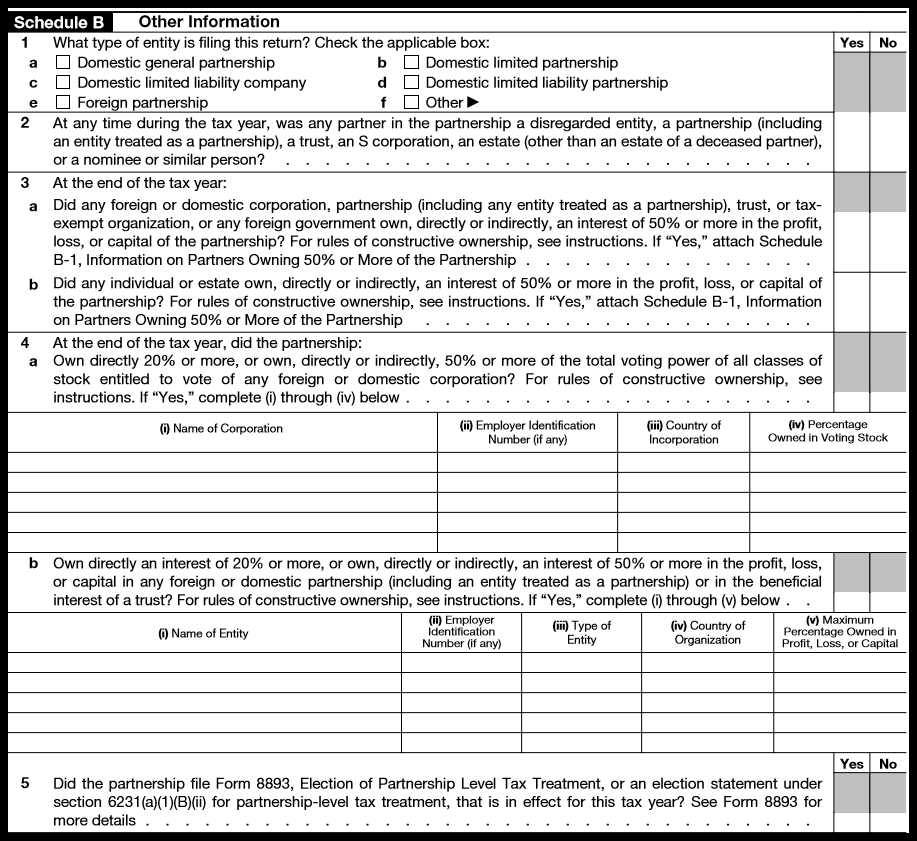

Schedule B Form 1065

Schedule B Form 1065 - If yes, the partnership isn't. The schedule b screen in the 1065 package has been enhanced. Web what should a partnership report? Return of partnership income is a tax document issued by the irs used to declare the profits, losses, deductions, and credits of a business partnership. To which payments does section 267a apply? Web beginning in tax year 2018, the schedule b has been altered with the irs adding additional questions to the form. Web a 1065 form is the annual us tax return filed by partnerships. The new audit regime applies to all partnerships. Web schedule b reports the interest and dividend income you receive during the tax year. Web entering form 1065, schedule b in proconnect tax solved • by intuit • 1 • updated 1 year ago proconnect tax will automatically fill out many of the schedule b questions based.

The new audit regime applies to all partnerships. Web a 1065 form is the annual us tax return filed by partnerships. Web to meet the requirements for form 1065, schedule b, question 4, the client must answer yes to all four of the following conditions: Web beginning in tax year 2018, the schedule b has been altered with the irs adding additional questions to the form. Return of partnership income is a tax document issued by the irs used to declare the profits, losses, deductions, and credits of a business partnership. To which payments does section 267a apply? Web the new audit regime replaces the consolidated audit proceedings under the tax equity and fiscal responsibility act (tefra). To which partners does section 267a apply? However, you don’t need to attach a schedule b every year you earn interest or. Web what should a partnership report?

Web the new audit regime replaces the consolidated audit proceedings under the tax equity and fiscal responsibility act (tefra). Web to meet the requirements for form 1065, schedule b, question 4, the client must answer yes to all four of the following conditions: To which payments does section 267a apply? Web what should a partnership report? Web a 1065 form is the annual us tax return filed by partnerships. It is used to report the partnership’s income, gains, losses, deductions, and credits to the irs. If yes, the partnership isn't. Return of partnership income is a tax document issued by the irs used to declare the profits, losses, deductions, and credits of a business partnership. Web beginning in tax year 2018, the schedule b has been altered with the irs adding additional questions to the form. Web entering form 1065, schedule b in proconnect tax solved • by intuit • 1 • updated 1 year ago proconnect tax will automatically fill out many of the schedule b questions based.

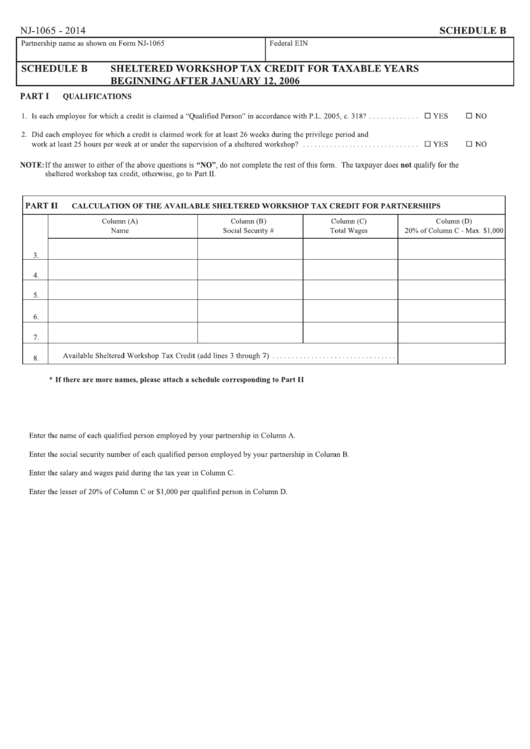

Fillable Form Nj1065 Schedule B Sheltered Tax Credit For

Web entering form 1065, schedule b in proconnect tax solved • by intuit • 1 • updated 1 year ago proconnect tax will automatically fill out many of the schedule b questions based. Return of partnership income is a tax document issued by the irs used to declare the profits, losses, deductions, and credits of a business partnership. However, you.

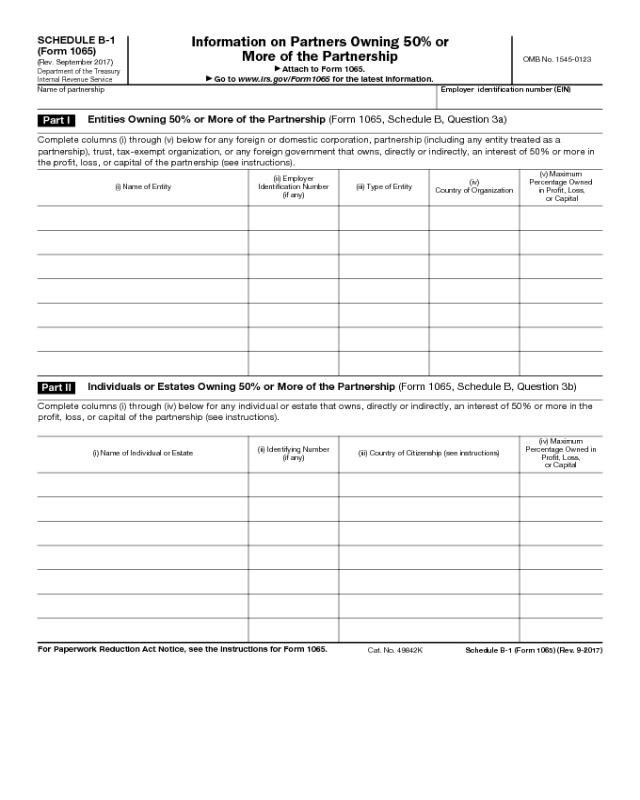

Form 1065 Schedule B1 Edit, Fill, Sign Online Handypdf

However, you don’t need to attach a schedule b every year you earn interest or. Web to meet the requirements for form 1065, schedule b, question 4, the client must answer yes to all four of the following conditions: Web entering form 1065, schedule b in proconnect tax solved • by intuit • 1 • updated 1 year ago proconnect.

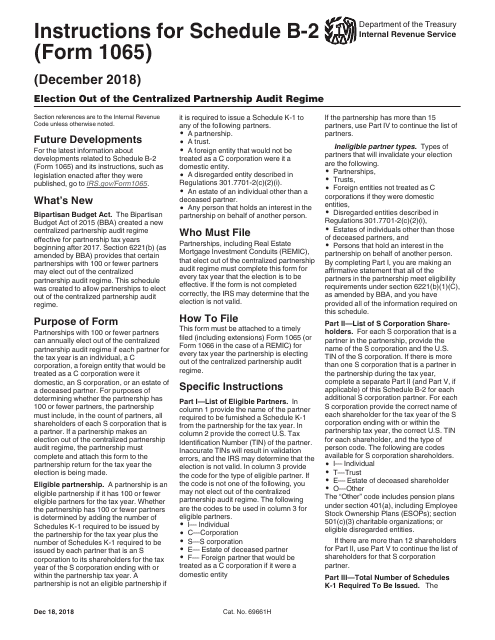

Download Instructions for IRS Form 1065 Schedule B2 Election out of

Web schedule b reports the interest and dividend income you receive during the tax year. Web input for schedule b, form 1065 in lacerte solved • by intuit • 13 • updated 1 year ago lacerte will automatically complete many of the entries on. Web a 1065 form is the annual us tax return filed by partnerships. Web beginning in.

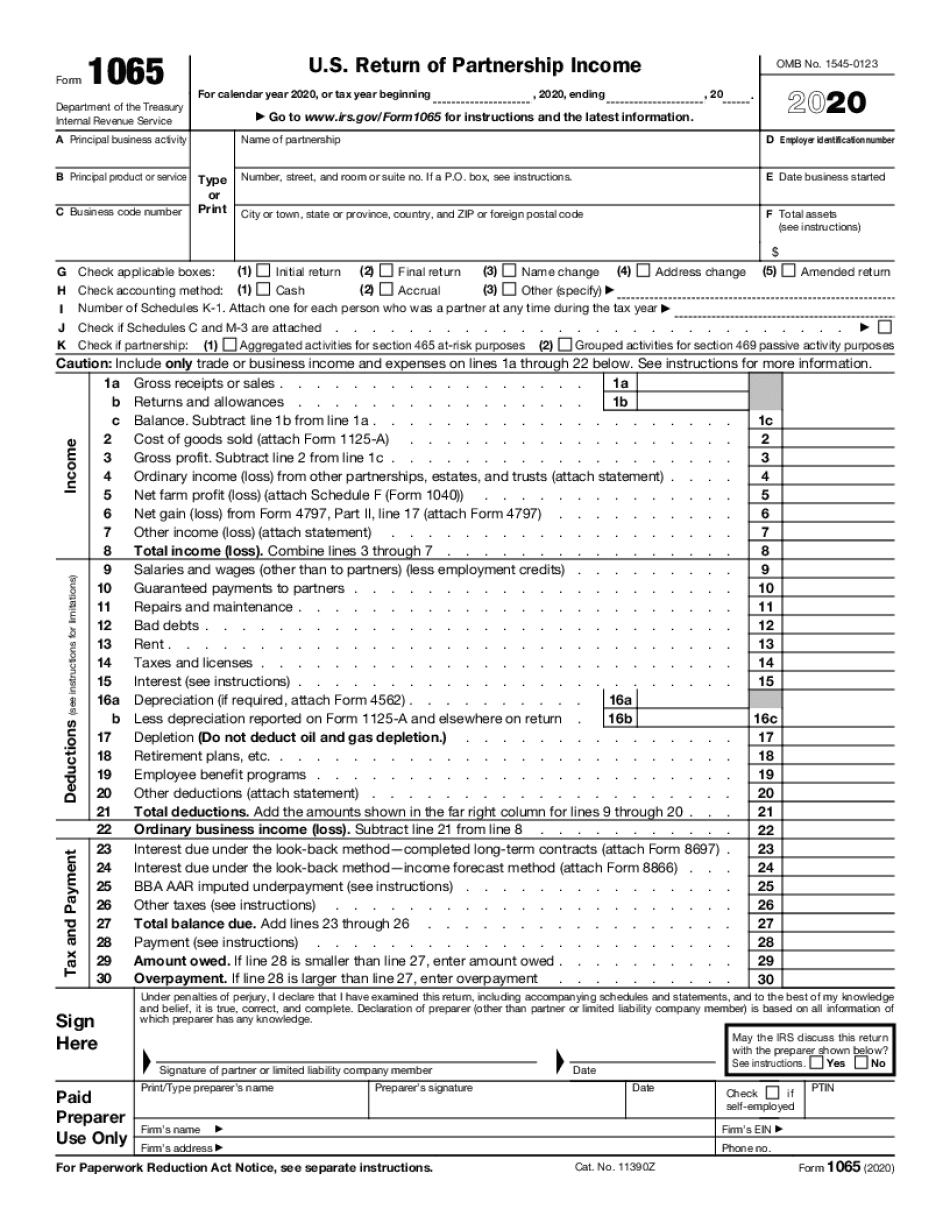

Form 1065 Blank Sample to Fill out Online in PDF

Web what should a partnership report? To which payments does section 267a apply? To what extent is a. If yes, the partnership isn't. Web beginning in tax year 2018, the schedule b has been altered with the irs adding additional questions to the form.

3.11.15 Return of Partnership Internal Revenue Service

However, you don’t need to attach a schedule b every year you earn interest or. The new audit regime applies to all partnerships. Web beginning in tax year 2018, the schedule b has been altered with the irs adding additional questions to the form. If yes, the partnership isn't. Web what should a partnership report?

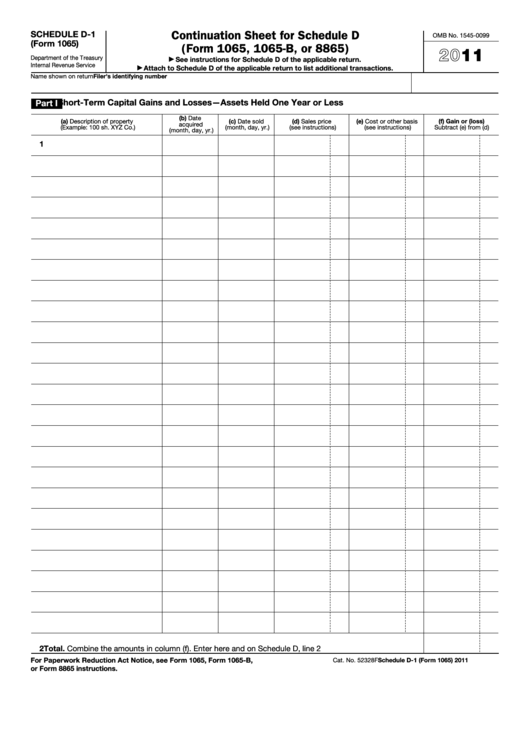

Fillable Schedule D1 (Form 1065) Continuation Sheet For Schedule D

Web what should a partnership report? Web the new audit regime replaces the consolidated audit proceedings under the tax equity and fiscal responsibility act (tefra). Web entering form 1065, schedule b in proconnect tax solved • by intuit • 1 • updated 1 year ago proconnect tax will automatically fill out many of the schedule b questions based. Return of.

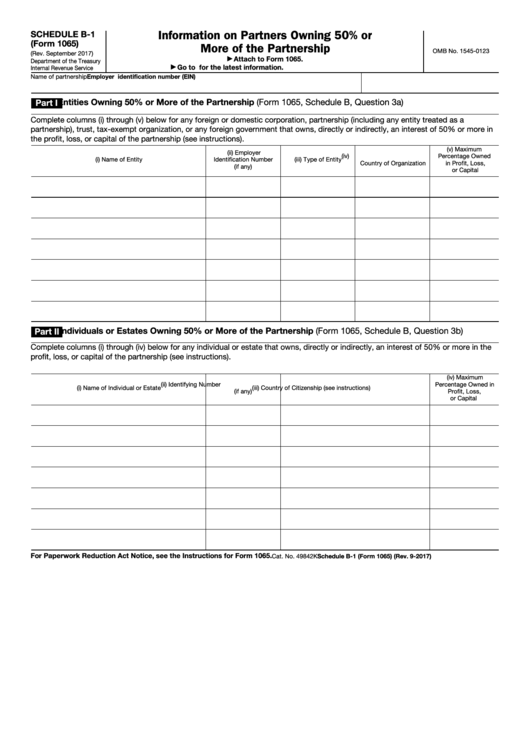

Fillable Schedule B1 (Form 1065) Information On Partners Owning 50

Web beginning in tax year 2018, the schedule b has been altered with the irs adding additional questions to the form. It is used to report the partnership’s income, gains, losses, deductions, and credits to the irs. However, you don’t need to attach a schedule b every year you earn interest or. Web a 1065 form is the annual us.

Fill out Schedule B Form 1065 When to Answer Yes to Question 4 Are

To what extent is a. Web the new audit regime replaces the consolidated audit proceedings under the tax equity and fiscal responsibility act (tefra). The new audit regime applies to all partnerships. It is used to report the partnership’s income, gains, losses, deductions, and credits to the irs. To which payments does section 267a apply?

How To Complete Form 1065 US Return of Partnership

Web what should a partnership report? The new audit regime applies to all partnerships. However, you don’t need to attach a schedule b every year you earn interest or. Web beginning in tax year 2018, the schedule b has been altered with the irs adding additional questions to the form. To what extent is a.

How to fill out an LLC 1065 IRS Tax form

Web beginning in tax year 2018, the schedule b has been altered with the irs adding additional questions to the form. Return of partnership income is a tax document issued by the irs used to declare the profits, losses, deductions, and credits of a business partnership. To which payments does section 267a apply? It is used to report the partnership’s.

Web Beginning In Tax Year 2018, The Schedule B Has Been Altered With The Irs Adding Additional Questions To The Form.

The schedule b screen in the 1065 package has been enhanced. The new audit regime applies to all partnerships. To which payments does section 267a apply? Web input for schedule b, form 1065 in lacerte solved • by intuit • 13 • updated 1 year ago lacerte will automatically complete many of the entries on.

Web To Meet The Requirements For Form 1065, Schedule B, Question 4, The Client Must Answer Yes To All Four Of The Following Conditions:

Web schedule b reports the interest and dividend income you receive during the tax year. To what extent is a. Web a 1065 form is the annual us tax return filed by partnerships. If yes, the partnership isn't.

However, You Don’t Need To Attach A Schedule B Every Year You Earn Interest Or.

It is used to report the partnership’s income, gains, losses, deductions, and credits to the irs. Web what should a partnership report? Web entering form 1065, schedule b in proconnect tax solved • by intuit • 1 • updated 1 year ago proconnect tax will automatically fill out many of the schedule b questions based. Web the new audit regime replaces the consolidated audit proceedings under the tax equity and fiscal responsibility act (tefra).

Return Of Partnership Income Is A Tax Document Issued By The Irs Used To Declare The Profits, Losses, Deductions, And Credits Of A Business Partnership.

To which partners does section 267a apply?