Oh Withholding Form

Oh Withholding Form - If your income will be $200,000 or less ($400,000 or less if. If too little is withheld, you will generally owe tax when. Web july 20, 2023. Web this requirement to fi le an individual estimated income tax form it 1040es may also apply to an individual who has two jobs, both of which are subject to withholding. Web download or print the 2022 ohio (employee's withholding exemption certificate) (2022) and other income tax forms from the ohio department of taxation. Snohomish county tax preparer pleads guilty to assisting in the. Web we last updated the schedule of ohio withholding in february 2023, so this is the latest version of form it wh, fully updated for tax year 2022. Web 49 is ohio withholding required if an employee will not be earning enough income to owe ohio individual income tax (e.g., summer employment)? Enter “p” in the “p/s” box if. Complete all fields for each form entered.

Civil penalty for false information with respect to withholding. 11 enter “p” in the “p/s” box if the form is the primary taxpayer’s and enter “s” if it is the spouse’s. You can download or print. Enter “p” in the “p/s” box if. Complete all fields for each form entered. Web filing the individual estimated income tax form it 1040es, the individual may provide for additional withholding with the death of a spouse or a dependent does not affect your. Web july 20, 2023. Web this form allows ohio employees to claim income tax withholding exemptions or waivers, ensuring their employers withhold the correct amount for two types of ohio taxes: If the ohio id number on a statement has 9 digits,. If you make a false statement with no reasonable basis that results in no.

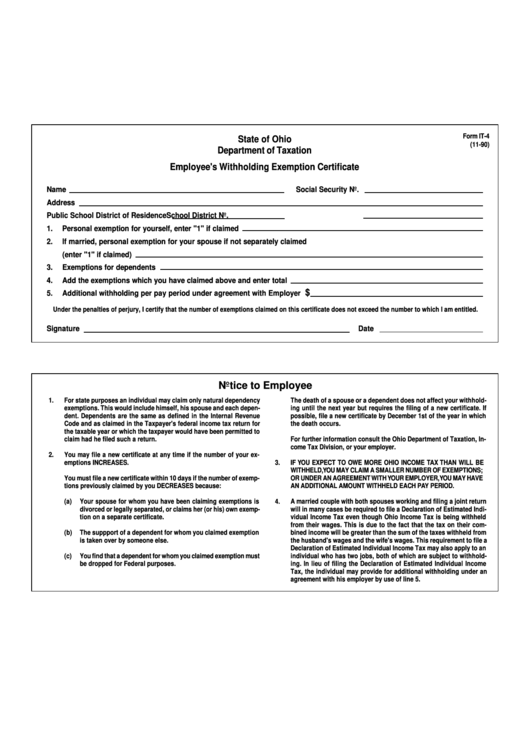

Web ohio it 4 is an ohio employee withholding exemption certificate. Only if they have ohio withholding. Other tax forms — a. Web this form allows ohio employees to claim income tax withholding exemptions or waivers, ensuring their employers withhold the correct amount for two types of ohio taxes: 50 my payroll provider submits. Web 49 is ohio withholding required if an employee will not be earning enough income to owe ohio individual income tax (e.g., summer employment)? Civil penalty for false information with respect to withholding. Web filing the individual estimated income tax form it 1040es, the individual may provide for additional withholding with the death of a spouse or a dependent does not affect your. The it 4 is a combined document. The ohio department of taxation provides a searchable repository of individual tax.

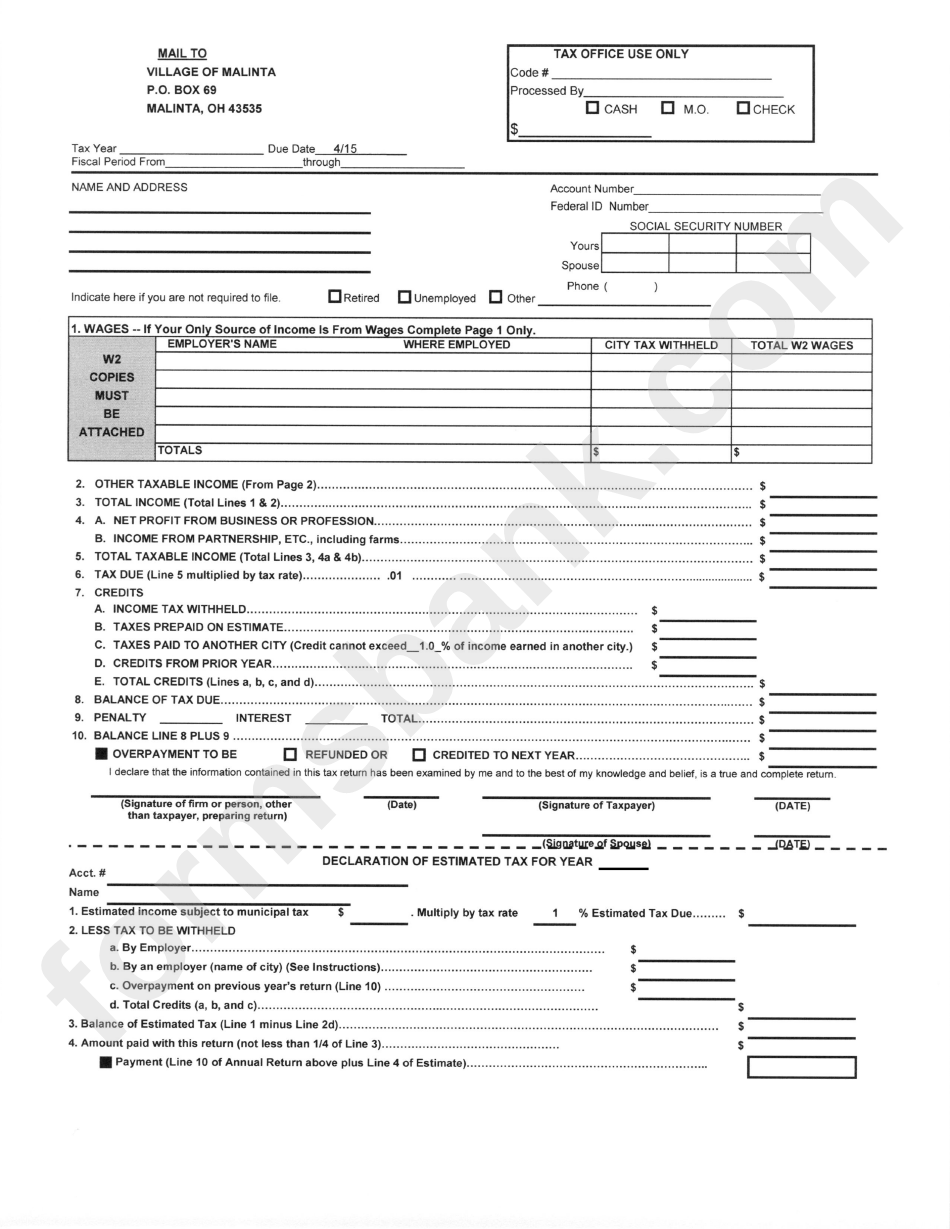

Ohio Tax Form printable pdf download

Web filing the individual estimated income tax form it 1040es, the individual may provide for additional withholding with the death of a spouse or a dependent does not affect your. Only if they have ohio withholding. If you make a false statement with no reasonable basis that results in no. The ohio department of taxation provides a searchable repository of.

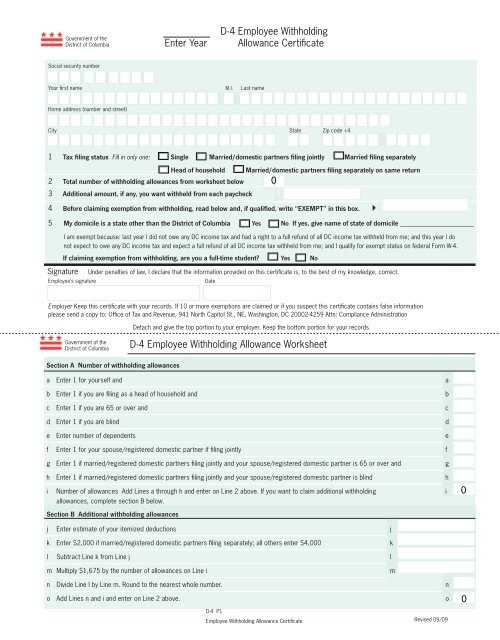

DC Withholding Form pdf format IATSE Local 22

Web 49 is ohio withholding required if an employee will not be earning enough income to owe ohio individual income tax (e.g., summer employment)? The ohio department of taxation provides a searchable repository of individual tax. Civil penalty for false information with respect to withholding. Web ohio it 4 is an ohio employee withholding exemption certificate. Other tax forms —.

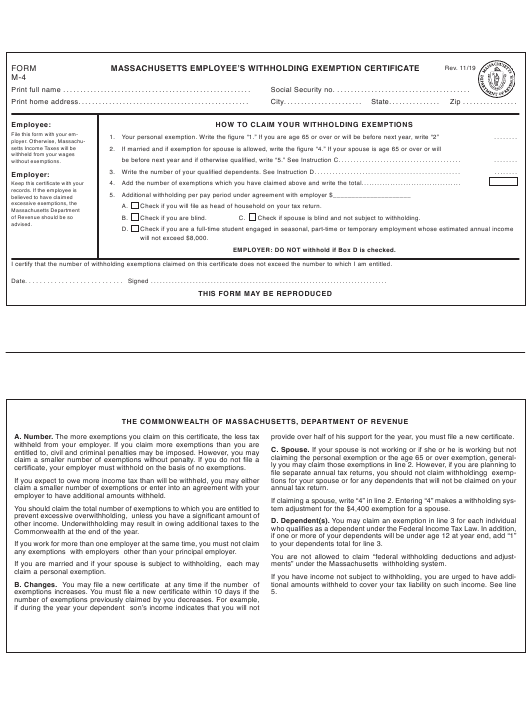

Massachusetts Employee Withholding Form 2022 W4 Form

Web 49 is ohio withholding required if an employee will not be earning enough income to owe ohio individual income tax (e.g., summer employment)? Omaha man sentenced for tax evasion and role in multimillion dollar embezzlement. Snohomish county tax preparer pleads guilty to assisting in the. Web download or print the 2022 ohio (employee's withholding exemption certificate) (2022) and other.

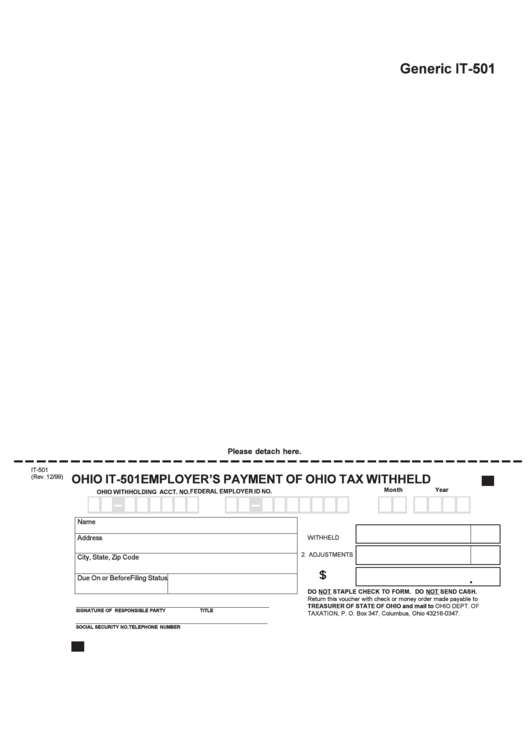

Ohio Form It501 Employers Payment Of Ohio Tax Withheld printable pdf

50 my payroll provider submits. If your income will be $200,000 or less ($400,000 or less if. Access the forms you need to file taxes or do business in ohio. If too little is withheld, you will generally owe tax when. Complete all fields for each form entered.

Ohio State Withholding Form 2021 2022 W4 Form

Web 49 is ohio withholding required if an employee will not be earning enough income to owe ohio individual income tax (e.g., summer employment)? Web ohio it 4 is an ohio employee withholding exemption certificate. If the ohio id number on a statement has 9 digits,. If you make a false statement with no reasonable basis that results in no..

Employee's Withholding Exemption Certificate Ohio Free Download

If your income will be $200,000 or less ($400,000 or less if. Web 49 is ohio withholding required if an employee will not be earning enough income to owe ohio individual income tax (e.g., summer employment)? Complete all fields for each form entered. 11 enter “p” in the “p/s” box if the form is the primary taxpayer’s and enter “s”.

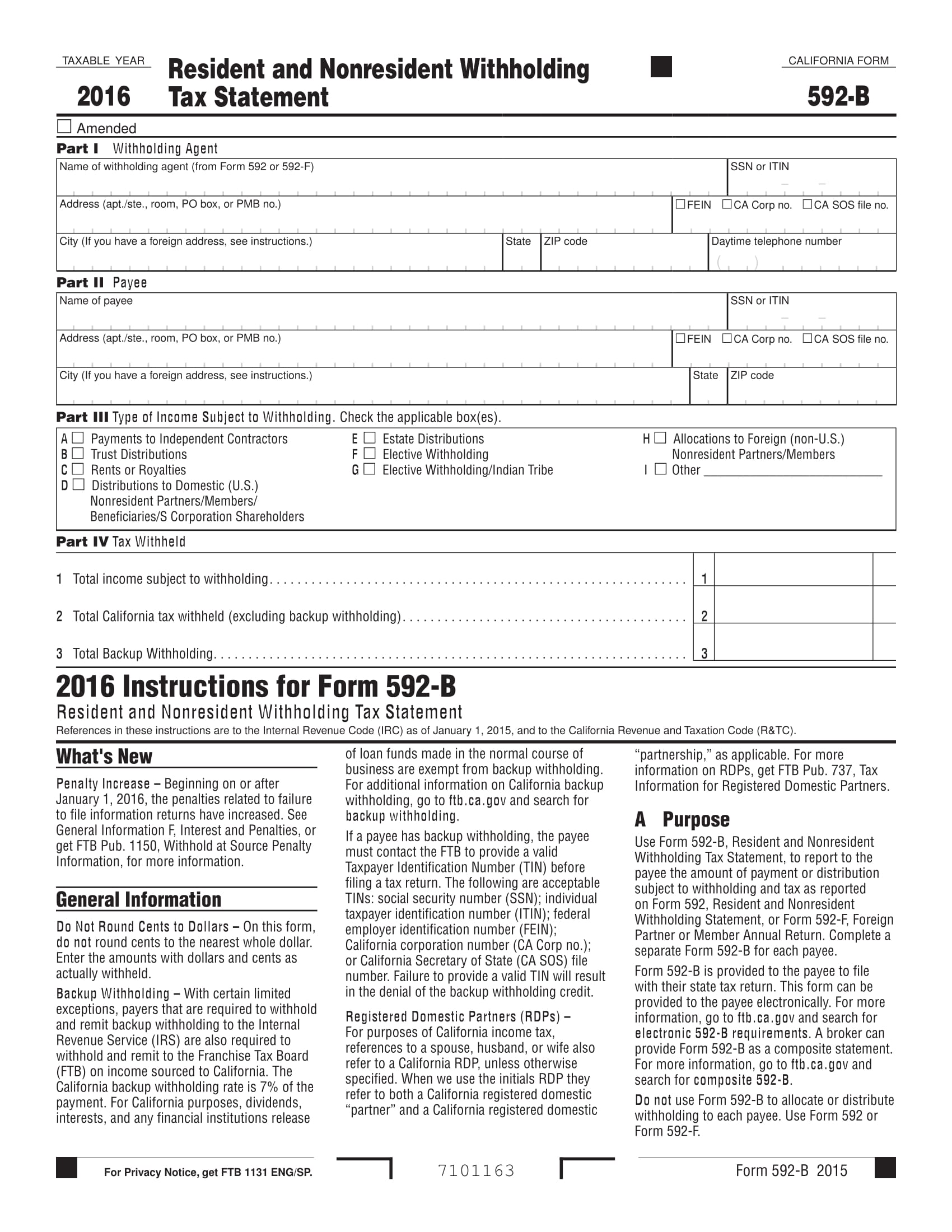

FREE 14+ Tax Statement Forms in PDF MS Word

Civil penalty for false information with respect to withholding. The ohio department of taxation provides a searchable repository of individual tax. Access the forms you need to file taxes or do business in ohio. You can download or print. Web july 20, 2023.

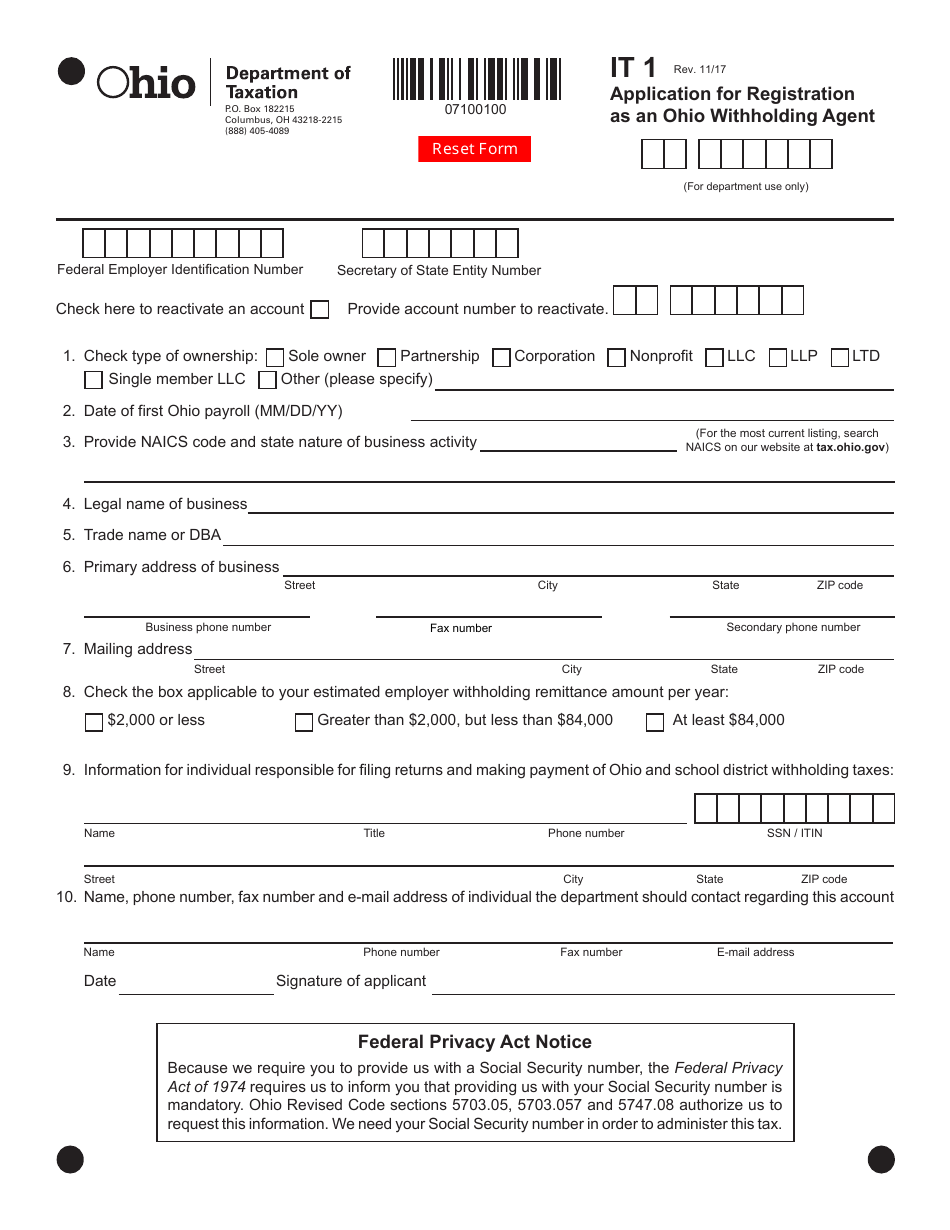

Form IT1 Download Fillable PDF or Fill Online Application for

Access the forms you need to file taxes or do business in ohio. You can download or print. Web submit form it 4 to your employer on or before the start date of employment so your employer will withhold and remit ohio income tax. If too little is withheld, you will generally owe tax when. Snohomish county tax preparer pleads.

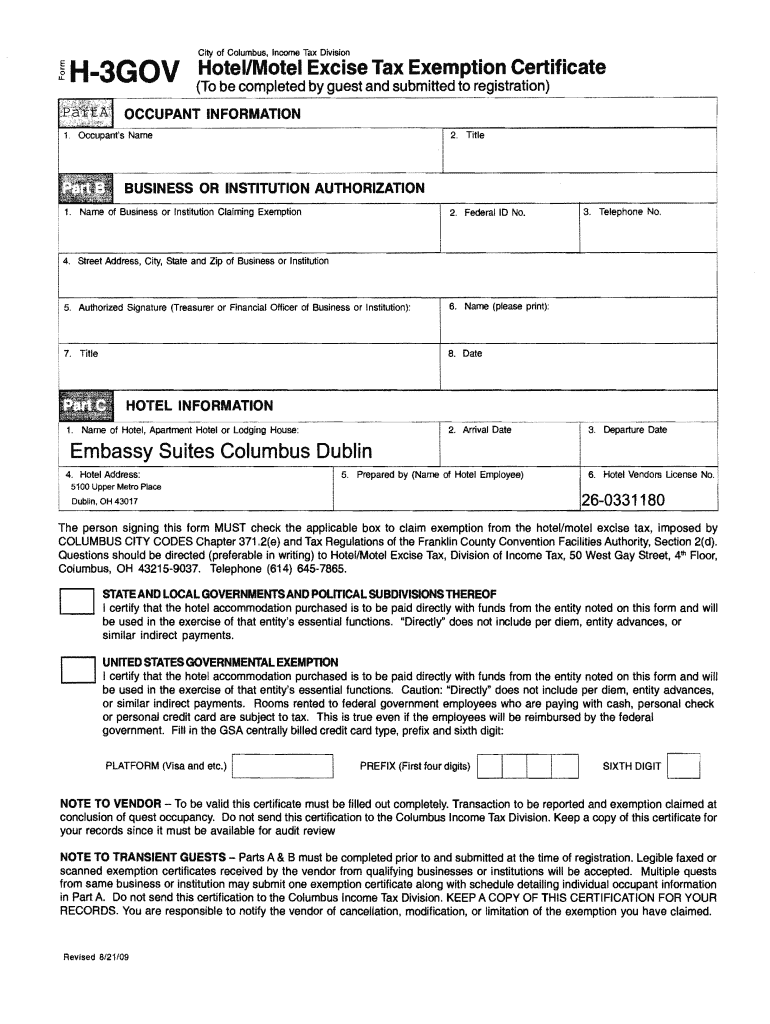

Top Ohio Withholding Form Templates free to download in PDF format

50 my payroll provider submits. Web download or print the 2022 ohio (employee's withholding exemption certificate) (2022) and other income tax forms from the ohio department of taxation. Snohomish county tax preparer pleads guilty to assisting in the. If your income will be $200,000 or less ($400,000 or less if. Other tax forms — a.

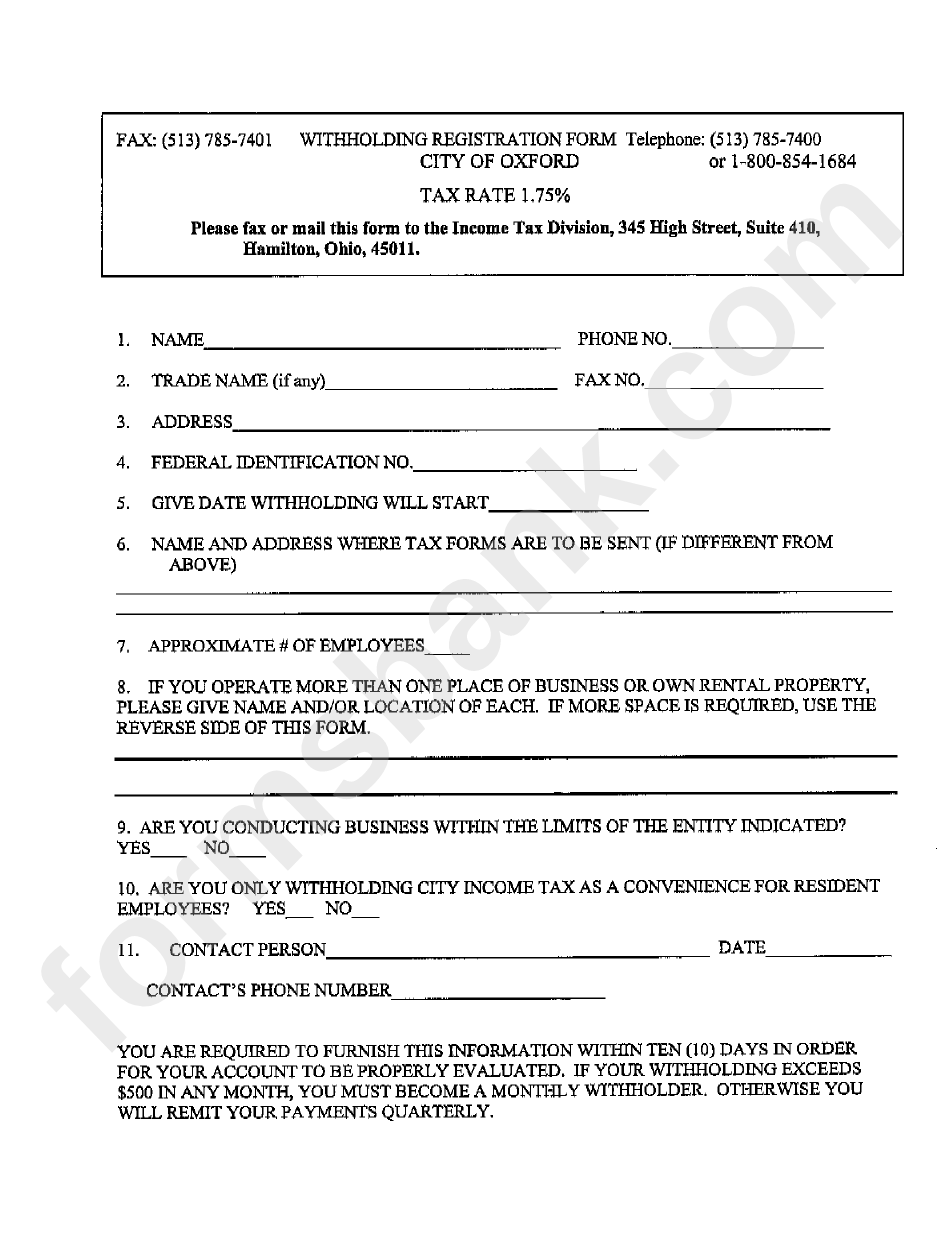

Withholding Registration Form City Of Oxford, Ohio printable pdf download

Web filing the individual estimated income tax form it 1040es, the individual may provide for additional withholding with the death of a spouse or a dependent does not affect your. If you make a false statement with no reasonable basis that results in no. If the ohio id number on a statement has 9 digits,. Web submit form it 4.

50 My Payroll Provider Submits.

11 enter “p” in the “p/s” box if the form is the primary taxpayer’s and enter “s” if it is the spouse’s. Snohomish county tax preparer pleads guilty to assisting in the. Other tax forms — a. Access the forms you need to file taxes or do business in ohio.

The Ohio Department Of Taxation Provides A Searchable Repository Of Individual Tax.

Enter “p” in the “p/s” box if. If too little is withheld, you will generally owe tax when. If your income will be $200,000 or less ($400,000 or less if. Web filing the individual estimated income tax form it 1040es, the individual may provide for additional withholding with the death of a spouse or a dependent does not affect your.

Omaha Man Sentenced For Tax Evasion And Role In Multimillion Dollar Embezzlement.

The employer is required to have each employee that works in ohio to complete this form. Web submit form it 4 to your employer on or before the start date of employment so your employer will withhold and remit ohio income tax. Civil penalty for false information with respect to withholding. Web this requirement to fi le an individual estimated income tax form it 1040es may also apply to an individual who has two jobs, both of which are subject to withholding.

Web This Form Allows Ohio Employees To Claim Income Tax Withholding Exemptions Or Waivers, Ensuring Their Employers Withhold The Correct Amount For Two Types Of Ohio Taxes:

If the ohio id number on a statement has 9 digits,. The it 4 is a combined document. Web july 20, 2023. Web we last updated the schedule of ohio withholding in february 2023, so this is the latest version of form it wh, fully updated for tax year 2022.