Michigan Homestead Exemption Form

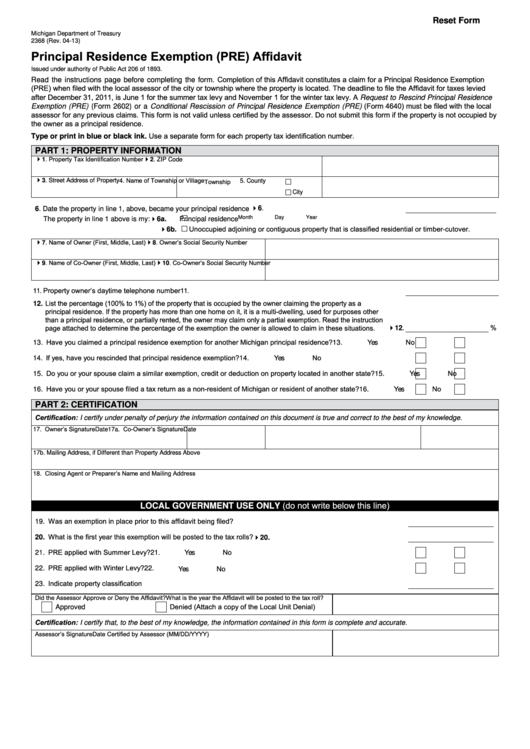

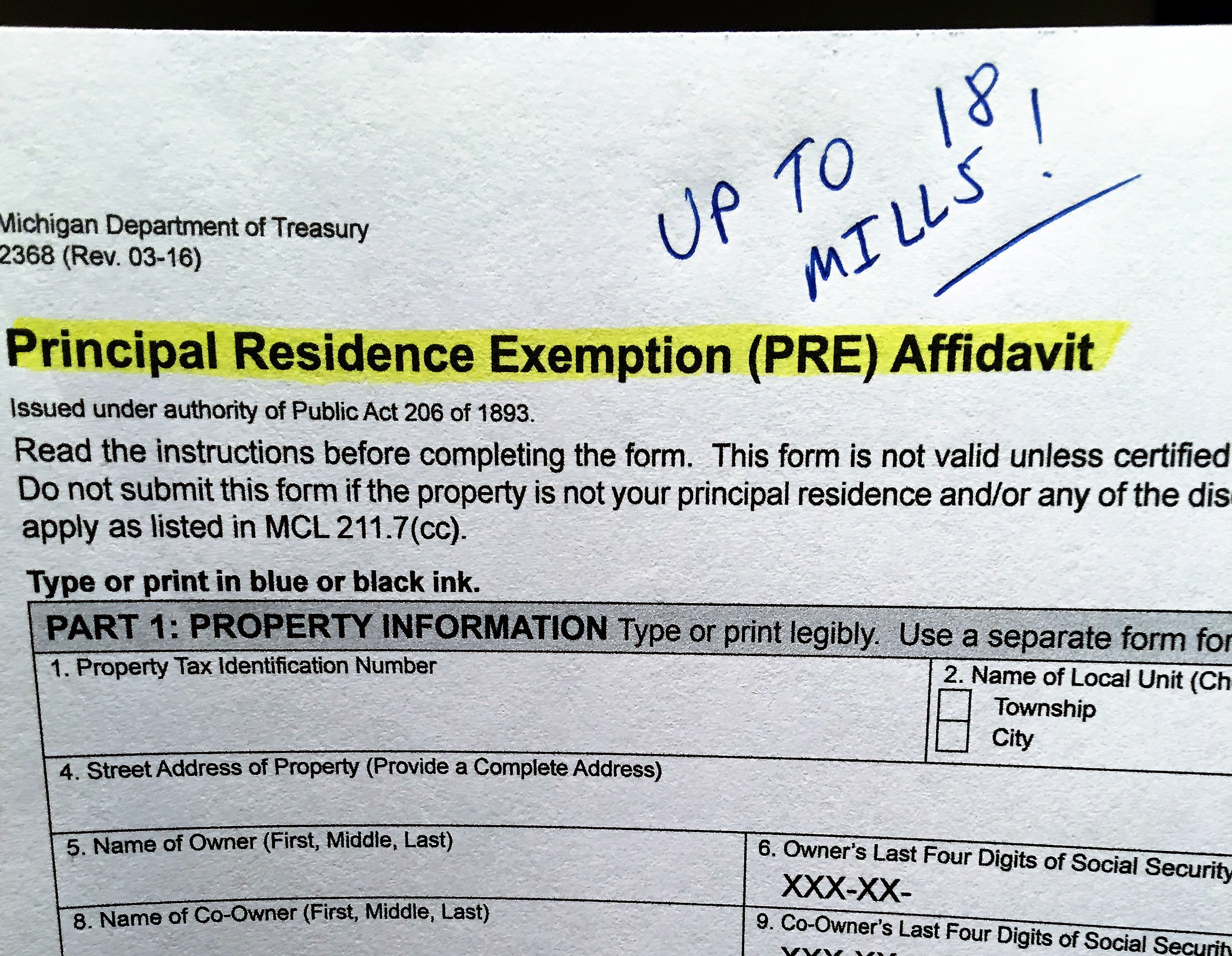

Michigan Homestead Exemption Form - The latter is called the michigan homestead property tax credit claim for veterans and blind people. Web a michigan homeowner is only entitled to one personal residence exemption. The deadlines for a property owner to file a “principal residence exemption (pre) affidavit” (form 2368) for taxes are on or before june 1 or on or before november 1. Web michigan — homestead property tax credit claim download this form print this form it appears you don't have a pdf plugin for this browser. An additional $400 exemption is. To claim an exemption, complete the homeowner's principal residence exemption affidavit (form 2368) and file it with your township or city assessor. Failure to do so may subject you to additional tax plus penalties and interest as determined under the general property tax act. Foreclosure entity payment form (pre) 5101. Is there a filing deadline to request a principal residence exemption? Download this form print this form

Foreclosure entity payment form (pre) 5101. Web if you own and occupy the property as your home, you should file a principal residence exemption affidavit (form 2368) with your county, city, township or village and submit your summer and winter property tax statements to michigan department of treasury for review. Web rescind principal residence exemption (pre) (form 2602) or file a conditional rescission (form 4640) with your township or city assessor. Web michigan — homestead property tax credit claim download this form print this form it appears you don't have a pdf plugin for this browser. To claim the exemption, you must be a michigan resident who has not made this kind of claim for exemption in another state. Web a michigan homeowner is only entitled to one personal residence exemption. Failure to do so may subject you to additional tax plus penalties and interest as determined under the general property tax act. The latter is called the michigan homestead property tax credit claim for veterans and blind people. To claim an exemption, complete the homeowner's principal residence exemption affidavit (form 2368) and file it with your township or city assessor. There are two deadlines by which a principal residence exemption may be filed.

Failure to do so may subject you to additional tax plus penalties and interest as determined under the general property tax act. Web the state also provides a $2,900 special exemption for each tax filer or dependent in the household who is deaf, paraplegic, quadriplegic, hemiplegic, totally and permanently disabled or blind. The property must be owned by a person for the exemption to be effective. The deadlines for a property owner to file a “principal residence exemption (pre) affidavit” (form 2368) for taxes are on or before june 1 or on or before november 1. Foreclosure entity payment form (pre) 5101. Principal residence exemption affidavit for similar exemptions in. Web the form a michigan taxpayer must file to claim a homestead property tax credit depends on the filer's circumstances. Web foreclosure entity conditional rescission of a principal residence exemption (pre) 5005. Web a michigan homeowner is only entitled to one personal residence exemption. Web michigan — homestead property tax credit claim download this form print this form it appears you don't have a pdf plugin for this browser.

Understanding Michigan’s Homestead Exemption Resnick Law, P.C.

Failure to do so may subject you to additional tax plus penalties and interest as determined under the general property tax act. Is there a filing deadline to request a principal residence exemption? Principal residence exemption affidavit for similar exemptions in. Web the form a michigan taxpayer must file to claim a homestead property tax credit depends on the filer's.

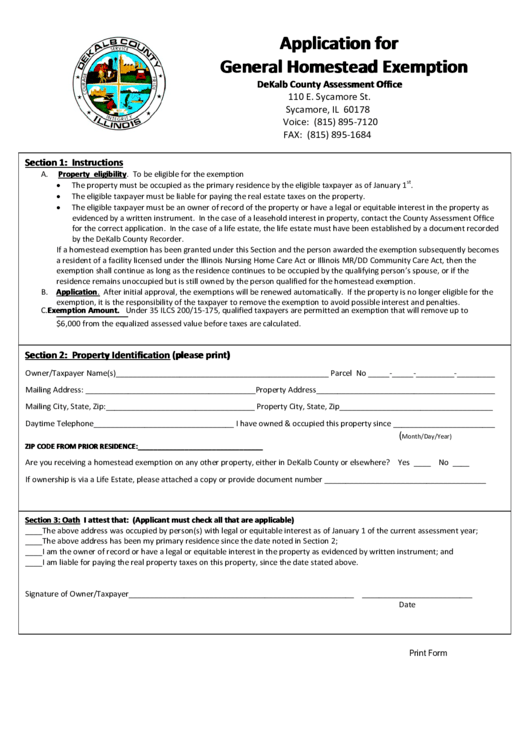

Homestead Exemption Joel Richardson

Web if you own and occupy the property as your home, you should file a principal residence exemption affidavit (form 2368) with your county, city, township or village and submit your summer and winter property tax statements to michigan department of treasury for review. Web the form a michigan taxpayer must file to claim a homestead property tax credit depends.

Ingham County Property Homestead Exemption Form

The deadlines for a property owner to file a “principal residence exemption (pre) affidavit” (form 2368) for taxes are on or before june 1 or on or before november 1. Web the state also provides a $2,900 special exemption for each tax filer or dependent in the household who is deaf, paraplegic, quadriplegic, hemiplegic, totally and permanently disabled or blind..

Top Michigan Homestead Exemption Form Templates free to download in PDF

Web a michigan homeowner is only entitled to one personal residence exemption. Failure to do so may subject you to additional tax plus penalties and interest as determined under the general property tax act. To claim the exemption, you must be a michigan resident who has not made this kind of claim for exemption in another state. To claim an.

Michigan Homestead Property Tax Credit Tax credits, Homestead

The latter is called the michigan homestead property tax credit claim for veterans and blind people. Web the form a michigan taxpayer must file to claim a homestead property tax credit depends on the filer's circumstances. To claim the exemption, you must be a michigan resident who has not made this kind of claim for exemption in another state. Web.

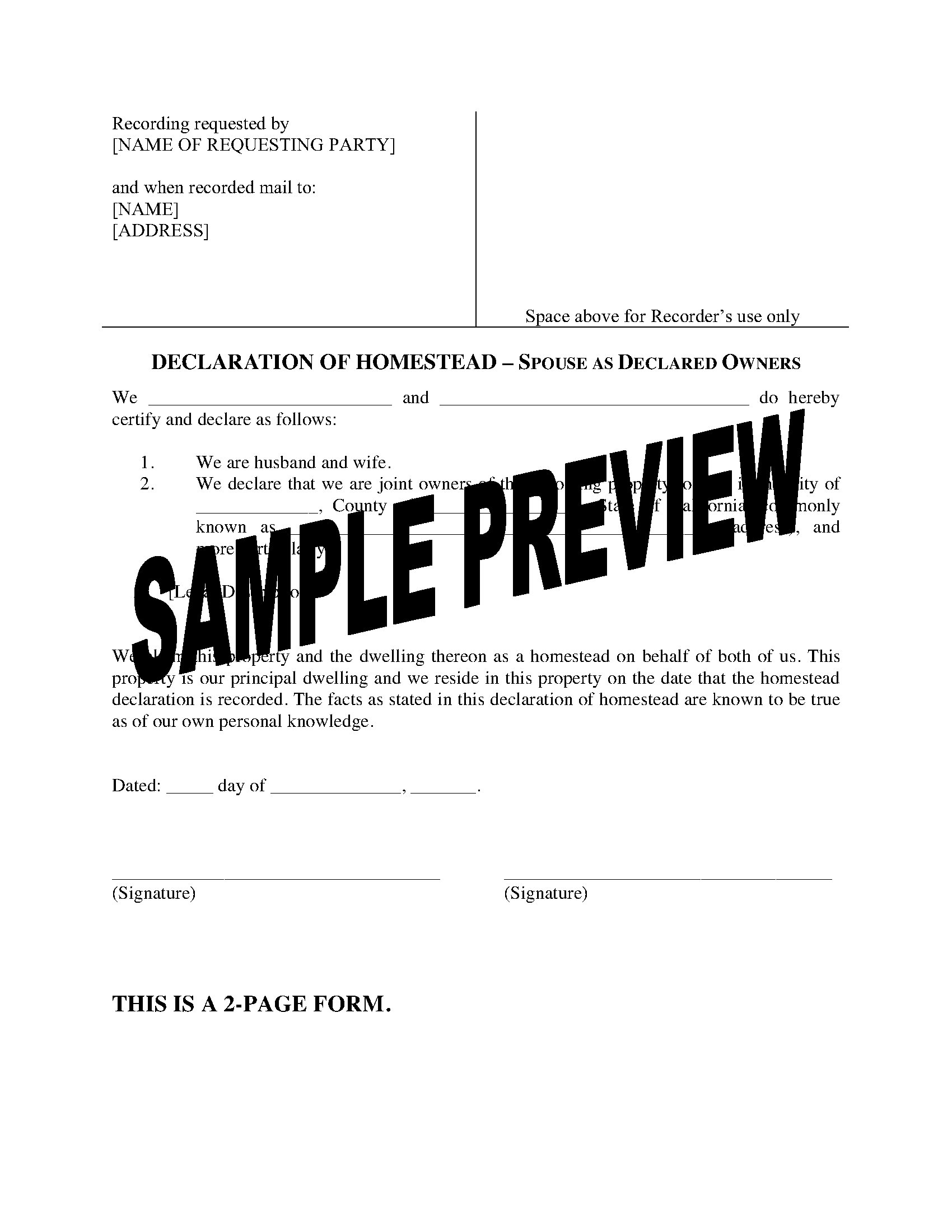

California Homestead Declaration Form for spouses Legal Forms and

Failure to do so may subject you to additional tax plus penalties and interest as determined under the general property tax act. The property must be owned by a person for the exemption to be effective. To claim an exemption, complete the homeowner's principal residence exemption affidavit (form 2368) and file it with your township or city assessor. Is there.

Your Homestead Exemption (AKA Principal Residence) Know the Limits!

Foreclosure entity payment form (pre) 5101. Failure to do so may subject you to additional tax plus penalties and interest as determined under the general property tax act. Download this form print this form Is there a filing deadline to request a principal residence exemption? To claim an exemption, complete the homeowner's principal residence exemption affidavit (form 2368) and file.

An Introduction to the Homestead Exemption Envoy Mortgage

To claim the exemption, you must be a michigan resident who has not made this kind of claim for exemption in another state. There are two deadlines by which a principal residence exemption may be filed. Web foreclosure entity conditional rescission of a principal residence exemption (pre) 5005. An additional $400 exemption is. The deadlines for a property owner to.

Homestead Exemption in Michigan YouTube

An additional $400 exemption is. Web the state also provides a $2,900 special exemption for each tax filer or dependent in the household who is deaf, paraplegic, quadriplegic, hemiplegic, totally and permanently disabled or blind. Web rescind principal residence exemption (pre) (form 2602) or file a conditional rescission (form 4640) with your township or city assessor. Foreclosure entity payment form.

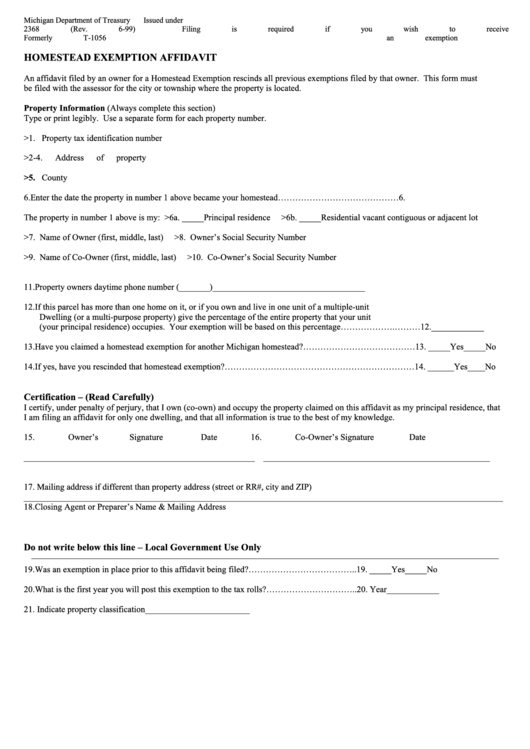

Form 2368 (Formerly T1056) Homestead Exemption Affidavit 1999

Web foreclosure entity conditional rescission of a principal residence exemption (pre) 5005. Failure to do so may subject you to additional tax plus penalties and interest as determined under the general property tax act. Web if you own and occupy the property as your home, you should file a principal residence exemption affidavit (form 2368) with your county, city, township.

The Latter Is Called The Michigan Homestead Property Tax Credit Claim For Veterans And Blind People.

Failure to do so may subject you to additional tax plus penalties and interest as determined under the general property tax act. The property must be owned by a person for the exemption to be effective. Principal residence exemption affidavit for similar exemptions in. Web rescind principal residence exemption (pre) (form 2602) or file a conditional rescission (form 4640) with your township or city assessor.

To Claim The Exemption, You Must Be A Michigan Resident Who Has Not Made This Kind Of Claim For Exemption In Another State.

An additional $400 exemption is. Is there a filing deadline to request a principal residence exemption? Web a michigan homeowner is only entitled to one personal residence exemption. Foreclosure entity payment form (pre) 5101.

The Deadlines For A Property Owner To File A “Principal Residence Exemption (Pre) Affidavit” (Form 2368) For Taxes Are On Or Before June 1 Or On Or Before November 1.

To claim an exemption, complete the homeowner's principal residence exemption affidavit (form 2368) and file it with your township or city assessor. Web michigan — homestead property tax credit claim download this form print this form it appears you don't have a pdf plugin for this browser. Web the state also provides a $2,900 special exemption for each tax filer or dependent in the household who is deaf, paraplegic, quadriplegic, hemiplegic, totally and permanently disabled or blind. Download this form print this form

Web The Form A Michigan Taxpayer Must File To Claim A Homestead Property Tax Credit Depends On The Filer's Circumstances.

Web foreclosure entity conditional rescission of a principal residence exemption (pre) 5005. There are two deadlines by which a principal residence exemption may be filed. Web if you own and occupy the property as your home, you should file a principal residence exemption affidavit (form 2368) with your county, city, township or village and submit your summer and winter property tax statements to michigan department of treasury for review.