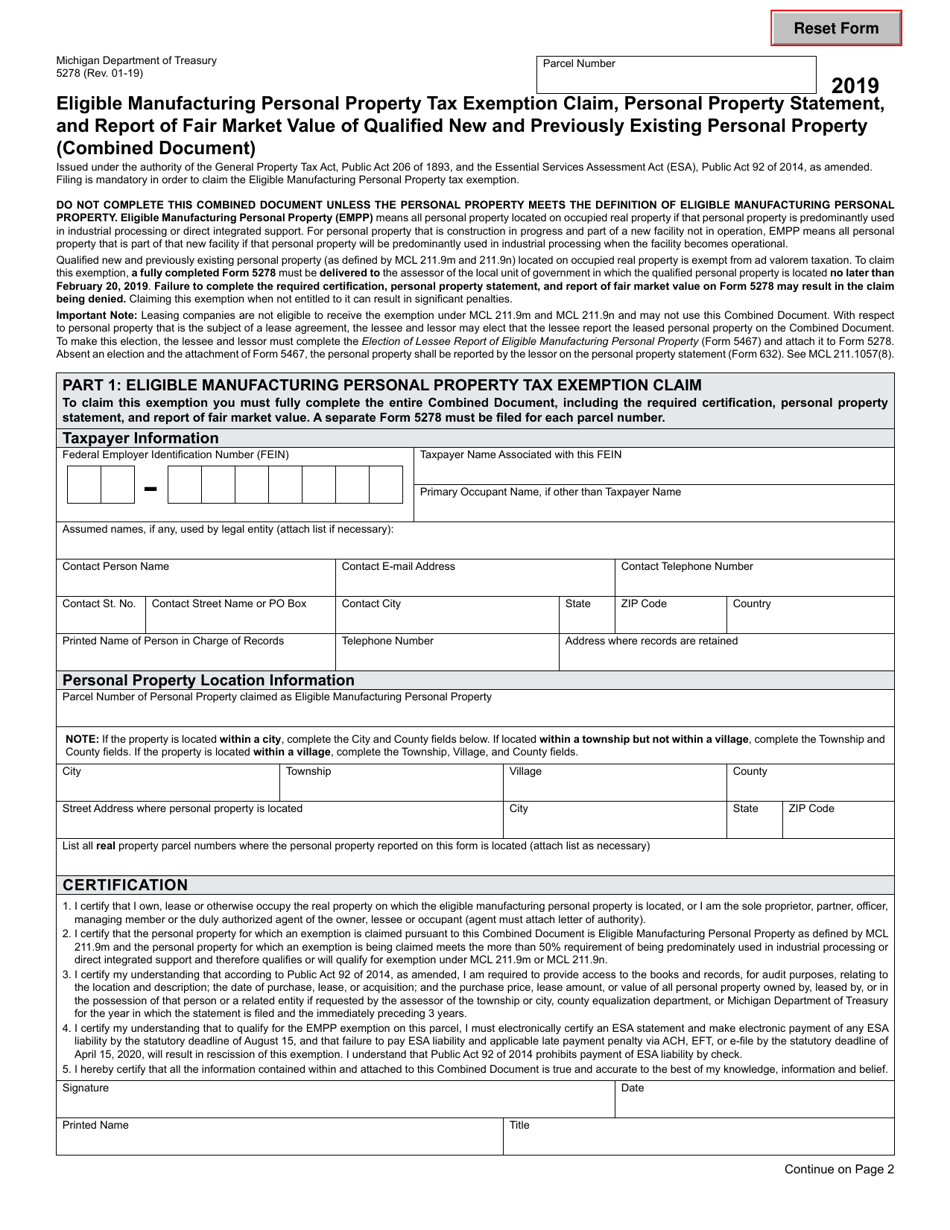

Mi Form 5278

Mi Form 5278 - Leasing companies are not eligible to file form 5278 and must complete this form. Web michigan department of treasury parcel number 5278 (rev. Web form 5278, eligible manufacturing personal property tax exemption claim, personal property statement, and report of fair market value of qualified new and previously existing personal property (combined document) form 5467, election of lessee report of eligible manufacturing personal property Web a combined document (form 5278) will only be required if a taxpayer wishes to claim the exemption on a new or previously unclaimed parcel. Web form 5278 for eligible manufacturing personal property tax exemption claim, and report of fair market value of qualified new and previously existing personal property must be postmarked no later than february 21, 2023. Failure to complete the required certification, personal property statement, and report of fair market value on form 5278 Failure to complete the required certification, personal property statement, and report of fair market value on To claim this exemption, a fully completed form 5278 must be delivered to the assessor of the local unit of government in which the qualified personal property is located, postmarked no later than february 21, 2023. To claim this exemption, a fully completed form 5278 must be delivered tothe assessor of the local unit of government in which the qualified personal property is located no later than february 22, 2021. Web to claim an exemption for empp, file form 5278 with the local assessor where the personal property is located no later than february 21, 2023.

Web a combined document (form 5278) will only be required if a taxpayer wishes to claim the exemption on a new or previously unclaimed parcel. Failure to complete the required certification, personal property statement, and report of fair market value on form 5278 Failure to complete the required certification, personal property statement, and report of fair market value on To claim this exemption, a fully completed form 5278 must be delivered tothe assessor of the local unit of government in which the qualified personal property is located no later than february 22, 2021. Web michigan department of treasury parcel number 5278 (rev. To claim this exemption, a fully completed form 5278 must be delivered to the assessor of the local unit of government in which the qualified personal property is located, postmarked no later than february 21, 2023. Web to claim an exemption for empp, file form 5278 with the local assessor where the personal property is located no later than february 21, 2023. The process for reporting on form 5278 remains unchanged. Web form 5278 for eligible manufacturing personal property tax exemption claim, and report of fair market value of qualified new and previously existing personal property must be postmarked no later than february 21, 2023. Web form 5278 (affidavit and statement for eligible manufacturing personal property and essential services assessment)

Web form 5278 (affidavit and statement for eligible manufacturing personal property and essential services assessment) Web michigan department of treasury parcel number 5278 (rev. The exemption will remain on the parcel until it is rescinded by the taxpayer, local unit of government, or. Failure to complete the required certification, personal property statement, and report of fair market value on form 5278 Leasing companies are not eligible to file form 5278 and must complete this form. To claim this exemption, a fully completed form 5278 must be delivered to the assessor of the local unit of government in which the qualified personal property is located, postmarked no later than february 21, 2023. The process for reporting on form 5278 remains unchanged. Web form 5278 for eligible manufacturing personal property tax exemption claim, and report of fair market value of qualified new and previously existing personal property must be postmarked no later than february 21, 2023. Web to claim an exemption for empp, file form 5278 with the local assessor where the personal property is located no later than february 21, 2023. Web form 5278, eligible manufacturing personal property tax exemption claim, personal property statement, and report of fair market value of qualified new and previously existing personal property (combined document) form 5467, election of lessee report of eligible manufacturing personal property

Tax Savings for Michigan Manufacturers Form 5278 Extension YouTube

To claim this exemption, a fully completed form 5278 must be delivered tothe assessor of the local unit of government in which the qualified personal property is located no later than february 22, 2021. The process for reporting on form 5278 remains unchanged. Web a combined document (form 5278) will only be required if a taxpayer wishes to claim the.

This isnt even my final form! — Weasyl

The exemption will remain on the parcel until it is rescinded by the taxpayer, local unit of government, or. Failure to complete the required certification, personal property statement, and report of fair market value on To claim this exemption, a fully completed form 5278 must be delivered to the assessor of the local unit of government in which the qualified.

Michigan Form 3372 Fillable Fill Online, Printable, Fillable, Blank

Leasing companies are not eligible to file form 5278 and must complete this form. Web michigan department of treasury parcel number 5278 (rev. Web a combined document (form 5278) will only be required if a taxpayer wishes to claim the exemption on a new or previously unclaimed parcel. Web form 5278 (affidavit and statement for eligible manufacturing personal property and.

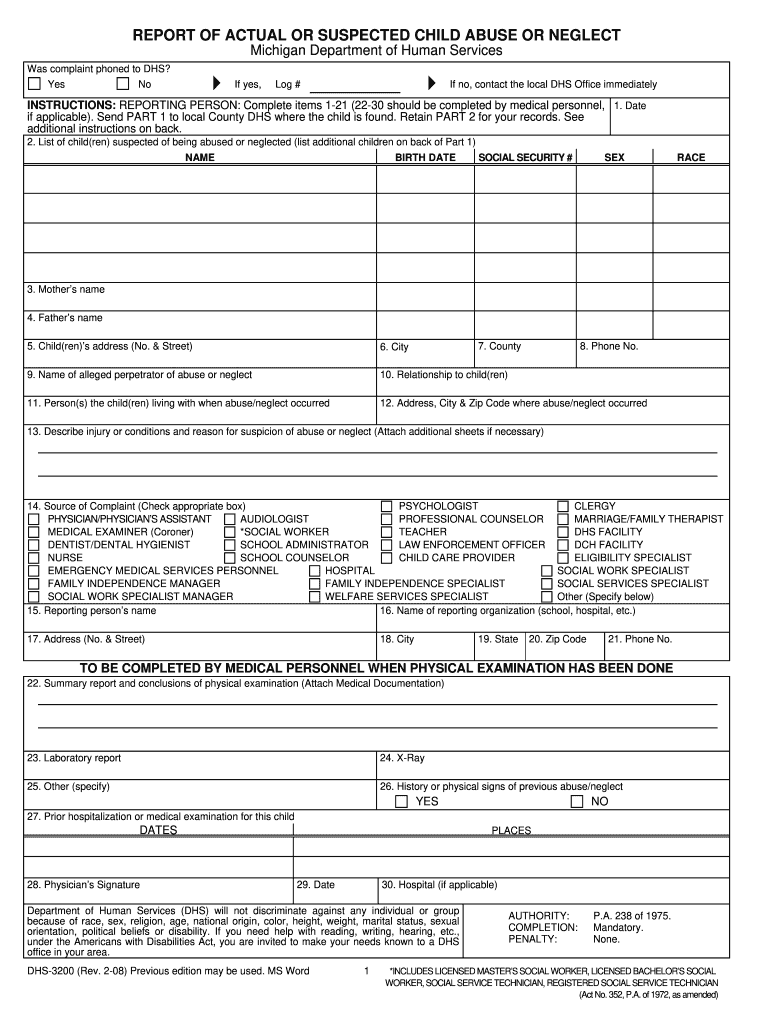

2008 Form MI DHS3200 Fill Online, Printable, Fillable, Blank pdfFiller

Web michigan department of treasury parcel number 5278 (rev. Failure to complete the required certification, personal property statement, and report of fair market value on Web form 5278, eligible manufacturing personal property tax exemption claim, personal property statement, and report of fair market value of qualified new and previously existing personal property (combined document) form 5467, election of lessee report.

MI LCMW811 2014 Fill out Tax Template Online US Legal Forms

Web form 5278 (affidavit and statement for eligible manufacturing personal property and essential services assessment) To claim this exemption, a fully completed form 5278 must be delivered to the assessor of the local unit of government in which the qualified personal property is located, postmarked no later than february 21, 2023. Web form 5278 for eligible manufacturing personal property tax.

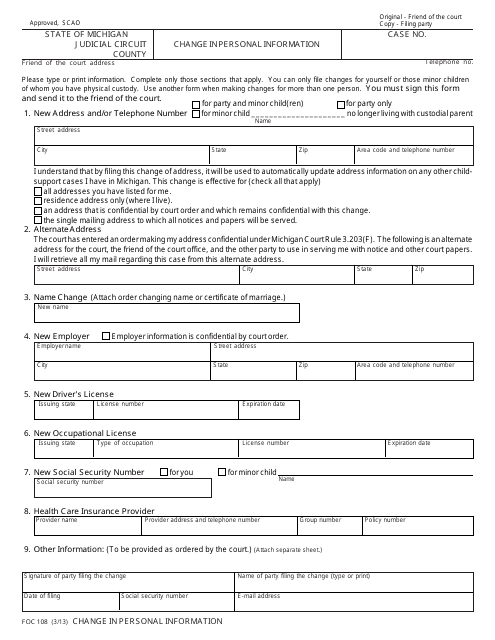

Form FOC108 Download Fillable PDF or Fill Online Change in Personal

Web a combined document (form 5278) will only be required if a taxpayer wishes to claim the exemption on a new or previously unclaimed parcel. Web michigan department of treasury parcel number 5278 (rev. To claim this exemption, a fully completed form 5278 must be delivered tothe assessor of the local unit of government in which the qualified personal property.

표준 공사 안전관리자 선임계(작성방법 포함) 부서별서식

Web form 5278 (affidavit and statement for eligible manufacturing personal property and essential services assessment) Failure to complete the required certification, personal property statement, and report of fair market value on form 5278 Web michigan department of treasury parcel number 5278 (rev. To claim this exemption, a fully completed form 5278 must be delivered to the assessor of the local.

MI MI1040CR7 2018 Fill and Sign Printable Template Online US

Web form 5278 (affidavit and statement for eligible manufacturing personal property and essential services assessment) To claim this exemption, a fully completed form 5278 must be delivered to the assessor of the local unit of government in which the qualified personal property is located, postmarked no later than february 21, 2023. Web michigan department of treasury parcel number 5278 (rev..

Form 5278 Download Fillable PDF or Fill Online Eligible Manufacturing

The exemption will remain on the parcel until it is rescinded by the taxpayer, local unit of government, or. Web michigan department of treasury parcel number 5278 (rev. Web form 5278, eligible manufacturing personal property tax exemption claim, personal property statement, and report of fair market value of qualified new and previously existing personal property (combined document) form 5467, election.

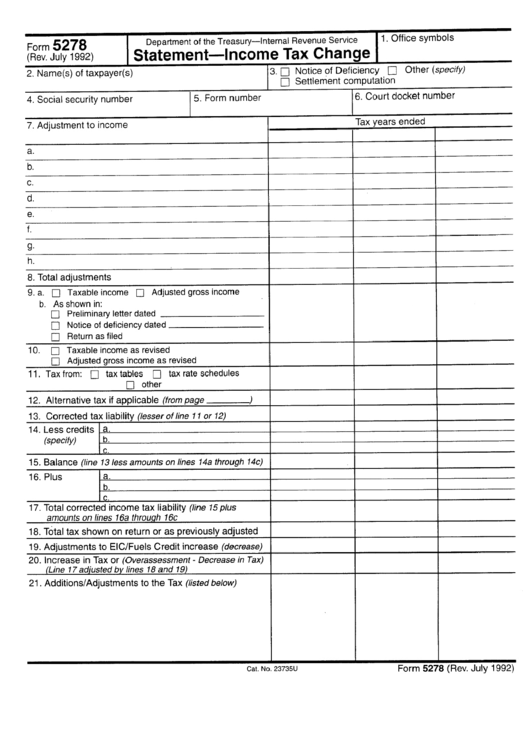

Form 5278 Statement Tax Change printable pdf download

The exemption will remain on the parcel until it is rescinded by the taxpayer, local unit of government, or. Web michigan department of treasury parcel number 5278 (rev. Failure to complete the required certification, personal property statement, and report of fair market value on The process for reporting on form 5278 remains unchanged. Web a combined document (form 5278) will.

Web Michigan Department Of Treasury Parcel Number 5278 (Rev.

Web form 5278 (affidavit and statement for eligible manufacturing personal property and essential services assessment) Web form 5278, eligible manufacturing personal property tax exemption claim, personal property statement, and report of fair market value of qualified new and previously existing personal property (combined document) form 5467, election of lessee report of eligible manufacturing personal property Web michigan department of treasury parcel number 5278 (rev. Leasing companies are not eligible to file form 5278 and must complete this form.

The Process For Reporting On Form 5278 Remains Unchanged.

Failure to complete the required certification, personal property statement, and report of fair market value on form 5278 Web form 5278 for eligible manufacturing personal property tax exemption claim, and report of fair market value of qualified new and previously existing personal property must be postmarked no later than february 21, 2023. Web a combined document (form 5278) will only be required if a taxpayer wishes to claim the exemption on a new or previously unclaimed parcel. Failure to complete the required certification, personal property statement, and report of fair market value on

To Claim This Exemption, A Fully Completed Form 5278 Must Be Delivered Tothe Assessor Of The Local Unit Of Government In Which The Qualified Personal Property Is Located No Later Than February 22, 2021.

To claim this exemption, a fully completed form 5278 must be delivered to the assessor of the local unit of government in which the qualified personal property is located, postmarked no later than february 21, 2023. The exemption will remain on the parcel until it is rescinded by the taxpayer, local unit of government, or. Web to claim an exemption for empp, file form 5278 with the local assessor where the personal property is located no later than february 21, 2023.