maryland withholding exemption certificate in january 2023, so this is the latest version of mw507 , fully updated for tax year 2022. Form used by individuals to direct their employer to withhold maryland income tax from their pay. Form used by civilian spouse to direct their employer to discontinue maryland withholding. Failure to fill out the form will result in an employer withholding taxes as if you were filing no deductions, causing you to pay more taxes than is necessary. For maryland state government employees only. Employee's maryland withholding exemption certificate: If you are eligible to claim this exemption, your employer will not withhold maryland income tax from. Enter in item b of page 1, the whole dollar amount that you wish withheld from each annuity or sick pay payment.

This year you do not expect to owe any maryland income tax and expect to have a right to a full refund of all income tax withheld. Form used by recipients of annuity, sick pay or retirement distribution payments that choose to have maryland income tax withheld from each payment. Exemption from maryland withholding tax for a qualified civilian spouse of military: Enter in item b of page 1, the whole dollar amount that you wish withheld from each annuity or sick pay payment. Web mw507 requires you to list multiple forms of income, such as wages, interest, or alimony. If you are eligible to claim this exemption, your employer will not withhold maryland income tax from. Form used by individuals to direct their employer to withhold maryland income tax from their pay. It is not enough that the employee is eligible for the exemption under the act. Annuity and sick pay request for maryland income tax withholding: Last year you did not owe any maryland income tax and had a right to a full refund of any tax withheld;

How To Fill Out Mw507 Personal Exemptions Worksheet

We last updated the employee's maryland withholding exemption certificate in january 2023, so this is the latest version of mw507 , fully updated for tax year 2022. Failure to fill out the form will result in an employer withholding taxes as if you were filing no deductions, causing you to pay more taxes than is necessary. However, if you wish.

Fillable Form Mw507 Employee'S Maryland Withholding Exemption

Last year you did not owe any maryland income tax and had a right to a full refund of any tax withheld; Failure to fill out the form will result in an employer withholding taxes as if you were filing no deductions, causing you to pay more taxes than is necessary. The amount must not be less than $5 a.

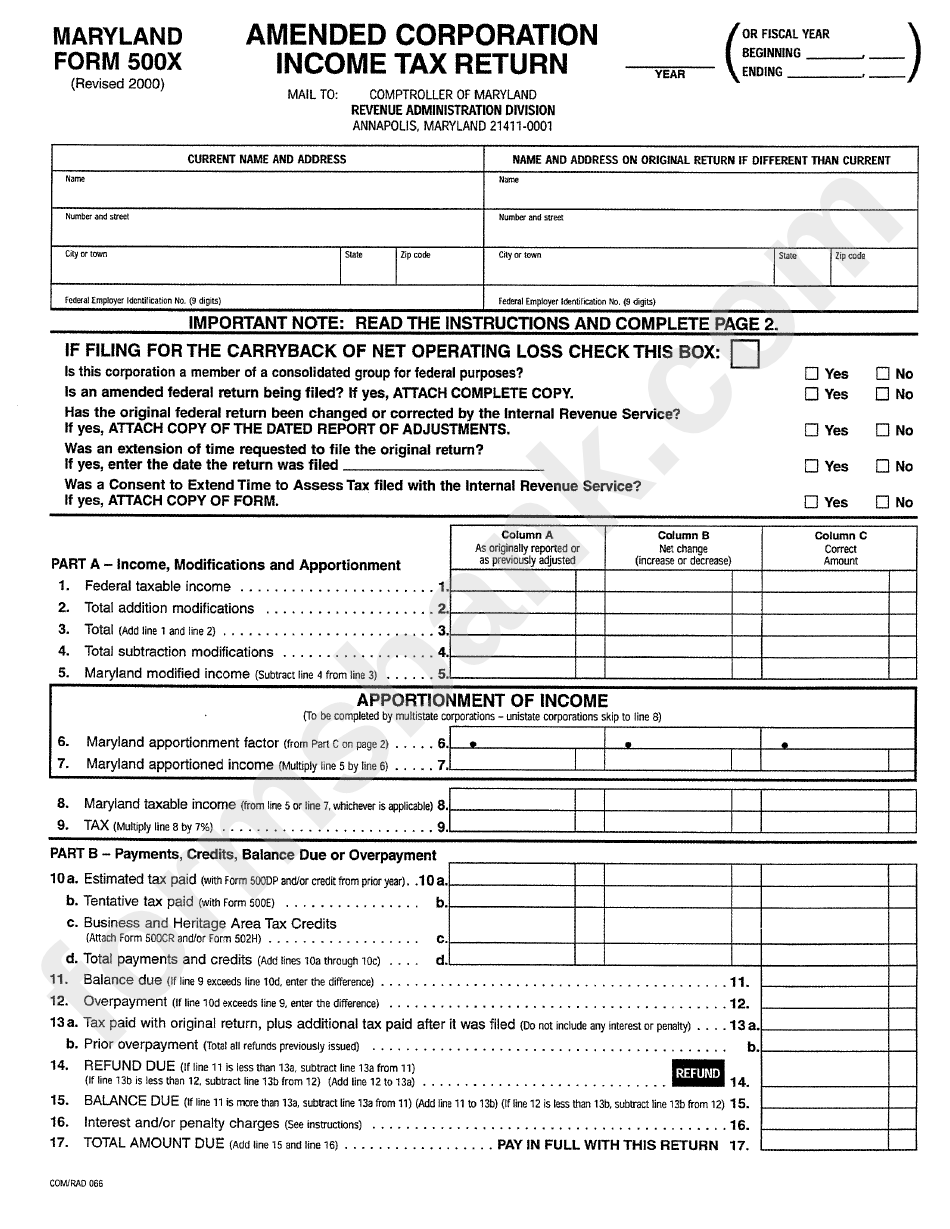

Maryland Form 500x Amended Corporation Tax Return 2000

Web a maryland form mw507 is a document used in maryland to ensure that the correct amount is withheld from an employee’s wages regarding state tax. Form used by civilian spouse to direct their employer to discontinue maryland withholding. What you must do if an employee gives you a completed form mw507m, do the Consider completing a new form mw507.

Fill Free fillable forms Comptroller of Maryland

It is not enough that the employee is eligible for the exemption under the act. The amount must not be less than $5 a month for annuities and retirement distributions and at least $2 per daily Web form used by individuals to direct their employer to withhold the correct amount of maryland income tax from their pay. If you are.

How To Fill Out Mw507 Personal Exemptions Worksheet

Last year you did not owe any maryland income tax and had a right to a full refund of any tax withheld; However, if you wish to claim. Consider completing a new form mw507 each year and when your personal or financial situation changes. Employee's maryland withholding exemption certificate: Enter on line 1 below, the number of personal exemptions you.

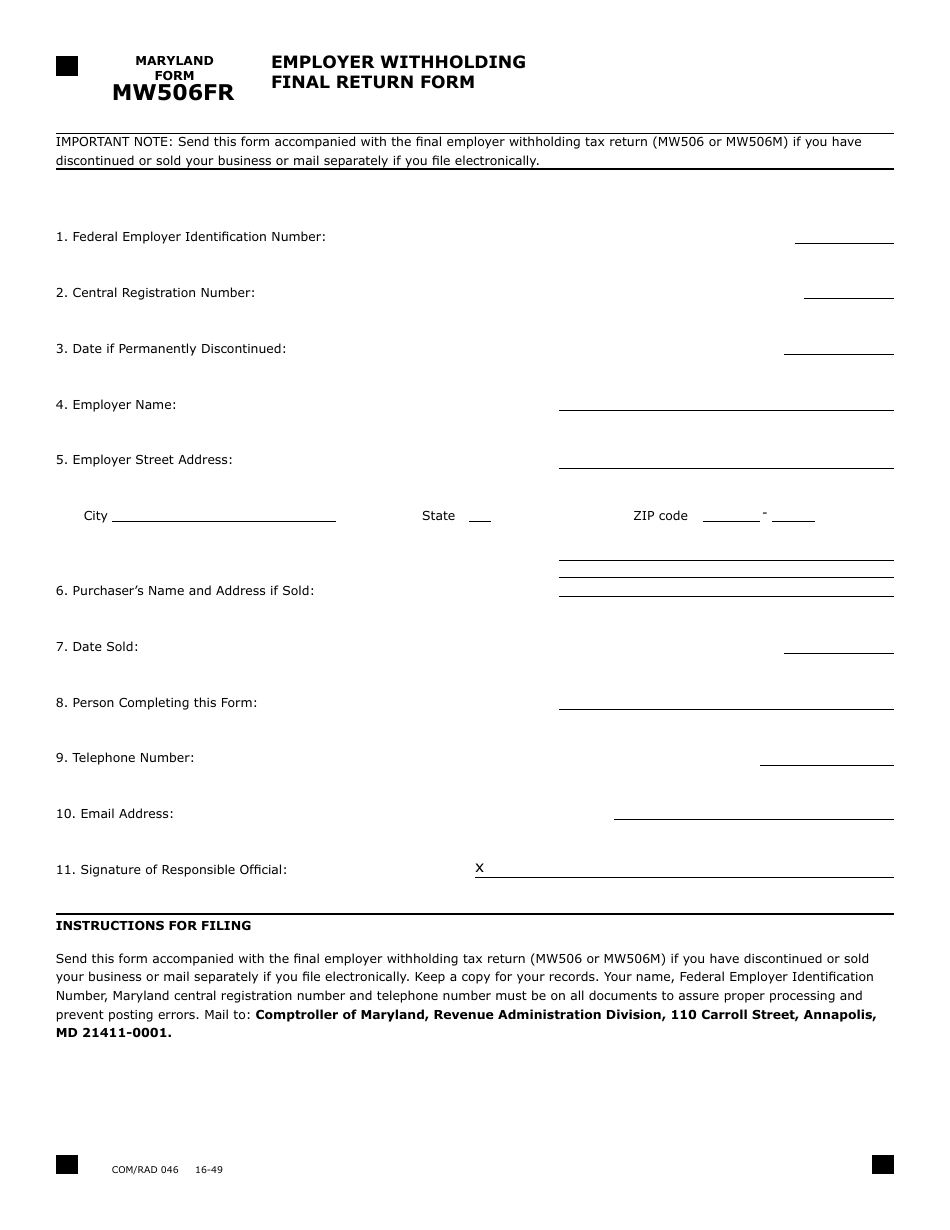

Form MW506FR Download Fillable PDF or Fill Online Employer Withholding

Form used by civilian spouse to direct their employer to discontinue maryland withholding. Web a maryland form mw507 is a document used in maryland to ensure that the correct amount is withheld from an employee’s wages regarding state tax. It is not enough that the employee is eligible for the exemption under the act. This exception applies only if you.

Maryland State Withholding Form Mw507 In Spanish

Form used by civilian spouse to direct their employer to discontinue maryland withholding. If you are eligible to claim this exemption, your employer will not withhold maryland income tax from. Consider completing a new form mw507 each year and when your personal or financial situation changes. Consider completing a new form mw507 each year and when your personal or financial.

Fill Free fillable forms Comptroller of Maryland

This year you do not expect to owe any maryland income tax and expect to have a right to a full refund of all income tax withheld. Failure to fill out the form will result in an employer withholding taxes as if you were filing no deductions, causing you to pay more taxes than is necessary. We last updated the.

Top 6 Mw507 Form Templates free to download in PDF format

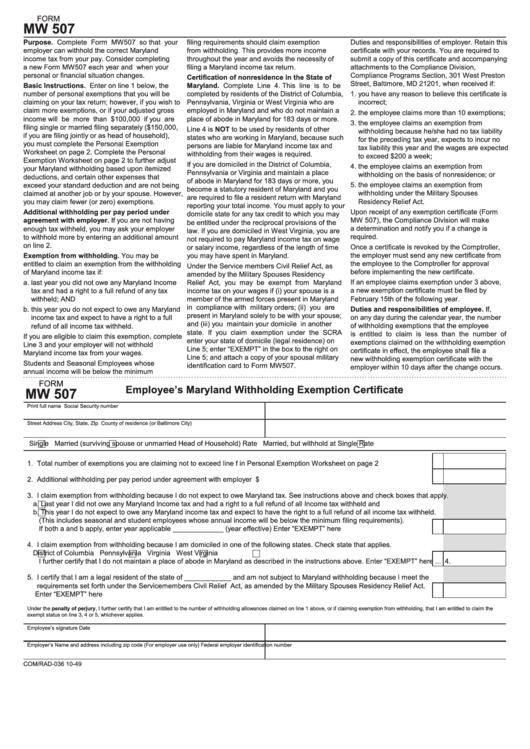

Web complete form mw507 so that your employer can withhold the correct maryland income tax from your pay. Employee's maryland withholding exemption certificate: This exception applies only if you have these forms on file for the employee; Form used by civilian spouse to direct their employer to discontinue maryland withholding. Complete form mw507 so that your employer can withhold the.

Mw507 Form Help amulette

If you are eligible to claim this exemption, your employer will not withhold maryland income tax from. This year you do not expect to owe any maryland income tax and expect to have a right to a full refund of all income tax withheld. Consider completing a new form mw507 each year and when your personal or financial situation changes..

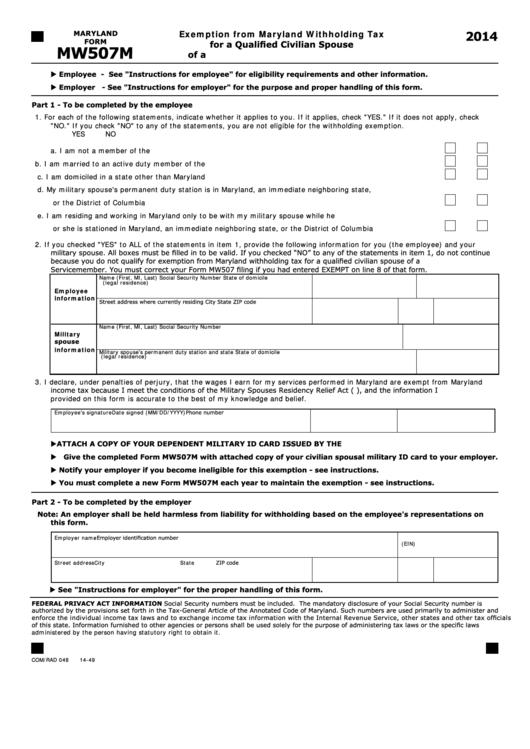

Exemption From Maryland Withholding Tax For A Qualified Civilian Spouse Of Military:

For maryland state government employees only. Failure to fill out the form will result in an employer withholding taxes as if you were filing no deductions, causing you to pay more taxes than is necessary. Web a maryland form mw507 is a document used in maryland to ensure that the correct amount is withheld from an employee’s wages regarding state tax. Web form used by individuals to direct their employer to withhold the correct amount of maryland income tax from their pay.

If You Are Eligible To Claim This Exemption, Your Employer Will Not Withhold Maryland Income Tax From.

It is not enough that the employee is eligible for the exemption under the act. Annuity and sick pay request for maryland income tax withholding: The amount must not be less than $5 a month for annuities and retirement distributions and at least $2 per daily However, if you wish to claim.

This Year You Do Not Expect To Owe Any Maryland Income Tax And Expect To Have A Right To A Full Refund Of All Income Tax Withheld.

Name of employing agency agency number social security number employee. What you must do if an employee gives you a completed form mw507m, do the Consider completing a new form mw507 each year and when your personal or financial situation changes. This exception applies only if you have these forms on file for the employee;

Complete Form Mw507 So That Your Employer Can Withhold The Correct Maryland Income Tax From Your Pay.

Web complete form mw507 so that your employer can withhold the correct maryland income tax from your pay. Form used by civilian spouse to direct their employer to discontinue maryland withholding. Enter in item b of page 1, the whole dollar amount that you wish withheld from each annuity or sick pay payment. Web tax applies if an employee completes and gives to you forms mw507 and mw507m.