Ss4 Form Download

Ss4 Form Download - Income tax return for an s corporation. Complete, edit or print tax forms instantly. Ad access irs tax forms. • form 2290, heavy highway vehicle use tax return. An ein, also known as a federal taxpayer identification number, is a type of tin used to identify a business entity including a trust or estate. The legal name of your business and the trade name, if different. As soon as the i.r.s. Uslegalforms allows users to edit, sign, fill & share all type of documents online. Web you can download and print the form from the irs website (irs.gov) before filling it out and sending it back to the agency. Web if you don’t want to wait for your social security statement to be mailed to you, you may sign up to get your social security statement online.

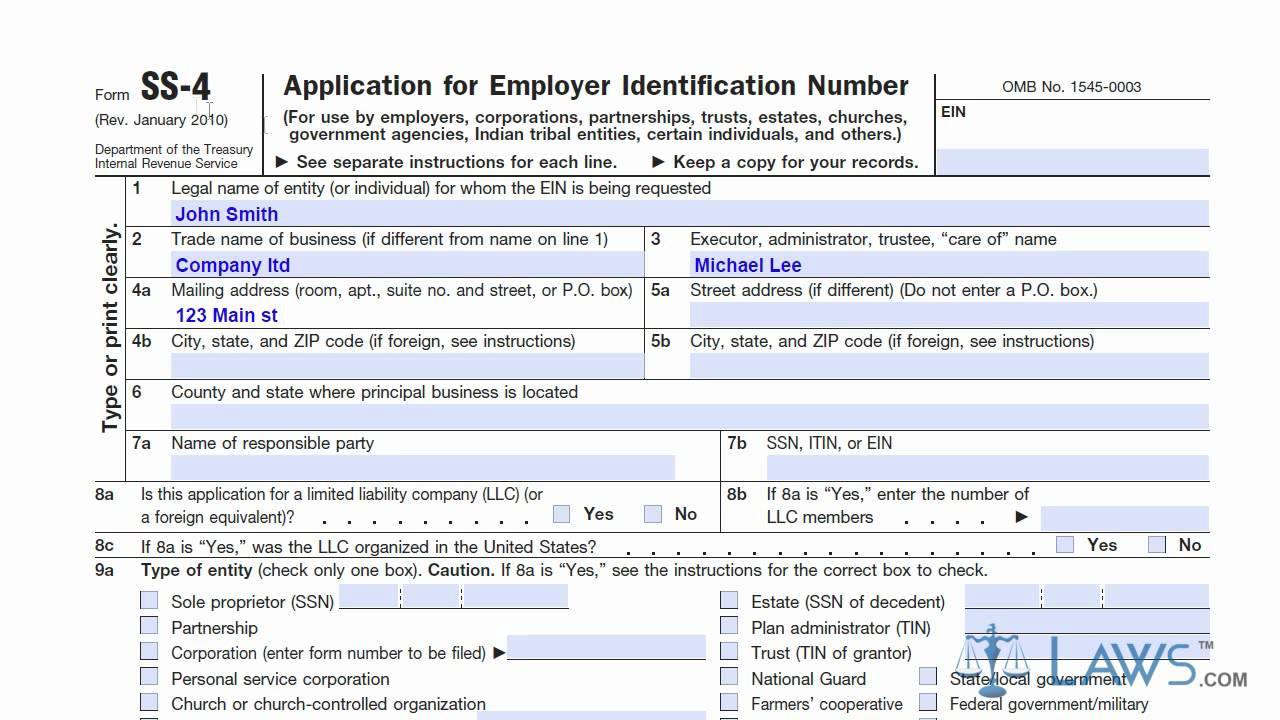

To view this form, click here: These forms are provided by the u.s. Get ready for tax season deadlines by completing any required tax forms today. You’ll need information about your business, including the administrator. Get ready for tax season deadlines by completing any required tax forms today. Even if you file your form via fax or mail, you should. Gather the information necessary to complete. An ein, also known as a federal taxpayer identification number, is a type of tin used to identify a business entity including a trust or estate. This includes obtaining an employer identification number (ein) from the irs. Internal revenue service and are related to tax reporting and.

The legal name of your business and the trade name, if different. Web in the general information section, you complete basic facts about your company. • form 2290, heavy highway vehicle use tax return. Income tax return for an s corporation. If you already have an ein, and the organization (entity) or ownership of your business changes, you may need to apply for a new number. Web you can download and print the form from the irs website (irs.gov) before filling it out and sending it back to the agency. Web choose a needed format if a few options are available (e.g., pdf or word). You’ll need information about your business, including the administrator. Complete, edit or print tax forms instantly. • form 2553, election by a small business corporation.

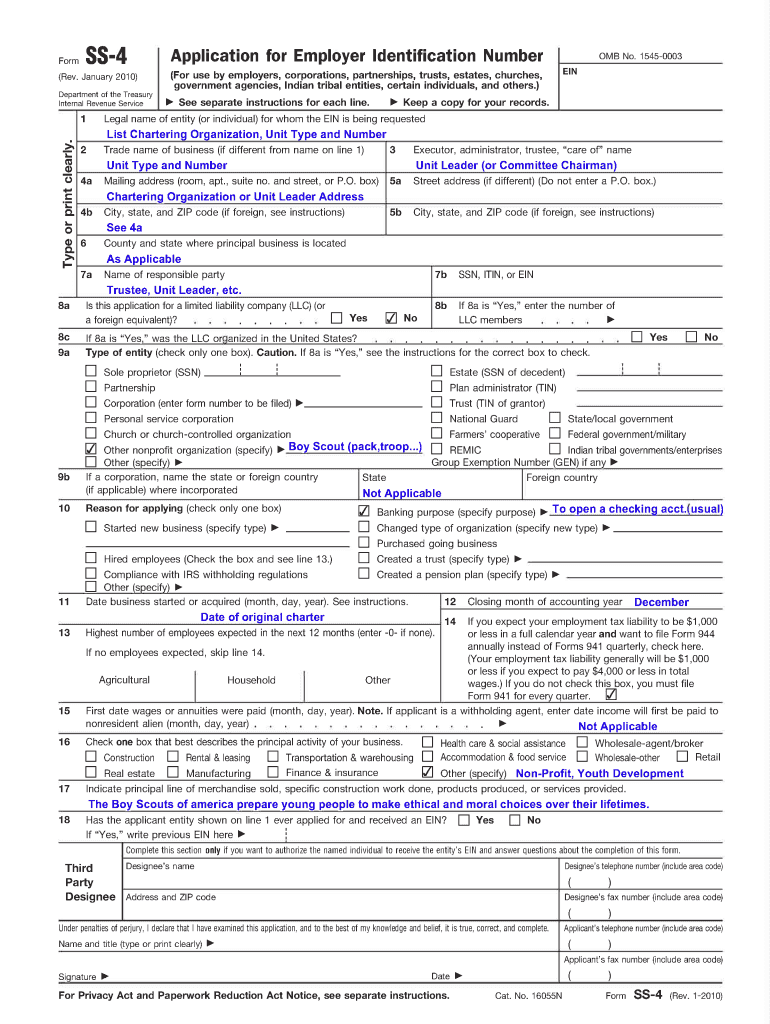

for How to Fill in IRS Form SS4

Web you can download and print the form from the irs website (irs.gov) before filling it out and sending it back to the agency. Online, through fax, or by mail. Web in the general information section, you complete basic facts about your company. An ein, also known as a federal taxpayer identification number, is a type of tin used to.

Ss4 Fill Out and Sign Printable PDF Template signNow

If you would like to receive your social. Web if you don’t want to wait for your social security statement to be mailed to you, you may sign up to get your social security statement online. Online, through fax, or by mail. Internal revenue service and are related to tax reporting and. Get ready for tax season deadlines by completing.

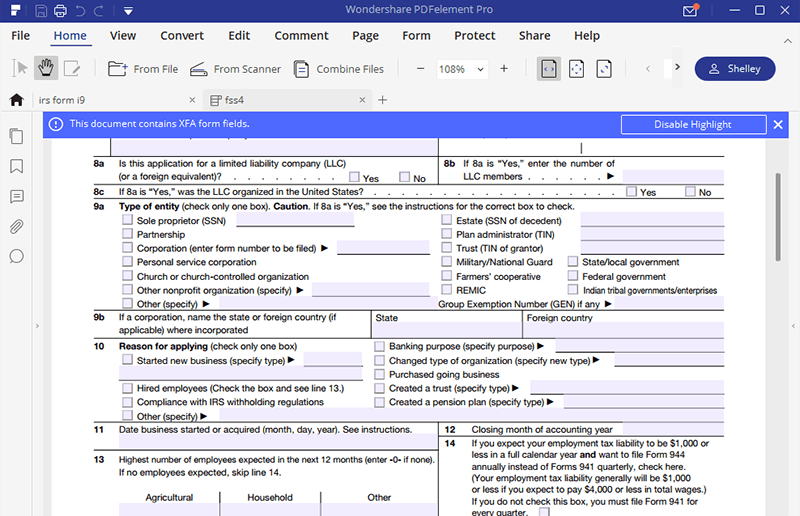

Form Ss 4 Application Unique Ss 4 form Unique Precedence Diagramming

Web if you don’t want to wait for your social security statement to be mailed to you, you may sign up to get your social security statement online. Ad access irs tax forms. The legal name of your business and the trade name, if different. Uslegalforms allows users to edit, sign, fill & share all type of documents online. For.

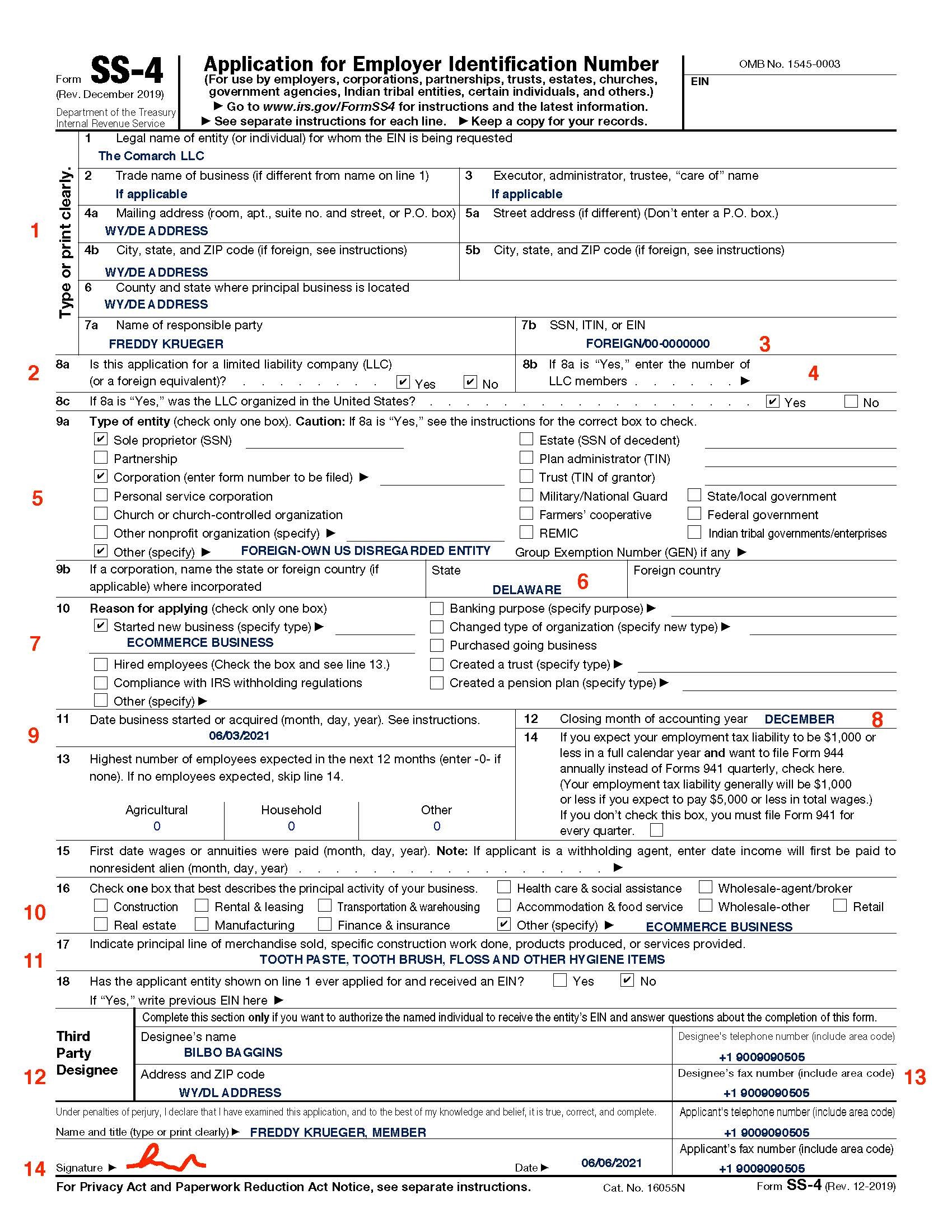

Understanding the SS4 form Firstbase.io

Ad access irs tax forms. Online, through fax, or by mail. Income tax return for an s corporation. Uslegalforms allows users to edit, sign, fill & share all type of documents online. An ein, also known as a federal taxpayer identification number, is a type of tin used to identify a business entity including a trust or estate.

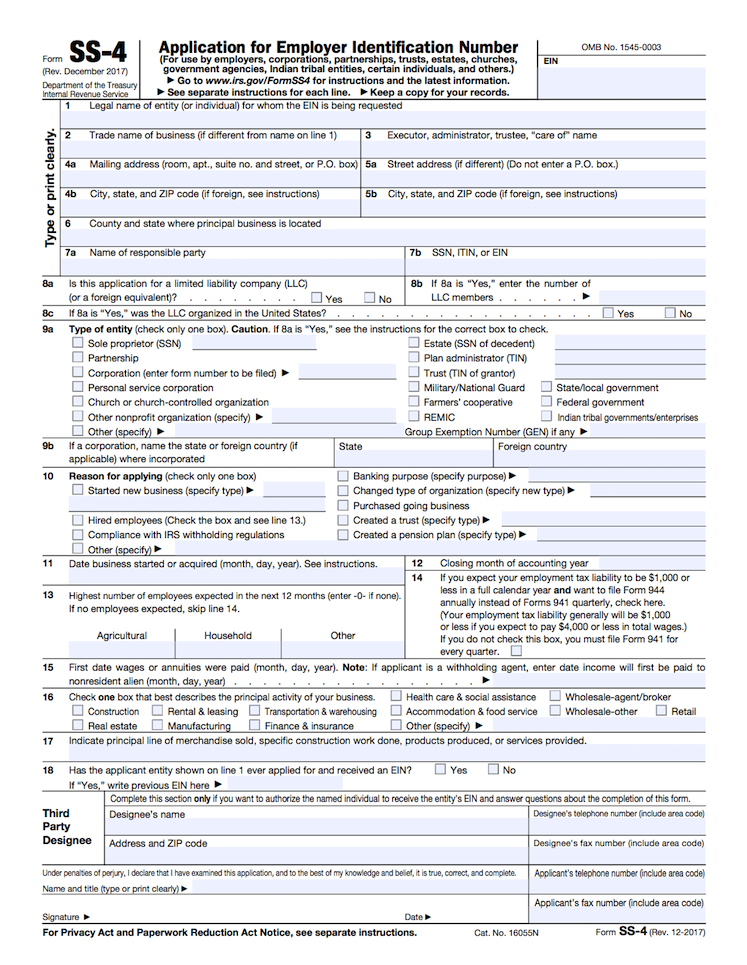

Irs Ss4 Form

Complete and download irs forms in minutes. If you would like to receive your social. Internal revenue service and are related to tax reporting and. To view this form, click here: Get ready for tax season deadlines by completing any required tax forms today.

SS4 Letter

For more information on completing these. An ein, also known as a federal taxpayer identification number, is a type of tin used to identify a business entity including a trust or estate. Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. Web choose a needed format if a few.

How to Get A Copy Of Your Form SS4 Letter Excel Capital

• form 2553, election by a small business corporation. Complete and download irs forms in minutes. Internal revenue service and are related to tax reporting and. Web you can download and print the form from the irs website (irs.gov) before filling it out and sending it back to the agency. Even if you file your form via fax or mail,.

ss4 letter example Fill Online, Printable, Fillable Blank formss

Income tax return for an s corporation. • form 2290, heavy highway vehicle use tax return. Online, through fax, or by mail. Uslegalforms allows users to edit, sign, fill & share all type of documents online. Web choose a needed format if a few options are available (e.g., pdf or word).

form ss4 instructions Fill Online, Printable, Fillable Blank form

Web you can download and print the form from the irs website (irs.gov) before filling it out and sending it back to the agency. These forms are provided by the u.s. Ad access irs tax forms. Get ready for tax season deadlines by completing any required tax forms today. Gather the information necessary to complete.

Learn How to Fill the Form SS 4 Application for EIN YouTube

These forms are provided by the u.s. Ad complete irs tax forms online or print government tax documents. Ad access irs tax forms. As soon as the i.r.s. An ein, also known as a federal taxpayer identification number, is a type of tin used to identify a business entity including a trust or estate.

If You Already Have An Ein, And The Organization (Entity) Or Ownership Of Your Business Changes, You May Need To Apply For A New Number.

These forms are provided by the u.s. Web if you don’t want to wait for your social security statement to be mailed to you, you may sign up to get your social security statement online. You’ll need information about your business, including the administrator. An ein, also known as a federal taxpayer identification number, is a type of tin used to identify a business entity including a trust or estate.

Web You Can Download And Print The Form From The Irs Website (Irs.gov) Before Filling It Out And Sending It Back To The Agency.

Ad access irs tax forms. This includes obtaining an employer identification number (ein) from the irs. Gather the information necessary to complete. Get ready for tax season deadlines by completing any required tax forms today.

• Form 2553, Election By A Small Business Corporation.

Income tax return for an s corporation. If you would like to receive your social. • form 2290, heavy highway vehicle use tax return. Uslegalforms allows users to edit, sign, fill & share all type of documents online.

Complete And Download Irs Forms In Minutes.

Make sure to contact the irs business. Online, through fax, or by mail. To view this form, click here: The legal name of your business and the trade name, if different.