Form 8954 Instructions

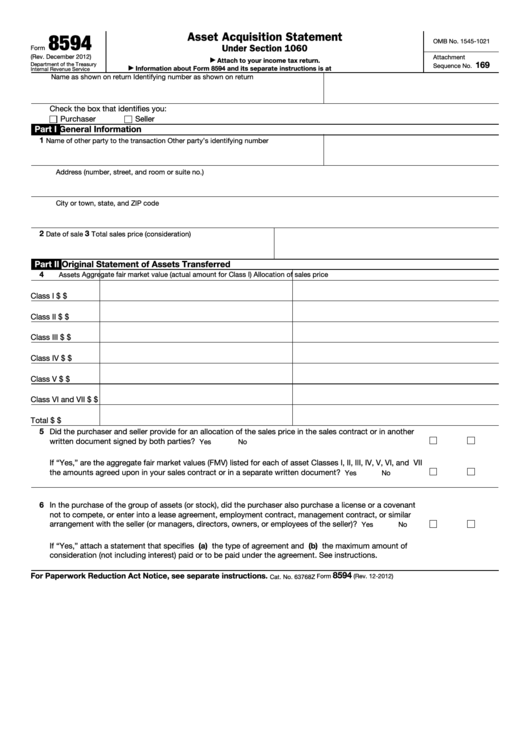

Form 8954 Instructions - Web both the seller and purchaser of a group of assets that makes up a trade or business must use form 8594 to report such a sale if: Web the irs instructs that both the buyer and seller must file the form and attach their income tax returns. Web now the irs backtracked again. Goodwill or going concern value. Web the form is required for the acquisition of a trade or business, which almost always would not include a rental property. Both the seller and purchaser of a group of assets that makes up a trade or business must use form 8594 to report such a sale if goodwill or going concern value. You disposed of it in 2022. Web if so, you may need to file irs form 8594 with your federal tax return. Check the box below that applies to you. Here is the definition rom the form's.

Web partnerships, partners, or their representatives will use form 15254 to request a section 754 revocation. No repayment of the credit is required (see instructions). Web the irs instructs that both the buyer and seller must file the form and attach their income tax returns. Both the seller and purchaser of a group of assets that makes up a trade or business must use form 8594 to report such a sale if goodwill or going concern value. We purchased a business in march 2019 with inventory (independent valuation), equipment (value. In a statement posted on its website for tax professionals, it said, “for the upcoming 2018 filing season, the irs will not accept. Web if so, you may need to file irs form 8594 with your federal tax return. See the instructions for the definition of. File form 15254 to request a section 754 revocation. Here is the definition rom the form's.

See the instructions for the definition of. Web the form is required for the acquisition of a trade or business, which almost always would not include a rental property. In a statement posted on its website for tax professionals, it said, “for the upcoming 2018 filing season, the irs will not accept. Web both the seller and purchaser of a group of assets that makes up a trade or business must use form 8594 to report such a sale if: Web partnerships, partners, or their representatives will use form 15254 to request a section 754 revocation. Web instructions to printers form 8594, page 1 of 2 margins: Web the irs instructs that both the buyer and seller must file the form and attach their income tax returns. No repayment of the credit is required (see instructions). Here is the definition rom the form's. File form 15254 to request a section 754 revocation.

IMG_8954

Check the box below that applies to you. See the instructions for the definition of. You disposed of it in 2019. File form 15254 to request a section 754 revocation. Web you must file form 5405 with your 2022 tax return if you purchased your home in 2008 and you meet either of the following conditions.

LEGO instructions Bionicle 8954 Mazeka YouTube

Web both the seller and purchaser of a group of assets that makes up a trade or business must use form 8594 to report such a sale if: In a statement posted on its website for tax professionals, it said, “for the upcoming 2018 filing season, the irs will not accept. You disposed of it in 2019. Web irs form.

Form 8938 Instructions 2022 2023 IRS Forms Zrivo

Web you must file form 5405 with your 2022 tax return if you purchased your home in 2008 and you meet either of the following conditions. Web now the irs backtracked again. Web both the seller and purchaser of a group of assets that makes up a trade or business must use form 8594 to report such a sale if:.

IRS Instructions 8379 2016 2019 Fillable and Editable PDF Template

Web instructions for form 15254, request for section 754 revocation general instructions section references are to the internal revenue code unless otherwise noted. Web if so, you may need to file irs form 8594 with your federal tax return. No repayment of the credit is required (see instructions). Here is the definition rom the form's. In a statement posted on.

IRS Instructions 8938 2018 2019 Fillable and Editable PDF Template

You disposed of it in 2022. Both the seller and purchaser of a group of assets that makes up a trade or business must use form 8594 to report such a sale if goodwill or going concern value. Web instructions for form 15254, request for section 754 revocation general instructions section references are to the internal revenue code unless otherwise.

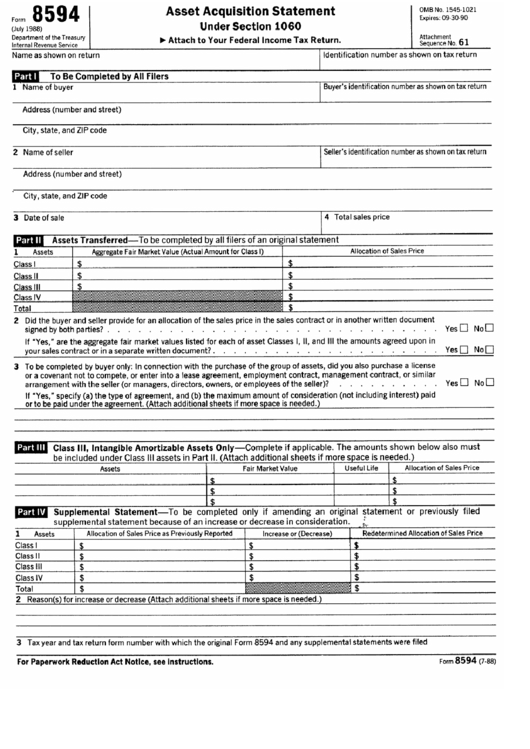

Form 8594 Asset Acquisition Statement Under Section 1060 Internal

Make sure to file this form to avoid irs penalties and a potential audit. No repayment of the credit is required (see instructions). Web instructions to printers form 8594, page 1 of 2 margins: Web you must file form 5405 with your 2022 tax return if you purchased your home in 2008 and you meet either of the following conditions..

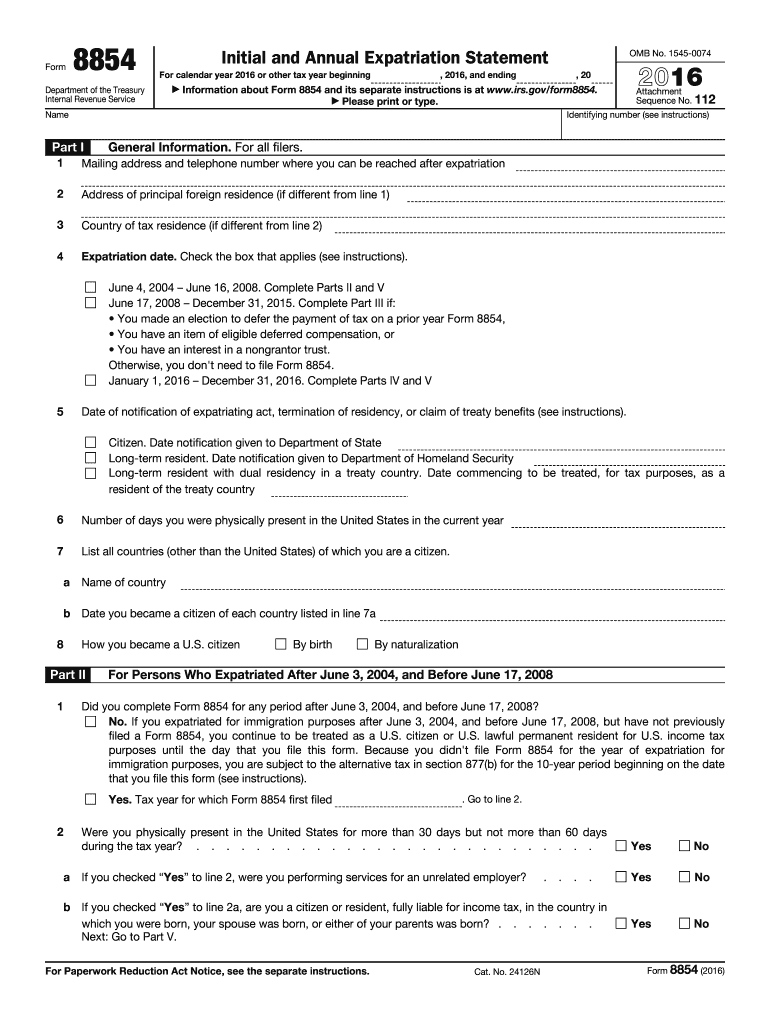

Form 8854 Initial and Annual Expatriation Statement Fill Out and Sign

In a statement posted on its website for tax professionals, it said, “for the upcoming 2018 filing season, the irs will not accept. Both the seller and purchaser of a group of assets that makes up a trade or business must use form 8594 to report such a sale if goodwill or going concern value. Web the irs instructs that.

LEGO 8954 Mazeka Set Parts Inventory and Instructions LEGO Reference

See the instructions for the definition of. No repayment of the credit is required (see instructions). Make sure to file this form to avoid irs penalties and a potential audit. Goodwill or going concern value. Web instructions to printers form 8594, page 1 of 2 margins:

Cms 1500 Claim Form Instructions 2016 Form Resume Examples XE8je6e3Oo

Web if so, you may need to file irs form 8594 with your federal tax return. Web instructions for form 15254, request for section 754 revocation general instructions section references are to the internal revenue code unless otherwise noted. Web the irs instructs that both the buyer and seller must file the form and attach their income tax returns. You.

Fillable Form 8594 Asset Acquisition Statement printable pdf download

Goodwill or going concern value. Make sure to file this form to avoid irs penalties and a potential audit. Web the irs instructs that both the buyer and seller must file the form and attach their income tax returns. Web the form is required for the acquisition of a trade or business, which almost always would not include a rental.

Web You Must File Form 5405 With Your 2019 Tax Return If You Purchased Your Home In 2008 And You Meet Either Of The Following Conditions.

Web instructions for form 15254, request for section 754 revocation general instructions section references are to the internal revenue code unless otherwise noted. No repayment of the credit is required (see instructions). Web you must file form 5405 with your 2022 tax return if you purchased your home in 2008 and you meet either of the following conditions. Web if so, you may need to file irs form 8594 with your federal tax return.

Web Instructions To Printers Form 8594, Page 1 Of 2 Margins:

Goodwill or going concern value. Check the box below that applies to you. You disposed of it in 2019. The form must be filed when a group of assets were transferred (in a trade or.

Both The Seller And Purchaser Of A Group Of Assets That Makes Up A Trade Or Business Must Use Form 8594 To Report Such A Sale If Goodwill Or Going Concern Value.

You disposed of it in 2022. Here is the definition rom the form's. Web both the seller and purchaser of a group of assets that makes up a trade or business must use form 8594 to report such a sale if: Web partnerships, partners, or their representatives will use form 15254 to request a section 754 revocation.

Make Sure To File This Form To Avoid Irs Penalties And A Potential Audit.

See the instructions for the definition of. In a statement posted on its website for tax professionals, it said, “for the upcoming 2018 filing season, the irs will not accept. Web now the irs backtracked again. Web irs form 8594 requires that both parties allocate the purchase price among the various assets of the business being purchased so the seller can calculate the taxes due upon.